Hudson's Bay: 65 Leases Attract Significant Interest

Table of Contents

The Appeal of Hudson's Bay's Lease Portfolio

The significant investor interest in these 65 Hudson's Bay leases stems from several key factors. The portfolio offers a compelling mix of attractive features that make it a highly desirable investment opportunity.

Prime Locations

These leases boast enviable locations across Canada, placing them in high-traffic areas with desirable demographics. This translates to strong potential for tenant occupancy and rental income.

- Major City Centers: Many leases are situated in the heart of major Canadian cities like Toronto, Vancouver, Calgary, and Montreal.

- High Foot Traffic Areas: Properties are strategically positioned near major transportation hubs, popular shopping districts, and affluent residential neighborhoods.

- Proximity to Key Attractions: Several leases are located near popular tourist attractions, ensuring consistent foot traffic throughout the year.

These prime locations offer significant advantages to a variety of businesses, from flagship retail stores to smaller boutiques and service-oriented businesses. The high visibility and accessibility ensure maximum exposure and customer reach.

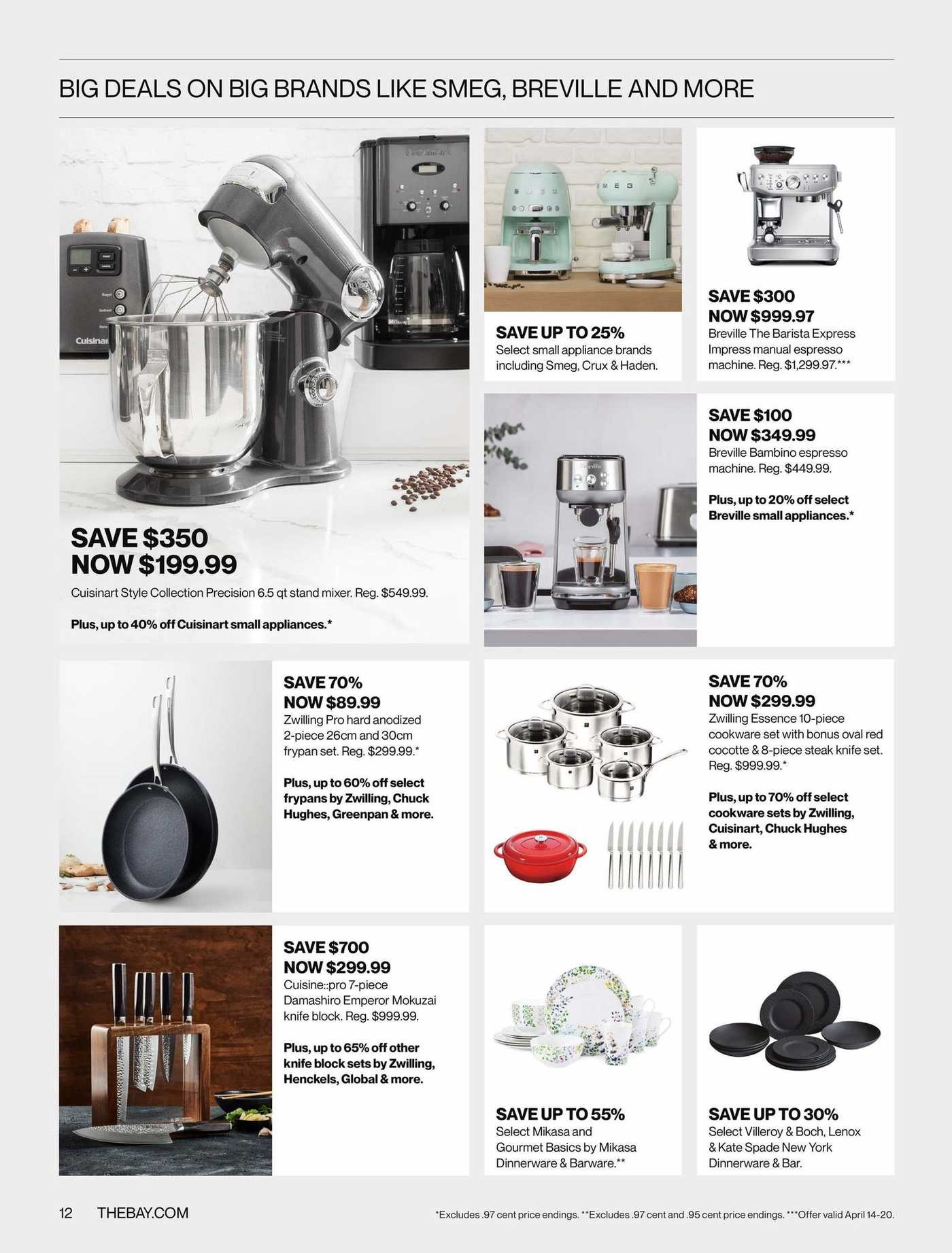

Diverse Property Types

The portfolio is not limited to a single type of property. This diversity broadens the appeal to a wide range of investors and investment strategies.

