Home Depot's Financial Performance: Disappointment And Tariff Considerations

Table of Contents

Q2 2024 Earnings Miss Expectations

Home Depot's Q2 2024 earnings report revealed a significant shortfall compared to analysts' projections. Several key financial metrics missed expectations, raising concerns among investors.

- Earnings Per Share (EPS): The reported EPS of $[Insert Actual EPS] fell short of the anticipated $[Insert Analyst Estimate] by $[Insert Difference] – a [Insert Percentage]% decrease.

- Revenue: Total revenue reached $[Insert Actual Revenue], slightly below the projected $[Insert Analyst Estimate]. This represents a [Insert Percentage]% increase compared to Q2 2023, but significantly lower than the anticipated growth rate.

- Comparable Sales Growth: Comparable sales, a key indicator of performance, grew by only [Insert Percentage]%, falling short of the projected [Insert Percentage]% growth.

These figures, detailed in the official [link to Home Depot earnings release], indicate a slowdown in growth for the home improvement giant. Furthermore, Home Depot revised its future guidance downward, signaling continued uncertainty in the coming quarters. This underwhelming performance impacted Home Depot stock, causing a [Insert Percentage]% decrease in share price following the announcement. Investors are closely monitoring Home Depot's response and subsequent performance to gauge the long-term impact of these results. The overall sentiment surrounding Home Depot earnings has shifted from optimistic to cautious.

SEO Keywords: Home Depot earnings, Home Depot Q2 2024 results, Home Depot stock, Home Depot revenue, Home Depot comparable sales.

Impact of Tariffs on Home Improvement Spending

The ongoing impact of tariffs on imported goods significantly affects Home Depot's costs and profitability. The company has been forced to navigate increased prices on crucial products, impacting both its margins and consumer purchasing behavior.

- Price Increases: Tariffs on imported lumber, appliances, and other materials have led to substantial price increases passed on to consumers. This directly impacts Home Depot's ability to maintain competitive pricing and attract customers.

- Decreased Consumer Demand: Higher prices, coupled with economic uncertainty, have dampened consumer demand for home improvement projects. Fewer large-scale renovations and smaller DIY projects translate to decreased sales volume for Home Depot.

- Mitigation Strategies: Home Depot has implemented several strategies to mitigate the effects of tariffs, including exploring alternative sourcing options from different countries and making strategic price adjustments to balance profitability and competitiveness. However, these strategies have not been completely effective in offsetting the negative impact.

The tariffs represent a major challenge for Home Depot and the entire home improvement sector. The company's ability to effectively manage these increased costs and maintain consumer demand will be critical for future success.

SEO Keywords: Home Depot tariffs, lumber tariffs, import tariffs, Home Depot pricing, consumer spending, home improvement market.

Macroeconomic Factors and Consumer Sentiment

The broader economic climate significantly influences Home Depot's performance. Several macroeconomic factors contribute to the recent downturn in sales and earnings.

- Interest Rate Hikes: Rising interest rates have increased borrowing costs, making home improvement loans more expensive and potentially discouraging large-scale projects.

- Inflation: Persistent inflation erodes consumer purchasing power, leaving less disposable income for discretionary spending like home renovations.

- Housing Market Trends: A slowdown in the housing market, including decreased new home construction, directly impacts demand for home improvement products. This is particularly relevant for Home Depot's professional customer base.

- Consumer Confidence: Declining consumer confidence, driven by economic uncertainty, reduces spending on non-essential items like home improvement projects.

H3: Supply Chain Disruptions

Adding to the macroeconomic challenges, Home Depot, like many retailers, continues to face supply chain disruptions. These disruptions affect inventory levels and product availability.

- Sourcing Challenges: Securing materials and managing inventory remains a significant challenge, leading to stock shortages and impacting customer experience.

- Pricing Volatility: Supply chain issues further contribute to pricing volatility, making it difficult for Home Depot to accurately forecast costs and set competitive prices.

Comparing Home Depot's performance to its main competitor, Lowe's, reveals similar challenges across the industry, highlighting the impact of broader economic conditions.

SEO Keywords: Home Depot economy, inflation impact, interest rates, housing market, consumer confidence, Lowe's, home improvement market trends.

Home Depot's Response and Future Outlook

Home Depot is actively addressing the challenges it faces through various strategic initiatives. The company's response will be crucial for its future financial performance and long-term growth.

- Cost-Cutting Measures: Home Depot is implementing cost-cutting measures to improve profitability in the face of increased input costs.

- Inventory Management Improvements: The company is focusing on enhancing its supply chain and inventory management systems to improve efficiency and reduce stockouts.

- Marketing Initiatives: Home Depot is likely to implement targeted marketing campaigns to stimulate demand and attract customers despite economic uncertainty.

Home Depot executives have expressed cautious optimism about the company's long-term growth prospects, emphasizing their commitment to adapting to the changing market conditions. However, the ongoing economic uncertainty and the impact of tariffs continue to pose significant challenges. A detailed analysis of their future strategies is necessary to accurately gauge Home Depot's potential for recovery.

SEO Keywords: Home Depot strategy, Home Depot future, Home Depot growth, Home Depot stock forecast.

