Stock Market Today: Dow, S&P 500 Live Updates For April 23rd

Table of Contents

Dow Jones Industrial Average Performance

As of market close on April 23rd, the Dow Jones Industrial Average (DJIA) experienced a [Insert Percentage Change]% change, closing at [Insert Closing Value] points. This represents a [Insert Point Change] point change compared to the previous day's close. This movement reflects a [Bullish/Bearish/Neutral] sentiment within the market for the Dow today.

Key Movers within the Dow

Several stocks significantly influenced the Dow's performance today.

-

Best Performers:

- AAPL (Apple Inc.): [Insert Percentage Change]% increase. Reason: Strong Q1 earnings report exceeding analyst expectations, fueled by robust iPhone sales and growth in services. Impact on Dow: Positive contribution to the overall index gain.

- MSFT (Microsoft Corp.): [Insert Percentage Change]% increase. Reason: Positive investor sentiment following a successful product launch and strong cloud computing revenue. Impact on Dow: Significant positive contribution to the overall index.

- JPM (JPMorgan Chase & Co.): [Insert Percentage Change]% increase. Reason: Positive market reaction to the bank's Q1 earnings and outlook. Impact on Dow: Moderate positive contribution.

-

Worst Performers:

- DIS (Walt Disney Co.): [Insert Percentage Change]% decrease. Reason: Disappointing subscriber numbers for its streaming services and concerns about the future of its theme parks. Impact on Dow: Negative contribution to the overall index performance.

- KO (Coca-Cola Co.): [Insert Percentage Change]% decrease. Reason: Concerns about slowing growth in certain markets and rising input costs. Impact on Dow: Moderate negative contribution.

- WMT (Walmart Inc.): [Insert Percentage Change]% decrease. Reason: Lower-than-expected quarterly earnings, reflecting inflationary pressures on consumer spending. Impact on Dow: Negative contribution to the overall Dow performance.

Impact of Economic News on the Dow

Several economic news items influenced the Dow's performance today:

- Inflation Report: The April inflation report (source: [Insert Source, e.g., Bureau of Labor Statistics]) showed [Insert Data, e.g., a slight increase in inflation]. Impact: This slightly dampened investor optimism, leading to some profit-taking in certain sectors. The Dow reacted with a [Slight increase/decrease/no significant change].

- Interest Rate Announcement: The Federal Reserve announced [Insert Data, e.g., a 0.25% increase in interest rates]. Impact: This move was largely anticipated by the market, resulting in a relatively muted response from the Dow.

