The Impact Of Reduced Consumer Spending On The Credit Card Industry

Table of Contents

1. Introduction:

The recent dip in consumer confidence, reflected in a reported 5% decrease in retail sales last quarter (hypothetical statistic), highlights a growing concern: reduced consumer spending is significantly impacting the credit card industry. This trend is not merely a minor fluctuation; it's a fundamental shift with far-reaching consequences for credit card companies, merchants, and consumers alike. This article will analyze how reduced consumer spending negatively impacts various aspects of the credit card industry, from transaction volume to lending practices.

2. Main Points:

H2: Decreased Credit Card Transaction Volume

Reduced consumer spending directly translates to fewer credit card transactions, impacting both merchants and card issuers.

H3: Lower Merchant Revenue

Lower consumer spending means fewer purchases made using credit cards, leading to a decline in revenue for merchants. This impact is felt across various sectors:

- Restaurants: Dine-in and takeout orders are significantly affected by reduced consumer spending. A recent study shows a 10% decrease in restaurant credit card transactions (hypothetical statistic).

- Retail Stores: Brick-and-mortar stores are experiencing lower foot traffic and sales, directly impacting their credit card revenue streams. Data indicates a 7% drop in retail credit card transactions (hypothetical statistic).

- Online Businesses: E-commerce businesses are also feeling the pinch, with decreased online purchases resulting in lower credit card processing volumes.

H3: Impact on Interchange Fees

Interchange fees, the fees paid by merchants to card networks and issuers for each credit card transaction, are directly affected by transaction volume. Lower transaction volume means lower interchange fees for everyone involved in the credit card processing chain:

- Reduced profitability: Card issuers and payment processors see a direct reduction in their earnings.

- Fee structure adjustments: We might see adjustments in interchange fee structures to compensate for the reduced volume, potentially impacting merchants further.

- Investment implications: This decrease in revenue can affect investment in new technologies and infrastructure within the credit card industry.

