Today's Stock Market: 1000-Point Dow Rally, S&P 500 & Nasdaq Gains

Table of Contents

Analyzing the 1000-Point Dow Rally: Causes and Contributing Factors

The 1000-point Dow rally wasn't a spontaneous event; it was fueled by a confluence of positive factors that significantly boosted investor confidence and spurred a surge in buying activity.

Positive Economic Indicators

Several key economic indicators pointed towards a healthier-than-expected economic outlook, contributing to the market's positive sentiment. This included:

- Lower-than-expected inflation: The latest inflation data revealed a slower-than-anticipated rise in consumer prices, easing concerns about persistent inflationary pressures. This suggested that the Federal Reserve's monetary policy tightening might be starting to have the desired effect.

- Strong jobs report: A robust jobs report, exceeding expectations in terms of job creation and unemployment figures, further solidified the positive economic narrative. This demonstrated the resilience of the labor market, a crucial factor in economic growth.

- Increased consumer confidence: Positive consumer confidence indices reflected growing optimism among consumers about the economy's future prospects. This translated into increased spending and investment, bolstering economic activity. The improved sentiment played a pivotal role in the stock market surge. These positive economic indicators significantly influenced investor sentiment, leading to increased investment activity and fueling the 1000-point Dow rally.

Impact of Federal Reserve Policy

The Federal Reserve's monetary policy plays a crucial role in shaping market trends. While the exact influence on this specific rally is complex and debated, several interpretations exist:

- Interest rate hikes (or pauses): The Federal Reserve's decisions regarding interest rate hikes significantly impact borrowing costs and investor behavior. Market reaction to recent rate decisions, whether hikes or pauses, can be seen as a contributing factor to the overall market sentiment.

- Quantitative easing (or tapering): The Federal Reserve's actions concerning quantitative easing (QE) – the large-scale purchase of government bonds and other assets to inject liquidity into the market – also influence the overall market. Any shifts in QE policy can have significant ripple effects. Analyzing the Federal Reserve's recent statements and actions is crucial for understanding their impact on the 1000-point Dow rally and broader market trends.

Strong Corporate Earnings Reports

Robust corporate earnings reports from various sectors played a significant role in driving the market rally. Companies across multiple sectors exceeded expectations, contributing to the positive investor sentiment:

- Technology stocks: Strong performance in the technology sector, driven by positive earnings reports from key players, fueled a substantial portion of the market gains. Specifically, [mention specific companies and their positive contributions].

- Other strong sectors: Beyond technology, other sectors like [mention other strong-performing sectors, e.g., energy or consumer staples] also reported strong earnings, adding to the overall positive market momentum. These strong corporate earnings painted a picture of economic health and growth, further bolstering the 1000-point Dow rally.

S&P 500 and Nasdaq Gains: A Detailed Look

The 1000-point Dow rally wasn't isolated to the Dow Jones Industrial Average; it was accompanied by substantial gains in the S&P 500 and Nasdaq indices.

S&P 500 Performance Analysis

The S&P 500, a broader market index, experienced significant gains, mirroring the positive performance of the Dow. This signifies a widespread positive sentiment across various market sectors.

- Percentage gains: The S&P 500 saw a [insert percentage]% increase, highlighting the widespread nature of the market surge.

- Key components' performance: Strong performance from key sectors within the S&P 500, like [mention specific sectors], contributed significantly to the overall index performance. The strong performance of these components demonstrates a broad-based rally, not limited to a few specific stocks.

Nasdaq's Significant Rise

The Nasdaq Composite, heavily weighted with technology stocks, experienced an even more pronounced surge, reflecting the strength of the tech sector.

- Technology stocks' influence: The strong performance of prominent technology companies, such as [mention specific tech giants], played a crucial role in driving the Nasdaq's significant rise. The growth in these companies reflects strong investor confidence in the future of the tech sector.

- Growth stocks' rally: The Nasdaq's performance also showcased a rally in growth stocks, which often benefit disproportionately from positive economic sentiment and expectations of future growth.

Implications and Outlook for Investors: Navigating the Post-Rally Market

The 1000-point Dow rally presents both opportunities and challenges for investors.

Short-Term vs. Long-Term Investment Strategies

Investors should adopt strategies aligned with their risk tolerance and investment horizon.

- Short-term strategies: Short-term investors might consider capitalizing on potential short-term gains while remaining vigilant about market volatility.

- Long-term strategies: Long-term investors should maintain a diversified portfolio, focusing on asset allocation aligned with their long-term financial goals. This approach allows them to weather short-term market fluctuations. The importance of diversification and careful asset allocation cannot be overstated, regardless of market conditions.

Potential Risks and Market Volatility

While the current market sentiment is positive, investors must remain aware of potential risks.

- Market volatility: Market conditions can change rapidly, and the current upward trend could reverse. Investors should be prepared for potential volatility and have a risk management strategy in place.

- Economic uncertainty: Unforeseen economic events or shifts in geopolitical landscapes could impact the market's trajectory. Monitoring economic indicators and global news remains crucial.