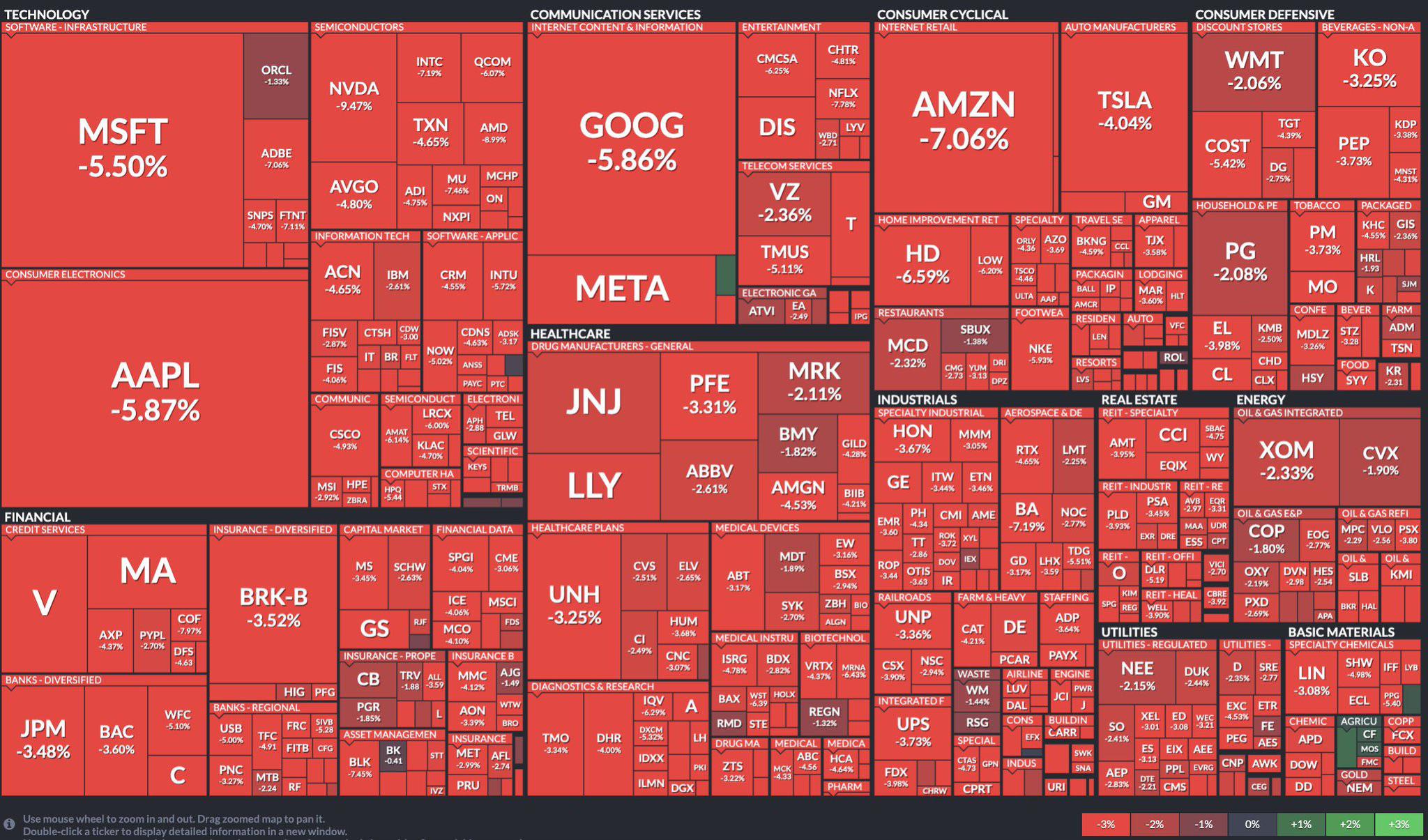

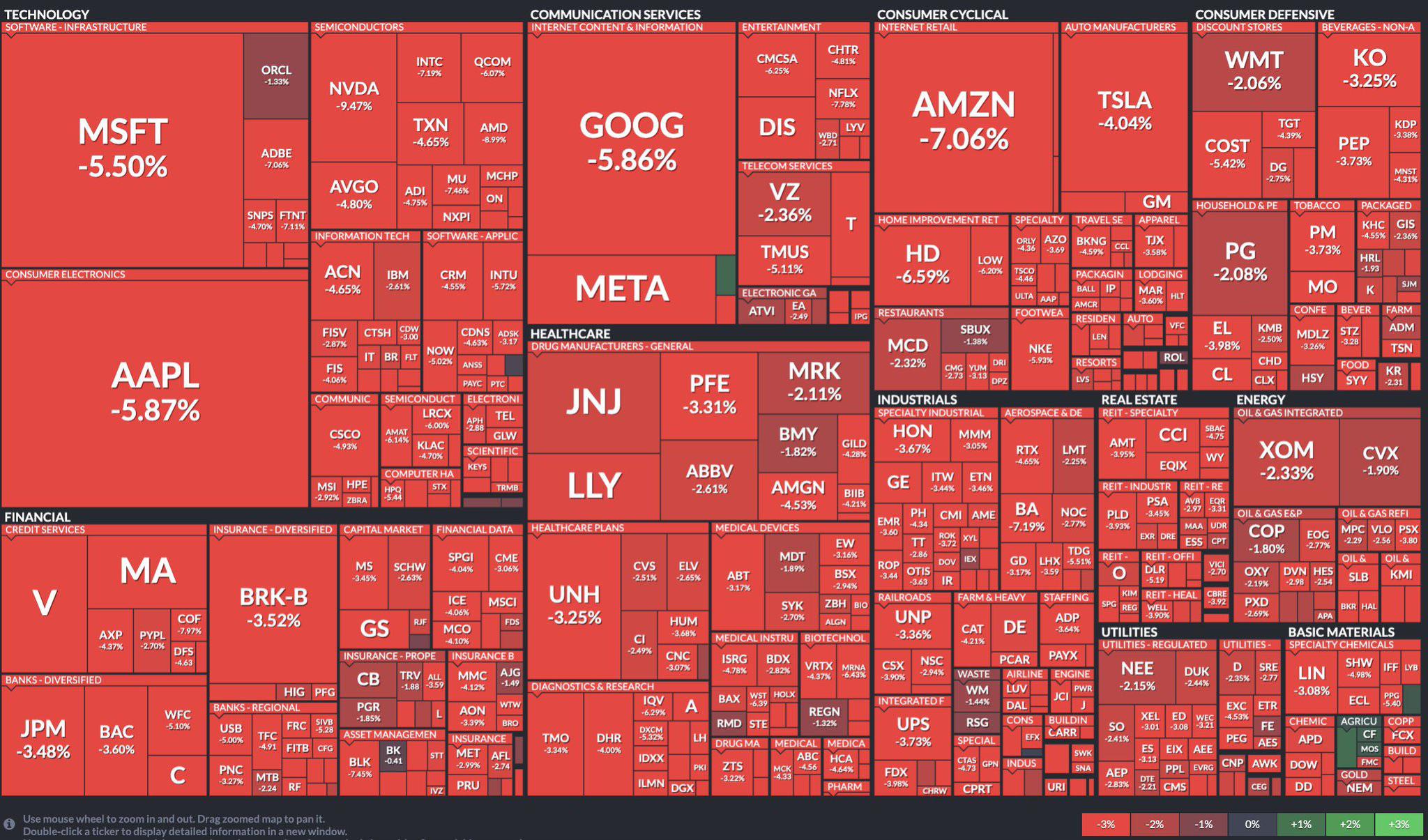

S&P 500 Index Performance

The S&P 500 index mirrored the Dow's performance, closing with a [Insert Percentage Change]% change at [Insert Closing Value] points, representing a [Insert Point Change] point movement. This indicates a similar [Bullish/Bearish/Neutral] market sentiment for the broader market.

Sector Performance within the S&P 500

The technology sector outperformed other sectors, while the energy sector experienced a slight downturn.

-

Top Performing Sectors:

- Technology: [Insert Percentage Change]% increase. Driven by strong earnings reports from tech giants.

- Consumer Discretionary: [Insert Percentage Change]% increase. Reflecting increased consumer spending.

-

Worst Performing Sectors:

- Energy: [Insert Percentage Change]% decrease. Likely due to concerns about [Insert Reason, e.g., global oil supply].

- Utilities: [Insert Percentage Change]% decrease. Possibly due to [Insert Reason, e.g., interest rate hikes].

Correlation between Dow and S&P 500 movements

The Dow and S&P 500 moved in [tandem/divergent directions] today. [Explain the correlation. If divergent, explain why.]

Market Sentiment and Future Outlook (brief)

Overall market sentiment is currently [Bullish/Bearish/Neutral]. This is largely influenced by [Mention key factors].

Potential Factors Influencing Future Market Movement

Several factors could impact the market in the coming days:

- Upcoming Earnings Reports: Several major companies will release their quarterly earnings reports next week, which could significantly impact market performance.