- Retail Spaces: A substantial portion of the leases encompasses traditional retail spaces, suitable for a variety of businesses.

- Office Spaces: Several leases offer adaptable office spaces, catering to the growing demand for flexible work environments.

- Mixed-Use Development Potential: Some properties offer the exciting potential for mixed-use developments, combining retail, residential, and office spaces to maximize returns.

This variety allows for significant flexibility in terms of redevelopment and repurposing, enabling investors to tailor properties to meet evolving market demands.

Strong Brand Recognition

The enduring legacy of the Hudson's Bay Company adds an intangible yet invaluable asset to these lease investments.

- Established Reputation: Hudson's Bay is a nationally recognized brand synonymous with quality and reliability.

- Historical Significance: The brand's rich history and iconic status resonate with consumers, contributing to a strong sense of place and community.

- Enhanced Tenant Attraction: The association with the Hudson's Bay brand can attract high-quality tenants and command premium rental rates.

This strong brand recognition translates directly into increased property value and a lower risk profile for investors.

Potential Investors and Their Interests

The diverse nature of the Hudson's Bay lease portfolio attracts a wide spectrum of investors, each with their own unique investment strategies.

Types of Investors

Interest comes from various investor profiles, each with their specific investment goals:

- REITs (Real Estate Investment Trusts): Large REITs see these leases as a valuable addition to their diversified portfolios, offering stable income streams and potential for long-term growth.

- Private Equity Firms: These firms are drawn to the opportunity for value creation through redevelopment and repositioning of specific properties.

- Individual High-Net-Worth Investors: Individual investors are attracted by the potential for significant returns and the prestige associated with owning a piece of Canadian retail history.

Each investor type brings a unique perspective and investment strategy to the table, fueling the competition and driving up the value of these leases.

Investment Strategies

Several investment strategies are being considered for these Hudson's Bay leases:

- Long-Term Hold: Investors seeking stable, passive income will likely pursue a long-term hold strategy, benefiting from consistent rental income and potential property appreciation.

- Redevelopment: Some investors will focus on redeveloping properties to maximize their potential, creating modern, high-value spaces.

- Flipping Properties: More opportunistic investors may consider a short-term strategy of buying, renovating, and quickly reselling properties for a profit.

The current market conditions, including interest rates and economic forecasts, will play a crucial role in determining which strategy proves most profitable.

Market Analysis and Future Outlook

Understanding the current market conditions and future projections is vital for assessing the potential return on investment.

Current Market Conditions

The commercial real estate market is experiencing a dynamic period characterized by:

- Fluctuating Interest Rates: Interest rate changes directly influence borrowing costs and impact investment decisions.

- Economic Growth: The overall health of the Canadian economy influences consumer spending and rental demand.

- Retail Sector Trends: Evolving consumer preferences and the rise of e-commerce are shaping the demand for retail spaces.

These factors must be carefully considered when evaluating the potential returns on these Hudson's Bay leases.

Projected Growth and Returns

While precise predictions are impossible, the outlook for these leases is generally positive.

- Potential for Appreciation: Prime locations and strong brand recognition suggest significant potential for property value appreciation over time.

- Stable Rental Income: High occupancy rates in desirable locations are expected to generate consistent rental income.

- Redevelopment Opportunities: The potential for redevelopment and repurposing offers opportunities for significant value creation.

However, investors should approach any projections with caution, acknowledging inherent market risks. Due diligence and professional advice are crucial before making investment decisions.

Conclusion

The significant interest in Hudson's Bay's 65 leases underscores the exceptional investment potential they present. The combination of prime locations, diverse property types, and strong brand recognition makes this a compelling opportunity for a wide range of investors. These Hudson's Bay leases offer a unique blend of stability and growth potential within the Canadian real estate market. Learn more about investing in these highly sought-after Hudson's Bay leases today! (Link to relevant resources would go here)

Featured Posts

-

Bold And The Beautiful April 3 Recap Liams Health Crisis Following Fight With Bill

Apr 24, 2025

Bold And The Beautiful April 3 Recap Liams Health Crisis Following Fight With Bill

Apr 24, 2025 -

Canadian Dollar Weakness A Deeper Dive Into Recent Currency Movements

Apr 24, 2025

Canadian Dollar Weakness A Deeper Dive Into Recent Currency Movements

Apr 24, 2025 -

A More Fiscally Responsible Canada Rethinking Liberal Economic Strategies

Apr 24, 2025

A More Fiscally Responsible Canada Rethinking Liberal Economic Strategies

Apr 24, 2025 -

Consumers Curb Spending Impact On Credit Card Companies

Apr 24, 2025

Consumers Curb Spending Impact On Credit Card Companies

Apr 24, 2025 -

Is Betting On Wildfires Like The La Fires A Sign Of The Times

Apr 24, 2025

Is Betting On Wildfires Like The La Fires A Sign Of The Times

Apr 24, 2025