Google's AI Ambitions: Convincing Investors Of Long-Term Success

Table of Contents

Demonstrating Technological Superiority and Innovation

Google's dominance in the AI landscape hinges on its demonstrable technological superiority and continuous innovation. This is achieved through significant investments in both fundamental research and product development.

Leading-Edge Research and Development

Google's commitment to fundamental AI research is unparalleled. DeepMind, a Google subsidiary, consistently pushes the boundaries of AI capabilities.

- AlphaFold: This revolutionary AI system accurately predicts the 3D structure of proteins, a breakthrough with implications for drug discovery and biotechnology. This achievement garnered significant media attention and solidified Google's reputation as an AI leader.

- Quantum AI: Google is heavily invested in exploring the potential of quantum computing for accelerating AI advancements, potentially unlocking solutions to problems currently intractable for classical computers. This long-term investment signals a commitment to maintaining a technological edge.

- Numerous Publications and Patents: Google's researchers consistently publish groundbreaking research papers in leading AI conferences (NeurIPS, ICML, etc.) and secure numerous patents related to AI algorithms, hardware, and applications. This intellectual property portfolio is a key asset in maintaining a competitive advantage.

Product Integration and Market Penetration

Google seamlessly integrates AI into its core products and services, enhancing user experience and driving market penetration.

- Google Search: AI powers sophisticated search algorithms, providing more relevant and personalized results.

- Google Assistant: This AI-powered virtual assistant continues to evolve, becoming more intuitive and capable of handling complex tasks.

- Google Cloud AI: Offers a comprehensive suite of AI tools and services for businesses, driving significant revenue and solidifying Google's position in the cloud computing market. This provides a substantial and growing revenue stream directly linked to AI capabilities.

- Impact on User Engagement and Market Share: The success of these AI-powered features is demonstrably increasing user engagement and expanding Google’s market share across various sectors.

Strategic Partnerships and Acquisitions

Google strategically expands its AI capabilities through partnerships and acquisitions of promising AI startups.

- DeepMind acquisition: This acquisition significantly bolstered Google’s AI research capabilities.

- Other strategic partnerships: Collaborations with leading research institutions and companies extend Google’s reach and expertise in specific AI domains. These partnerships accelerate innovation and access to specialized talent and technology.

Addressing Ethical Concerns and Building Trust

Investor confidence is heavily influenced by the ethical considerations surrounding AI development. Google actively addresses these concerns.

Responsible AI Development and Deployment

Google is committed to developing and deploying AI responsibly.

- Ethical AI guidelines: Google has established clear guidelines to mitigate bias, ensure transparency, and promote accountability in its AI systems.

- Internal reviews and audits: Regular internal reviews and audits help identify and address potential ethical issues in AI development and deployment.

Data Privacy and Security

Protecting user data is paramount for maintaining investor trust.

- Robust security measures: Google invests heavily in security measures to protect user data from breaches and misuse.

- Compliance with regulations: Google actively complies with data privacy regulations such as GDPR and CCPA, demonstrating a commitment to responsible data handling. This commitment minimizes legal and reputational risks, increasing investor confidence.

Financial Projections and Return on Investment (ROI)

Google's AI initiatives are not just about technological prowess; they are expected to deliver significant financial returns.

Revenue Generation and Market Opportunities

AI is a major driver of Google's revenue growth.

- Cloud AI: Google Cloud's AI services generate substantial revenue, and this market is projected for continued significant expansion.

- Advertising Personalization: AI-powered advertising personalization increases ad revenue through improved targeting and engagement.

- Market Analysis and Financial Projections: Independent market research firms project substantial growth in Google’s AI-related revenue streams over the next decade. These projections underpin the long-term financial viability of Google's AI ambitions.

Competitive Landscape and Market Positioning

Google faces competition from other tech giants like Microsoft and Amazon, but it holds several key advantages.

- Strong research foundation: Google's deep commitment to fundamental AI research provides a long-term competitive edge.

- Broad product portfolio: The integration of AI across Google’s diverse product portfolio creates a synergistic effect, reinforcing its market dominance.

- Massive user base: Google's massive user base provides valuable data for training and improving its AI models, a critical advantage over competitors.

Conclusion: Investing in Google's AI Future: A Calculated Risk with High Potential Rewards

Google's AI ambitions represent a calculated risk with potentially enormous rewards. The company's demonstrated technological superiority, proactive approach to ethical concerns, and strong financial projections strongly suggest a sound long-term investment. By prioritizing responsible AI development, maintaining a competitive edge through innovation, and demonstrating clear pathways to substantial ROI, Google is successfully building investor confidence in its AI future. Learn more about Google's AI initiatives and consider investing in the future of Google's AI; the potential for significant returns is substantial. Explore Google's AI investments and be a part of shaping the future of artificial intelligence.