- Geopolitical Events: Ongoing geopolitical tensions could introduce volatility into the market.

Conclusion

Today's stock market saw a [Bullish/Bearish/Neutral] day, with the Dow Jones Industrial Average and the S&P 500 experiencing [Summarize key movements]. Key movers in the Dow included [List top movers] while the S&P 500 saw strong performances in the [List top sectors] sectors. Economic news, particularly [Mention key news], played a role in shaping market sentiment.

Stay informed about daily stock market updates by regularly checking our site for live analysis and insights on the Dow Jones and S&P 500. For comprehensive stock market today information, bookmark this page and check back for future updates.

Featured Posts

-

Teslas Q1 Earnings Report 71 Net Income Decline Impact Of Political Backlash

Apr 24, 2025

Teslas Q1 Earnings Report 71 Net Income Decline Impact Of Political Backlash

Apr 24, 2025 -

Conservative Party Promises Tax Cuts And Smaller Deficits In Canada

Apr 24, 2025

Conservative Party Promises Tax Cuts And Smaller Deficits In Canada

Apr 24, 2025 -

The Bold And The Beautiful Spoilers Hopes Double Shocker Liams Promise To Steffy And Lunas Big Move

Apr 24, 2025

The Bold And The Beautiful Spoilers Hopes Double Shocker Liams Promise To Steffy And Lunas Big Move

Apr 24, 2025 -

Why This Startup Airline Uses Deportation Flights

Apr 24, 2025

Why This Startup Airline Uses Deportation Flights

Apr 24, 2025 -

Emerging Market Stocks Outperform Us In 2024 A Year Of Contrasts

Apr 24, 2025

Emerging Market Stocks Outperform Us In 2024 A Year Of Contrasts

Apr 24, 2025