Understanding CoreWeave Inc.'s (CRWV) Wednesday Stock Price Increase

Table of Contents

Potential Factors Contributing to the CRWV Stock Price Increase

Several factors likely contributed to the positive market sentiment and the subsequent CRWV stock price increase on Wednesday. Let's explore the key potential contributors:

Positive Financial News and Earnings Reports

Positive financial news often significantly impacts investor sentiment. A strong earnings report exceeding expectations can trigger a stock price surge. For CRWV, several scenarios could have played a role:

- Exceeded Earnings Expectations: CoreWeave might have announced earnings that surpassed analysts' predictions, demonstrating robust financial performance and growth.

- Announced New Contracts: Securing significant new contracts with major clients in the cloud computing sector would signal increased demand for CoreWeave's services and boost investor confidence.

- Positive Revenue Growth: Consistent and substantial revenue growth, indicative of a healthy and expanding business, is a powerful driver of stock price appreciation.

- Improved Profitability: Demonstrating improved profitability, showcasing efficient operations and strong margins, is highly attractive to investors.

These positive financial indicators would collectively paint a picture of a thriving and financially sound company, justifying the increased investor interest and higher CRWV stock price.

Market Sentiment and Industry Trends

The overall market sentiment toward cloud computing stocks and broader industry trends significantly influence individual company performance. Positive trends in the cloud computing market could have amplified the impact of CoreWeave's own news:

- Increased Demand for Cloud Services: A growing demand for cloud-based solutions across various industries naturally benefits cloud computing providers like CoreWeave.

- Positive Analyst Ratings: Upward revisions in analyst ratings and price targets for CRWV would reflect a positive outlook on the company's future prospects.

- Competitor Performance: Strong performance from competitors in the cloud computing space can sometimes create a positive ripple effect, boosting overall sector sentiment.

- General Market Optimism: A generally optimistic market environment, characterized by low interest rates or positive economic indicators, can lift even individual stocks not directly impacted by specific positive news.

The confluence of these positive market forces could have created a fertile ground for a substantial CRWV stock price increase.

Strategic Partnerships and Acquisitions

Strategic partnerships and acquisitions can significantly impact a company's growth trajectory and market positioning. For CoreWeave, any such announcements could have fueled the Wednesday stock surge:

- Strategic Alliances: New partnerships with key technology players or large enterprises could expand CoreWeave's market reach and enhance its service offerings.

- Technological Advancements: Acquisitions of innovative technologies or companies could solidify CoreWeave's competitive advantage and boost its long-term growth potential.

- Market Expansion: Strategic moves into new geographical markets or expanding into new service verticals would indicate ambition and growth potential.

These strategic initiatives would likely be viewed favorably by investors, leading to a positive market reaction.

Speculation and Market Volatility

It's crucial to acknowledge the role of speculation and market volatility in influencing stock prices. Even without concrete news, market dynamics can drive significant price swings:

- Short Squeezes: A short squeeze, where investors who bet against the stock are forced to buy to cover their positions, can artificially inflate the price.

- News Coverage: Positive media coverage highlighting CoreWeave's potential or recent achievements can boost investor interest and drive up the stock price.

- Social Media Influence: Positive sentiment on social media platforms can influence investor behavior and create a buying frenzy.

- Overall Market Conditions: Favorable overall market conditions, independent of CoreWeave-specific news, can contribute to the stock's upward movement.

These factors highlight the complex interplay of news, speculation, and market forces influencing a stock's price.

Analyzing the Impact on CoreWeave Inc.'s (CRWV) Future

The Wednesday stock price increase provides insights into investor sentiment but doesn't fully determine CoreWeave's future trajectory. A comprehensive analysis requires examining both potential growth and inherent risks.

Long-Term Growth Potential

CoreWeave's long-term growth potential depends on several key factors:

- Future Projections: The company's own projections for revenue growth, market share expansion, and profitability will influence investor confidence.

- Market Share: CoreWeave's ability to gain and maintain significant market share in the competitive cloud computing landscape is crucial.

- Technological Innovation: Continued investment in research and development and the adoption of cutting-edge technologies are vital for maintaining a competitive edge.

- Competitive Landscape: The intensity of competition from established players and emerging rivals will significantly influence CoreWeave's future success.

Risk Factors and Potential Challenges

Despite the positive outlook, several risks and challenges could impact CoreWeave's future stock performance:

- Competition: The cloud computing market is intensely competitive, with established giants and agile startups vying for market share.

- Economic Downturn: A broader economic downturn could reduce demand for cloud services, impacting CoreWeave's revenue and profitability.

- Regulatory Changes: Changes in government regulations or policies related to data privacy or cybersecurity could pose challenges.

- Technological Disruptions: Rapid technological advancements could render CoreWeave's current technology obsolete, requiring significant investment in upgrades.

Conclusion: Understanding the CoreWeave Inc. (CRWV) Stock Price Movement – Next Steps

The CoreWeave Inc. (CRWV) stock price increase on Wednesday was likely a result of a combination of positive financial news, favorable market sentiment, strategic initiatives, and potentially some market speculation. While the short-term increase is noteworthy, understanding the long-term growth potential and associated risks is crucial for informed investment decisions. Analyzing CoreWeave's financial performance, market positioning, and competitive landscape provides a more comprehensive perspective. Continue your research into CoreWeave's (CRWV) stock performance to make informed investment decisions and stay tuned for further analysis of CoreWeave's (CRWV) stock price movements. Understanding the intricacies of the cloud computing market and CoreWeave's place within it is key to navigating the complexities of CRWV stock.