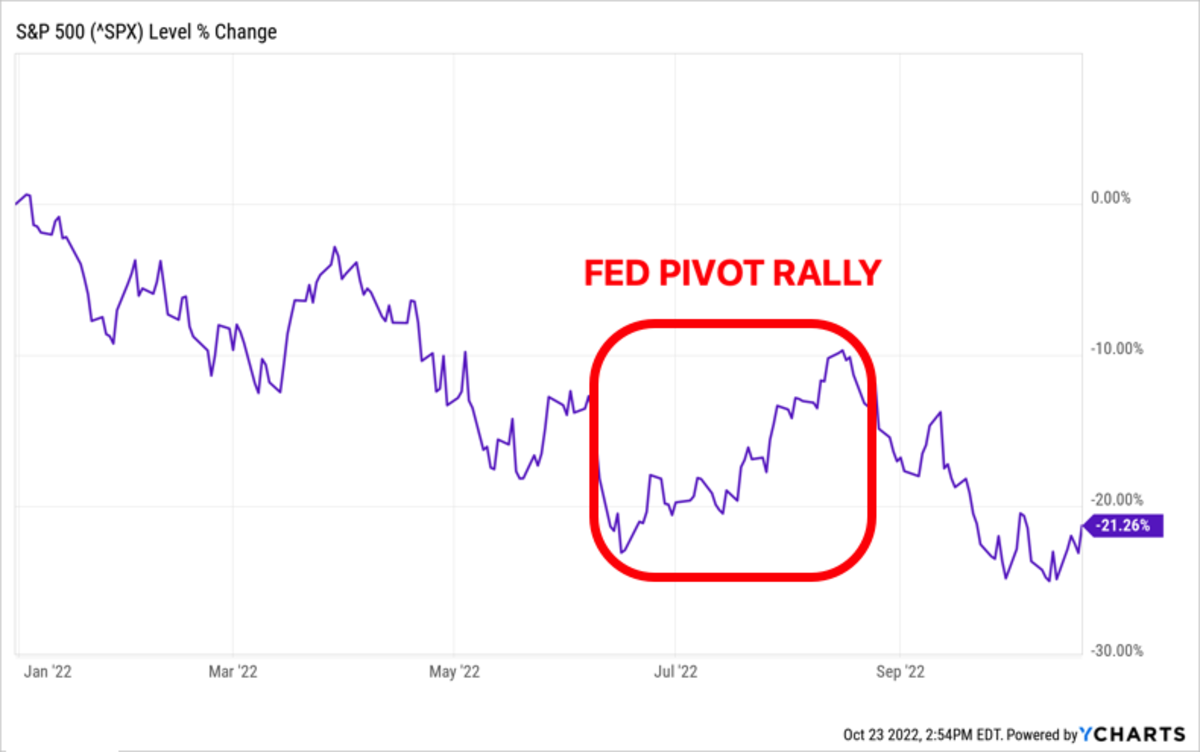

H2: Increased Credit Card Delinquency Rates

As consumers face financial strain due to reduced disposable income, credit card delinquency rates are rising.

H3: Financial Strain on Consumers

Inflation and potential job losses are forcing consumers to rely more heavily on credit, increasing the likelihood of missed payments:

- Rising delinquency rates: Industry reports show a 3% increase in credit card delinquency rates (hypothetical statistic).

- Debt accumulation: Consumers are accumulating more debt, making it harder to manage their finances and leading to increased delinquency.

- Impact on credit scores: Missed payments negatively affect credit scores, limiting access to future credit.

H3: Impact on Credit Card Companies' Profitability

Increased delinquency rates directly impact the profitability of credit card companies:

- Increased write-offs: Credit card companies have to write off bad debt, leading to significant financial losses.

- Higher collection costs: Companies incur higher costs in pursuing delinquent payments.

- Risk assessment changes: Credit card companies are forced to re-evaluate their risk assessment models, potentially tightening lending criteria further.

