Interest Rate Cuts: Why The Federal Reserve Is Different

Table of Contents

The Federal Reserve's Dual Mandate

The Federal Reserve, unlike many other central banks, operates under a dual mandate. This means it is tasked with two primary goals: maintaining price stability and promoting maximum employment. This contrasts sharply with central banks that focus solely on inflation targeting, prioritizing price stability above all else. This dual mandate significantly influences the Federal Reserve's approach to interest rate cuts.

-

Implications of the Dual Mandate: A focus on price stability might lead to slower interest rate cuts in response to economic downturns, to prevent inflationary pressures. Conversely, prioritizing maximum employment might result in quicker and more aggressive rate cuts to stimulate economic growth, even if it risks slightly higher inflation.

-

Historical Examples: The Federal Reserve's response to the 2008 financial crisis exemplifies this balancing act. The aggressive interest rate cuts implemented were primarily aimed at preventing a deeper economic recession, even as inflation remained a concern.

-

Challenges of Balancing Competing Goals: The inherent tension between price stability and maximum employment makes the Federal Reserve's decision-making process incredibly complex. Finding the right balance often involves intricate economic forecasting and a careful assessment of various economic indicators. The trade-offs can be substantial and have far-reaching consequences.

The Global Impact of US Interest Rate Cuts

The United States holds a dominant position in the global economy, with the US dollar serving as the world's primary reserve currency. Consequently, the Federal Reserve's actions regarding interest rate cuts have profound global repercussions that extend far beyond US borders.

-

Impact on Global Capital Flows: Lower interest rates in the US can attract foreign investment, strengthening the dollar and potentially leading to capital flight from other countries. This can significantly impact exchange rates and international capital markets.

-

Influence on Exchange Rates and International Trade: A weaker dollar resulting from interest rate cuts might benefit US exporters, making their goods more competitive in the global market. Conversely, it could make imports more expensive.

-

Reactions from Other Countries: Other central banks often respond to Federal Reserve actions, either by adjusting their own monetary policies or by intervening in foreign exchange markets to manage the impact on their economies. This creates a complex interplay of global monetary policy responses.

Political Considerations and the Federal Reserve

Despite its legally mandated independence, the Federal Reserve operates within a political environment. This creates a tension between maintaining its autonomy and responding to political pressures, particularly concerning interest rate cuts.

-

Examples of Political Influence: While the Fed strives for independence, political considerations can subtly influence its decision-making. For instance, the timing of interest rate cuts might be influenced by upcoming elections or the administration's economic agenda.

-

Consequences of Political Interference: Political interference in the Fed's decision-making process can undermine its credibility and its ability to effectively manage the economy. It can lead to less effective monetary policy and increased uncertainty in financial markets.

-

Maintaining Credibility and Independence: Preserving the Federal Reserve's independence is critical for maintaining its credibility and effectiveness in managing the US economy. This requires a delicate balance between responding to legitimate economic concerns and resisting undue political pressure.

Comparing the Fed to Other Central Banks

Comparing the Federal Reserve's actions to other major central banks, such as the European Central Bank (ECB) and the Bank of Japan (BOJ), reveals key differences. The ECB, for example, primarily focuses on price stability, while the BOJ has employed unconventional monetary policies like quantitative easing to combat deflation for an extended period. These differing mandates and approaches lead to different responses to economic situations and varying outcomes.

-

Case Studies: The ECB's more cautious approach to interest rate cuts compared to the Fed’s during the Eurozone debt crisis illustrates the impact of differing mandates and risk assessments. The BOJ's prolonged period of near-zero interest rates reflects a different economic context and policy priorities.

-

Summary of Recent Actions: Analyzing the recent actions of these central banks, including the timing, magnitude, and rationale behind their interest rate cuts (or lack thereof), reveals significant variations in their approaches. These differences highlight the diverse economic challenges faced and the range of policy tools employed globally.

Conclusion

The Federal Reserve's approach to interest rate cuts is distinctive due to its unique dual mandate, its considerable global influence as the issuer of the world's reserve currency, and the ongoing interaction between its operational independence and political realities. Understanding these nuances is critical for analyzing the economic consequences of interest rate changes. Understanding the intricacies of interest rate cuts and the Federal Reserve's unique approach is crucial for navigating the complexities of the global economy. Continue your research by exploring the Federal Reserve's website for detailed data and analysis on monetary policy.