Conclusion: Understanding and Capitalizing on the 1000-Point Dow Rally

The 1000-point Dow rally, accompanied by substantial gains in the S&P 500 and Nasdaq, resulted from a combination of positive economic indicators, Federal Reserve policy, and strong corporate earnings. Understanding these factors is crucial for investors to navigate this dynamic market effectively. Both short-term and long-term strategies should be considered, always keeping risk management and diversification at the forefront. Stay informed about the latest stock market trends and make informed investment decisions by regularly checking our analysis of the 1000-point Dow rally and related market movements.

Featured Posts

-

Analysis Of Oil Prices And Market Trends For April 23

Apr 24, 2025

Analysis Of Oil Prices And Market Trends For April 23

Apr 24, 2025 -

B And B Wednesday Recap April 9 Steffy Finn Liam And Bills Intense Confrontation

Apr 24, 2025

B And B Wednesday Recap April 9 Steffy Finn Liam And Bills Intense Confrontation

Apr 24, 2025 -

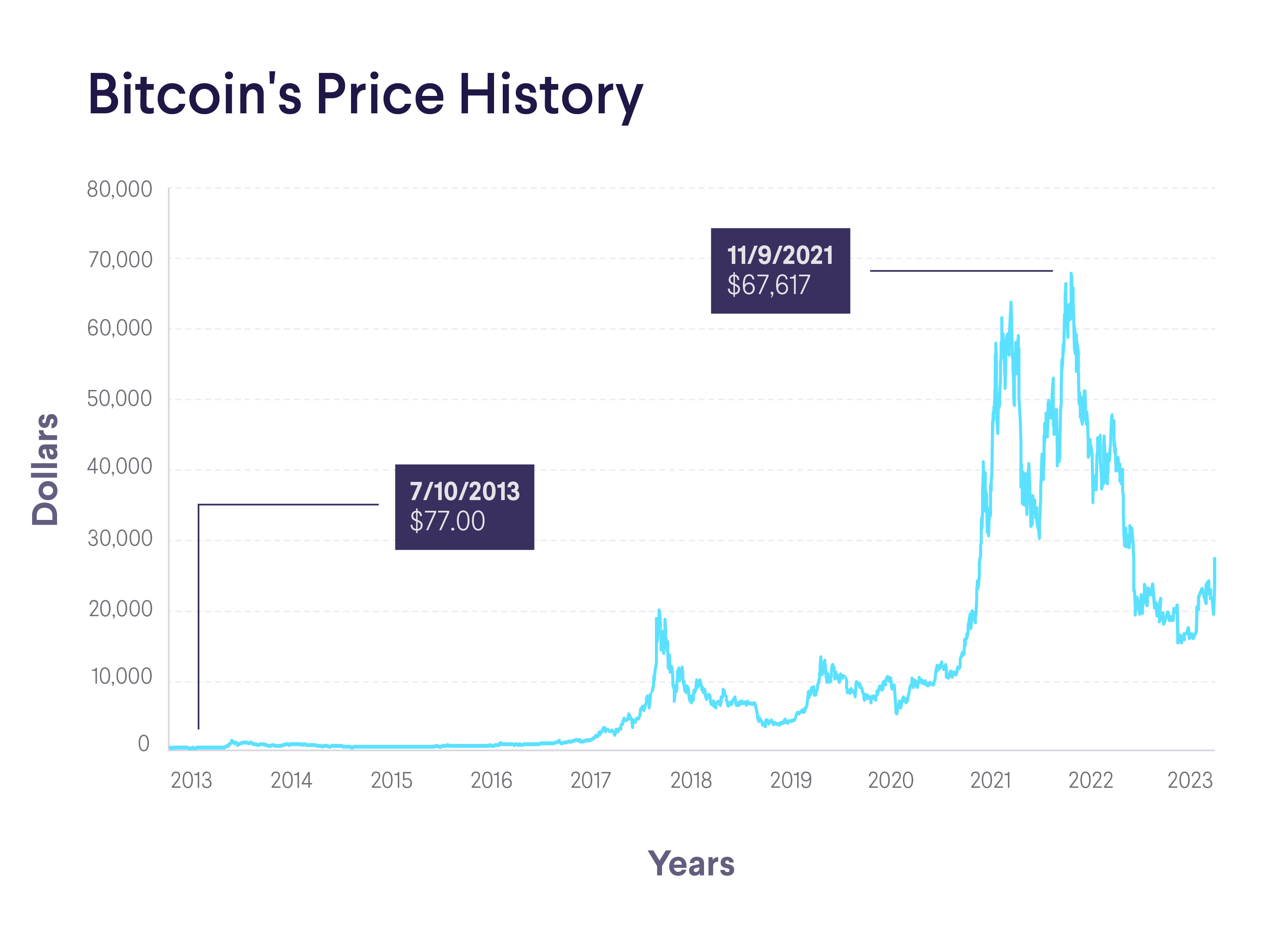

Bitcoin Btc Price Surge Trumps Actions And Fed Influence

Apr 24, 2025

Bitcoin Btc Price Surge Trumps Actions And Fed Influence

Apr 24, 2025 -

February 20th Bold And The Beautiful Spoilers Liams Loneliness Finns Warning

Apr 24, 2025

February 20th Bold And The Beautiful Spoilers Liams Loneliness Finns Warning

Apr 24, 2025 -

Trumps Powell Remarks Boost Us Stock Futures

Apr 24, 2025

Trumps Powell Remarks Boost Us Stock Futures

Apr 24, 2025