Investing In 2025: MicroStrategy Stock Or Bitcoin? A Detailed Analysis

Table of Contents

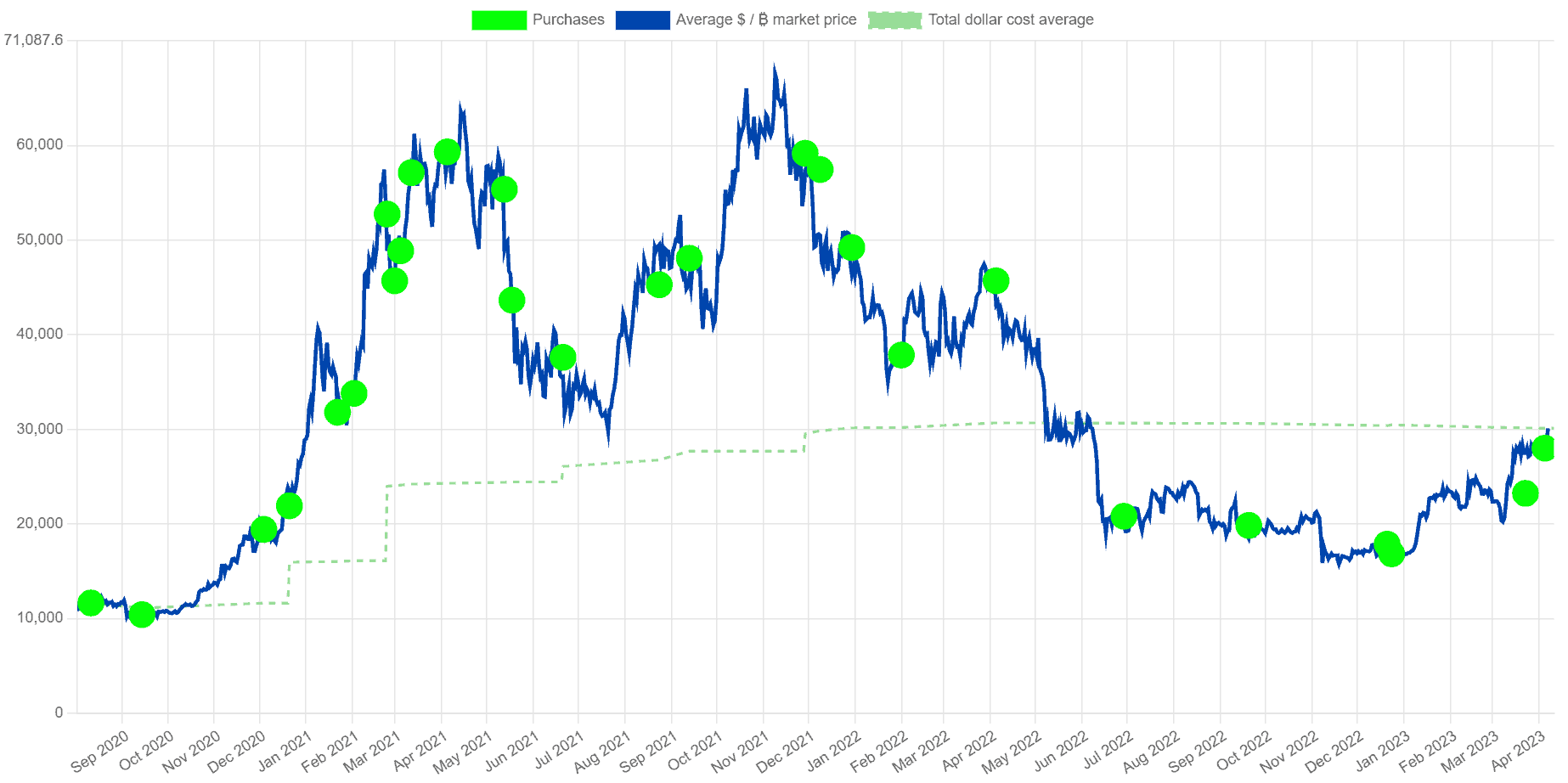

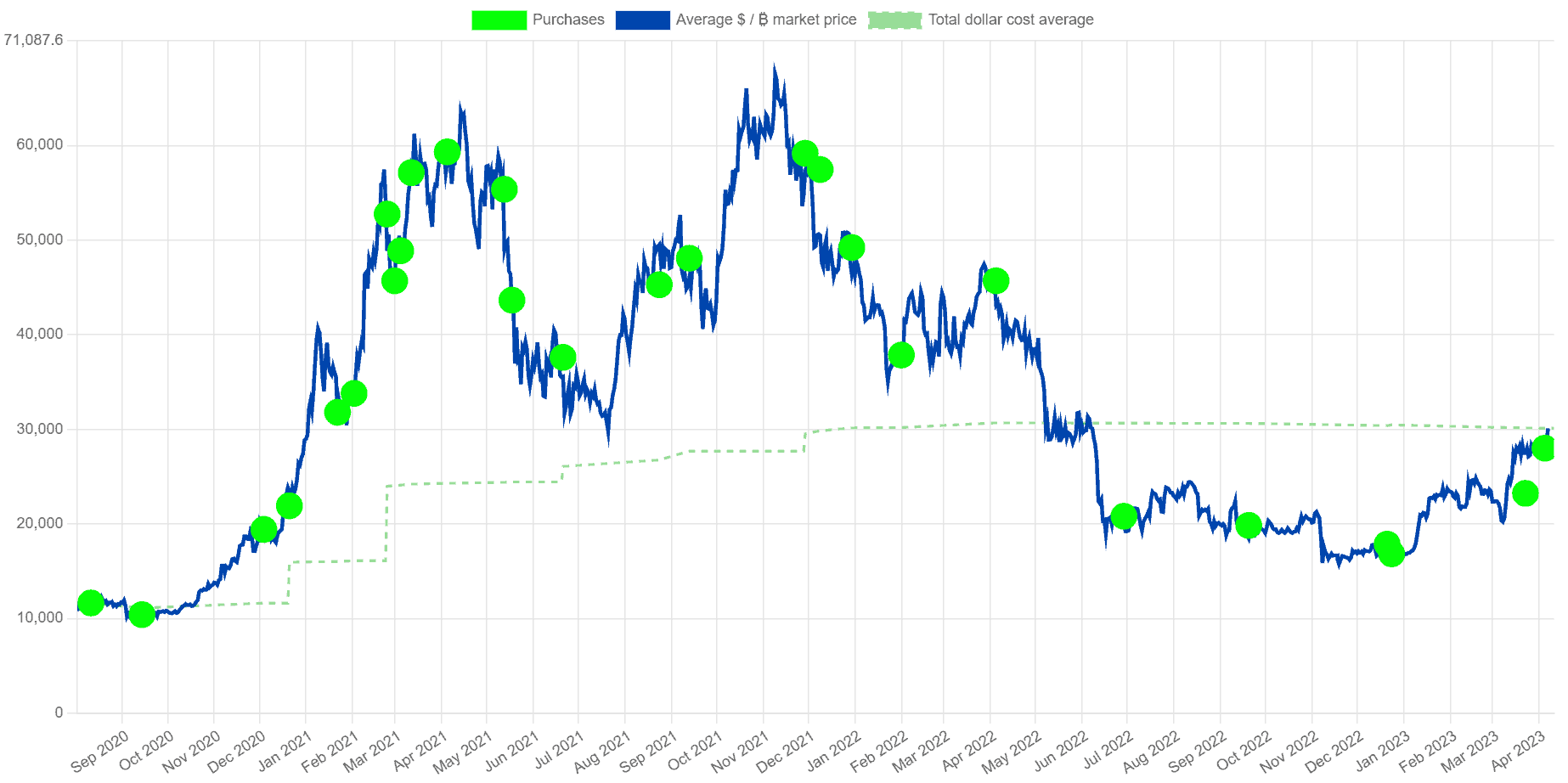

MicroStrategy's aggressive Bitcoin acquisition strategy has undeniably impacted its stock price, making it a proxy investment in the cryptocurrency. This article aims to dissect the potential returns and risks of both MicroStrategy stock and direct Bitcoin investment in 2025, providing you with the tools for a comprehensive comparison.

