Invest Smart: A Guide To The Country's Up-and-Coming Business Areas

Table of Contents

The Booming Tech Sector: A Hotspot for Smart Investments

The technology sector is experiencing explosive growth, making it a prime area for smart investments. From software development to e-commerce and fintech, numerous opportunities exist for investors seeking substantial returns. Understanding the nuances of this dynamic sector is key to making informed investment decisions.

Software Development and IT Services

The demand for skilled tech professionals is constantly rising, driving significant growth in the software development and IT services sector.

- High demand for specialized software solutions: Businesses across all industries rely on customized software to streamline operations and gain a competitive edge. This fuels the demand for skilled developers and creates lucrative investment opportunities.

- Growing outsourcing market attracting international clients: The country's reputation for talented developers and competitive pricing is attracting a growing number of international clients, further boosting the sector's growth. This global reach minimizes risk and provides diversified income streams.

- Opportunities in AI, machine learning, and cybersecurity: These cutting-edge fields are experiencing exponential growth, offering significant investment potential for those willing to take on slightly higher risk for potentially higher reward. These areas represent the future of technology and present substantial long-term opportunities.

E-commerce and Fintech

Online businesses are flourishing, with e-commerce and fintech leading the charge. This digital transformation presents a wealth of smart investment opportunities.

- Rapid growth of mobile commerce and digital payments: The increasing adoption of smartphones and mobile wallets is driving the rapid expansion of mobile commerce and digital payment systems. This trend creates opportunities for investors in payment processing companies and e-commerce platforms.

- Increasing adoption of fintech solutions by businesses and consumers: Fintech companies are disrupting traditional financial services, offering innovative solutions for lending, investing, and managing personal finances. This creates opportunities in areas such as blockchain technology, peer-to-peer lending, and robo-advisors.

- Potential for disruption and innovation in the financial sector: The fintech sector is characterized by rapid innovation and disruption, presenting exciting opportunities for investors who can identify promising startups and emerging technologies.

Investing in Tech: Strategies for Success

Investing in the tech sector requires a strategic approach to minimize risk and maximize returns.

- Consider investing in promising startups through venture capital or angel investing: This high-risk, high-reward strategy can yield substantial returns if you identify the next big thing. Thorough due diligence is crucial.

- Explore publicly traded tech companies with strong growth potential: This offers a more stable investment option, albeit with potentially lower returns than startup investing. Analyze financial statements and market trends carefully.

- Diversify your tech investments across different sub-sectors: Diversification helps to mitigate risk and balance potential losses across different segments of the tech industry.

Renewable Energy: A Sustainable Investment for the Future

Government initiatives and growing environmental awareness are driving the rapid expansion of the renewable energy sector. This presents a compelling opportunity for sustainable and potentially lucrative investments.

Solar and Wind Power

Solar and wind power are leading the charge in the renewable energy revolution.

- Increased investment in renewable energy infrastructure: Governments worldwide are investing heavily in renewable energy infrastructure, creating a favorable environment for investors.

- Growing demand for clean energy solutions from businesses and consumers: Consumers and businesses are increasingly seeking clean energy solutions, driving the demand for solar and wind power.

- Potential for long-term, stable returns: Once established, renewable energy projects can generate stable returns for many years, providing a reliable income stream.

Energy Storage Solutions

Efficient energy storage is crucial for the widespread adoption of renewable energy sources.

- Advancements in battery technology are creating new investment opportunities: Innovations in battery technology are improving energy storage capacity and efficiency, opening up new investment avenues.

- Growing demand for grid-scale energy storage solutions: The need for large-scale energy storage to balance intermittent renewable energy sources is driving investment in grid-scale storage solutions.

- Potential for high growth and substantial returns: The energy storage sector is poised for significant growth, offering investors the potential for substantial returns.

Investing in Green Energy: Minimizing Risk and Maximizing Returns

Investing in renewable energy requires careful consideration of various factors.

- Research companies with proven track records and strong management teams: Due diligence is crucial when investing in any sector, and especially when dealing with longer-term investments like renewable energy projects.

- Consider government incentives and tax credits for renewable energy investments: Many governments offer incentives to encourage investment in renewable energy, which can significantly improve your returns.

