Investing In XRP (Ripple): A Practical Guide To Assessing Risk And Reward

Table of Contents

Understanding XRP and the Ripple Network

XRP is a cryptocurrency designed to facilitate fast and low-cost cross-border payments through the Ripple network. Unlike cryptocurrencies like Bitcoin that rely on Proof-of-Work, XRP uses a unique consensus mechanism on the XRP Ledger (XRPL), making transactions significantly faster and cheaper.

- Cross-border Payments: XRP's primary function is to enable near-instantaneous international money transfers, bypassing traditional banking systems and their associated delays and fees. This offers a potentially disruptive solution to the current SWIFT system.

- Speed and Low Transaction Costs: XRP transactions are significantly faster and less expensive than many other cryptocurrencies, making it attractive for businesses seeking efficient payment solutions.

- Ripple's Institutional Partnerships: Ripple has established numerous partnerships with banks and financial institutions globally, integrating XRP into their payment infrastructure. This widespread adoption strengthens XRP's position in the market.

- Disrupting SWIFT: Ripple's technology has the potential to significantly disrupt the traditional SWIFT system, a dominant player in international payments, by offering a faster, cheaper, and more transparent alternative.

The XRP Ledger (XRPL) utilizes a unique consensus mechanism, ensuring transaction security and efficiency. For more in-depth technical information, you can explore the official Ripple documentation [link to Ripple docs].

Assessing the Potential Rewards of XRP Investment

XRP investment presents the potential for substantial returns on investment (ROI). However, it's crucial to understand that this potential is accompanied by significant risk.

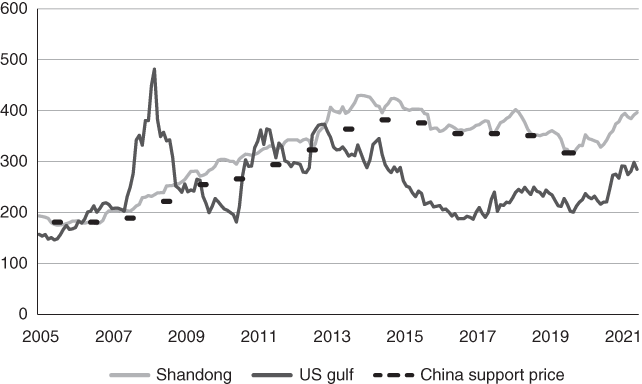

- High Price Volatility and Appreciation Potential: XRP's price has historically exhibited significant volatility, meaning it can experience rapid price increases and decreases. This volatility presents the opportunity for significant price appreciation, but also substantial losses.

- Factors Driving Price Increase: Several factors could drive XRP's price upwards: increased adoption by financial institutions, growing transaction volume on the Ripple network, positive regulatory developments, and wider acceptance of the technology.

- Portfolio Diversification: XRP can offer diversification benefits within a cryptocurrency portfolio, reducing overall risk by spreading investments across different assets.

- Future Applications: Beyond cross-border payments, XRP and Ripple technology might find applications in other areas like micropayments, supply chain management, and decentralized finance (DeFi), further fueling potential growth.

[Insert chart illustrating past XRP price performance with appropriate disclaimers about past performance not indicating future results].

Analyzing the Risks Associated with XRP Investment

Investing in XRP, like any cryptocurrency, comes with considerable risks. It's essential to understand these risks before investing any capital.

- Market Volatility: The cryptocurrency market is inherently volatile, and XRP is no exception. Sudden price drops can lead to significant losses.

- Regulatory Uncertainty: The ongoing SEC lawsuit against Ripple and the regulatory landscape surrounding cryptocurrencies introduce significant uncertainty. Unfavorable rulings could negatively impact XRP's price and functionality.

- Market Manipulation and Scams: The cryptocurrency market is susceptible to manipulation and scams. Investors need to be vigilant and cautious about fraudulent schemes.

- Complete Loss of Investment: There's always the risk of losing your entire investment in XRP due to market crashes, regulatory actions, or project failure.

- Lack of Inherent Value: Unlike fiat currencies or gold, XRP doesn't possess inherent value backed by a government or physical commodity. Its value is entirely dependent on market demand and speculation.

The SEC lawsuit against Ripple is a critical factor to consider. Understanding the details and potential outcomes of this legal battle is essential for assessing the risk associated with XRP investment. [Link to reputable news source covering the SEC lawsuit].

Diversification and Risk Management Strategies for XRP Investment

Diversification is crucial for managing risk in any investment portfolio, including one containing XRP.

- Diversification: Don't put all your eggs in one basket. Spread your investments across different asset classes (stocks, bonds, real estate, other cryptocurrencies) to mitigate the impact of potential losses in any single asset.

- Investment Strategies (Long-Term vs. Short-Term): Consider your investment timeline. A long-term strategy can help weather short-term market volatility, while a short-term approach requires closer monitoring and a higher risk tolerance.

- Stop-Loss Orders: Setting stop-loss orders can help limit potential losses by automatically selling your XRP if the price falls below a predetermined level.

- Invest Only What You Can Afford to Lose: Never invest money you cannot afford to lose. Cryptocurrency investments are highly speculative, and losses are possible.

- Thorough Research and Due Diligence: Before investing in XRP, conduct thorough research to understand the technology, the risks, and the potential rewards.

Examples of diversified portfolios including XRP can be found online [Link to example portfolio articles/blogs], but remember to customize your portfolio based on your personal risk tolerance and financial goals.

Conclusion

Investing in XRP presents both significant opportunities and considerable risks. Understanding the underlying technology of the Ripple network, along with a thorough assessment of potential rewards and inherent risks, is crucial for making informed investment decisions. Remember to diversify your portfolio, manage your risk effectively, and only invest what you can afford to lose. Before making any XRP investment, conduct thorough research and consider seeking advice from a qualified financial advisor. Start your journey towards informed XRP investment today!

Featured Posts

-

Investing In Xrp Ripple A Practical Guide To Assessing Risk And Reward

May 07, 2025

Investing In Xrp Ripple A Practical Guide To Assessing Risk And Reward

May 07, 2025 -

Cavs Fill Rookie Car With Popcorn Donovan Mitchells Hilarious Game Prediction

May 07, 2025

Cavs Fill Rookie Car With Popcorn Donovan Mitchells Hilarious Game Prediction

May 07, 2025 -

Ontarios Upcoming Budget Expanded Manufacturing Tax Credit

May 07, 2025

Ontarios Upcoming Budget Expanded Manufacturing Tax Credit

May 07, 2025 -

The Privilege Dilemma Implications For Expedited Wto Membership

May 07, 2025

The Privilege Dilemma Implications For Expedited Wto Membership

May 07, 2025 -

Steelers Wide Receiver Future The Decision Is In

May 07, 2025

Steelers Wide Receiver Future The Decision Is In

May 07, 2025