India And Saudi Arabia: Joint Venture For Two Major Oil Refineries

Table of Contents

Strategic Significance of the Joint Venture for India

This joint venture holds immense strategic importance for India, offering substantial benefits across various sectors.

Enhanced Energy Security

- Reduced reliance on other global suppliers: The project significantly reduces India's dependence on volatile global oil markets and diverse supplier nations. This diversification strengthens India's energy independence.

- Assured access to crucial crude oil resources: A direct pipeline to Saudi Arabian crude oil ensures a consistent and reliable supply, mitigating risks associated with geopolitical instability in other oil-producing regions. This reliable access to Saudi crude oil is a key element of the joint venture.

- Price stability and reduced vulnerability to global price fluctuations: Direct access to Saudi crude oil helps India negotiate better prices and reduces its vulnerability to sudden price shocks in the international oil market. This price stability is a significant advantage for the Indian economy.

- Potential for long-term supply contracts: The partnership facilitates long-term supply agreements, ensuring a predictable and stable flow of crude oil, minimizing disruptions to India's energy sector.

Economic Boost for India

The project is a major catalyst for economic growth in India:

- Creation of numerous jobs in construction, operation, and related industries: The refineries will create thousands of jobs across various sectors, from construction and engineering to operation and maintenance, stimulating significant employment opportunities. These job creation opportunities are a substantial component of the project's economic impact.

- Stimulation of downstream industries like petrochemicals: The increased availability of refined petroleum products will fuel growth in downstream industries, such as petrochemicals, plastics, and fertilizers, further boosting the Indian economy.

- Increased foreign investment and technological transfer: The Saudi Arabian investment will bring significant capital inflow and advanced refining technologies, accelerating India's technological advancement in the energy sector.

- Contribution to India's GDP growth: The project's positive impacts on employment, industry, and investment will contribute significantly to India's overall GDP growth, further strengthening the national economy.

Infrastructure Development

The project will trigger significant infrastructure development:

- Development of new port facilities and transportation networks: To handle the increased volume of crude oil and refined products, new port infrastructure and efficient transportation networks will be developed, improving India's overall logistics capabilities.

- Modernization of India's refining infrastructure: The venture will lead to a modernization of India's existing refining infrastructure, incorporating cutting-edge technologies and enhancing efficiency.

- Investment in related technological advancements: The joint venture will stimulate investment in research and development of advanced refining technologies, propelling India towards energy sector innovation.

Saudi Arabia's Gains from the Partnership

The joint venture presents significant advantages for Saudi Arabia:

Market Access and Expansion

- Gaining a strong foothold in the rapidly growing Indian energy market: India's massive energy demands offer a lucrative market for Saudi Arabian oil, ensuring long-term market stability for Saudi Arabia's oil exports.

- Diversification of Saudi Arabia's oil export destinations: The partnership diversifies Saudi Arabia's export markets, reducing its reliance on any single buyer and strengthening its overall market position.

- Strengthening bilateral economic ties with a key strategic partner: The joint venture fosters stronger diplomatic and economic relationships between Saudi Arabia and India, two key players in the global energy market.

Investment Opportunities

- Attracting significant investment in Saudi Arabian oil infrastructure: The project will attract substantial investment in Saudi Arabia's oil infrastructure, further solidifying its position as a global energy leader.

- Creating new revenue streams and economic growth opportunities: The refinery project will generate significant revenue streams and stimulate economic growth within Saudi Arabia.

Geopolitical Implications

- Strengthening Saudi Arabia's influence in the region: The partnership strengthens Saudi Arabia's geopolitical influence, particularly within South Asia and the broader Indian Ocean region.

- Promoting closer ties with a major global player: The strengthened relationship with India enhances Saudi Arabia's standing on the global stage.

Details of the Refinery Projects

While specific details are still emerging, the project is anticipated to be massive.

Location and Capacity

[Insert specific details about planned locations and capacities of refineries once available. Use placeholder text until confirmed details are released: e.g., "The refineries are planned for [Location 1] and [Location 2], with a combined refining capacity of approximately [Capacity] barrels per day."]

Technology and Investment

[Insert information about planned technologies and investment costs once available. Use placeholder text until confirmed details are released: e.g., "The project will utilize state-of-the-art refining technologies, including [Specific Technologies], with an estimated investment of [Amount] USD."]

