GOP Tax Megaplan In Trouble: Demands For Medicaid And Clean Energy Revisions

Table of Contents

Medicaid Cuts Under Scrutiny: A Potential Deal Breaker

The proposed Medicaid cuts within the GOP Tax Megaplan represent a major point of contention, potentially derailing the entire legislative effort. These cuts threaten to significantly alter the healthcare landscape for millions of Americans.

The Proposed Changes:

- Block Granting: The plan proposes shifting from a federal matching system to a block grant system for Medicaid funding. This would significantly reduce federal funding for states, forcing them to either drastically cut services or increase state taxes. Estimates vary, but some projections suggest a reduction of federal Medicaid funding by as much as 20% over the next decade.

- Work Requirements: The plan is likely to include stricter work requirements for Medicaid recipients, potentially pushing millions off the program. This could disproportionately impact low-income families, individuals with disabilities, and the elderly.

- Enrollment Caps: Some versions of the plan propose imposing enrollment caps, further restricting access to vital healthcare services for vulnerable populations.

The consequences of these cuts are severe. Reduced access to healthcare could lead to poorer health outcomes, increased mortality rates, and a strain on already overburdened hospital systems. State budgets would face immense pressure, forcing difficult choices between vital services. Experts from organizations like the Kaiser Family Foundation have warned of these devastating potential effects on healthcare access and state budgetary stability.

Opposition and Lobbying Efforts:

The proposed Medicaid cuts have faced fierce resistance from various groups:

- Healthcare Providers: Hospitals and healthcare providers fear reduced reimbursements and a surge in uninsured patients, impacting their financial stability and ability to provide care.

- Patient Advocacy Groups: Organizations representing individuals with disabilities, low-income families, and the elderly are actively lobbying against the cuts, highlighting the potential harm to vulnerable populations.

- State Governors (particularly Democratic): Many Democratic governors have voiced strong opposition, concerned about the financial burden on their states.

These groups are employing various strategies, including public awareness campaigns, direct lobbying of lawmakers, and grassroots mobilization to pressure Congress to amend or eliminate the Medicaid cuts. The intense political lobbying surrounding this issue underscores the significant obstacles the GOP Tax Megaplan faces.

Clean Energy Incentives: A Point of Contention

The GOP Tax Megaplan's proposed changes to clean energy tax credits and incentives have ignited a separate but equally significant battle. These changes threaten to stifle investment in renewable energy and undermine efforts to combat climate change.

The Proposed Changes to Clean Energy Tax Credits:

- Reduction or Elimination of Tax Credits: The plan proposes significant reductions or even the complete elimination of crucial tax credits for solar, wind, and other renewable energy technologies.

- Impact on Investment: This reduction in incentives could lead to a sharp decline in private investment in renewable energy projects, slowing down the transition to a cleaner energy future.

- Job Losses: The renewable energy sector employs hundreds of thousands of Americans. The proposed changes could result in significant job losses across the sector, impacting both manufacturing and installation.

The arguments against these changes highlight the critical role of clean energy in creating jobs, boosting the economy, and mitigating the effects of climate change. Conversely, proponents of the changes often cite budgetary concerns and argue for a more market-based approach to energy development. The Environmental Protection Agency (EPA) and other scientific bodies have published substantial data on the economic benefits and environmental necessity of investing in clean energy.

Bipartisan Pushback and Alternative Proposals:

Bipartisan opposition to the proposed cuts in clean energy incentives is growing. Senators from both parties are advocating for alternative solutions that would balance budgetary concerns with the need for environmental sustainability:

- Targeted Tax Credits: Some suggest focusing tax credits on specific technologies or regions to maximize their impact and economic benefits.

- Investment in Grid Modernization: Others advocate for investment in upgrading the nation's electricity grid to better accommodate renewable energy sources.

These alternative proposals demonstrate a willingness to find common ground and address concerns surrounding both the environment and the economy. The feasibility of these alternatives and their chances of being incorporated into the final legislation remain to be seen.

The Future of the GOP Tax Megaplan: Uncertain Prospects

The current political landscape suggests significant uncertainty regarding the future of the GOP Tax Megaplan. The intense opposition to the Medicaid and clean energy provisions could force significant compromises and amendments.

Analysis of Current Political Landscape:

The narrow margins in both the House and Senate mean that securing enough votes for passage will require significant concessions. Whether the GOP leadership is willing to make the necessary compromises remains a major question.

Potential Outcomes and Implications:

Several scenarios are possible:

- Significant Alterations: The plan might pass with major changes to the Medicaid and clean energy provisions, potentially diminishing its intended impact.