- Assess the long-term viability of the projects before investing: Thorough assessment of project feasibility, including environmental impact assessments and long-term operational costs, is vital.

Healthcare and Wellness: Capitalizing on a Growing Industry

The healthcare and wellness industry is experiencing significant growth, driven by an aging population, technological advancements, and a growing focus on preventative health.

Medical Technology and Pharmaceuticals

Innovation is driving significant growth in the medical technology and pharmaceuticals sector.

- Development of new medical devices and treatments: Continuous innovation in medical technology and pharmaceuticals is leading to the development of life-saving treatments and advanced medical devices.

- Rising demand for healthcare services due to an aging population: The global population is aging, leading to increased demand for healthcare services and creating opportunities for investors.

- Opportunities in telemedicine and remote patient monitoring: Telemedicine and remote patient monitoring are rapidly expanding, offering convenient and cost-effective healthcare solutions.

Wellness and Fitness

Growing consumer interest in health and wellness presents numerous investment opportunities.

- Expansion of fitness centers and wellness retreats: The increasing focus on health and wellness is driving the expansion of fitness centers, wellness retreats, and related businesses.

- Increased demand for healthy food options and supplements: Consumers are increasingly seeking healthy food options and supplements, creating opportunities for investors in the food and supplement industries.

- Growing popularity of mindfulness and meditation services: The demand for mindfulness and meditation services is rising as people seek ways to improve their mental and emotional well-being.

Investing in Healthcare: Due Diligence is Key

Investing in the healthcare industry requires a thorough understanding of the regulatory landscape and potential risks.

- Analyze the regulatory landscape and potential risks associated with healthcare investments: The healthcare industry is heavily regulated, so understanding the regulatory environment is crucial for successful investment.

- Evaluate the company's pipeline and intellectual property portfolio: For pharmaceutical and medical device companies, evaluating their pipeline and intellectual property portfolio is vital for assessing future growth potential.

- Assess the market potential for the product or service: Understanding the market demand for a particular product or service is crucial for determining its investment viability.

Conclusion

Investing smart requires careful consideration of emerging trends and market opportunities. This guide has highlighted some of the country's most promising up-and-coming business areas: the tech sector, renewable energy, and the healthcare and wellness industry. By conducting thorough research and diversifying your portfolio, you can position yourself to capitalize on these exciting growth sectors. Don't miss out – start exploring these smart investment opportunities today and secure your financial future. Remember to always conduct your own thorough due diligence before making any investment decisions. Invest smart in the country's future!

Featured Posts

-

Tracking The Daily Net Asset Value Nav Of The Amundi Msci World Catholic Principles Ucits Etf

May 24, 2025

Tracking The Daily Net Asset Value Nav Of The Amundi Msci World Catholic Principles Ucits Etf

