Investment Analysis: Deciphering CoreWeave, Inc. (CRWV)'s Recent Stock Growth

Table of Contents

1. Introduction

CoreWeave, Inc. (CRWV) has made waves in the high-performance computing (HPC) market since its initial public offering (IPO). While the stock has shown impressive growth, understanding the underlying factors is crucial for potential investors. CoreWeave's business model centers around providing cloud-based solutions tailored for computationally intensive tasks, primarily serving the rapidly expanding AI and machine learning sectors. This article delves into the intricacies of CoreWeave Inc. (CRWV) stock growth, offering a comprehensive analysis to help investors navigate this dynamic market.

2. Main Points

H2: Understanding CoreWeave's Business Model and Competitive Advantages

H3: CoreWeave's Niche in the High-Performance Computing Market

CoreWeave specializes in delivering scalable and cost-effective cloud computing solutions optimized for AI, machine learning, and other high-performance computing applications. Its unique selling propositions (USPs) set it apart from competitors.

- Superior Infrastructure: CoreWeave leverages cutting-edge NVIDIA GPUs, providing unparalleled processing power and performance.

- Competitive Pricing: Its pricing model aims to be more cost-effective than traditional HPC solutions, making it accessible to a broader range of clients.

- Strong Customer Support: CoreWeave offers dedicated support teams and robust documentation to assist clients in optimizing their workloads.

H3: Analysis of CoreWeave's Key Partnerships and Client Base

CoreWeave's strategic partnerships and diverse clientele contribute significantly to its growth trajectory.

- Major Partnerships: Collaborations with leading technology providers strengthen its infrastructure and expand its reach. These partnerships provide access to cutting-edge technologies and wider market access.

- Client Diversity: CoreWeave serves a broad range of industries, including AI research, financial modeling, gaming, and visual effects, reducing reliance on any single sector. This diversification minimizes risk and ensures consistent demand.

H3: Evaluating CoreWeave's Scalability and Future Growth Potential

CoreWeave's potential for future growth is considerable due to several factors:

- Market Trends: The explosive growth of AI and machine learning fuels the demand for high-performance computing resources.

- Technological Advancements: CoreWeave's commitment to innovation and research ensures it remains at the forefront of technological advancements.

- Market Expansion: Potential expansion into new markets and applications could unlock further growth opportunities.

H2: Examining the Factors Driving CoreWeave's Recent Stock Growth

H3: Impact of Market Demand for High-Performance Computing

The surging demand for high-performance computing is a primary driver of CoreWeave's growth.

- Market Growth Statistics: The HPC market is experiencing rapid expansion, projected to reach [insert projected market size and source] in the coming years.

- CoreWeave's Market Share: CoreWeave is strategically positioned to capture a significant portion of this expanding market.

- Future Demand Projections: The continued growth of AI and machine learning will further fuel demand for CoreWeave's services.

H3: Influence of Technological Advancements and Innovation

CoreWeave's continuous innovation plays a vital role in its success.

- Latest Technologies: Regular updates and integration of the latest technologies keep its platform competitive and efficient.

- Patents and R&D: Investment in research and development secures its technological leadership.

- Adaptability to Market Needs: Its ability to respond to evolving market needs and customer requirements fuels its growth.

H3: Role of Investor Sentiment and Market Speculation

Investor sentiment and market speculation influence CoreWeave's stock price.

- Analyst Reports: Positive analyst reports and ratings can boost investor confidence.

- News Events: Positive news regarding partnerships, technological breakthroughs, or financial performance can positively impact the stock price.

- Market Trends: Overall market trends and investor appetite for technology stocks also play a role.

H2: Assessing the Risks and Challenges Facing CoreWeave

H3: Competitive Landscape and Potential Threats

CoreWeave faces competition in the HPC market.

- Key Competitors: Identifying and analyzing the strengths and weaknesses of major competitors is vital for assessing CoreWeave's position.