Conclusion:

Home Depot's recent financial performance reflects a complex interplay of factors, including disappointing earnings, the substantial impact of tariffs, and broader macroeconomic headwinds. While challenges persist, understanding these issues is crucial for investors and industry analysts alike. Home Depot's strategic response to these difficulties will be instrumental to its future success. Continuous monitoring of Home Depot's financial performance, along with careful observation of tariff developments and the overall economic climate, is essential for informed decision-making. Stay informed about the latest updates in Home Depot's financial performance to make well-informed investment choices.

Featured Posts

-

Analiz Finansovikh Pokaznikiv Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus Sered Naykraschikh U 2024 Rotsi

May 22, 2025

Analiz Finansovikh Pokaznikiv Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus Sered Naykraschikh U 2024 Rotsi

May 22, 2025 -

Selena Gomezs Claim About Blake Lively A Wake Up Call For Taylor Swift

May 22, 2025

Selena Gomezs Claim About Blake Lively A Wake Up Call For Taylor Swift

May 22, 2025 -

Revitalizing Otter Populations A Turning Point In Wyomings Conservation Strategy

May 22, 2025

Revitalizing Otter Populations A Turning Point In Wyomings Conservation Strategy

May 22, 2025 -

Core Weave Crwv Stock Surge Reasons Behind The Jump

May 22, 2025

Core Weave Crwv Stock Surge Reasons Behind The Jump

May 22, 2025 -

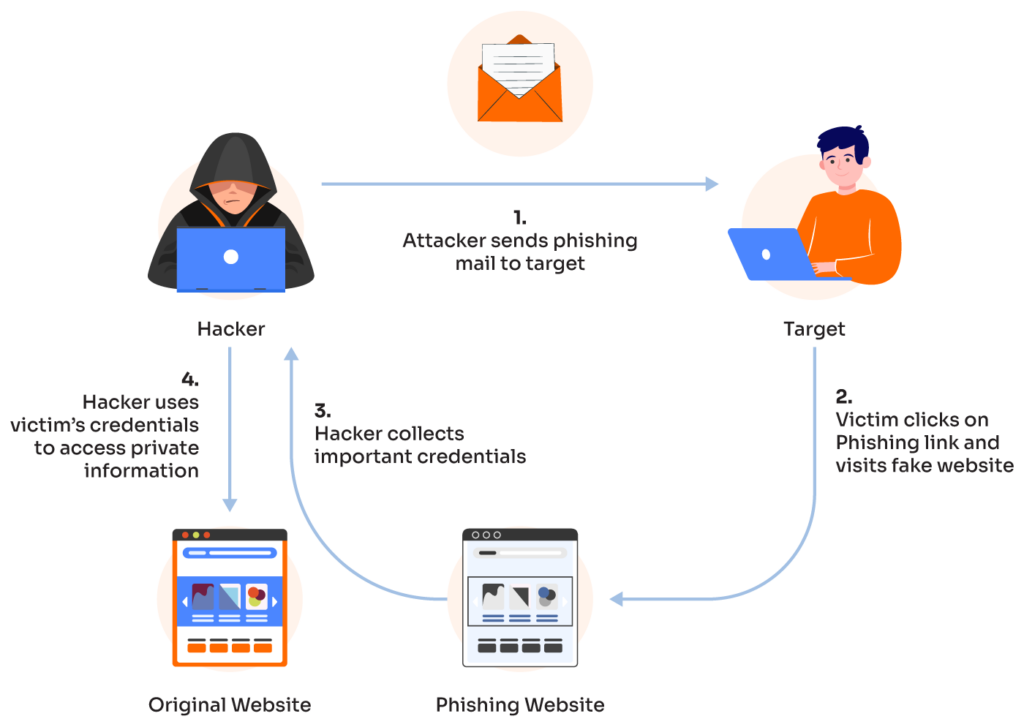

Cybercrime Investigation Hacker Profits Millions From Office365 Compromise

May 22, 2025

Cybercrime Investigation Hacker Profits Millions From Office365 Compromise

May 22, 2025

Latest Posts

-

Cau Ma Da Du An Trong Diem Ket Noi Dong Nai

May 22, 2025

Cau Ma Da Du An Trong Diem Ket Noi Dong Nai

May 22, 2025 -

Xay Dung Cau Ma Da Ket Noi Giao Thong Giua Hai Tinh Dong Nai

May 22, 2025

Xay Dung Cau Ma Da Ket Noi Giao Thong Giua Hai Tinh Dong Nai

May 22, 2025 -

Kien Nghi Xay Dung Tuyen Duong 4 Lan Xe Noi Dong Nai Binh Phuoc Qua Rung Ma Da

May 22, 2025

Kien Nghi Xay Dung Tuyen Duong 4 Lan Xe Noi Dong Nai Binh Phuoc Qua Rung Ma Da

May 22, 2025 -

Du An Duong 4 Lan Xe Xuyen Rung Ma Da Dong Nai Kien Nghi Voi Binh Phuoc

May 22, 2025

Du An Duong 4 Lan Xe Xuyen Rung Ma Da Dong Nai Kien Nghi Voi Binh Phuoc

May 22, 2025 -

Dong Nai Keu Goi Xay Duong Cao Toc 4 Lan Xe Xuyen Rung Ma Da

May 22, 2025

Dong Nai Keu Goi Xay Duong Cao Toc 4 Lan Xe Xuyen Rung Ma Da

May 22, 2025