Understanding MicroStrategy's Bitcoin Strategy

MicroStrategy's Business Model and Bitcoin's Role

MicroStrategy's core business revolves around providing business intelligence, mobile software, and cloud-based services. However, its foray into Bitcoin has fundamentally reshaped its financial narrative. The company's significant Bitcoin holdings now represent a considerable portion of its assets.

- Revenue Streams: Primarily derived from software licenses, subscriptions, and services. Bitcoin holdings do not directly contribute to revenue but heavily influence the company's market capitalization.

- Profit Margins: Historically, MicroStrategy has experienced fluctuating profit margins, influenced by factors like competition and economic cycles. Bitcoin price fluctuations dramatically impact the perceived profitability and valuation of the company.

- Impact of Bitcoin Price Fluctuations: A rising Bitcoin price increases MicroStrategy's asset value, boosting its stock price. Conversely, a decline in Bitcoin's price negatively impacts the company's valuation and investor sentiment. This makes "MicroStrategy stock price" highly correlated to "Bitcoin holdings". The company's corporate treasury strategy is now intrinsically linked to the success of Bitcoin as a long-term investment.

Risks and Rewards of Investing in MicroStrategy Stock

Investing in MicroStrategy stock presents a unique blend of risks and rewards. Its reliance on Bitcoin introduces significant volatility.

- Market Volatility: MicroStrategy's stock price is highly sensitive to fluctuations in the Bitcoin market. This "stock market volatility" makes it a higher-risk investment compared to more diversified companies.

- Regulatory Risks: Changes in cryptocurrency regulations globally could negatively impact Bitcoin's value and, consequently, MicroStrategy's stock price. "Regulatory uncertainty" is a key factor to consider.

- Potential Benefits from Bitcoin's Long-Term Appreciation: If Bitcoin appreciates significantly in value, MicroStrategy stockholders could realize substantial gains. However, this depends heavily on the long-term outlook for Bitcoin's adoption and value.

Bitcoin's Potential in 2025

Bitcoin's Price Prediction and Market Factors

Predicting Bitcoin's price in 2025 is inherently challenging, with numerous analysts offering varying forecasts. However, several market factors influence its potential trajectory.

- Adoption Rates: Wider institutional and individual adoption of Bitcoin is crucial for sustained price appreciation. Increased usage and integration into mainstream financial systems will be key drivers.

- Technological Advancements: Improvements in blockchain technology, such as scaling solutions and increased transaction speeds, could positively influence Bitcoin's value and utility. The rise of potential altcoins, while competitive, could also indirectly benefit Bitcoin by raising awareness of the broader cryptocurrency market.

- Macroeconomic Conditions: Global economic trends, inflation rates, and monetary policies play a significant role in influencing investor sentiment towards Bitcoin and other risk assets.

Risks Associated with Direct Bitcoin Investment

Direct Bitcoin investment carries substantial risks. The cryptocurrency market is known for its volatility and unpredictable nature.

- Cryptocurrency Volatility: Bitcoin's price can experience significant daily fluctuations, leading to substantial gains or losses within short periods. "Cryptocurrency volatility" is a defining characteristic of this asset class.

- Digital Asset Security: Investors need to be aware of the security risks associated with storing and managing Bitcoin, including hacking, theft, and exchange failures. "Digital asset security" is paramount.

- Regulatory Uncertainty: Governments worldwide are still developing regulatory frameworks for cryptocurrencies, creating uncertainty and potential risks for investors. "Market manipulation" is also a concern within the relatively unregulated cryptocurrency market.