- Disruptive Technologies: The emergence of new technologies could pose a potential threat.

- Competitive Pricing Strategies: Maintaining competitive pricing while ensuring profitability is a key challenge.

H3: Financial Performance and Sustainability

CoreWeave's financial health and long-term sustainability are crucial considerations.

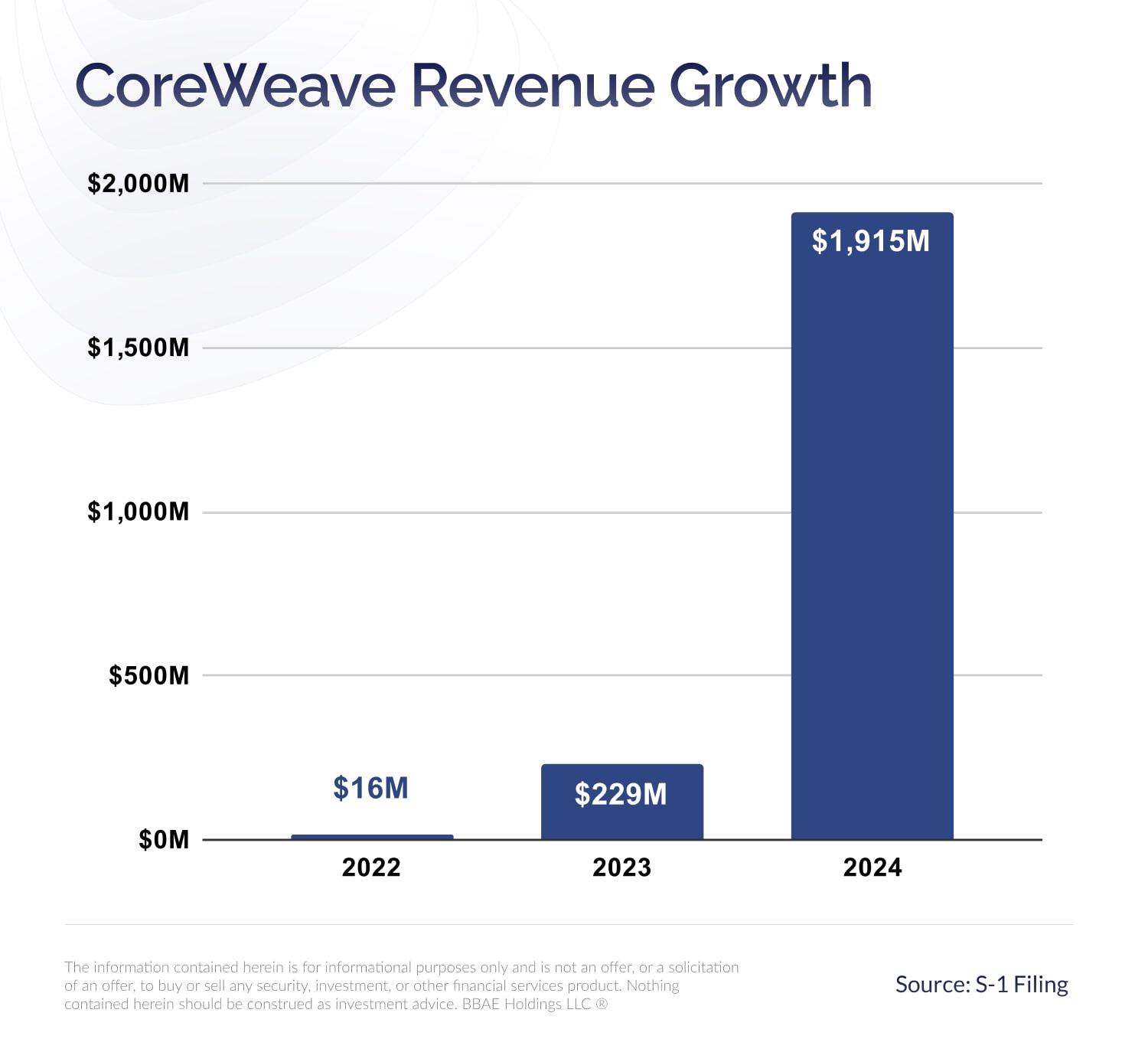

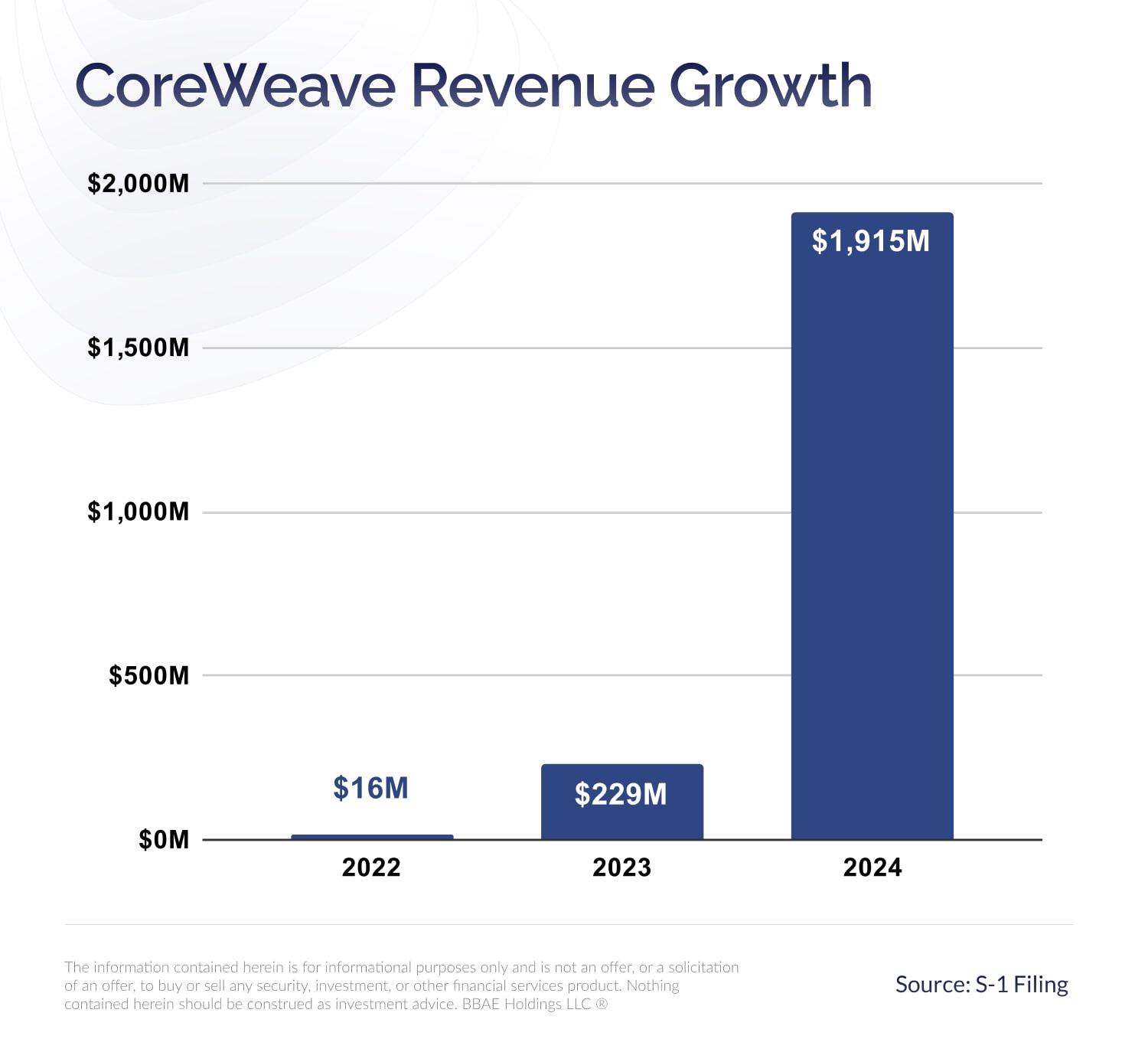

- Revenue Growth: Sustained revenue growth is essential for long-term success.

