Palantir Technologies Stock: A Detailed Investment Analysis For 2024

Table of Contents

Palantir's Business Model and Revenue Streams

Palantir's business model hinges on its proprietary data integration and analytics platform, serving both government and commercial clients. Understanding these distinct revenue streams is crucial for assessing Palantir's investment potential.

Government Contracts

A significant portion of Palantir's revenue stems from lucrative government contracts, primarily with US intelligence agencies and defense organizations, but also expanding internationally. This sector provides a degree of stability, given the consistent demand for advanced data analytics in national security and cybersecurity.

- Key Government Clients: The company works with agencies like the CIA, the Department of Defense, and various international intelligence services. These contracts often involve complex, large-scale projects related to counterterrorism, intelligence gathering, and cybersecurity.

- Services Provided: Palantir provides its platform for data integration, analysis, and visualization, enabling government agencies to make better informed decisions based on vast datasets.

- Risks: The dependence on government contracts presents inherent risks. Funding cycles can fluctuate with changing political priorities and budgetary constraints, potentially impacting revenue predictability. Furthermore, competition for government contracts is fierce.

Commercial Sector Growth

While government contracts form a solid base, Palantir is actively pursuing growth in the commercial sector, targeting diverse industries like finance, healthcare, and aerospace. This diversification is essential for long-term sustainability and reduced reliance on a single revenue source.

- Key Commercial Clients: Palantir is steadily gaining traction among large corporations, with clients in various sectors utilizing its platform for fraud detection, risk management, supply chain optimization, and operational efficiency.

- Competitive Landscape: The commercial sector is a highly competitive market, with established players like IBM, Microsoft, and Salesforce offering similar data analytics solutions. However, Palantir's unique platform and focus on complex data integration provides a competitive edge.

- Software as a Service (SaaS) Model: Palantir's transition towards a SaaS model is streamlining its operations and enhancing recurring revenue, a positive sign for long-term financial health.