- Delay or Defeat: The intense opposition could lead to a significant delay or even the complete failure of the bill to pass.

- Piecemeal Approach: Instead of a comprehensive megaplan, the GOP might attempt to pass the tax changes in smaller, more manageable pieces.

Each of these outcomes carries substantial implications for the American economy, healthcare system, and the nation's efforts to address climate change.

Conclusion: The Fate of the GOP Tax Megaplan Hangs in the Balance

The GOP Tax Megaplan faces significant headwinds, primarily due to intense opposition to its proposed Medicaid cuts and clean energy revisions. The future of this ambitious legislative effort is uncertain, and the potential consequences of both its passage and failure are substantial. Stay informed about the evolving details of the GOP Tax Megaplan and contact your representatives to voice your concerns regarding Medicaid and clean energy policy. Understanding the intricacies of this megaplan and its potential impact on Medicaid reform and clean energy initiatives is crucial for every American citizen.

Featured Posts

-

Assessing The Winners And Losers In Trumps Middle East Diplomacy

May 18, 2025

Assessing The Winners And Losers In Trumps Middle East Diplomacy

May 18, 2025 -

The Netherlands Public Opposition To Eu Action On Trumps Tariffs

May 18, 2025

The Netherlands Public Opposition To Eu Action On Trumps Tariffs

May 18, 2025 -

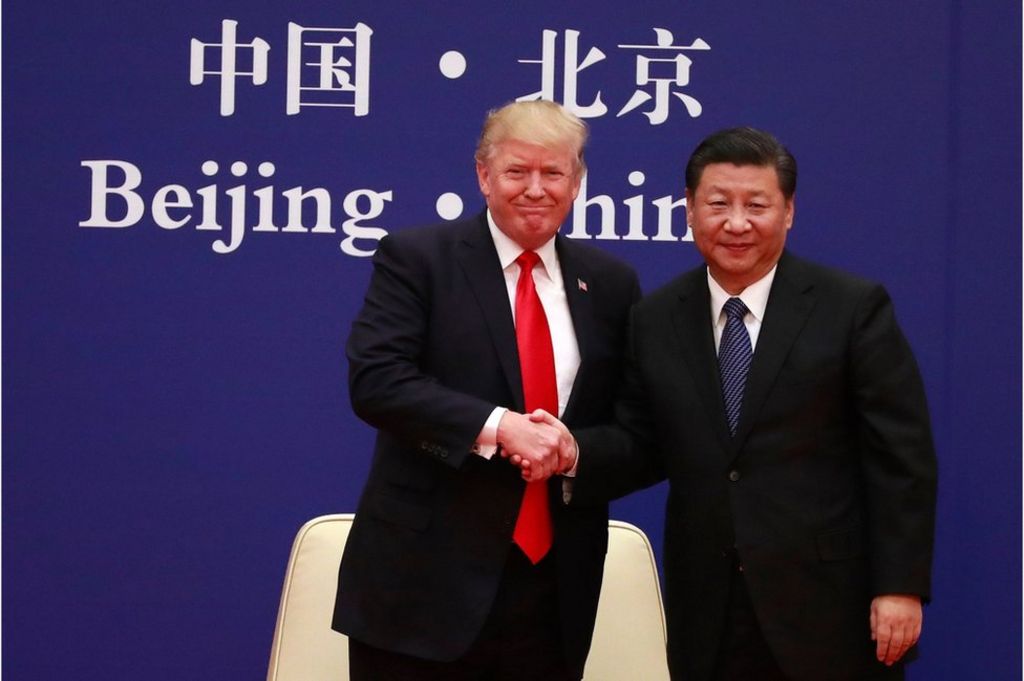

Trump Open To China Trip For Xi Jinping Meeting

May 18, 2025

Trump Open To China Trip For Xi Jinping Meeting

May 18, 2025 -

Analyzing Indias Economic Strategy Reduced Dependence On Pakistan Turkey And Azerbaijan

May 18, 2025

Analyzing Indias Economic Strategy Reduced Dependence On Pakistan Turkey And Azerbaijan

