Inflation Report Impacts BOE Rate Cut Probabilities, Boosting The Pound

Table of Contents

The Inflation Report's Key Findings and Market Reaction

The recent inflation report revealed crucial data points that significantly impacted market sentiment. Understanding these findings is key to grasping the subsequent shifts in BOE rate cut probabilities and the Pound's value.

Headline Inflation Figures and Their Deviation from Expectations

The report presented headline inflation figures, including the Consumer Price Index (CPI) and Retail Price Index (RPI), which deviated from market expectations. This deviation played a crucial role in triggering the market's reaction.

- CPI: The CPI figure came in at [insert actual CPI figure], exceeding the forecasted [insert forecasted CPI figure] by [insert percentage difference].

- RPI: Similarly, the RPI reported [insert actual RPI figure], exceeding predictions of [insert forecasted RPI figure].

- Market Response: The immediate reaction was a sharp [increase/decrease] in the GBP against major currencies like the USD and EUR. Analysts attributed this to [insert reason for market reaction based on data].

Specific components of inflation, such as soaring energy prices and persistent food price increases, contributed significantly to the overall inflation reading and fueled negative market sentiment. This inflation data fueled concerns about the BOE's ability to control rising prices.

BOE Rate Cut Probabilities: Before and After the Report

Market expectations regarding interest rate changes shifted dramatically following the release of the inflation report.

Pre-report Expectations of Interest Rate Changes

Before the report, market forecasts pointed towards a [percentage]% probability of a BOE rate cut within the next [timeframe].

- Analyst Predictions: Many analysts predicted a rate cut given [insert reasons for pre-report rate cut predictions].

- Market Pricing: Futures contracts and options pricing reflected this expectation, suggesting a [percentage]% probability of a rate cut.

Post-report Shift in Rate Cut Probabilities

The unexpectedly high inflation figures drastically altered market expectations.

- Revised Expectations: The probability of a BOE rate cut significantly [increased/decreased] to approximately [percentage]%, following the report's release.

- Market Pricing Adjustments: Futures contracts and options pricing immediately adjusted, reflecting the reduced likelihood of a rate cut in the short term. This adjustment underscores the direct impact of inflation data on BOE monetary policy expectations.