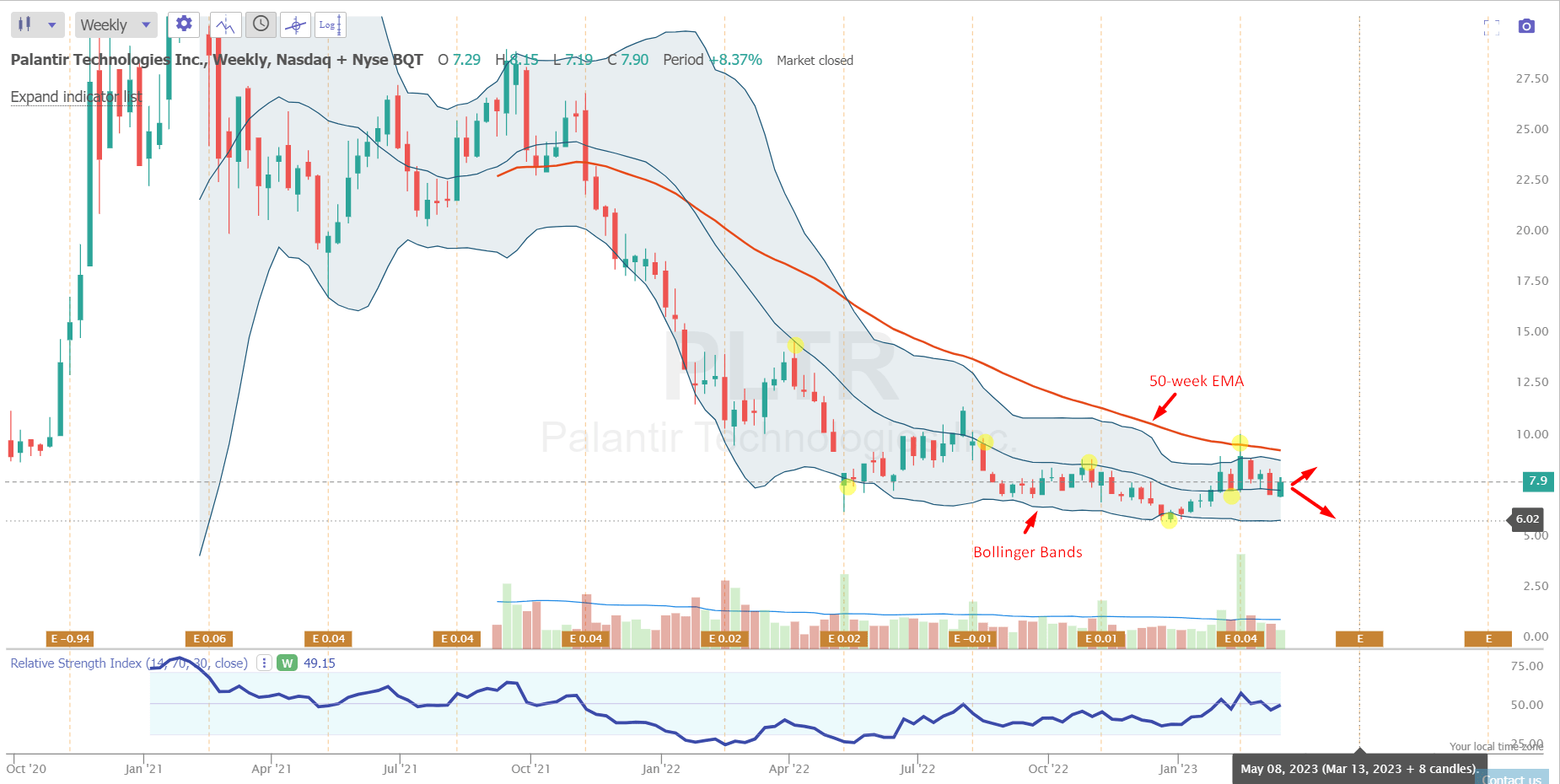

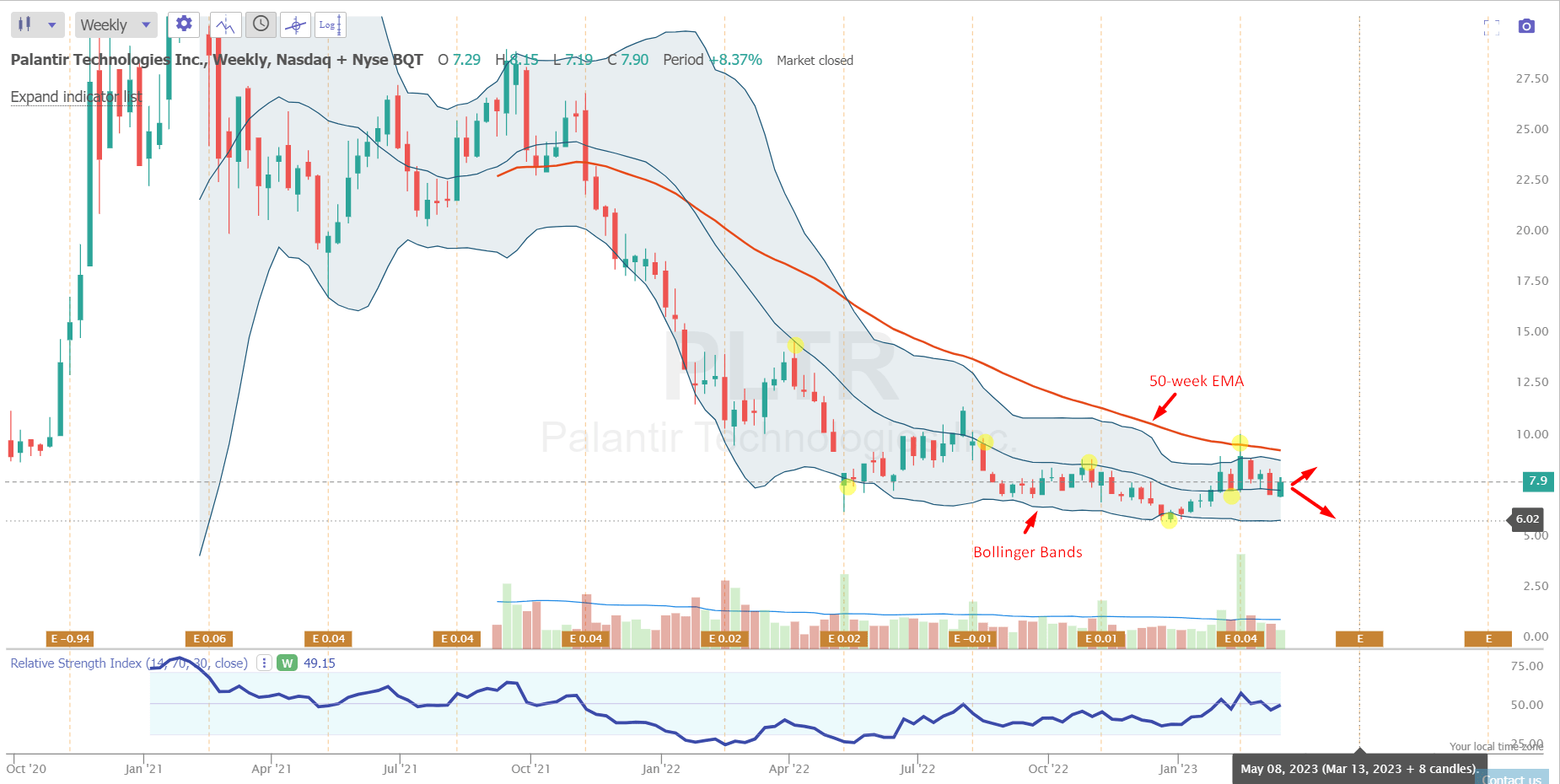

Financial Performance and Valuation

Analyzing Palantir's financial performance and valuation is critical for any investment decision. This section will examine key metrics to understand the company's financial health and relative attractiveness.

Revenue Growth and Profitability

Palantir has demonstrated consistent revenue growth, but profitability has been a more elusive target. Analyzing historical financial statements reveals trends in key metrics.

- Revenue Growth: While impressive year-over-year growth has been seen in recent years, investors need to consider if this growth is sustainable.

- Profitability Margins: Palantir's operating margin and net income have fluctuated. Investors should analyze the factors contributing to this variability.

- Cash Flow: Positive free cash flow is a crucial indicator of financial strength, reflecting the company's ability to generate cash from its operations. Monitoring this metric is vital.

Valuation Metrics

Several valuation metrics are essential for assessing Palantir's stock price relative to its fundamentals and comparing it to competitors.

- Price-to-Sales (P/S) Ratio: This ratio compares the company's market capitalization to its revenue, providing a measure of valuation relative to its sales.

- Price-to-Earnings (P/E) Ratio: The P/E ratio is another important metric, comparing the market price to earnings per share. A high P/E ratio indicates investors are willing to pay a premium for future growth.

- Discounted Cash Flow (DCF) Analysis: A more complex method, DCF analysis projects future cash flows and discounts them to their present value, offering a valuation based on future potential.

