Is A 40% Increase In 2025 Enough To Consider Palantir Stock?

Table of Contents

Palantir's Current Market Position and Financial Performance

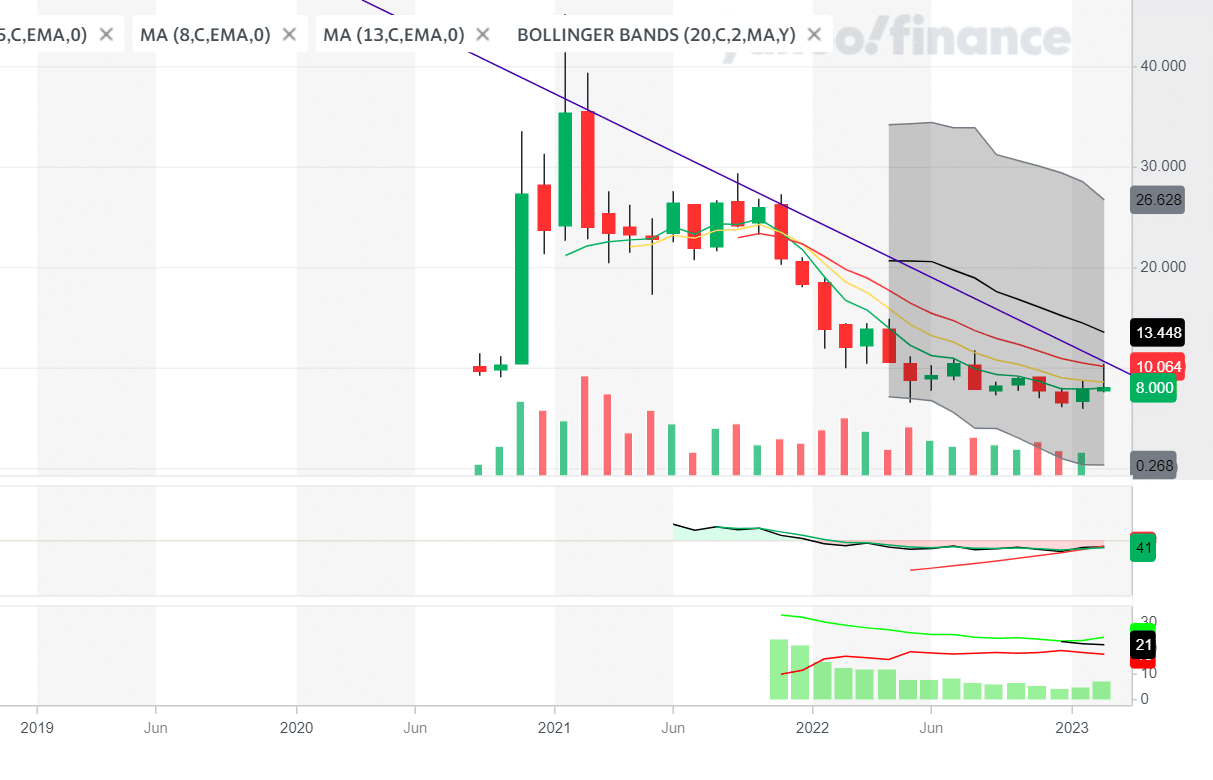

Palantir occupies a unique space in the big data and analytics market, specializing in providing sophisticated software platforms to government agencies and large commercial enterprises. Understanding Palantir's current financial health is crucial for any investment consideration. Recent financial reports reveal a mixed picture. While revenue growth has been substantial, profitability remains a key area of focus.

- Revenue Growth: Palantir has demonstrated consistent revenue growth over the past few years, though the rate of growth might fluctuate. Analyzing year-over-year comparisons is essential for a complete picture.

- Profitability Metrics: Net income and operating margins provide crucial insights into Palantir's ability to translate revenue into profit. Examining these metrics alongside revenue growth paints a clearer picture of financial health.

- Key Contracts and Partnerships: Palantir's success hinges on securing significant contracts, particularly within the government sector. Analyzing the pipeline of future contracts is vital. High-profile partnerships also contribute to the company's overall market standing and influence future Palantir stock price prediction.

- Comparison to Competitors: A competitive analysis against industry giants like AWS, Microsoft, and Google Cloud is crucial to evaluate Palantir's market share and potential for future growth. This comparison should include market penetration, technological innovation, and overall market valuation.

Factors Influencing Palantir's Projected 40% Increase

The projected 40% increase in Palantir stock price by 2025 is contingent on several factors. These include market trends, technological advancements, and the company's ability to secure and deliver on large contracts.

- Government Spending: Increased government spending on data analytics and cybersecurity initiatives presents a significant tailwind for Palantir, bolstering Palantir stock price prediction models.

- Commercial Sector Growth: Expanding into the commercial sector and securing contracts with major corporations is crucial for diversification and long-term growth. Success in this area would greatly impact future Palantir investment potential.

- Technological Innovations: Palantir's ongoing investment in research and development is key to its ability to maintain a competitive edge. New product features and platform enhancements directly influence its value proposition and, consequently, the Palantir stock price.

- Risks and Uncertainties: Geopolitical instability, economic downturns, and shifts in government priorities represent significant risks that could negatively impact the projected 40% increase. Careful consideration of these uncertainties is necessary when evaluating a Palantir investment.

Risk Assessment and Alternative Investment Opportunities

Investing in Palantir stock, like any investment, carries inherent risks. A thorough risk assessment is essential before committing capital.

- Government Contract Dependence: Palantir's reliance on government contracts exposes it to potential shifts in government policy and funding. Diversification into the commercial sector mitigates this risk, but it remains a crucial consideration.

