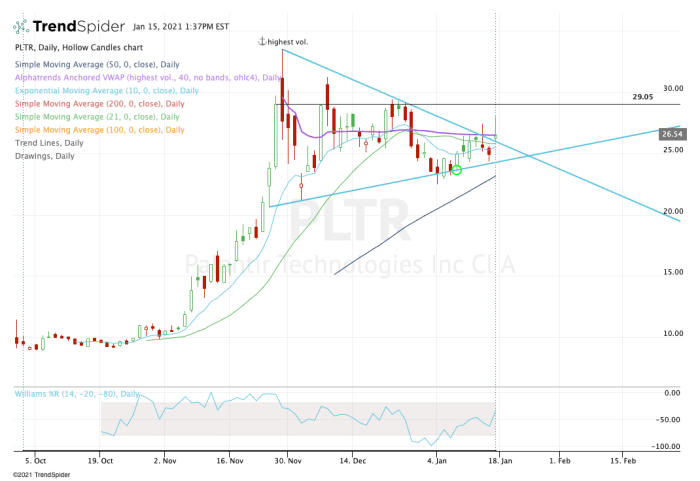

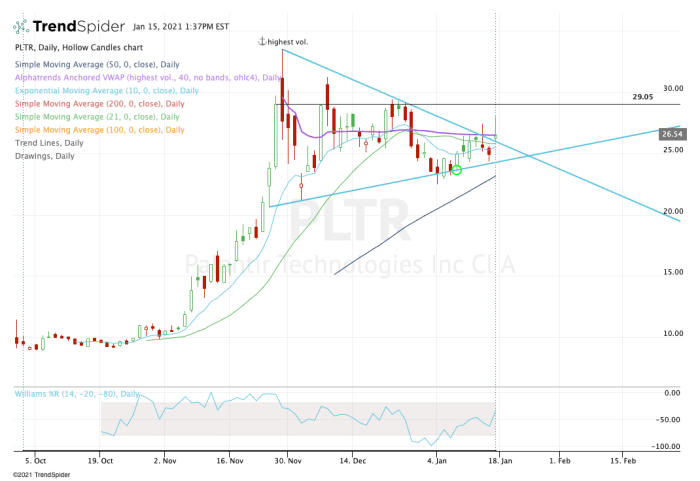

Investing In Palantir Stock Before May 5th: What To Consider

Table of Contents

1. Palantir's Recent Financial Performance and Future Projections

Palantir, a leader in big data analytics and artificial intelligence, operates in both the government and commercial sectors. Understanding its recent performance is crucial before considering an investment.

H3: Q4 2023 Earnings Report Analysis: (Note: Replace with the actual Q4 2023 data when available) Let's assume Palantir's Q4 2023 earnings report showed strong revenue growth, exceeding analyst expectations. This positive trend needs further investigation to understand its sustainability.

- Revenue growth percentage: Let's hypothesize a 25% year-over-year revenue growth, a strong indicator of market demand for Palantir's solutions.

- Key performance indicators (KPIs): Analyzing customer acquisition, average revenue per user (ARPU), and contract values provides insight into the health of the business. A significant increase in large contracts would be particularly positive.

- Management commentary: Pay close attention to management's guidance for the upcoming quarter and their outlook on the overall market. Their confidence level is a valuable indicator.

- Comparison to analyst expectations: Did the earnings surpass or fall short of analyst consensus estimates? A positive surprise often leads to a short-term stock price boost.

H3: Long-Term Growth Potential and Market Position: Palantir's future success depends on its ability to maintain its position within the rapidly evolving big data and AI landscape.

- Market share analysis: Evaluate Palantir's market share in comparison to its main competitors. Is it gaining or losing ground?

- Key partnerships and strategic alliances: Strong partnerships can accelerate growth. Analyzing Palantir's strategic alliances with major players in the industry is vital.

- Potential risks and threats: Increased competition, changing regulatory environments, and economic downturns pose significant threats.

- Future market opportunities: The expansion into new sectors or the development of new technologies can be key drivers of future growth.

2. Understanding Palantir's Business Model and Technology

Palantir's dual focus on government and commercial clients presents both opportunities and risks.

H3: Government Contracts vs. Commercial Sales: Government contracts often provide stable, long-term revenue, but they can be subject to budget constraints and political cycles. Commercial sales, while potentially more volatile, offer higher growth potential.