May 18, 2025 -

Kanye West And Bianca Censori Back Together After Weeks Apart

May 18, 2025

Kanye West And Bianca Censori Back Together After Weeks Apart

May 18, 2025

Latest Posts

-

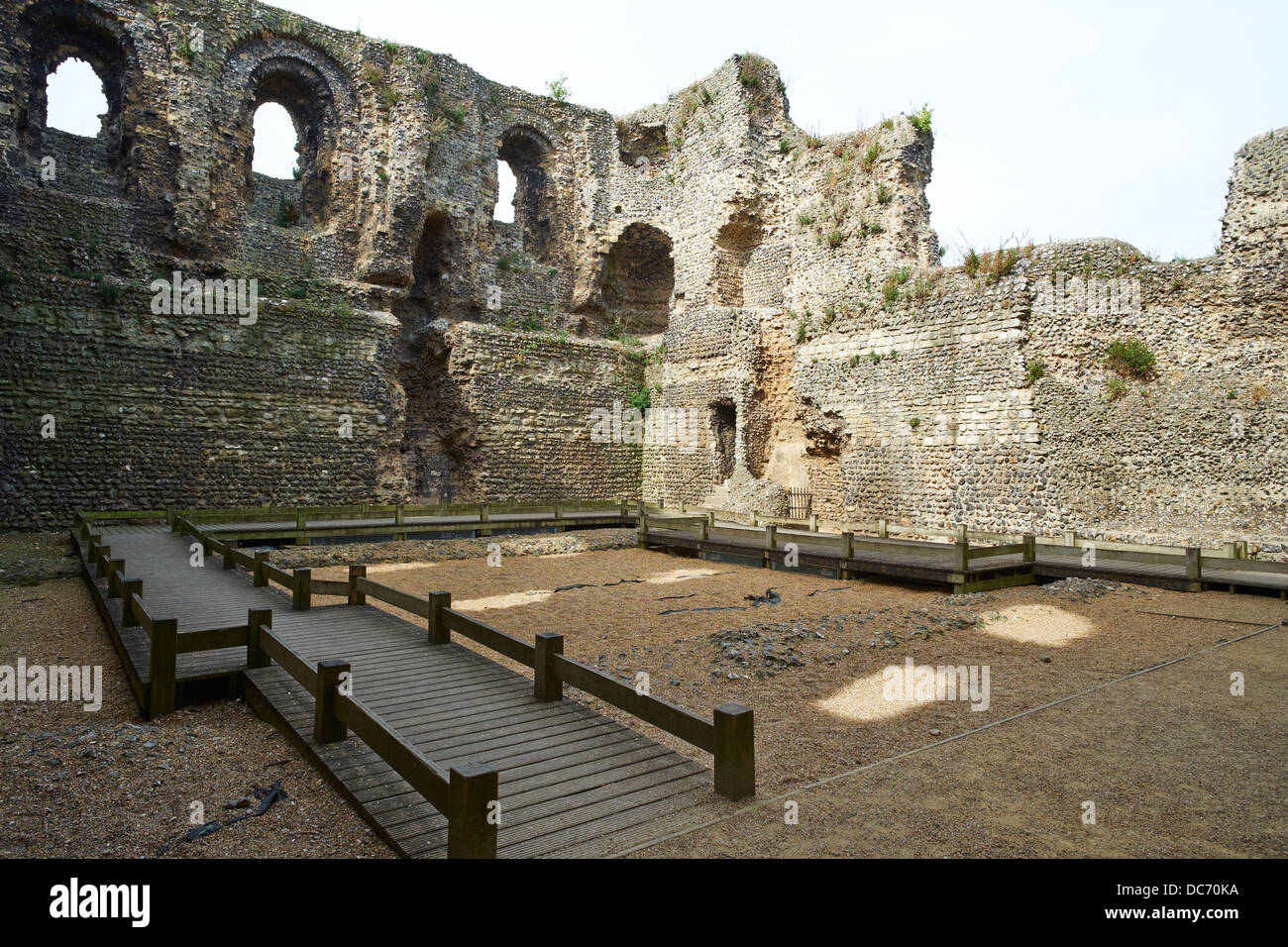

Canterbury Castle Sold For 705 499 A Historic Landmark Changes Hands

May 18, 2025

Canterbury Castle Sold For 705 499 A Historic Landmark Changes Hands

May 18, 2025 -

Stephen Millers Troubling Past A Former Colleagues Account

May 18, 2025

Stephen Millers Troubling Past A Former Colleagues Account

May 18, 2025 -

Why A Former Colleague Calls Stephen Miller A Horrible Human Being

May 18, 2025

Why A Former Colleague Calls Stephen Miller A Horrible Human Being

May 18, 2025 -

Axios Kto Zaymet Post Sovetnika Trampa Po Natsionalnoy Bezopasnosti Prognozy I Analiz

May 18, 2025

Axios Kto Zaymet Post Sovetnika Trampa Po Natsionalnoy Bezopasnosti Prognozy I Analiz

May 18, 2025 -

Is Stephen Miller The Next National Security Advisor Analyzing His Qualifications

May 18, 2025

Is Stephen Miller The Next National Security Advisor Analyzing His Qualifications

May 18, 2025