Import Duties USA: Impact On Clothing Prices

Table of Contents

Understanding US Import Duties on Clothing

Import duties, or tariffs, are taxes levied on goods imported into a country. For clothing, these duties are determined by the Harmonized Tariff Schedule (HTS). The HTS is a standardized system used globally to classify traded products, with each item assigned a specific code. This code determines the applicable import duty rate. The duty itself can be calculated in two main ways: ad valorem (a percentage of the goods' value) and specific (a fixed amount per unit). The country of origin of the clothing is another critical factor in determining the final import tax.

- Different types of clothing have different tariff rates. A simple cotton t-shirt will likely have a different duty rate than a complex, embellished silk gown.

- The HTS code determines the applicable duty rate. Understanding the HTS code for your imported clothing is essential to calculating the correct import taxes.

- Duties are calculated on the value of the goods plus shipping costs. This means the final cost includes not just the price of the garment but also the expenses associated with getting it to the US.

How Import Duties Increase Clothing Prices

Import duties directly impact the final price consumers pay. When clothing is imported, the importer (typically a retailer or brand) must pay these tariffs to US Customs and Border Protection before the goods can enter the country. These costs are then factored into the retailer's pricing strategy. The higher the import duty, the higher the price the consumer ultimately pays.

- Duties increase the cost of importing clothing. This is a fundamental principle affecting the price structure of imported apparel.

- Increased costs are usually passed on to the consumer. Retailers rarely absorb these extra costs; they typically include them in the final selling price.

- Higher import duties can lead to higher retail prices. This makes clothing less affordable, potentially affecting consumer purchasing power, especially for those on a budget.

- This can affect affordability and consumer purchasing power. Higher clothing prices can restrict consumer choices and limit access to fashionable apparel for some demographics.

Factors Influencing Import Duty Rates on Apparel

Several factors determine the specific duty rate applied to imported clothing. These include the material composition, the country of origin, and sometimes even the manufacturing process.

- The type of fabric (e.g., cotton, silk, synthetic) impacts the duty rate. Different fabrics are assigned different HTS codes, leading to varied duty rates. Synthetic materials might have different tariffs than natural fibers like cotton or silk.

- The country of origin significantly influences the tariff. Trade agreements between the US and other countries can significantly impact duty rates. Clothing imported from a country with a free trade agreement with the US will likely have lower or no duties.

- Trade agreements (e.g., NAFTA/USMCA) can reduce or eliminate duties. These agreements aim to streamline trade and reduce barriers to commerce between participating countries.

- The manufacturing process (e.g., handmade vs. mass-produced) may play a role. While less common, the way a garment is made could influence its classification and tariff rate.

The Impact on Consumers and the Fashion Industry

High import duties have far-reaching consequences. For consumers, higher prices can lead to reduced spending and a shift towards cheaper, potentially lower-quality alternatives. For the fashion industry, it can stifle growth, particularly for smaller businesses that rely on imports. Conversely, domestic manufacturers might benefit from increased protection against foreign competition.

- Higher prices can lead to decreased consumer demand. Consumers might delay purchases or buy fewer items of clothing.

- Consumers may opt for cheaper alternatives, even if of lower quality. This can lead to a decline in overall quality within the market.

- It can hinder the growth of small businesses importing clothing. High duties increase their operational costs, making it harder to compete.

- Domestic manufacturers may benefit from higher import duties, potentially increasing jobs. Protectionist tariffs can help shield local producers from cheaper imports.

Exploring Alternatives to High Import Duty Clothing

Despite the challenges posed by import duties, there are strategies consumers can employ to find affordable and ethically sourced clothing.

- Buying second-hand clothing. This is a sustainable and economical alternative, often offering unique and stylish pieces at lower prices.

- Supporting local or domestic brands. Purchasing clothes made in the USA avoids import duties altogether.

- Looking for sales and discounts. Retailers frequently offer sales and promotional periods, making clothing more accessible.

