Infineon's (IFX) Revised Sales Outlook: Impact Of Trump-Era Tariffs

Table of Contents

Infineon Technologies AG (IFX), a leading semiconductor manufacturer, recently revised its sales outlook. This adjustment significantly reflects the lingering impact of the Trump-era tariffs imposed on various goods, including semiconductors. This article will delve into the specific ways these tariffs affected Infineon's performance and explore the long-term implications for the company and the broader semiconductor industry. The ripple effects of these trade policies continue to be felt, making a thorough understanding of their impact crucial for investors and industry analysts alike.

Direct Impact of Tariffs on Infineon's Costs

Increased Input Costs

Tariffs on raw materials and components directly increased Infineon's production expenses. This resulted in a significant squeeze on profit margins.

- Specific examples: Tariffs on imported silicon wafers, specialized chemicals used in chip manufacturing, and certain packaging materials all contributed to increased input costs.

- Quantification: While precise figures are not always publicly available, industry analyses suggest that input costs for semiconductor manufacturers rose by an average of 5-10% during the peak of the tariff period. This translates to a considerable impact on Infineon's bottom line, particularly considering the high volume of components they process.

- Impact on pricing strategies: To offset these increased costs, Infineon had to carefully consider pricing strategies. Aggressive price increases risked losing market share, but absorbing the entire cost burden would severely impact profitability. The company likely implemented a combination of price adjustments and cost-cutting measures.

Supply Chain Disruptions

The tariffs also significantly disrupted Infineon's global supply chain, leading to delays and increased logistical challenges.

- Supply chain bottlenecks: Tariffs led to extended lead times for certain components, impacting production schedules and potentially resulting in lost sales opportunities. The complexity of the semiconductor supply chain, with multiple suppliers across different geographical regions, magnified the impact of these disruptions.

- Increased transportation costs: The need to source components from alternative suppliers or navigate trade restrictions resulted in increased transportation costs, adding further pressure to profit margins.

- Sourcing alternatives: Infineon likely had to explore sourcing components from alternative suppliers, which may have resulted in additional costs associated with qualifying new suppliers and potentially compromising on quality or delivery consistency. This highlights the vulnerability of globalized supply chains to trade disruptions.

Indirect Impact on Market Demand and Consumer Spending

Reduced Consumer Demand

Tariffs contributed to overall price increases in various sectors, directly influencing consumer spending and subsequently impacting demand for Infineon's products.

- Correlation between tariff-related price increases and consumer spending: Increased prices on consumer electronics, automobiles (a major market for Infineon's power semiconductors), and industrial goods led to reduced consumer demand. This drop in consumer confidence had a knock-on effect on the demand for the semiconductor components Infineon supplies.

- Data illustrating changes in market demand: Market research data during and after the tariff period would reveal a correlation between price increases and reduced demand. While precise figures pertaining directly to Infineon are usually proprietary information, industry-wide data would paint a clear picture.

Competitive Landscape Shifts

The tariffs also significantly altered the competitive landscape, impacting Infineon's position relative to its competitors.

- Comparative analysis of how competitors were affected: Some competitors may have had more diversified supply chains or better access to alternative sourcing options, making them less vulnerable to the impact of tariffs. This altered the competitive dynamics within the semiconductor industry.

- Changes in market share: The ability of companies to adapt to the new realities created by tariffs could have affected their relative market shares. Companies that successfully mitigated the negative effects might have gained an advantage over those that struggled.

- Strategic responses by competitors: Different companies employed various strategies to navigate the challenges, leading to shifts in market positions and strategic alliances.

Infineon's Response and Revised Sales Outlook

Strategic Adjustments

Infineon employed several strategies to mitigate the negative effects of the tariffs.

- Cost-cutting measures: The company likely implemented various cost-cutting measures across its operations, from streamlining production processes to optimizing logistics.

- Diversification strategies: To reduce reliance on specific suppliers or geographical regions, Infineon might have diversified its supply chain, sourcing components from a broader range of suppliers in different countries.

- Lobbying efforts: Like other affected companies, Infineon might have engaged in lobbying efforts to influence trade policies and alleviate the negative impacts of tariffs.

- Pricing adjustments: As previously mentioned, Infineon carefully balanced price adjustments with the need to maintain competitiveness.

Revised Sales Projections

Infineon's revised sales outlook reflects the combined impact of the direct and indirect effects of the tariffs, along with other macroeconomic factors.

- Specific figures (percentage change, revenue figures): Infineon's official announcements should provide the specific figures detailing the differences between the previous and revised sales projections.

- Explanation of the revisions: Infineon's management commentary should provide details on the factors driving the revisions, clearly indicating the extent to which tariffs contributed to the adjustments.

