Hong Kong Market Rally: Chinese Stocks Soar On Trade Hopes

Table of Contents

Main Points:

2.1 Soaring Chinese Stocks: Sector-Specific Analysis

The Hong Kong market rally is largely attributable to the exceptional performance of Chinese stocks listed on the Hong Kong exchange. Several sectors are leading this charge.

2.1.1 Tech Sector Leads the Charge:

The technology sector has witnessed explosive growth, with prominent players like Alibaba and Tencent experiencing substantial gains. This surge in Chinese tech stocks is fueled by a combination of factors, including increasing domestic demand and ongoing innovation. The Hong Kong tech index has soared, reflecting the overall positive sentiment towards this sector.

- Alibaba saw a [insert percentage]% increase in its stock price.

- Tencent experienced a [insert percentage]% surge, driven by strong growth in its gaming and fintech segments.

- Other major players in the Hong Kong tech index also showed significant gains.

2.1.2 Consumer Staples Show Strength:

Despite economic uncertainty, consumer staples companies in Hong Kong have shown remarkable resilience. This sector's performance highlights the enduring demand for essential goods and services, even amidst market fluctuations. The stability of this sector contributes significantly to the overall strength of the Hong Kong market rally.

- [Company A] in the consumer goods sector reported strong quarterly earnings, exceeding market expectations.

- [Company B] specializing in retail saw increased sales, indicating sustained consumer spending.

- The overall stability of the consumer staples sector reflects underlying economic strength.

2.1.3 Financial Sector Gains Momentum:

The financial sector, encompassing banks and insurance companies, has also participated in the Hong Kong market rally. This growth reflects increased investor confidence in the stability of the Chinese and Hong Kong economies.

- [Bank Name] reported strong profits, boosted by increased lending activity.

- [Insurance Company Name] saw a rise in new policy sales, indicating growing demand for financial security.

- The improved performance of the Hong Kong banking sector is a positive sign for the overall economy.

2.2 Trade Hopes Reignite Investor Confidence

The primary catalyst for the Hong Kong market rally is the renewed optimism surrounding US-China trade relations. Easing trade tensions and increased foreign investment have significantly contributed to this positive market sentiment.

2.2.1 Easing Trade Tensions:

Recent positive developments in US-China trade negotiations, such as [mention specific events, e.g., a potential phase-one trade deal or reduced tariffs], have significantly boosted investor confidence. These developments signal a potential de-escalation of trade disputes, reducing uncertainty in the market.

- Reduced tariffs on certain goods have lessened the burden on Chinese companies.

- Statements from both governments suggesting a willingness to cooperate have calmed investor fears.

- The potential for a comprehensive trade deal further boosts positive market sentiment.

2.2.2 Increased Foreign Investment:

The improved outlook for US-China relations has led to a significant influx of foreign investment into the Hong Kong market. This capital inflow further fuels the market rally, reinforcing the positive feedback loop of investor confidence.

- Foreign institutional investors have increased their holdings in Hong Kong-listed Chinese stocks.

- This increased foreign investment highlights the global confidence in the Hong Kong market's potential.

- The inflow of capital supports the ongoing market growth and stability.

2.2.3 Impact on the Hong Kong Dollar:

The Hong Kong market rally has had a positive impact on the Hong Kong dollar, strengthening its exchange rate against other major currencies. This reflects the increased demand for the Hong Kong dollar in the forex market, driven by the positive market sentiment.

- The Hong Kong dollar has appreciated against the US dollar.

- This strengthens Hong Kong's position in the global financial markets.

- The currency's stability contributes further to investor confidence.

2.3 Expert Opinions and Market Forecasts

Market analysts offer varied perspectives on the sustainability of the current Hong Kong market rally. While the outlook is generally positive, potential risks and challenges must be considered.

2.3.1 Analyst Predictions:

Many analysts predict continued growth in the Hong Kong market, citing the sustained positive momentum and improved trade outlook. However, forecasts vary on the extent and duration of this rally.

- [Analyst Name] predicts a [percentage]% increase in the Hang Seng Index over the next year.

- [Analyst Name] emphasizes the potential for continued growth in the technology and consumer staples sectors.

- The consensus view is generally positive, but with cautions about potential volatility.

2.3.2 Potential Risks and Challenges:

Despite the current positive momentum, potential risks and challenges could impact the continued growth of the Hong Kong market. Geopolitical uncertainties and macroeconomic factors remain potential headwinds.

- Escalation of trade tensions could negatively impact market sentiment.

- Global economic slowdown could dampen investor confidence.

- Market volatility remains a risk, necessitating careful investment strategies.

Conclusion: Navigating the Hong Kong Market Rally: A Look Ahead

The Hong Kong market rally, fueled by soaring Chinese stocks and renewed hope for improved US-China trade relations, presents both significant opportunities and potential risks. The impressive performance of key sectors, coupled with increased investor confidence, paints a largely positive picture. However, maintaining a balanced perspective, acknowledging potential challenges, and employing a well-informed investment strategy are crucial for navigating this dynamic market. Stay informed about the Hong Kong market rally and consider diversifying your portfolio to mitigate risks. Further research into individual Chinese stocks and ongoing trade negotiations is recommended for a comprehensive understanding of the evolving market landscape.