- Considering clothing rental services. This is a growing trend that allows consumers to access a variety of styles without the commitment of purchasing.

Conclusion

Import duties significantly impact the price of clothing in the USA, influencing consumer choices and impacting both the fashion industry and the broader economy. Fluctuations in tariffs directly affect retail prices, making understanding these dynamics crucial.

Understanding the impact of US import duties on clothing prices is crucial for both consumers and businesses. Stay informed about changes in import duties and tariff rates to make informed purchasing decisions and better manage your business strategies related to clothing imports. Learn more about how US import duties affect your favorite clothing brands and how you can navigate this complex landscape effectively.

Featured Posts

-

Joy Crookes New Single Carmen Release Date And Details

May 24, 2025

Joy Crookes New Single Carmen Release Date And Details

May 24, 2025 -

Viral Video Tik Tokers Encounter With Pope Leo Years After Confirmation

May 24, 2025

Viral Video Tik Tokers Encounter With Pope Leo Years After Confirmation

May 24, 2025 -

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Net Asset Value Nav Explained

May 24, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Net Asset Value Nav Explained

May 24, 2025 -

A Viral Tik Tok Story Reunion With A Former Bishop Now Pope

May 24, 2025

A Viral Tik Tok Story Reunion With A Former Bishop Now Pope

May 24, 2025 -

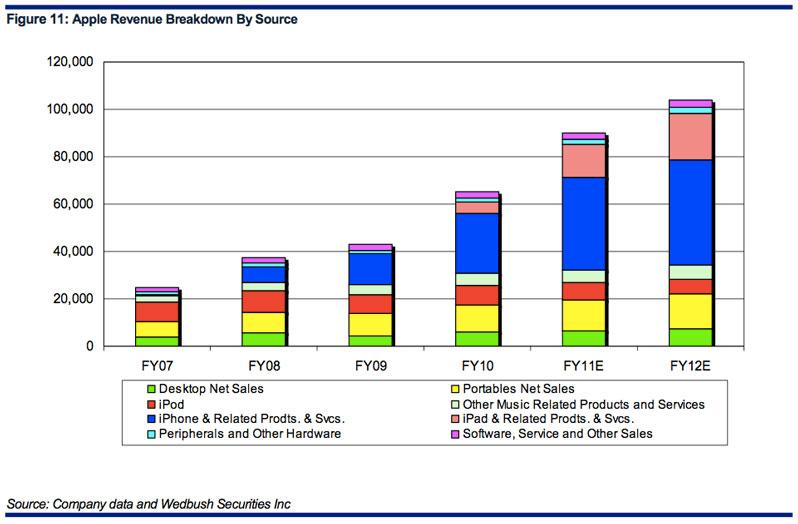

Should You Follow Wedbushs Lead On Apple Stock Despite Price Target Cut

May 24, 2025

Should You Follow Wedbushs Lead On Apple Stock Despite Price Target Cut

May 24, 2025

Latest Posts

-

New Photo Of Dylan Dreyer And Brian Fichera Causes Stir On Social Media

May 24, 2025

New Photo Of Dylan Dreyer And Brian Fichera Causes Stir On Social Media

May 24, 2025 -

Dylan Dreyers Postpartum Weight Loss Journey On Today

May 24, 2025

Dylan Dreyers Postpartum Weight Loss Journey On Today

May 24, 2025 -

Recent Dylan Dreyer Post With Brian Fichera Generates Strong Fan Response

May 24, 2025

Recent Dylan Dreyer Post With Brian Fichera Generates Strong Fan Response

May 24, 2025 -

Nbcs Dylan Dreyer A Remarkable Physical Transformation

May 24, 2025

Nbcs Dylan Dreyer A Remarkable Physical Transformation

May 24, 2025 -

Dylan Dreyers Weight Loss Transformation A Powerful Impression On Nbc

May 24, 2025

Dylan Dreyers Weight Loss Transformation A Powerful Impression On Nbc

May 24, 2025