- Profitability: Achieving and maintaining profitability is crucial for investor confidence.

- Debt Levels: Managing debt levels effectively is vital for financial stability.

H3: Regulatory and Legal Considerations

Regulatory and legal factors can impact CoreWeave's operations.

- Data Privacy Regulations: Compliance with data privacy regulations is paramount.

- Intellectual Property Protection: Protecting its intellectual property is essential for maintaining a competitive advantage.

- Industry Regulations: Adherence to industry-specific regulations is crucial for avoiding legal issues.

3. Conclusion

This analysis of CoreWeave Inc. (CRWV) stock growth highlights the significant potential of the company, driven by strong market demand, technological innovation, and strategic partnerships. However, investors should also consider the competitive landscape and associated risks. Understanding these factors is crucial for making informed investment decisions. The key takeaways are the substantial growth potential fueled by the expanding HPC market, CoreWeave's innovative technology, and its strategic positioning. However, potential investors should also carefully consider the competitive pressures and financial stability of the company. To stay informed about CoreWeave Inc. (CRWV)'s future trajectory and the evolving dynamics of the high-performance computing market, continue to follow our blog for regular updates on CoreWeave Inc. (CRWV) stock growth and related trends.

Featured Posts

-

2 98 Gallon Wisconsin Gas Prices Rise By 3 Cents

May 22, 2025