Featured Posts

-

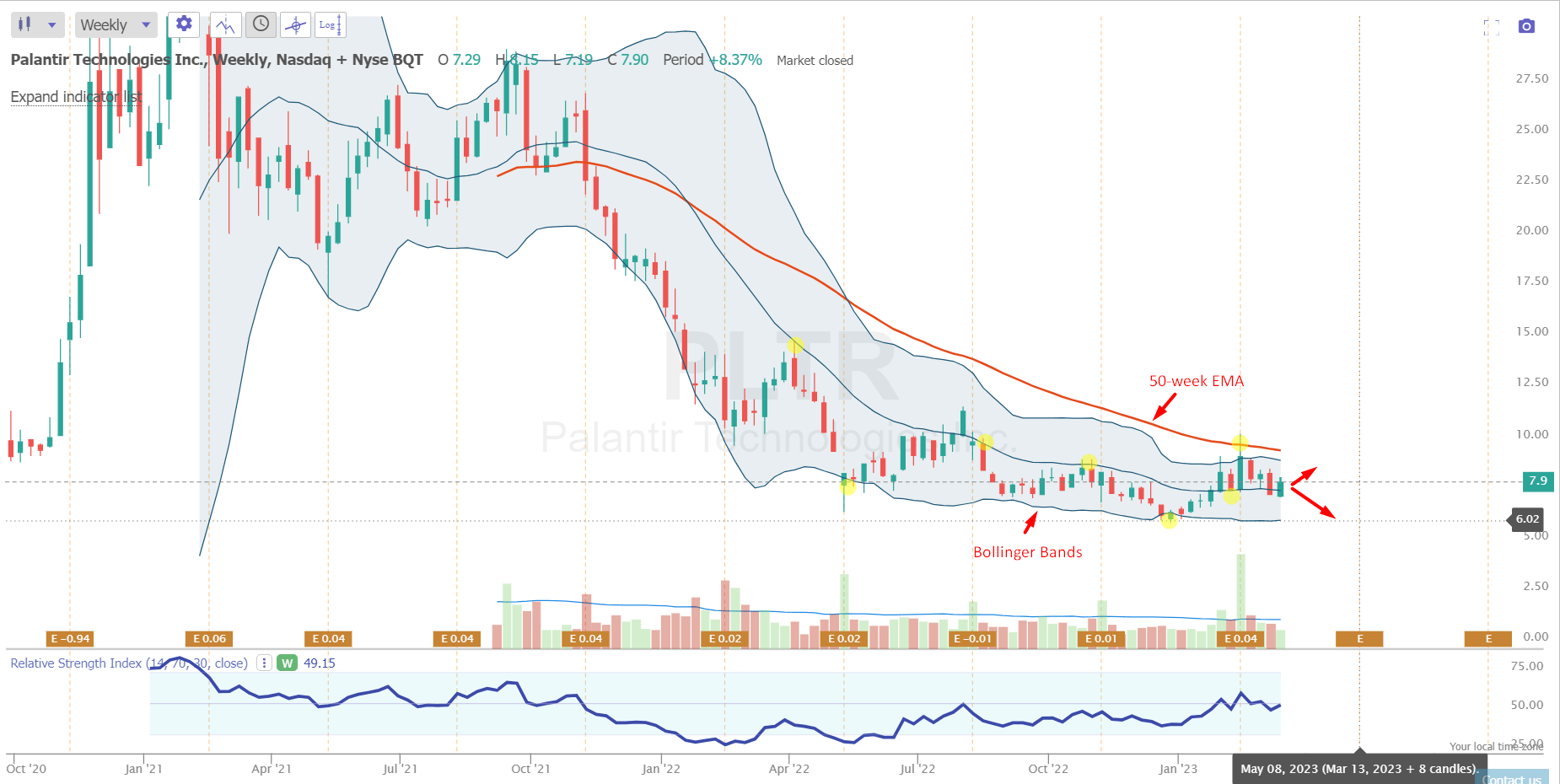

Palantir Stock Down 30 Is This A Buying Opportunity

May 10, 2025

Palantir Stock Down 30 Is This A Buying Opportunity

May 10, 2025 -

Strands Nyt Crossword Solutions And Clues For February 15th Game 349

May 10, 2025

Strands Nyt Crossword Solutions And Clues For February 15th Game 349

May 10, 2025 -

Arrestan A Universitaria Transgenero Por Usar Bano Femenino El Caso Que Genera Debate

May 10, 2025

Arrestan A Universitaria Transgenero Por Usar Bano Femenino El Caso Que Genera Debate

May 10, 2025 -

Palantir Technologies Stock A Detailed Investment Analysis For 2024

May 10, 2025

Palantir Technologies Stock A Detailed Investment Analysis For 2024

May 10, 2025 -

St Albert Dinner Theatre Presents A Hilarious Fast Paced Farce

May 10, 2025

St Albert Dinner Theatre Presents A Hilarious Fast Paced Farce

May 10, 2025