Risks and Opportunities

Like any investment, Palantir Technologies stock comes with inherent risks and significant potential opportunities. A thorough understanding of both is crucial for informed decision-making.

Potential Risks

Investors should be mindful of several potential risks associated with investing in Palantir:

- High Valuation: Palantir's stock price can be considered highly valued relative to its current profitability, making it susceptible to market corrections.

- Government Contract Dependence: Over-reliance on government contracts exposes the company to fluctuations in government spending and political changes.

- Competition: Intense competition from established players in the data analytics market presents a significant challenge.

- Regulatory Risks: Data privacy regulations and cybersecurity concerns could impact the company's operations and growth.

- Economic Downturn Impact: A broader economic downturn could reduce demand for Palantir's services, especially in the commercial sector.

Growth Opportunities

Despite the risks, Palantir boasts significant growth opportunities:

- Expansion into New Markets: Expanding into new geographical markets and industries can unlock significant revenue potential.

- Product Development: Developing new products and services, particularly leveraging Artificial Intelligence (AI) and machine learning capabilities, can drive further growth.

- Strategic Acquisitions: Acquiring smaller companies with complementary technologies can accelerate innovation and market penetration.

- Increased Platform Adoption: Increasing the adoption of its platform among both government and commercial clients is key to sustained growth.