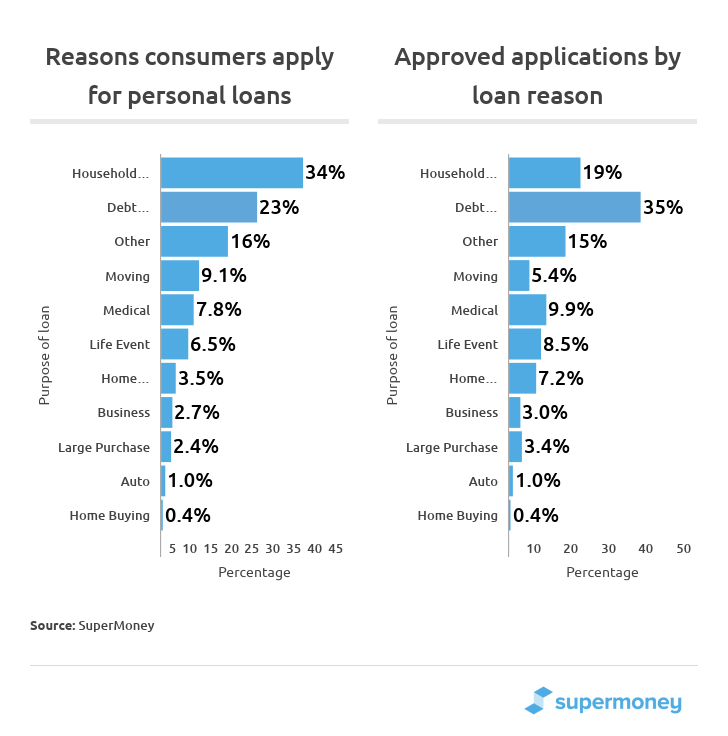

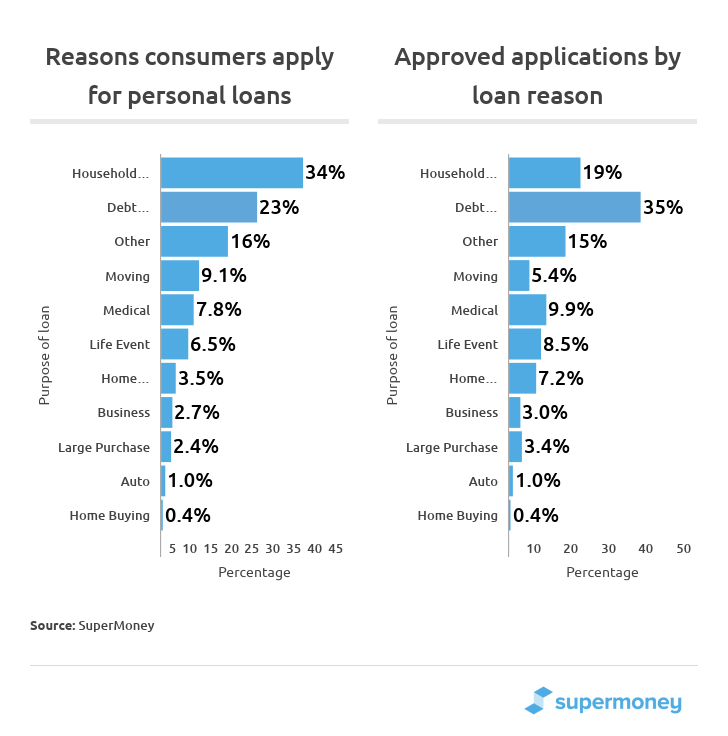

H2: Changes in Credit Card Lending Practices

In response to reduced consumer spending and increased risk, credit card companies are adapting their lending practices.

H3: Tighter Lending Criteria

To mitigate risk, credit card companies are implementing stricter lending criteria:

- More stringent approval processes: Applicants face more rigorous scrutiny before being approved for credit cards.

- Lower credit limits: Approved applicants receive lower credit limits than previously.

- Higher interest rates: Interest rates are increasing to compensate for higher risk.

H3: Reduced Credit Card Offers and Promotions

Reduced consumer spending leads to a decrease in marketing and promotional efforts:

- Less advertising spending: Credit card companies are reducing their marketing budgets.

- Fewer attractive offers: There are fewer attractive sign-up bonuses and promotional incentives.

- Impact on customer acquisition: Attracting new customers becomes more challenging.

H2: Opportunities for Innovation and Adaptation

While the challenges are significant, the reduced consumer spending trend also presents opportunities for innovation and adaptation.

H3: Fintech Solutions and Alternative Payment Methods

The rise of Buy Now Pay Later (BNPL) services and other alternative payment methods poses both a challenge and an opportunity for traditional credit card companies:

- Competition from BNPL: BNPL services are capturing market share, forcing credit card companies to innovate.

- Integration of new technologies: Credit card companies are exploring integration with BNPL and other fintech solutions.

- Evolving customer expectations: Credit card companies need to adapt to changing customer preferences and expectations.

H3: Focus on Customer Retention and Loyalty Programs

Retaining existing customers is crucial in a challenging economic climate:

- Improved customer service: Companies are investing in enhancing customer service and building stronger customer relationships.

- Loyalty programs and rewards: Attractive loyalty programs and rewards are being implemented to retain customers.

- Personalized offers: Personalized offers and tailored services are becoming increasingly important.

3. Conclusion:

Reduced consumer spending has a significant and multifaceted impact on the credit card industry, affecting transaction volume, delinquency rates, and lending practices. The interconnectedness of these challenges requires credit card companies to adapt and innovate. Understanding these impacts is crucial for both businesses and consumers. Stay informed about the evolving credit card landscape and learn more about managing your credit during times of reduced consumer spending. Understand the impact of reduced consumer spending on your finances and your business's financial health.

Featured Posts

-

Child Actor Sophie Nyweide Known For Mammoth And Noah Passes Away At 24

Apr 24, 2025

Child Actor Sophie Nyweide Known For Mammoth And Noah Passes Away At 24

Apr 24, 2025 -

Bof As Take On Elevated Stock Market Valuations

Apr 24, 2025

Bof As Take On Elevated Stock Market Valuations

Apr 24, 2025 -

The Impact Of Missed Mammograms Learning From Tina Knowles Cancer Diagnosis

Apr 24, 2025

The Impact Of Missed Mammograms Learning From Tina Knowles Cancer Diagnosis

Apr 24, 2025 -

Stock Market Rally Trumps Influence On Us Futures

Apr 24, 2025

Stock Market Rally Trumps Influence On Us Futures

Apr 24, 2025 -

Emerging Market Stocks Outperform Us In 2024 A Year Of Contrasts

Apr 24, 2025

Emerging Market Stocks Outperform Us In 2024 A Year Of Contrasts

Apr 24, 2025