Conclusion

The Trump-era tariffs had a significant impact on Infineon's (IFX) sales outlook, affecting both the direct costs of production and the broader market demand. Increased input costs, supply chain disruptions, reduced consumer spending, and shifts in the competitive landscape all played a role in shaping Infineon's response and revised projections. The company's strategic adjustments, while effective to some degree, highlight the challenges faced by global companies navigating volatile trade environments.

Stay updated on Infineon's (IFX) evolving sales outlook and the continuing effects of trade policies by following our regular market analyses. Understanding the impact of tariffs on Infineon and other semiconductor companies is crucial for informed investment decisions.

Featured Posts

-

Nhl Playoff Projections Following The 2025 Trade Deadline

May 09, 2025

Nhl Playoff Projections Following The 2025 Trade Deadline

May 09, 2025 -

Jack Doohan I Control You Briatores Tense Netflix Moment

May 09, 2025

Jack Doohan I Control You Briatores Tense Netflix Moment

May 09, 2025 -

The Mischaracterization Of Mentally Ill Killers Why The Monster Narrative Fails

May 09, 2025

The Mischaracterization Of Mentally Ill Killers Why The Monster Narrative Fails

May 09, 2025 -

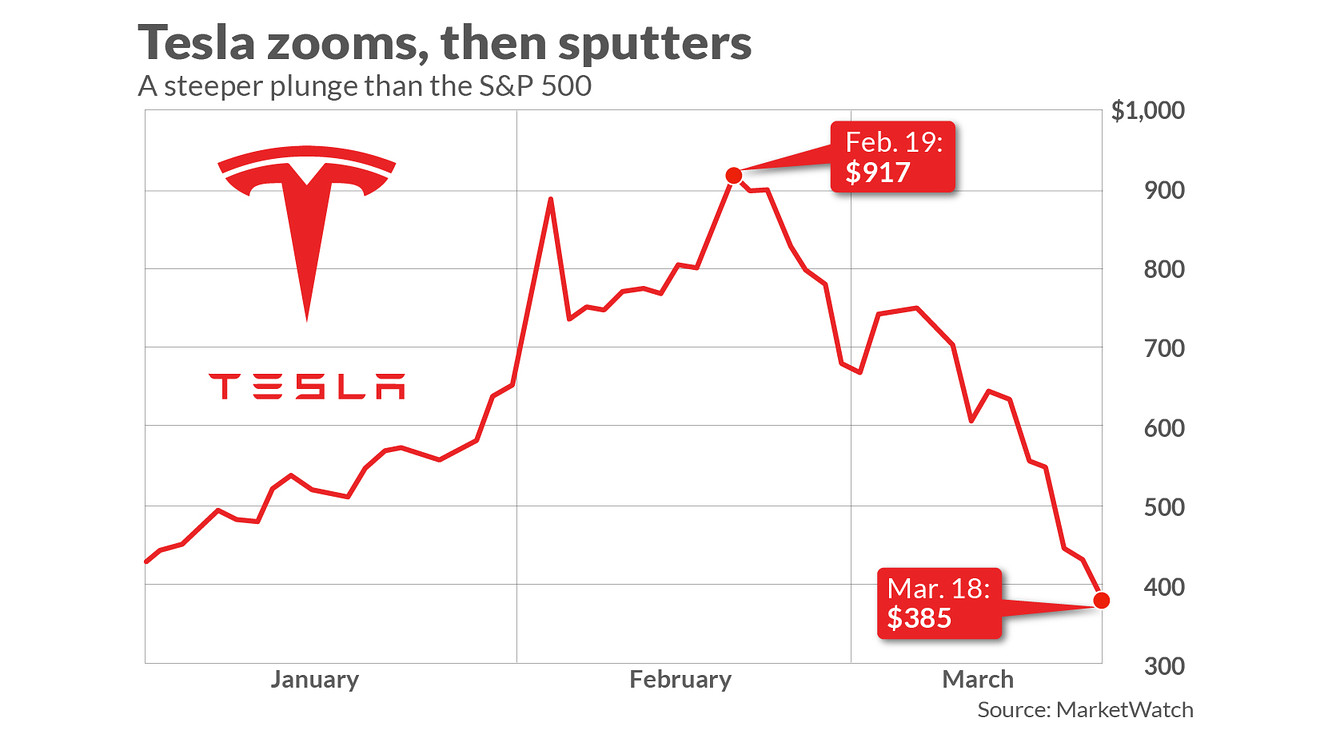

Elon Musks Influence Tesla Stock Decline And The Impact On Dogecoin

May 09, 2025

Elon Musks Influence Tesla Stock Decline And The Impact On Dogecoin

May 09, 2025 -

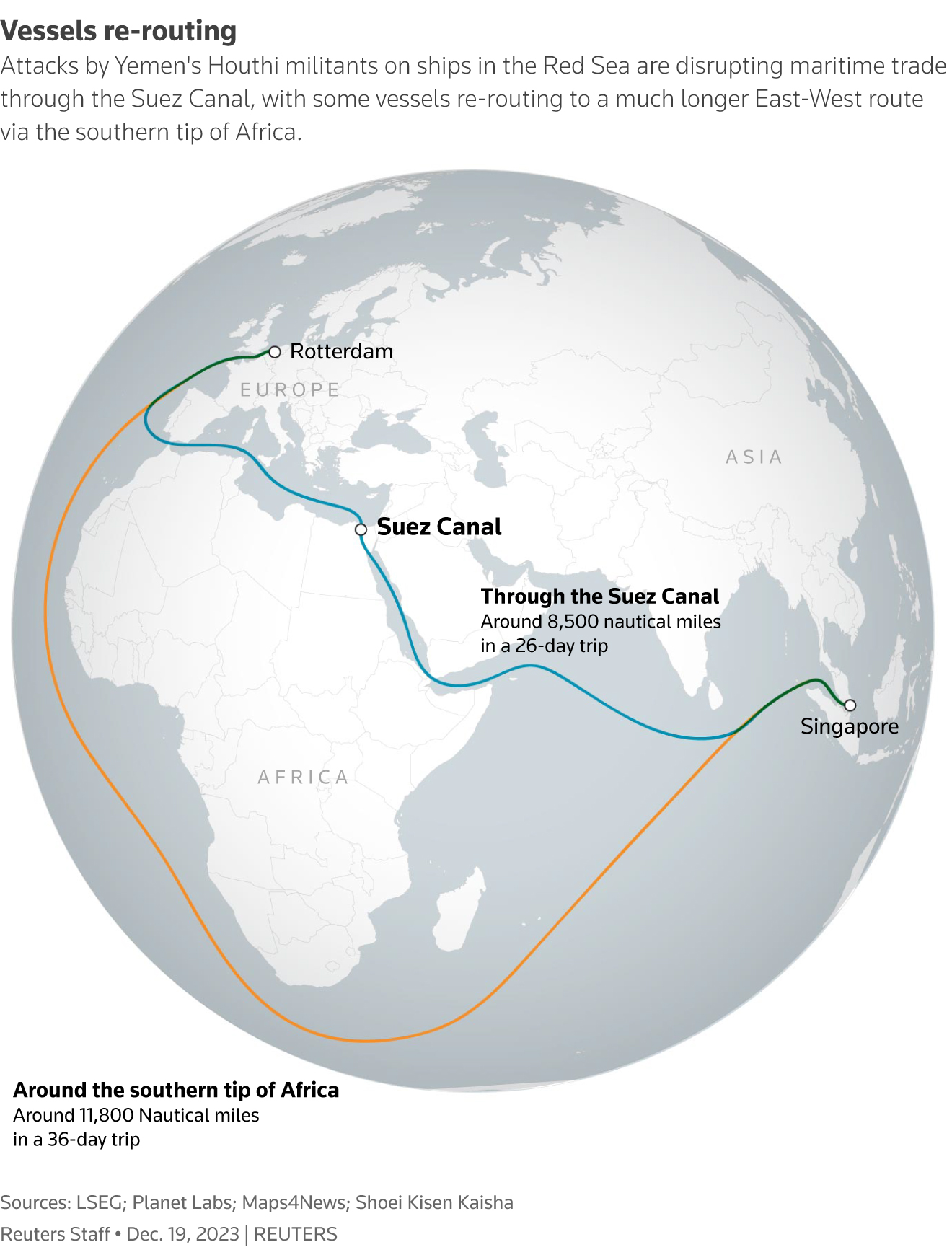

Trumps Houthi Truce Will It Ease Shipping Concerns

May 09, 2025

Trumps Houthi Truce Will It Ease Shipping Concerns

May 09, 2025

Latest Posts

-

Fate Of Historic Broad Street Diner Sealed Hyatt Hotel Plans Proceed

May 09, 2025

Fate Of Historic Broad Street Diner Sealed Hyatt Hotel Plans Proceed

May 09, 2025 -

Demolition Of Beloved Broad Street Diner For New Hyatt Hotel

May 09, 2025

Demolition Of Beloved Broad Street Diner For New Hyatt Hotel

May 09, 2025 -

Broad Street Diners Demise Hyatt Hotel Construction To Begin

May 09, 2025

Broad Street Diners Demise Hyatt Hotel Construction To Begin

May 09, 2025 -

Historic Broad Street Diner Demolition Hyatt Hotel Development

May 09, 2025

Historic Broad Street Diner Demolition Hyatt Hotel Development

May 09, 2025 -

Man Dies In Racist Stabbing Woman Arrested For Unprovoked Attack

May 09, 2025

Man Dies In Racist Stabbing Woman Arrested For Unprovoked Attack

May 09, 2025