Featured Posts

-

John Travolta Speaks Out After Private Bedroom Photo Surfaces Online

Apr 24, 2025

John Travolta Speaks Out After Private Bedroom Photo Surfaces Online

Apr 24, 2025 -

Stock Market Valuation Concerns Bof A Offers Reassurance

Apr 24, 2025

Stock Market Valuation Concerns Bof A Offers Reassurance

Apr 24, 2025 -

Todays Stock Market 1000 Point Dow Rally S And P 500 And Nasdaq Gains

Apr 24, 2025

Todays Stock Market 1000 Point Dow Rally S And P 500 And Nasdaq Gains

Apr 24, 2025 -

Review 77 Inch Lg C3 Oled Tv Is It Right For You

Apr 24, 2025

Review 77 Inch Lg C3 Oled Tv Is It Right For You

Apr 24, 2025 -

Us Lawyers Warned Judge Abrego Garcia Demands End To Stonewalling

Apr 24, 2025

Us Lawyers Warned Judge Abrego Garcia Demands End To Stonewalling

Apr 24, 2025

Latest Posts

-

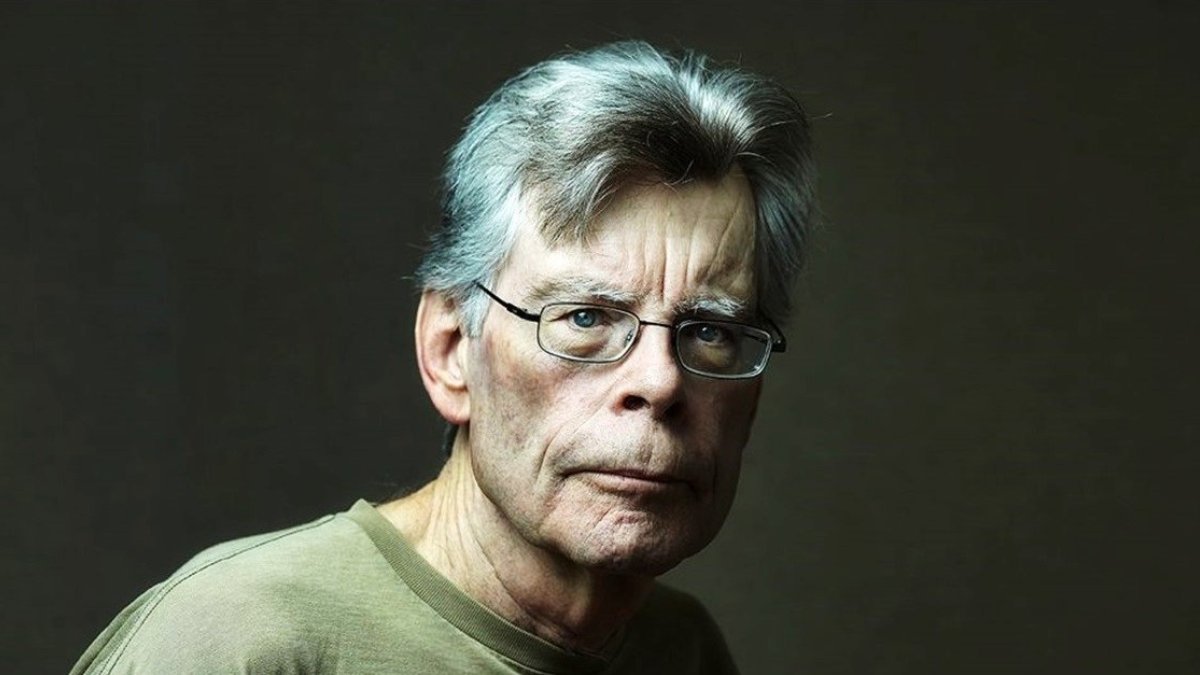

Vislovlyuvannya Stivena Kinga Pro Trampa Ta Maska Pislya Povernennya Do Kh

May 09, 2025

Vislovlyuvannya Stivena Kinga Pro Trampa Ta Maska Pislya Povernennya Do Kh

May 09, 2025 -

Pismennik Stiven King Vvazhaye Maska Ta Trampa Zradnikami

May 09, 2025

Pismennik Stiven King Vvazhaye Maska Ta Trampa Zradnikami

May 09, 2025 -

5 Notable Disputes Stephen King Had With Fellow Celebrities

May 09, 2025

5 Notable Disputes Stephen King Had With Fellow Celebrities

May 09, 2025 -

Stiven King U Kh Gostri Slova Na Adresu Trampa Ta Maska

May 09, 2025

Stiven King U Kh Gostri Slova Na Adresu Trampa Ta Maska

May 09, 2025 -

King Pro Maska Ta Trampa Zrada Na Korist Putina

May 09, 2025

King Pro Maska Ta Trampa Zrada Na Korist Putina

May 09, 2025