May 24, 2025 -

Porsche Cayenne Gts Coupe Czy Spelnia Oczekiwania

May 24, 2025

Porsche Cayenne Gts Coupe Czy Spelnia Oczekiwania

May 24, 2025 -

Pronosticos Astrologicos Semana Del 4 Al 10 De Marzo De 2025

May 24, 2025

Pronosticos Astrologicos Semana Del 4 Al 10 De Marzo De 2025

May 24, 2025 -

Quebec Nouvelles Reglementations Pour Le Contenu Francophone En Ligne

May 24, 2025

Quebec Nouvelles Reglementations Pour Le Contenu Francophone En Ligne

May 24, 2025 -

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist Key Considerations

May 24, 2025

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist Key Considerations

May 24, 2025

Latest Posts

-

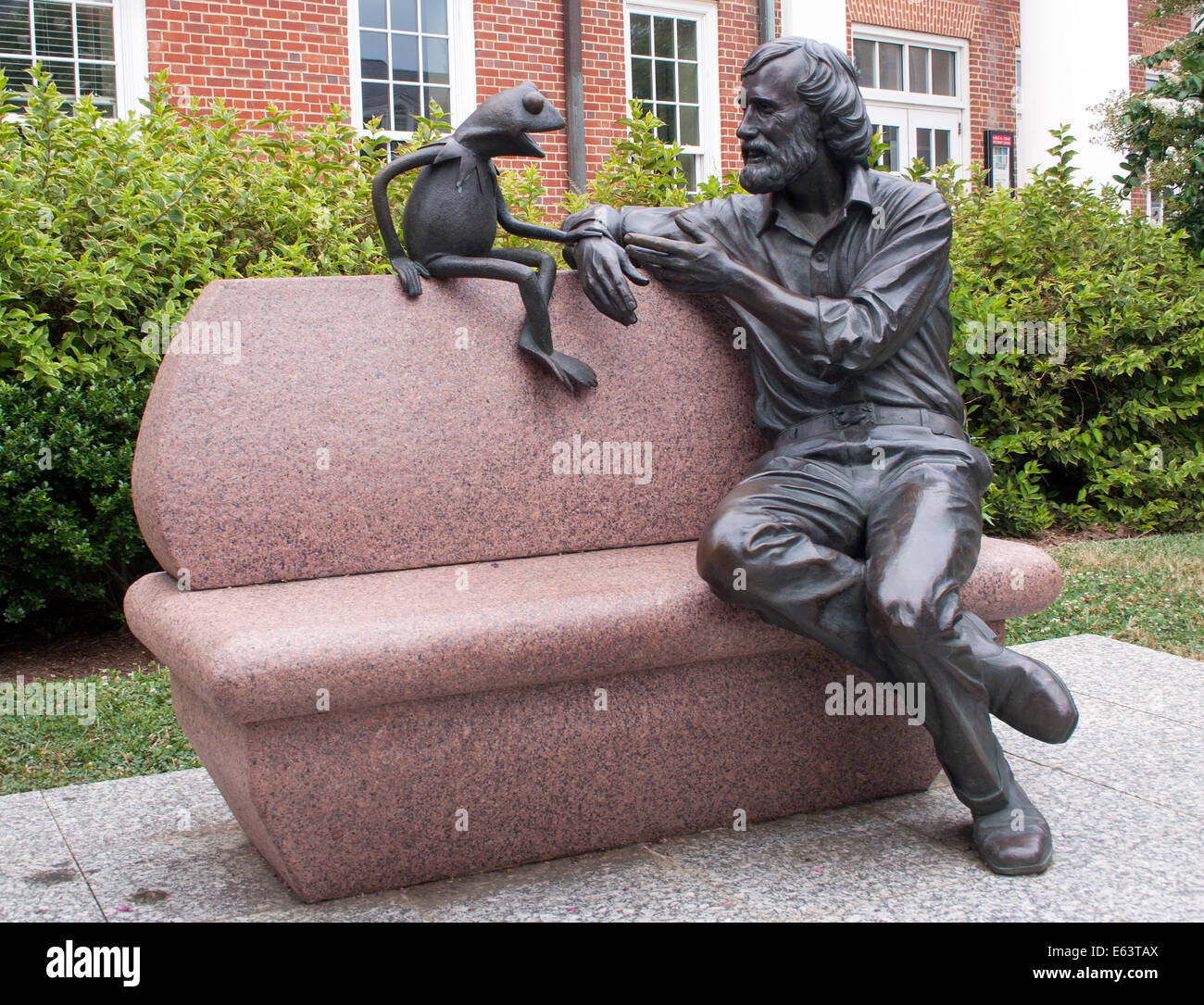

Kermit The Frog University Of Marylands 2024 Commencement Speaker

May 24, 2025

Kermit The Frog University Of Marylands 2024 Commencement Speaker

May 24, 2025 -

University Of Maryland Announces Kermit The Frog As Commencement Speaker

May 24, 2025

University Of Maryland Announces Kermit The Frog As Commencement Speaker

May 24, 2025 -

Kermit The Frog To Deliver University Of Maryland Commencement Address

May 24, 2025

Kermit The Frog To Deliver University Of Maryland Commencement Address

May 24, 2025 -

Kazakhstan Scores Billie Jean King Cup Win Against Australia

May 24, 2025

Kazakhstan Scores Billie Jean King Cup Win Against Australia

May 24, 2025 -

2025 University Of Maryland Graduation Kermit The Frog To Speak

May 24, 2025

2025 University Of Maryland Graduation Kermit The Frog To Speak

May 24, 2025