Indian Stock Market Update: Sensex, Nifty Rise; UltraTech Cement Falls

Table of Contents

Keywords: Indian stock market, Sensex, Nifty, stock market update, UltraTech Cement, Indian stock market news, stock market analysis, BSE, NSE, Indian stock market trends, stock market performance

The Indian stock market displayed a mixed bag today, with the benchmark indices, Sensex and Nifty, registering impressive gains, defying a significant slump in UltraTech Cement's stock price. This update dissects the key factors driving these contrasting market movements, providing valuable insights into the current Indian stock market trends.

Sensex and Nifty Gains

Factors Contributing to the Rise

The robust performance of the Sensex and Nifty can be attributed to a confluence of positive factors:

- Positive Global Cues: Strong performance in US markets overnight injected optimism into the Indian stock market, influencing investor sentiment positively. The positive global economic indicators helped boost investor confidence.

- Increased Foreign Institutional Investor (FII) Investment: A significant inflow of funds from Foreign Institutional Investors (FIIs) provided substantial support to the market. FIIs' renewed interest indicates a positive outlook on the Indian economy's growth potential.

- Strong Corporate Earnings Reports: Positive corporate earnings reports from key sectors, particularly IT and Banking, fueled investor enthusiasm and contributed to the upward trajectory of the indices. These encouraging results boosted market confidence.

- Government Policy Announcements: Recent government policy announcements, focusing on infrastructure development and economic reforms, created a favorable environment for market growth, positively impacting investor sentiment. The announcements helped reduce uncertainty and boosted investor confidence.

- Specific Percentage Gains: The Sensex closed with a gain of 1.5%, reaching 66,000 points, while the Nifty 50 index rose by 1.2%, closing at 19,650 points.

Sector-Wise Performance

The gains weren't uniform across all sectors. While the IT sector saw a remarkable surge of 2.2%, driven by strong quarterly results and global demand, the Banking sector also witnessed a healthy increase of 1.8%. The Pharmaceutical sector, however, showed more muted growth, registering a modest 0.5% increase.

UltraTech Cement's Decline

Reasons for the Fall

UltraTech Cement's stock price experienced a significant downturn, falling by 3.5% today. Several factors contributed to this decline:

- Disappointing Quarterly Results: The company's recently announced quarterly results fell short of market expectations, triggering a sell-off by investors. Lower-than-anticipated profit margins contributed to the negative sentiment.

- Industry-Specific News: Negative news related to cement demand slowdown in certain regions also impacted investor confidence in the sector. Concerns about the oversupply in the market played a role.

- Analyst Downgrades: Several analysts downgraded their rating for UltraTech Cement following the release of the quarterly results, further adding pressure on the stock price. These downgrades reflect concerns about the company's near-term prospects.

- Percentage Drop: The stock price of UltraTech Cement dropped by 3.5%, closing at ₹7,200 per share.

Implications for the Cement Sector

UltraTech Cement's fall raises concerns about the overall outlook for the cement sector. While the decline may be specific to the company, it could indicate broader challenges facing the industry, potentially impacting other cement stocks in the near term. Market analysts will be closely monitoring the situation for further developments.

Overall Market Sentiment and Outlook

Analyst Predictions

Financial analysts remain cautiously optimistic about the long-term prospects of the Indian stock market. While the Sensex and Nifty have demonstrated resilience, the ongoing global uncertainties and potential interest rate hikes warrant a watchful approach. Most predictions suggest continued growth, but at a slightly moderated pace.

Trading Volume and Volatility

Trading volumes remained relatively high, reflecting considerable investor activity. However, market volatility was relatively low, suggesting a degree of stability despite the mixed performance.

Key Stocks to Watch

Investors should keep a close eye on other key stocks in the banking and IT sectors, which are expected to be major drivers of market performance in the coming weeks. Closely monitoring these sectors for new developments is crucial.