MicroStrategy Stock vs. Bitcoin: A Comparative Analysis

Risk Tolerance and Investment Goals

Choosing between MicroStrategy stock and Bitcoin depends heavily on your risk tolerance and investment goals.

- Risk-Averse Investors: May prefer more stable investments and might find the volatility of both options too high. Diversification away from both options should be considered.

- Risk-Tolerant Investors: Might be comfortable with the higher risk associated with both MicroStrategy stock and direct Bitcoin investment, seeking potentially higher returns.

- Investment Timeline: Long-term investors might be more willing to accept short-term volatility in pursuit of long-term growth.

Tax Implications and Investment Costs

The tax implications and transaction costs differ significantly between MicroStrategy stock and Bitcoin.

- Capital Gains Tax: Profits from both investments are subject to capital gains taxes, but the tax rates and reporting requirements may vary depending on jurisdiction.

- Transaction Fees: Trading fees for MicroStrategy stock are typically lower than those associated with buying and selling Bitcoin on cryptocurrency exchanges.

- Custody Costs: Storing Bitcoin securely incurs costs, while holding MicroStrategy stock through a brokerage account has minimal storage costs. "Investment costs" must be factored into the overall return calculation.

Conclusion

Investing in 2025: MicroStrategy stock or Bitcoin presents a complex decision. While MicroStrategy offers a less direct, but potentially less volatile, way to gain Bitcoin exposure, direct investment offers higher potential rewards but also carries significantly higher risks. Both options present considerable volatility and are not suitable for risk-averse investors with short-term investment horizons. Thoroughly understand your risk tolerance and investment goals before investing in either option. Consider the "tax implications" and "investment costs" associated with each. This analysis provides a starting point; further research is essential. Ultimately, the decision of "Investing in 2025: MicroStrategy Stock or Bitcoin?" rests on your individual circumstances and risk appetite. Conduct your own thorough research and consult with a financial advisor before making any investment decisions.

Featured Posts

-

The Closure Of Anchor Brewing Company Reflecting On 127 Years

May 09, 2025

The Closure Of Anchor Brewing Company Reflecting On 127 Years

May 09, 2025 -

Police Investigation Into Madeleine Mc Canns Disappearance Gets 108 000 Funding

May 09, 2025

Police Investigation Into Madeleine Mc Canns Disappearance Gets 108 000 Funding

May 09, 2025 -

Which Cryptocurrencies Will Survive The Trade War

May 09, 2025

Which Cryptocurrencies Will Survive The Trade War

May 09, 2025 -

Hl Yhqq Barys San Jyrman Tmwhh Alawrwby

May 09, 2025

Hl Yhqq Barys San Jyrman Tmwhh Alawrwby

May 09, 2025 -

Anons Matchey Ligi Chempionov Arsenal Protiv Ps Zh I Barselona Protiv Intera

May 09, 2025

Anons Matchey Ligi Chempionov Arsenal Protiv Ps Zh I Barselona Protiv Intera

May 09, 2025

Latest Posts

-

Mariah The Scientist And Young Thug A New Song Snippet Hints At Commitment

May 10, 2025

Mariah The Scientist And Young Thug A New Song Snippet Hints At Commitment

May 10, 2025 -

Young Thugs Vow Of Fidelity To Mariah The Scientist Revealed In Leaked Snippet

May 10, 2025

Young Thugs Vow Of Fidelity To Mariah The Scientist Revealed In Leaked Snippet

May 10, 2025 -

Mariah The Scientists Burning Blue Release Date Details And Fan Reaction

May 10, 2025

Mariah The Scientists Burning Blue Release Date Details And Fan Reaction

May 10, 2025 -

Elon Musks Path To Riches Key Investments And Entrepreneurial Strategies

May 10, 2025

Elon Musks Path To Riches Key Investments And Entrepreneurial Strategies

May 10, 2025 -

The Economic Impact Of Post Liberation Day Tariffs On Trumps Billionaire Circle

May 10, 2025

The Economic Impact Of Post Liberation Day Tariffs On Trumps Billionaire Circle

May 10, 2025