High Stock Market Valuations: BofA's Rationale For Investor Calm

Table of Contents

BofA's Key Arguments for Maintaining a Calm Investment Approach

BofA's perspective on high stock market valuations isn't simply bullish optimism; it's a carefully considered analysis factoring in several key economic and financial factors. Their argument for maintaining a calm approach rests on several pillars:

Low Interest Rates and Abundant Liquidity

One of BofA's core arguments centers on the continued impact of low interest rates and abundant liquidity in the global financial system. Years of quantitative easing and historically low interest rates have injected significant capital into the market, supporting asset prices, including stocks. This has several crucial consequences:

- Impact on Bond Yields: Low interest rates suppress bond yields, making equities a more attractive investment for yield-seeking investors. This increased demand further fuels equity valuations.

- Effect on Investor Behavior: Low rates encourage investors to take on more risk in their search for returns, driving up demand for equities.

- Search for Yield Driving Equity Investments: With low returns on traditional fixed-income investments, investors are actively seeking higher yields in the equity market, contributing to the current high valuations.

While BofA acknowledges this isn't a sustainable long-term strategy, the current environment continues to provide support for equity markets. (Note: Specific data points from BofA reports would be included here if available.)

Strong Corporate Earnings and Profitability

BofA's analysis emphasizes the robust performance of corporate earnings, a key factor underpinning their relatively optimistic outlook. They highlight several sectors exhibiting exceptional strength and profitability:

- Sectors Showing Strength: (Specific sectors mentioned by BofA would be listed here, e.g., Technology, Healthcare).

- Factors Supporting Profitability: Companies have benefited from cost-cutting measures, technological advancements boosting efficiency, and strategic mergers and acquisitions.

- Potential Risks to Earnings: While optimistic, BofA acknowledges potential risks such as rising inflation, supply chain disruptions, and geopolitical uncertainty that could impact future earnings.

To illustrate their point, BofA likely references key financial metrics such as Price-to-Earnings (P/E) ratios and profit margins across various sectors to support their analysis of corporate profitability.

Long-Term Growth Prospects

BofA's view extends beyond short-term market fluctuations; they emphasize the long-term growth prospects of the global economy. This long-term perspective informs their assessment of equity valuations:

- Key Drivers of Long-Term Growth: Technological innovation, particularly in areas like artificial intelligence and renewable energy, continues to drive productivity gains. The growth of emerging markets also presents significant opportunities.

- Potential Headwinds: However, they also acknowledge potential headwinds, including geopolitical risks, inflationary pressures, and demographic shifts.

- BofA's Forecast for Future Growth: (Insert BofA's projected growth rates and supporting reasoning here).

By considering both the potential for growth and the potential headwinds, BofA aims to provide a balanced assessment of the long-term outlook for the equity market.

Strategic Asset Allocation and Diversification

BofA underscores the importance of a well-diversified investment portfolio as a key strategy for mitigating risks associated with high stock market valuations. This involves:

- Importance of Diversification: Diversification across asset classes (equities, bonds, real estate), sectors, and geographies helps to reduce the overall portfolio risk.

- Specific Strategies: Value investing, focusing on undervalued companies, and considering alternative investments can offer attractive risk-adjusted returns.

- Role of Professional Advice: BofA emphasizes the importance of seeking professional financial advice tailored to individual risk tolerance and financial goals.

Understanding the Risks Associated with High Stock Market Valuations

While BofA advocates for maintaining calm, they certainly don't ignore the inherent risks associated with high stock market valuations. A market correction or even a bubble bursting is a real possibility:

- Potential Triggers for a Market Downturn: Rising interest rates, significant geopolitical events, uncontrolled inflation, or unexpected economic slowdowns could trigger a market downturn.

- Impact on Different Asset Classes: Different asset classes will react differently to a market correction. Equities generally experience higher volatility than bonds.

- Strategies for Risk Mitigation: Diversification, hedging strategies, and a disciplined approach to investing are crucial for mitigating risks.

BofA likely includes cautions and potential downside scenarios in their full reports, which should be considered carefully.

BofA's Recommendations for Investors

Based on their analysis, BofA offers investors several recommendations for navigating the current market environment characterized by high stock market valuations:

- Maintain a Long-Term Perspective: Avoid short-term market timing and focus on long-term investment goals.

- Focus on Quality Companies: Invest in companies with strong fundamentals, sustainable competitive advantages, and a history of consistent earnings growth.

- Consider Defensive Sectors: Allocate a portion of your portfolio to defensive sectors less susceptible to economic downturns (e.g., consumer staples, utilities).

- Rebalance Portfolio Regularly: Periodically rebalance your portfolio to maintain your desired asset allocation and manage risk.

(A link to relevant BofA reports or publications would be included here.)

Conclusion

High stock market valuations are a legitimate concern, but BofA's analysis provides a balanced perspective, highlighting both the risks and the opportunities. Their arguments for investor calm center on low interest rates, strong corporate earnings, long-term growth prospects, and the importance of strategic asset allocation and diversification. While acknowledging potential risks, BofA emphasizes the need for a long-term perspective and a disciplined investment strategy. Don't let concerns about high stock market valuations paralyze you; develop a sound investment strategy today. Learn more about managing your investments in a high-valuation market by [linking to relevant resources, e.g., BofA's website or financial planning resources].