Featured Posts

-

Patrushev Preduprezhdaet O Planakh Nato Zakhvatit Kaliningrad Analiz Situatsii

May 22, 2025

Patrushev Preduprezhdaet O Planakh Nato Zakhvatit Kaliningrad Analiz Situatsii

May 22, 2025 -

New York City Hosts Vybz Kartels Groundbreaking Performance

May 22, 2025

New York City Hosts Vybz Kartels Groundbreaking Performance

May 22, 2025 -

National Average Gas Price Jumps By Almost 20 Cents

May 22, 2025

National Average Gas Price Jumps By Almost 20 Cents

May 22, 2025 -

Nederlandse Bankieren Vereenvoudigd Alles Over Tikkie En Meer

May 22, 2025

Nederlandse Bankieren Vereenvoudigd Alles Over Tikkie En Meer

May 22, 2025 -

Pittsburgh Steelers 2025 Season A Look At The Upcoming Schedule

May 22, 2025

Pittsburgh Steelers 2025 Season A Look At The Upcoming Schedule

May 22, 2025

Big Rig Rock Report 3 12 99 7 The Fox Trucking Industry News And Analysis

Big Rig Rock Report 3 12 99 7 The Fox Trucking Industry News And Analysis

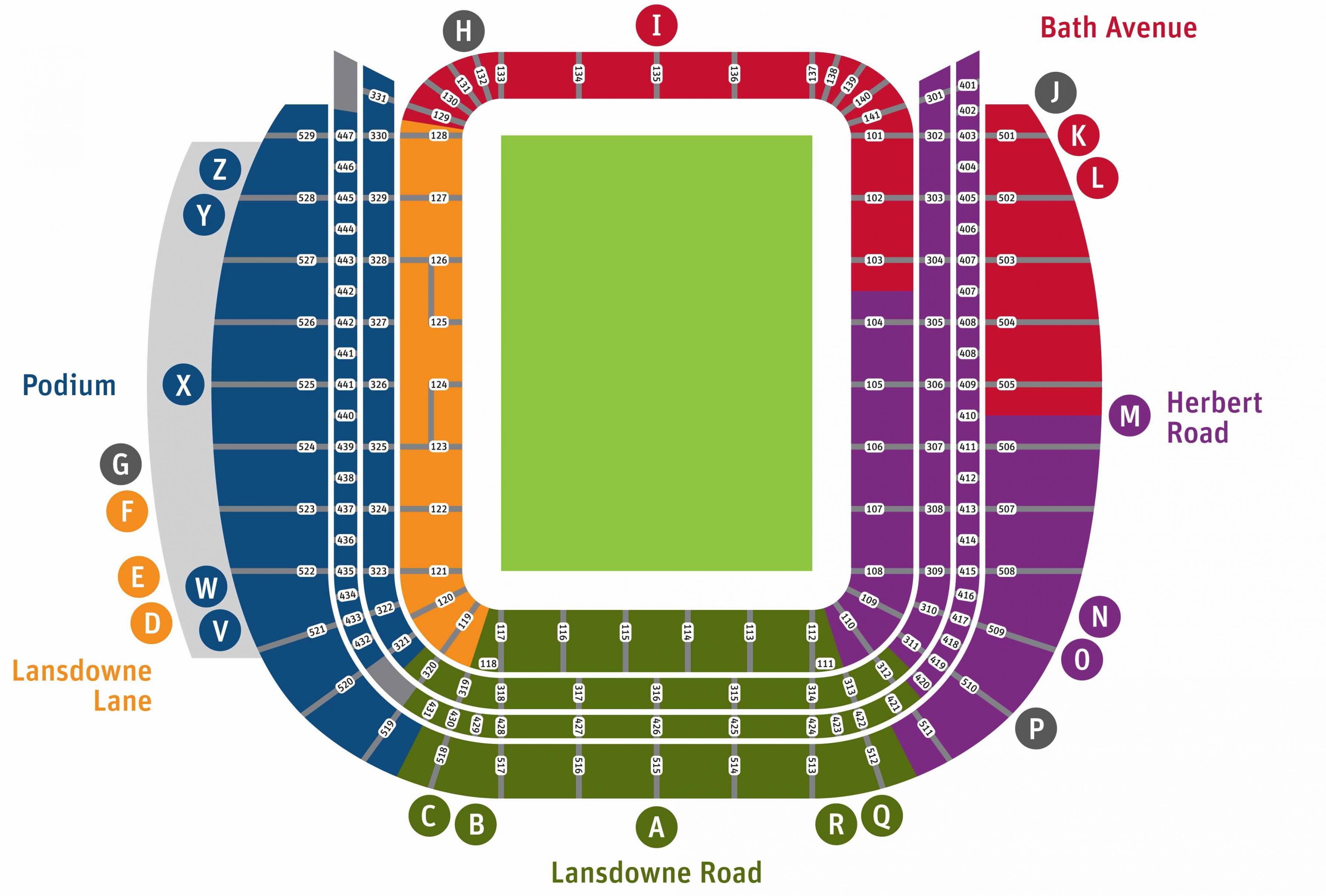

Metallicas Dublin Aviva Stadium Weekend June 2026 Shows Announced

Metallicas Dublin Aviva Stadium Weekend June 2026 Shows Announced