2 98 Gallon Wisconsin Gas Prices Rise By 3 Cents

May 22, 2025 -

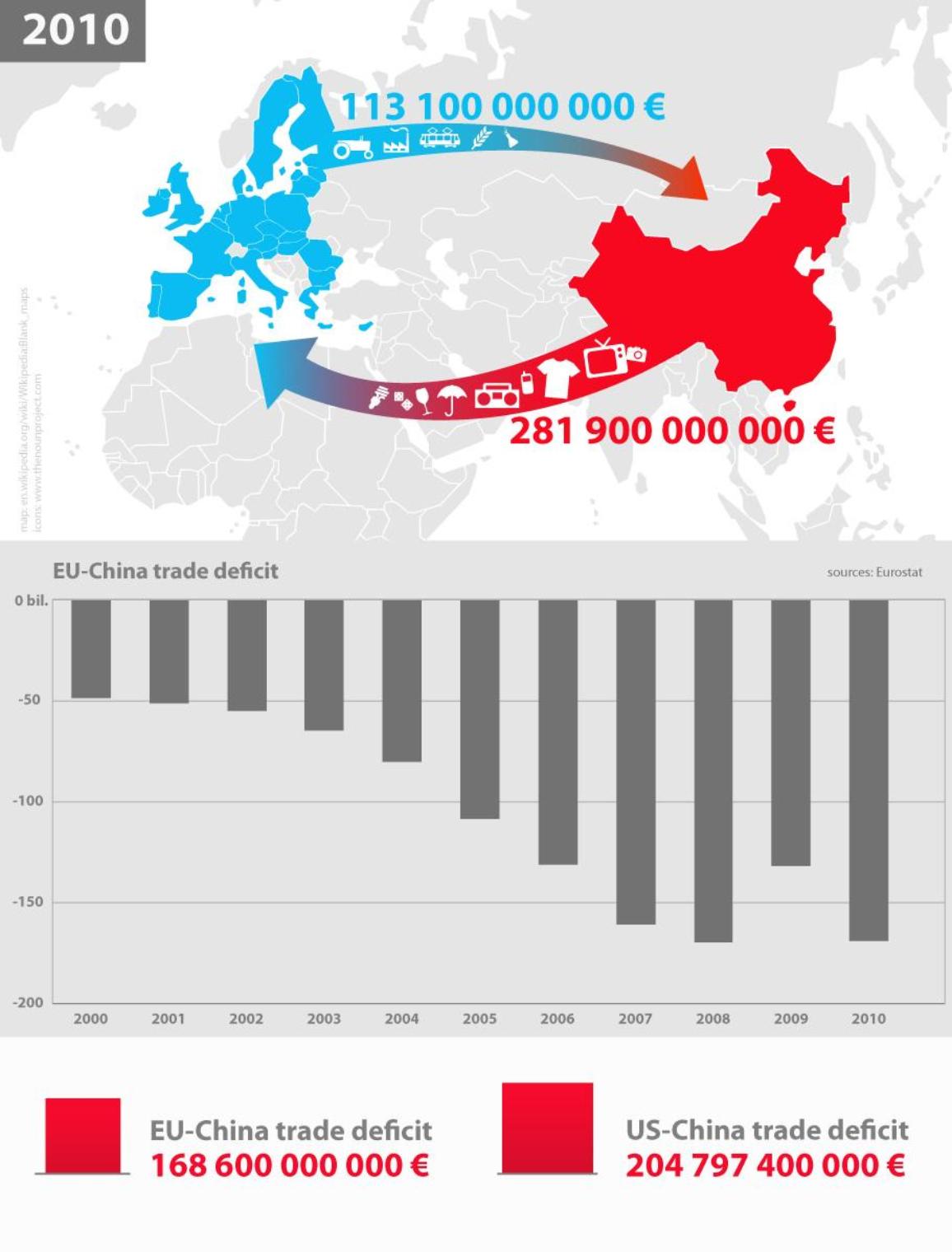

Eu Trade Policy Macrons Push For European Goods

May 22, 2025

Eu Trade Policy Macrons Push For European Goods

May 22, 2025 -

Understanding Core Weave Inc S Crwv Wednesday Stock Price Increase

May 22, 2025

Understanding Core Weave Inc S Crwv Wednesday Stock Price Increase

May 22, 2025 -

Adios Enfermedades Cronicas Este Superalimento Es Tu Aliado Para Un Envejecimiento Saludable

May 22, 2025

Adios Enfermedades Cronicas Este Superalimento Es Tu Aliado Para Un Envejecimiento Saludable

May 22, 2025 -

Nato Ta Ukrayina Analiz Peregovoriv Ta Komentar Yevrokomisara

May 22, 2025

Nato Ta Ukrayina Analiz Peregovoriv Ta Komentar Yevrokomisara

May 22, 2025

Latest Posts

-

Strategjia E Uefa S Per Zhvillimin E Futbollit Kosovar Rastet E Suksesit Ne Ligen E Kombeve

May 22, 2025

Strategjia E Uefa S Per Zhvillimin E Futbollit Kosovar Rastet E Suksesit Ne Ligen E Kombeve

May 22, 2025 -

Secure Your Metallica Glasgow Hampden Concert Tickets

May 22, 2025

Secure Your Metallica Glasgow Hampden Concert Tickets

May 22, 2025 -

Ngritja E Kosoves Ne Ligen B Nje Sukses I Uefa S Dhe I Ekipit Kombetar

May 22, 2025

Ngritja E Kosoves Ne Ligen B Nje Sukses I Uefa S Dhe I Ekipit Kombetar

May 22, 2025 -

How To Get Metallica Hampden Park Glasgow Tickets

May 22, 2025

How To Get Metallica Hampden Park Glasgow Tickets

May 22, 2025 -

Analiza E Performances Se Kosoves Ne Ligen E Kombeve Ndihma E Uefa S

May 22, 2025

Analiza E Performances Se Kosoves Ne Ligen E Kombeve Ndihma E Uefa S

May 22, 2025