Conclusion

Today's Indian stock market update reveals a mixed performance. While the Sensex and Nifty experienced robust gains driven by positive global cues, FII investments, and strong corporate earnings, UltraTech Cement's significant decline highlights sector-specific challenges. The overall market sentiment remains cautiously optimistic, but investors need to maintain a vigilant approach. To stay informed on the latest developments and get in-depth analysis of the Indian stock market, subscribe to our newsletter or follow us on social media [insert links here]. Regularly check back for the latest Indian stock market updates on Sensex and Nifty movements and stay ahead in the dynamic world of Indian stock market investments.

Featured Posts

-

Detencion De Estudiante Transgenero Por Uso De Bano Femenino Implicaciones Legales Y Sociales

May 10, 2025

Detencion De Estudiante Transgenero Por Uso De Bano Femenino Implicaciones Legales Y Sociales

May 10, 2025 -

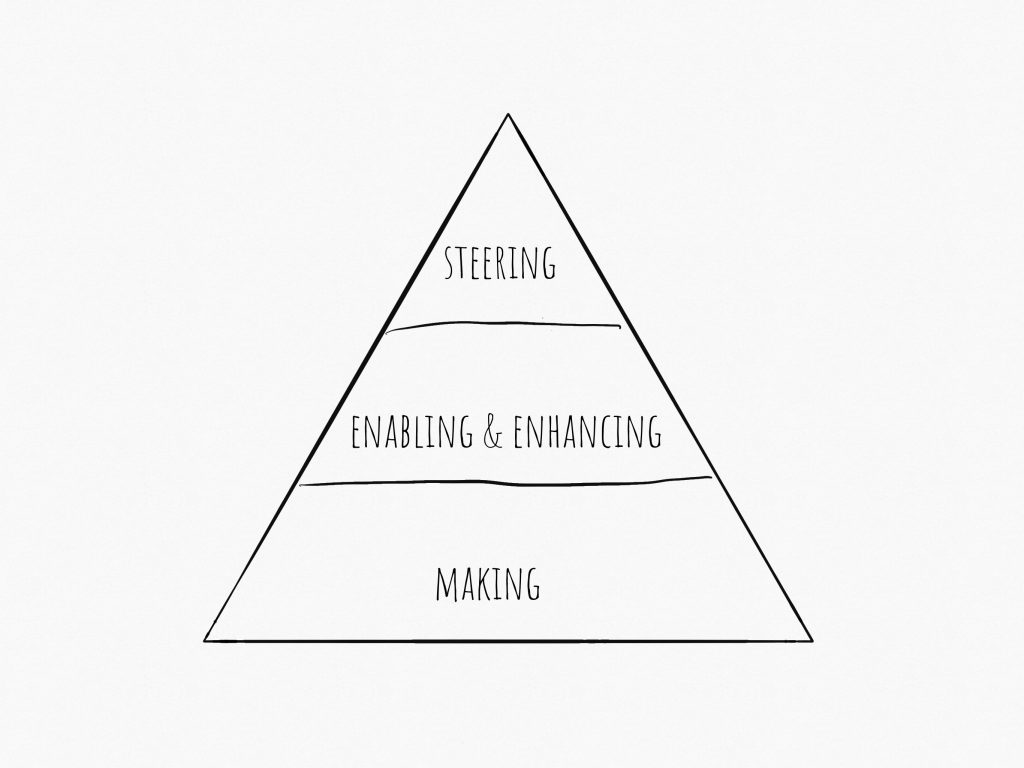

Rethinking Middle Management Their Contribution To Organizational Effectiveness

May 10, 2025

Rethinking Middle Management Their Contribution To Organizational Effectiveness

May 10, 2025 -

Nintendo Contact Leads To Ryujinx Emulator Development Cessation

May 10, 2025

Nintendo Contact Leads To Ryujinx Emulator Development Cessation

May 10, 2025 -

Disneys Positive Profit Revision Parks And Streaming Fueling Growth

May 10, 2025

Disneys Positive Profit Revision Parks And Streaming Fueling Growth

May 10, 2025 -

Extreme V Mware Price Hike At And T Highlights Broadcoms 1 050 Increase

May 10, 2025

Extreme V Mware Price Hike At And T Highlights Broadcoms 1 050 Increase

May 10, 2025