Featured Posts

-

Kl Shye En Aleab Blay Styshn 6 Alqadmt

May 02, 2025

Kl Shye En Aleab Blay Styshn 6 Alqadmt

May 02, 2025 -

School Closings And Trash Delays Impact Of Snow And Ice On Friday

May 02, 2025

School Closings And Trash Delays Impact Of Snow And Ice On Friday

May 02, 2025 -

Mqbwdh Kshmyr Eyd Ke Mwqe Pr Bharty Ryasty Dhshtgrdy Nwjwan Shhyd

May 02, 2025

Mqbwdh Kshmyr Eyd Ke Mwqe Pr Bharty Ryasty Dhshtgrdy Nwjwan Shhyd

May 02, 2025 -

Dallas And Carrie Legend Dead Amy Irvings Heartfelt Tribute

May 02, 2025

Dallas And Carrie Legend Dead Amy Irvings Heartfelt Tribute

May 02, 2025 -

Boj Slashes Growth Forecast Trade Tensions Dampen Economic Prospects

May 02, 2025

Boj Slashes Growth Forecast Trade Tensions Dampen Economic Prospects

May 02, 2025

Latest Posts

-

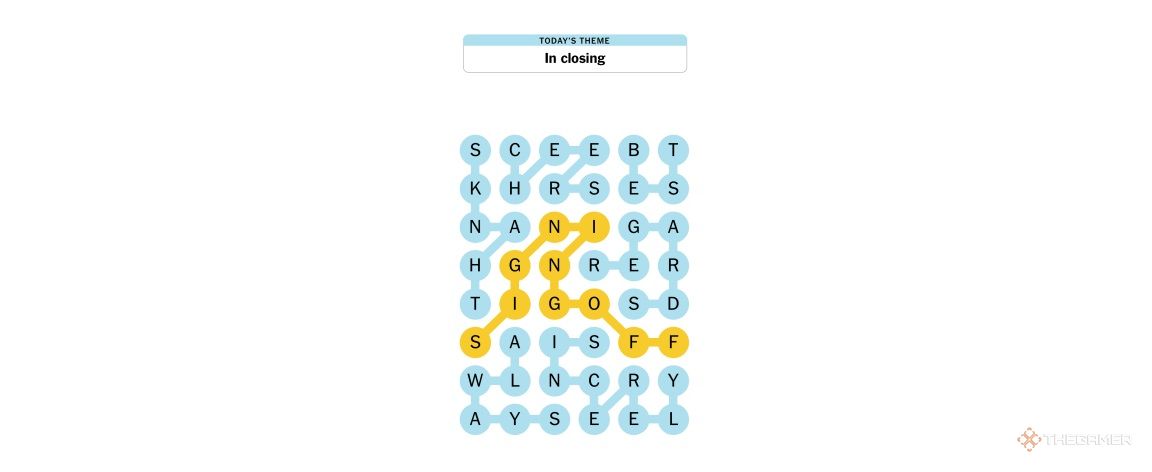

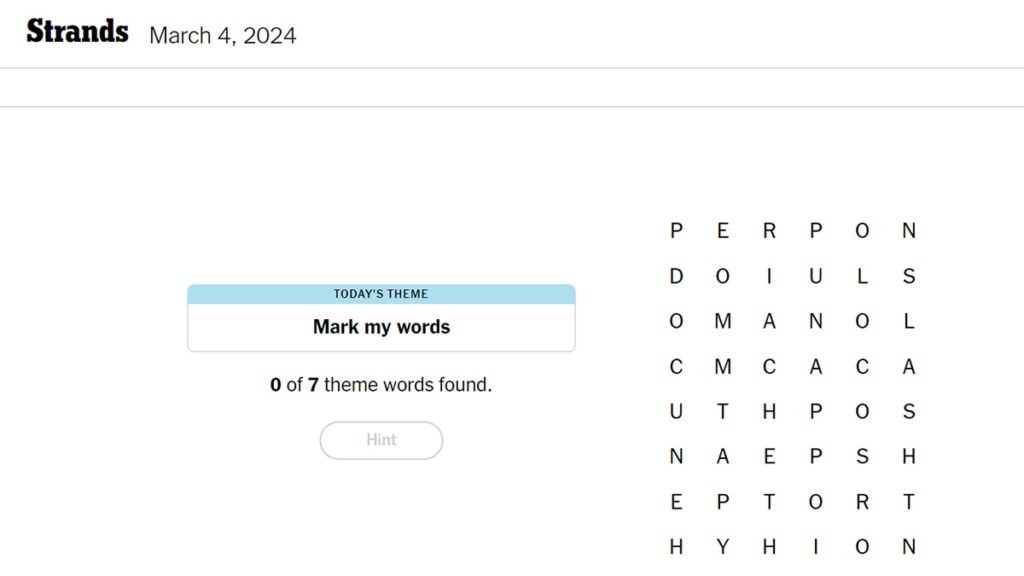

Nyt Strands April 9 2025 Complete Guide To Solving The Puzzle

May 10, 2025

Nyt Strands April 9 2025 Complete Guide To Solving The Puzzle

May 10, 2025 -

Nyt Strands Today April 9 2025 Clues Theme Hints And Spangram Solution

May 10, 2025

Nyt Strands Today April 9 2025 Clues Theme Hints And Spangram Solution

May 10, 2025 -

Nyt Spelling Bee Strands April 12 2025 Complete Gameplay Guide

May 10, 2025

Nyt Spelling Bee Strands April 12 2025 Complete Gameplay Guide

May 10, 2025 -

Nyt Strands March 14 2024 Game 376 Complete Solution Guide

May 10, 2025

Nyt Strands March 14 2024 Game 376 Complete Solution Guide

May 10, 2025 -

Solve Nyt Strands Puzzle 376 March 14 Hints And Answers

May 10, 2025

Solve Nyt Strands Puzzle 376 March 14 Hints And Answers

May 10, 2025