Conclusion

Our Palantir Technologies stock analysis reveals a company with significant potential but also considerable risks. While its innovative platform and strong government contracts provide a stable foundation, the high valuation, dependence on government funding, and intense competition are crucial considerations. The key financial metrics, including revenue growth and profitability margins, need careful monitoring. Furthermore, analyzing valuation metrics like the P/S and P/E ratios, along with a DCF analysis, is vital for assessing the stock's intrinsic value.

Based on this analysis, whether to buy, sell, or hold Palantir Technologies stock in 2024 depends on your risk tolerance and investment horizon. While the long-term prospects are promising, the inherent volatility necessitates a cautious approach. Analyze Palantir's potential and understand its investment risks before making any investment decisions. Conduct your own thorough due diligence and consider consulting a financial advisor before investing in Palantir Technologies stock. Invest in Palantir wisely, considering the outlined opportunities and challenges.

Featured Posts

-

Sensex And Nifty Rally 5 Reasons For Todays Significant Market Rise

May 10, 2025

Sensex And Nifty Rally 5 Reasons For Todays Significant Market Rise

May 10, 2025 -

Can Nigel Farages Reform Party Deliver On Its Promises

May 10, 2025

Can Nigel Farages Reform Party Deliver On Its Promises

May 10, 2025 -

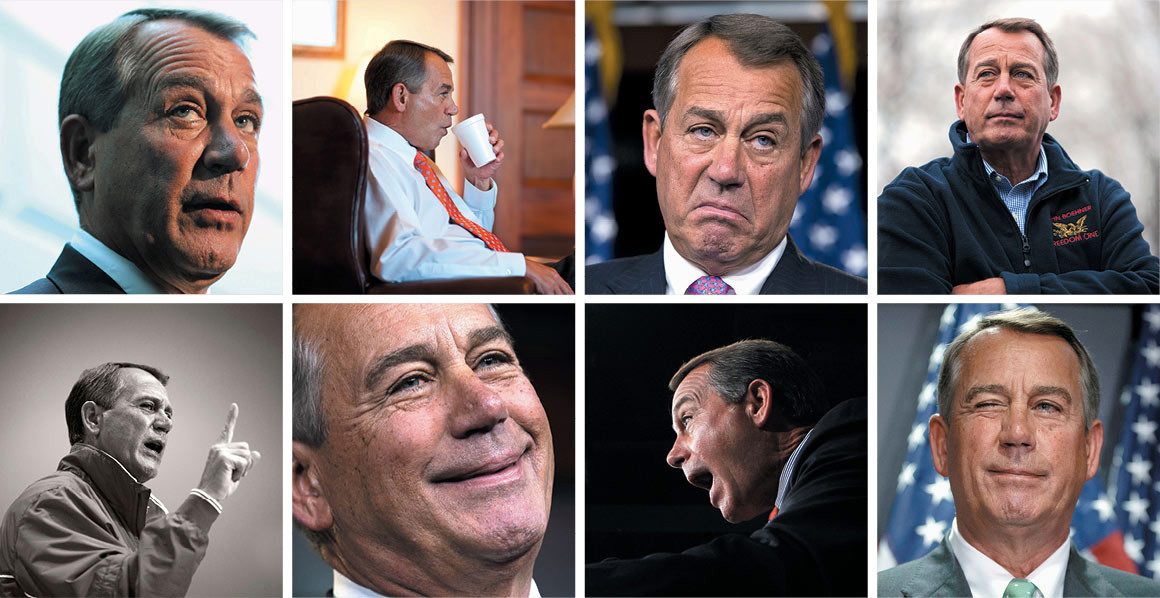

Chief Justice Roberts Shares Story Of Boehner Mix Up

May 10, 2025

Chief Justice Roberts Shares Story Of Boehner Mix Up

May 10, 2025 -

Jeanine Pirro From Fox News To Potential Dc Prosecutor Under Trump

May 10, 2025

Jeanine Pirro From Fox News To Potential Dc Prosecutor Under Trump

May 10, 2025 -

Sensex Today Live Stock Market Updates 100 Points Higher Nifty Above 17 950

May 10, 2025

Sensex Today Live Stock Market Updates 100 Points Higher Nifty Above 17 950

May 10, 2025