- Revenue breakdown: Determining the percentage of revenue from each sector is crucial for risk assessment. Over-reliance on government contracts can be a vulnerability.

- Key clients: Identifying key clients in both sectors provides insight into the stability and diversification of the revenue stream.

- Future growth potential: Assess the growth potential of each sector. Is one sector expected to outpace the other?

H3: Innovation and Technological Advantages: Palantir's success is closely tied to its ability to innovate and maintain a technological advantage.

- Core technologies: Understand Palantir's core platforms (Gotham and Foundry) and their capabilities.

- Technological advancements: Staying abreast of recent updates and new features is vital to assessing its competitive edge.

- Comparison to competitors: How does Palantir's technology compare to its competitors? Does it offer superior capabilities or unique functionalities?

3. Risks Associated with Investing in Palantir Stock Before May 5th

Before investing, it is crucial to understand potential risks.

H3: Market Volatility and Geopolitical Factors: External factors can significantly impact Palantir's stock price.

- Market trends: Broader market downturns can negatively impact even strong companies.

- Geopolitical events: Global instability can affect government spending and commercial activity, impacting Palantir's performance.

- Overall market sentiment: Investor sentiment towards the technology sector can influence Palantir's valuation.

H3: Company-Specific Risks: Palantir faces risks inherent to its business model and operations.

- Competition: The competitive landscape in big data and AI is intensely competitive.

- Dependence on large contracts: Losing a significant contract could severely impact revenue.

- Execution risk: The company's ability to execute its strategic plans and meet its targets is a key risk factor.

4. Conclusion

Investing in Palantir stock before May 5th requires careful consideration of its financial performance, business model, and associated risks. While Palantir demonstrates strong growth potential in the big data and AI market, factors such as market volatility, geopolitical events, and competitive pressures must be weighed carefully. The analysis of its Q4 2023 earnings and future projections are critical elements in this decision-making process. Remember, the information provided here is for educational purposes only. Before making any investment decisions regarding investing in Palantir stock before May 5th (or any other date), conduct thorough due diligence, consult with a financial advisor, and understand your own risk tolerance. The information above is hypothetical, and you should always rely on the most up-to-date financial information before making any investment decisions.

Featured Posts

-

Madhyamik Result 2025 Check Merit List And Toppers

May 09, 2025

Madhyamik Result 2025 Check Merit List And Toppers

May 09, 2025 -

Nottingham Attack Survivors Emotional Plea After Triple Killing

May 09, 2025

Nottingham Attack Survivors Emotional Plea After Triple Killing

May 09, 2025 -

Tang Cuong Giam Sat Ngan Chan Bao Hanh Tre Em Tai Cac Co So Giu Tre Tu Nhan

May 09, 2025

Tang Cuong Giam Sat Ngan Chan Bao Hanh Tre Em Tai Cac Co So Giu Tre Tu Nhan

May 09, 2025 -

Bitcoin Price Prediction Could Trumps 100 Day Speech Send Btc To 100 000

May 09, 2025

Bitcoin Price Prediction Could Trumps 100 Day Speech Send Btc To 100 000

May 09, 2025 -

Hl Njh Fyraty Me Alerby Alqtry Bed Rhylh En Alahly Almsry

May 09, 2025

Hl Njh Fyraty Me Alerby Alqtry Bed Rhylh En Alahly Almsry

May 09, 2025

Latest Posts

-

St Albert Dinner Theatre Catch Their Hilarious New Farce

May 09, 2025

St Albert Dinner Theatre Catch Their Hilarious New Farce

May 09, 2025 -

The Rise Of Samuel Dickson A Study Of A Canadian Lumber Barons Success

May 09, 2025

The Rise Of Samuel Dickson A Study Of A Canadian Lumber Barons Success

May 09, 2025 -

A Non Stop Laugh Riot Review Of St Albert Dinner Theatres Farce

May 09, 2025

A Non Stop Laugh Riot Review Of St Albert Dinner Theatres Farce

May 09, 2025 -

Olly Murs Music Festival A Stunning Castle Setting Near Manchester

May 09, 2025

Olly Murs Music Festival A Stunning Castle Setting Near Manchester

May 09, 2025 -

Samuel Dickson Contributions To Canadian Industry And Forestry

May 09, 2025

Samuel Dickson Contributions To Canadian Industry And Forestry

May 09, 2025