Timeline and Expected Completion

[Insert information about projected timeline and completion dates once available. Use placeholder text until confirmed details are released: e.g., "The project is expected to be completed within [Number] years, with initial operations commencing in [Year]."]

Challenges and Potential Risks

Despite the significant potential, challenges and risks must be addressed:

Environmental Concerns

- Environmental impact assessments and mitigation strategies: Thorough environmental impact assessments and robust mitigation strategies are crucial to minimize any negative environmental consequences of the project. Sustainable practices will be key.

- Sustainable and environmentally responsible operations: Commitment to sustainable and environmentally responsible operations is vital to ensure the long-term success and societal acceptance of the project.

Geopolitical Risks

Geopolitical instability in the region or global events could impact the project's timeline and cost. Careful risk assessment is crucial.

Regulatory Hurdles

Navigating regulatory hurdles and bureaucratic processes in both India and Saudi Arabia will require effective coordination and planning.

Conclusion

The India and Saudi Arabia joint venture for two major oil refineries represents a significant milestone in bilateral relations and has the potential to profoundly impact both nations’ energy security and economic growth. This strategic partnership promises enhanced energy access, economic stimulation, and infrastructural development for India, while providing Saudi Arabia with expanded market access and investment opportunities. While challenges and risks exist, the potential rewards of this ambitious undertaking make it a development worthy of close observation. Stay informed about the progress of this transformative India and Saudi Arabia Joint Venture Oil Refineries project to understand its evolving impact on the global energy market. Follow future updates on this vital India-Saudi Arabia energy partnership for more insights into its development and implications.

Featured Posts

-

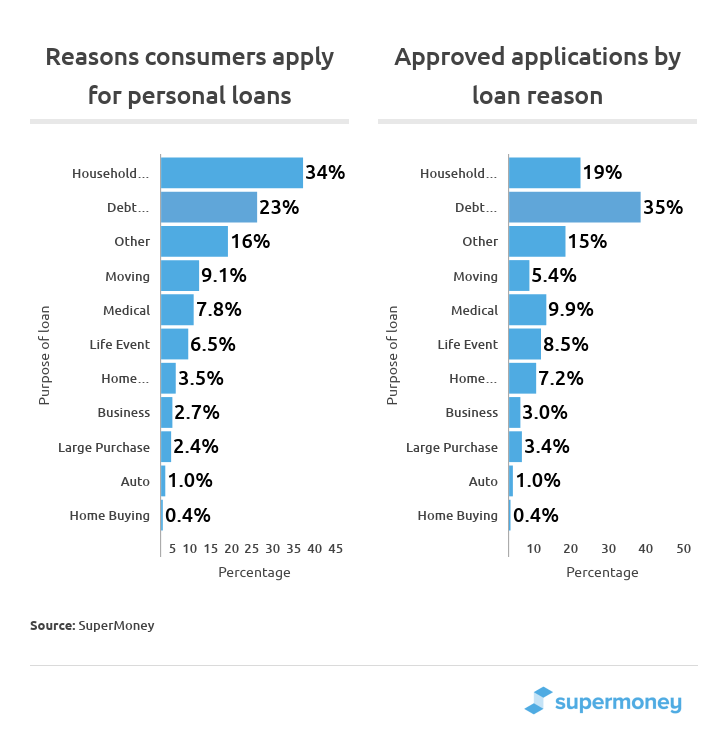

The Impact Of Reduced Consumer Spending On The Credit Card Industry

Apr 24, 2025

The Impact Of Reduced Consumer Spending On The Credit Card Industry

Apr 24, 2025 -

Bold And Beautiful Liams Promise Hopes Dilemma And Lunas Impact A 2 Week Spoiler

Apr 24, 2025

Bold And Beautiful Liams Promise Hopes Dilemma And Lunas Impact A 2 Week Spoiler

Apr 24, 2025 -

Office365 Security Breach Exposes Millions In Losses Criminal Charges Filed

Apr 24, 2025

Office365 Security Breach Exposes Millions In Losses Criminal Charges Filed

Apr 24, 2025 -

Us Lawyers Warned Judge Abrego Garcia Demands End To Stonewalling

Apr 24, 2025

Us Lawyers Warned Judge Abrego Garcia Demands End To Stonewalling

Apr 24, 2025 -

Two New Oil Refineries Planned Saudi Arabia India Collaboration

Apr 24, 2025

Two New Oil Refineries Planned Saudi Arabia India Collaboration

Apr 24, 2025