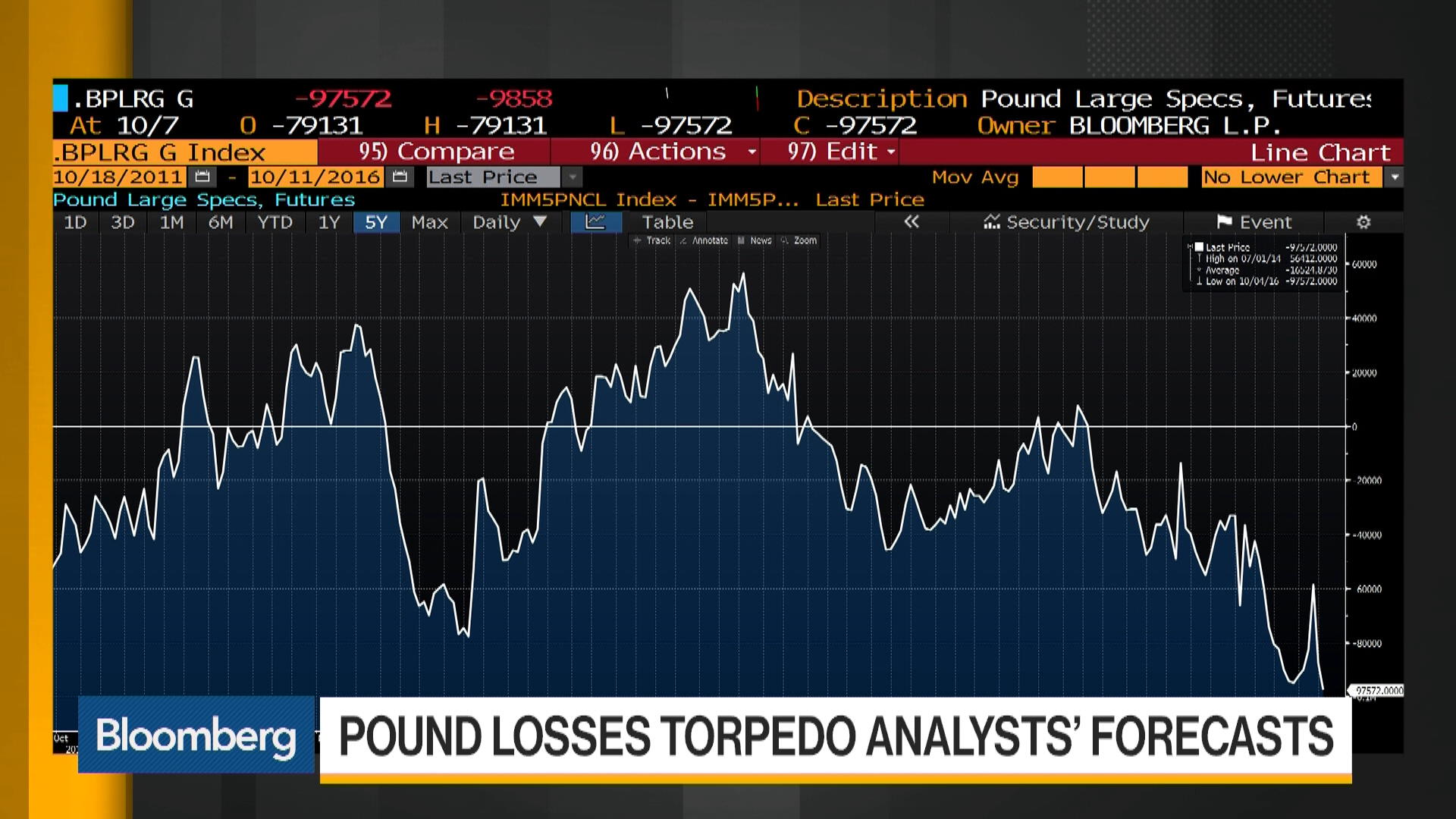

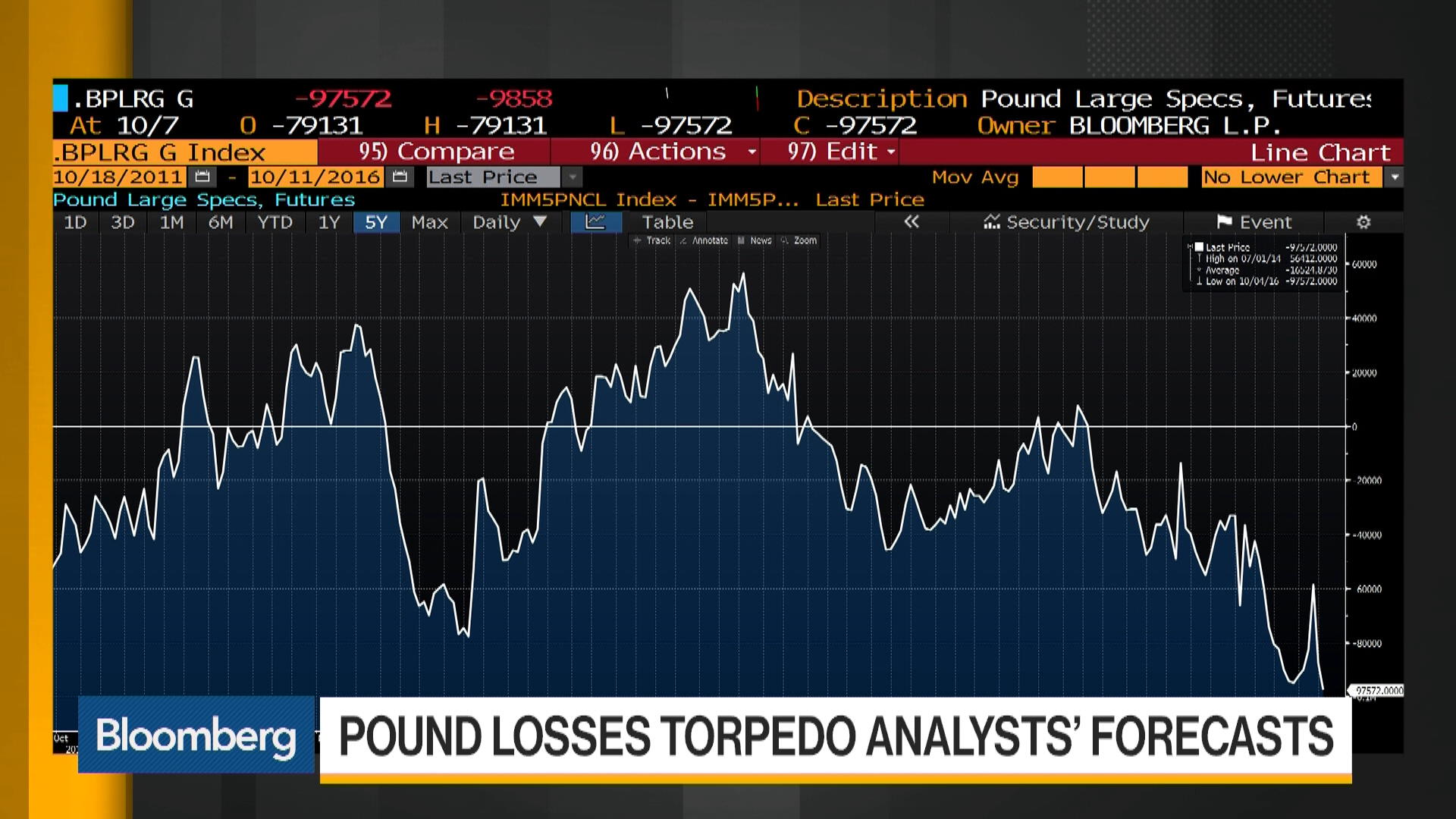

The Pound's Response to Inflation Data and BOE Expectations

The Pound's reaction to the inflation report and the subsequent shift in BOE rate cut probabilities was immediate and significant.

GBP Movement Immediately Following the Report

Following the release of the inflation report, GBP experienced a [percentage]% [increase/decrease] against the USD, trading at [USD/GBP exchange rate] and a [percentage]% [increase/decrease] against the EUR, trading at [EUR/GBP exchange rate].

- Chart/Graph: [Insert chart or graph illustrating GBP movement against major currencies].

Longer-Term Implications for GBP Strength

The updated inflation data and adjusted BOE rate cut probabilities have significant implications for the longer-term outlook of the Pound.

- Factors influencing GBP forecast: Future inflation data releases, global economic conditions, and any potential shifts in BOE policy will continue to influence the Pound's strength.

- Overall outlook: The current market sentiment suggests a [positive/negative] outlook for the GBP in the [short-term/long-term], although this remains subject to significant uncertainty.

Conclusion: Understanding the Interplay Between Inflation, BOE Policy, and the Pound

