High Stock Market Valuations: BofA Explains Why Investors Shouldn't Panic

Table of Contents

BofA's Arguments Against Immediate Panic

BofA's analysis suggests that while high stock market valuations are a valid concern, they don't automatically signal impending doom. Several factors contribute to their argument against immediate panic.

Low Interest Rates Justify Higher Valuations

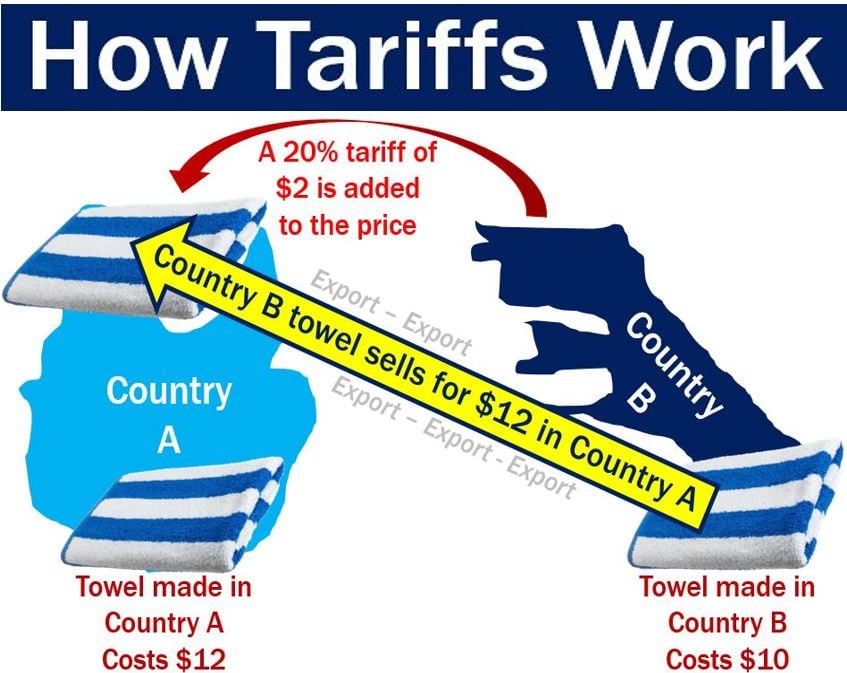

One key argument revolves around prevailing low interest rates. Low interest rates significantly impact stock valuations. They reduce the discount rate used in valuation models, making future earnings appear more valuable and thus justifying higher price-to-earnings (P/E) ratios.

- Lower borrowing costs for companies: Low interest rates translate to increased profitability for companies as they can borrow money cheaply for expansion and investment.

- Investor demand for higher returns: In a low-interest-rate environment, investors seek higher returns, pushing up demand for stocks and consequently driving prices higher. This increased demand contributes to higher valuations.

- Historical context: Examining historical data showing the correlation between interest rates and P/E ratios reveals a strong inverse relationship. Periods of low interest rates have historically coincided with higher P/E ratios, providing a historical precedent for current market conditions.

Strong Corporate Earnings and Profitability

Despite economic headwinds, many companies continue to demonstrate robust earnings growth. This fundamental strength underpins the current high stock market valuations.

- Strong performance in key sectors: Sectors like technology and healthcare have shown particularly strong earnings growth, contributing significantly to overall market performance.

- Healthy corporate profit margins: Data on corporate profit margins consistently supports the claim of strong corporate profitability, validating the current valuation levels.

- Technological advancements: Technological advancements have significantly boosted productivity and efficiency, leading to higher earnings and further justifying higher valuations.

Long-Term Growth Potential Remains

BofA's analysis likely emphasizes the long-term growth potential of the economy and specific sectors, thereby mitigating concerns about short-term valuation fluctuations.

- Positive long-term economic projections: Reputable sources, including the IMF and World Bank, often provide long-term economic projections that support a positive outlook for future growth.

- Innovation driving future growth: Technological innovation and disruptive technologies are key drivers of long-term economic expansion and corporate growth.

- Favorable demographic trends: Certain demographic trends, such as a growing global middle class, can also contribute significantly to long-term economic growth.

Understanding the Nuances of Stock Market Valuations

While acknowledging the concern surrounding high stock market valuations, it's crucial to understand the nuances involved. Relying solely on one metric can be misleading.

Different Valuation Metrics

The P/E ratio, while widely used, isn't the only metric for evaluating stock valuations. Other metrics provide a more comprehensive perspective.

- Price-to-sales (P/S) ratio: This ratio compares a company's market capitalization to its revenue, offering a different perspective than the P/E ratio.

- Price-to-book (P/B) ratio: This ratio compares a company's market value to its book value (assets minus liabilities), providing another valuable valuation metric.

- Limitations of each metric: Each valuation metric has its limitations and is most appropriately used in specific contexts. For example, P/E ratios are less useful for companies with low or negative earnings.

Considering Market Sentiment

Market psychology and investor sentiment play a significant role in shaping valuations. Periods of optimism and exuberance can drive valuations higher, even beyond what fundamental analysis suggests.

- Speculation and market bubbles: Speculation and the formation of market bubbles can significantly inflate valuations, creating temporary distortions.

- Analyzing market trends: It’s crucial to analyze market trends and investor behavior to get a sense of underlying sentiment and the potential for corrections.

Conclusion

While high stock market valuations warrant caution and careful consideration, BofA's analysis suggests that panicking may be premature. Factors such as low interest rates, robust corporate earnings, and substantial long-term growth potential can partially justify current valuations. However, investors should maintain a diversified portfolio and employ a long-term investment strategy. Understanding the nuances of valuation metrics and market sentiment remains critical for navigating these conditions. Don't let high stock market valuations trigger immediate panic. Instead, consider BofA's perspective and develop a well-informed, long-term investment strategy that accounts for both the potential risks and opportunities presented by the current market conditions. Learn more about managing your portfolio in the face of high stock market valuations by [link to relevant resource].

Featured Posts

-

Jeanine Pirro Exploring Her Background Achievements And Net Worth

May 10, 2025

Jeanine Pirro Exploring Her Background Achievements And Net Worth

May 10, 2025 -

Sex Slur Scandal Wynne Evans Removed From Go Compare Advertising Campaign

May 10, 2025

Sex Slur Scandal Wynne Evans Removed From Go Compare Advertising Campaign

May 10, 2025 -

Todays Stock Market China Tariff Impact And Uk Trade Deal Uncertainty

May 10, 2025

Todays Stock Market China Tariff Impact And Uk Trade Deal Uncertainty

May 10, 2025 -

West Bengal Madhyamik 2025 Result Merit List And Details

May 10, 2025

West Bengal Madhyamik 2025 Result Merit List And Details

May 10, 2025 -

Nottingham Attacks Inquiry Judge Taylors Appointment Announced

May 10, 2025

Nottingham Attacks Inquiry Judge Taylors Appointment Announced

May 10, 2025