Featured Posts

-

Love Monster A Childrens Book Review

May 22, 2025

Love Monster A Childrens Book Review

May 22, 2025 -

Britons Epic Australian Run Pain Flies And Controversy

May 22, 2025

Britons Epic Australian Run Pain Flies And Controversy

May 22, 2025 -

London Landmark Hosts Mummy Pigs Stylish Gender Reveal

May 22, 2025

London Landmark Hosts Mummy Pigs Stylish Gender Reveal

May 22, 2025 -

La Fires Price Gouging Concerns Raised By Reality Tv Star

May 22, 2025

La Fires Price Gouging Concerns Raised By Reality Tv Star

May 22, 2025 -

Ultrarunners Australian Speed Record Attempt A British Perspective

May 22, 2025

Ultrarunners Australian Speed Record Attempt A British Perspective

May 22, 2025

Latest Posts

-

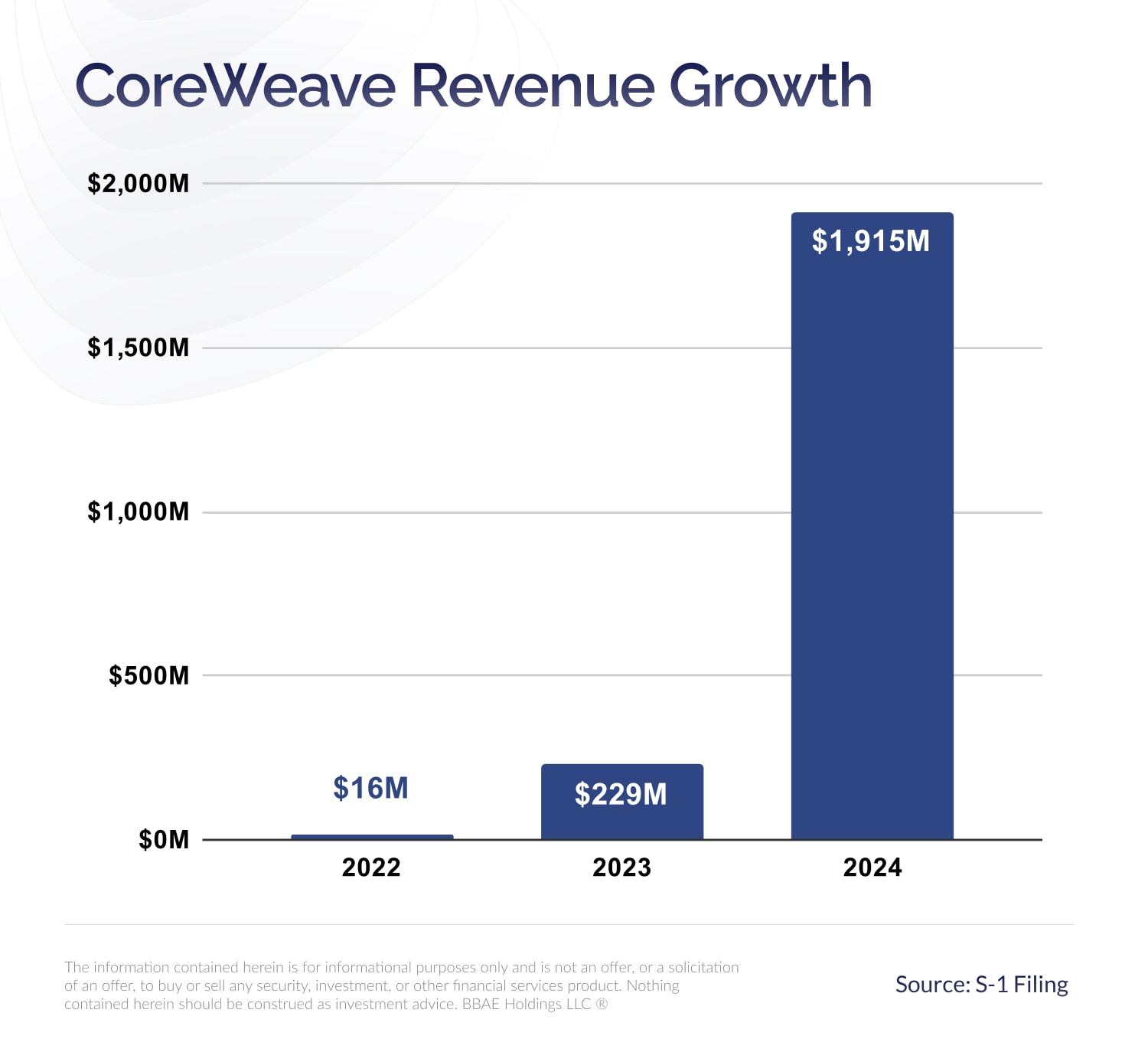

40 Ipo Price For Core Weave Lower Than Projected Midpoint

May 22, 2025

40 Ipo Price For Core Weave Lower Than Projected Midpoint

May 22, 2025 -

Core Weave Inc Crwv Stock Surge Reasons Behind Last Weeks Rise

May 22, 2025

Core Weave Inc Crwv Stock Surge Reasons Behind Last Weeks Rise

May 22, 2025 -

Investigating The Reasons Behind Core Weave Crwv S Thursday Stock Decline

May 22, 2025

Investigating The Reasons Behind Core Weave Crwv S Thursday Stock Decline

May 22, 2025 -

Understanding Core Weaves Crwv Significant Stock Increase Last Week

May 22, 2025

Understanding Core Weaves Crwv Significant Stock Increase Last Week

May 22, 2025 -

Exploring The Reasons For Core Weave Inc Crwv Stocks Rise On Wednesday

May 22, 2025

Exploring The Reasons For Core Weave Inc Crwv Stocks Rise On Wednesday

May 22, 2025