- Competitive Landscape: The big data analytics market is fiercely competitive. The emergence of new players and intensified competition from established tech giants poses a threat to Palantir's market share and profitability.

- Regulatory Challenges: Navigating the complexities of data privacy regulations and complying with evolving security standards represents ongoing challenges that could impact Palantir's operations and financial performance.

- Alternative Opportunities: Before investing in Palantir, it is prudent to compare it with other companies in the tech sector with similar growth potential but perhaps lower risk profiles.

Analyzing the 40% Increase in the Context of Long-Term Growth

A 40% increase in 2025 needs to be evaluated within Palantir's long-term growth strategy and overall market trajectory.

- Long-Term Projections: Palantir's long-term growth projections, as communicated by the company's management, should be carefully examined to assess the sustainability of the projected 40% increase.

- Sustainability of Growth: A critical aspect is determining whether the factors driving the projected growth are sustainable over the long term. Temporary boosts in government spending, for example, may not translate into consistent long-term growth.

- Company Valuation: Analyzing Palantir's valuation relative to its peers and future earnings potential is critical for determining if a 40% increase aligns with its intrinsic value.

Conclusion: Is a 40% Increase in 2025 Enough for You to Consider Palantir Stock?

A projected 40% increase in Palantir stock price by 2025 presents a compelling opportunity, but it’s not a guaranteed outcome. Palantir's current financial performance, its position in a competitive market, and the inherent risks associated with its business model all need to be carefully weighed. While the potential rewards are significant, the uncertainties are substantial. Therefore, before making any investment decision regarding Palantir stock, deepen your understanding of Palantir stock, carefully consider Palantir investment options, and further analyze Palantir stock before investing. Consult with a qualified financial advisor to help you assess your risk tolerance and determine if Palantir aligns with your overall investment strategy.

Featured Posts

-

Nottingham Attacks Inquiry Judge Who Jailed Boris Becker Appointed Chair

May 09, 2025

Nottingham Attacks Inquiry Judge Who Jailed Boris Becker Appointed Chair

May 09, 2025 -

9 Nhl Players With The Potential To Eclipse Ovechkins Goal Record

May 09, 2025

9 Nhl Players With The Potential To Eclipse Ovechkins Goal Record

May 09, 2025 -

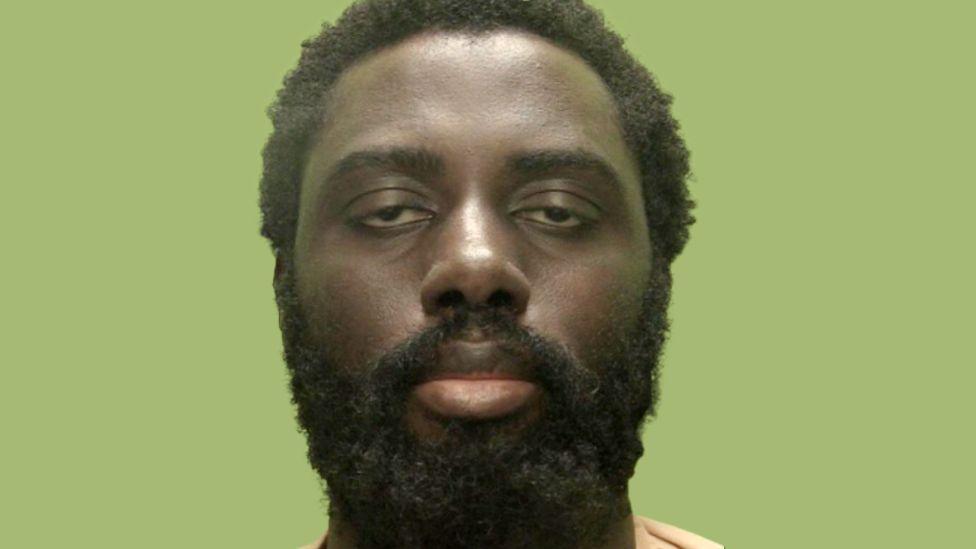

The Real Safe Bet Strategies For Minimizing Risk And Maximizing Returns

May 09, 2025

The Real Safe Bet Strategies For Minimizing Risk And Maximizing Returns

May 09, 2025 -

Accident Mortel A Dijon Chute D Un Jeune Ouvrier D Un Immeuble

May 09, 2025

Accident Mortel A Dijon Chute D Un Jeune Ouvrier D Un Immeuble

May 09, 2025 -

Global Power Shift Indias Ascent And Its Implications

May 09, 2025

Global Power Shift Indias Ascent And Its Implications

May 09, 2025

Latest Posts

-

From Wolves Reject To European Champion His Journey To The Top

May 09, 2025

From Wolves Reject To European Champion His Journey To The Top

May 09, 2025 -

Mdkhnw Krt Alqdm Asmae Lamet Athrt Altdkhyn Ela Msyrtha

May 09, 2025

Mdkhnw Krt Alqdm Asmae Lamet Athrt Altdkhyn Ela Msyrtha

May 09, 2025 -

Ashhr Laeby Krt Alqdm Aldhyn Kanwa Mdkhnyn

May 09, 2025

Ashhr Laeby Krt Alqdm Aldhyn Kanwa Mdkhnyn

May 09, 2025 -

West Hams Financial Future A 25m Gap And Potential Solutions

May 09, 2025

West Hams Financial Future A 25m Gap And Potential Solutions

May 09, 2025 -

Ashhr Njwm Krt Alqdm Almdkhnyn Hqayq Sadmt

May 09, 2025

Ashhr Njwm Krt Alqdm Almdkhnyn Hqayq Sadmt

May 09, 2025