The inflation report's impact on BOE rate cut probabilities demonstrates a clear and direct link between inflation data, monetary policy decisions, and GBP exchange rates. The unexpected inflation figures significantly reduced the likelihood of a near-term interest rate cut, causing an immediate and substantial increase in the Pound's value.

The potential for further GBP volatility remains high, dependent on upcoming economic data releases and any adjustments in BOE monetary policy. Staying informed about future inflation reports and BOE announcements is crucial for navigating the complexities of the GBP market. Stay updated on future inflation reports and their effect on BOE rate cut probabilities and the GBP to make informed decisions regarding your GBP trading or investment strategies.

Featured Posts

-

Polemique Grand Cactus Analyse De La Decision Du Csa Concernant Le Sketch Controverse

May 26, 2025

Polemique Grand Cactus Analyse De La Decision Du Csa Concernant Le Sketch Controverse

May 26, 2025 -

Journaliste Belge Hugo De Waha Remporte La Prestigieuse Bourse Payot

May 26, 2025

Journaliste Belge Hugo De Waha Remporte La Prestigieuse Bourse Payot

May 26, 2025 -

Jeu De Gestion Cycliste Rtbf Vivez Le Tour De France

May 26, 2025

Jeu De Gestion Cycliste Rtbf Vivez Le Tour De France

May 26, 2025 -

Successful Italian Open Launch For Alcaraz And Sabalenka

May 26, 2025

Successful Italian Open Launch For Alcaraz And Sabalenka

May 26, 2025 -

47 Y Mmkf Gde I Kogda Uznat Imena Pobediteley V Moskve

May 26, 2025

47 Y Mmkf Gde I Kogda Uznat Imena Pobediteley V Moskve

May 26, 2025