Is A Wall Street Revival On The Horizon, And What Does It Mean For The DAX?

Table of Contents

Signs of a Wall Street Revival

Several indicators suggest a possible resurgence on Wall Street. Analyzing these signals is crucial for assessing the likelihood of a sustained recovery and its global consequences.

Improving Economic Indicators

Positive economic data from the US points towards a potential recovery. This improved outlook influences investor sentiment and subsequent stock market performance.

- GDP Growth: Recent quarters have shown encouraging GDP growth rates, exceeding initial forecasts.

- Employment Figures: The unemployment rate has fallen consistently, demonstrating a strengthening labor market.

- Consumer Confidence: Consumer spending is increasing, reflecting growing optimism within the US economy.

These positive economic indicators collectively paint a picture of strengthening economic fundamentals, boosting investor confidence and potentially fueling a Wall Street revival. A strong US economy typically leads to increased investment and higher stock prices.

Corporate Earnings Reports

Strong corporate earnings reports are a key driver of market growth. Analyzing these reports reveals which sectors are performing well and how this translates to overall market performance.

- Technology Sector: Several tech giants have reported exceeding expectations, contributing significantly to market gains.

- Energy Sector: The energy sector has seen robust performance due to increased global demand and rising prices.

- Consumer Staples: This sector remains relatively stable, providing a buffer against market fluctuations.

Positive earnings reports signal strong corporate performance and future growth potential, fueling investor optimism and further contributing to a potential Wall Street revival.

Federal Reserve Policy

The Federal Reserve's monetary policy plays a pivotal role in shaping market trends. Interest rate adjustments and quantitative easing measures significantly influence investor confidence and market stability.

- Interest Rate Hikes: While interest rate hikes can curb inflation, they might also slow economic growth, impacting market performance. The current approach appears to be successfully navigating this balance.

- Quantitative Easing (QE): Although large-scale QE programs are less frequent now, their legacy impact on market liquidity continues to be felt.

- Inflation Targeting: The Fed's commitment to controlling inflation is crucial for maintaining investor confidence and long-term market stability.

The Federal Reserve's actions will continue to be carefully monitored as they directly influence borrowing costs, investor sentiment, and the overall direction of the US stock market, thus impacting the potential for a Wall Street revival.

The Impact on the DAX

The global nature of financial markets means that events on Wall Street have a considerable influence on the DAX.

Global Market Interdependence

The correlation between Wall Street and the DAX is strong. Positive performance in the US typically translates into positive momentum for the DAX.

- Past Correlations: Historical data shows a significant positive correlation between the S&P 500 and the DAX, indicating a strong link between these two major indices.

- Investor Sentiment: Positive sentiment on Wall Street often spills over into other global markets, boosting investor confidence and encouraging investments in the DAX.

- Global Trade: Strong US economic growth usually leads to increased global trade and demand, positively affecting German exporters and the DAX.

Potential Benefits for German Companies

A Wall Street revival could bring significant benefits to German companies listed on the DAX.

- Increased Exports: Stronger US consumer demand would boost exports from German companies, particularly in sectors like automobiles and industrial goods.

- Higher Demand for German Goods and Services: A recovering US economy would increase the demand for high-quality German products and services.

- Foreign Direct Investment (FDI): A positive outlook on Wall Street may increase FDI into German companies, boosting growth and profitability.

Potential Risks for the DAX

Despite a potential Wall Street revival, risks still exist for the DAX.

- Geopolitical Factors: Geopolitical instability, such as the ongoing conflict in Ukraine, could negatively impact the global economy and affect the DAX.

- Eurozone Economic Conditions: Challenges within the Eurozone, such as high inflation or sovereign debt crises, could counterbalance the positive effects of a Wall Street revival.

- Energy Prices: Volatile energy prices remain a significant risk for the German economy, impacting industrial production and corporate profitability.

Investment Strategies in a Recovering Market

Navigating a potentially recovering market requires a well-defined investment strategy.

Diversification

Diversification is paramount to mitigating risk. Spread investments across various asset classes to reduce the impact of any single market downturn.

- Asset Allocation: Allocate funds across stocks, bonds, real estate, and other asset classes to create a balanced portfolio.

- Geographic Diversification: Diversify investments across different countries and regions to reduce exposure to any single market's volatility.

- Sector Diversification: Diversify across various economic sectors to mitigate the impact of any sector-specific downturn.

Long-Term vs. Short-Term Investments

Choosing between long-term and short-term investment strategies depends on individual risk tolerance and financial goals.

- Long-Term Investments: Offer greater potential for growth but involve higher risk and less liquidity.

- Short-Term Investments: Involve lower risk and higher liquidity but might offer lower returns.

Consider your personal financial situation and risk tolerance when selecting an appropriate time horizon.

Seeking Professional Advice

Consulting a financial advisor is crucial for making informed investment decisions.

- Personalized Guidance: A financial advisor can tailor investment strategies to your specific needs and risk tolerance.

- Market Expertise: They possess in-depth market knowledge and can provide valuable insights into potential opportunities and risks.

- Risk Management: They can help develop strategies to manage and mitigate investment risks.

Conclusion

The potential for a Wall Street revival and its impact on the DAX are significant. While improving economic indicators, strong corporate earnings, and potentially stabilizing Federal Reserve policy suggest a positive outlook, investors must remain aware of potential risks such as geopolitical instability and Eurozone economic conditions. The interconnectedness of global markets underscores the importance of a well-diversified investment strategy. To effectively navigate this evolving landscape, stay informed about market trends, conduct thorough research, and consider seeking professional advice before making investment decisions related to the potential Wall Street market recovery and its impact on DAX index performance. Investing in a Wall Street revival requires careful planning and a comprehensive understanding of the global economic climate.

Featured Posts

-

Prognoz Konchiti Vurst Na Peremozhtsiv Yevrobachennya 2025 Analiz Unian

May 24, 2025

Prognoz Konchiti Vurst Na Peremozhtsiv Yevrobachennya 2025 Analiz Unian

May 24, 2025 -

Atfaq Washntn Wbkyn Aljmrky Artfae Mwshr Daks Alalmany Ila 24 Alf Nqtt

May 24, 2025

Atfaq Washntn Wbkyn Aljmrky Artfae Mwshr Daks Alalmany Ila 24 Alf Nqtt

May 24, 2025 -

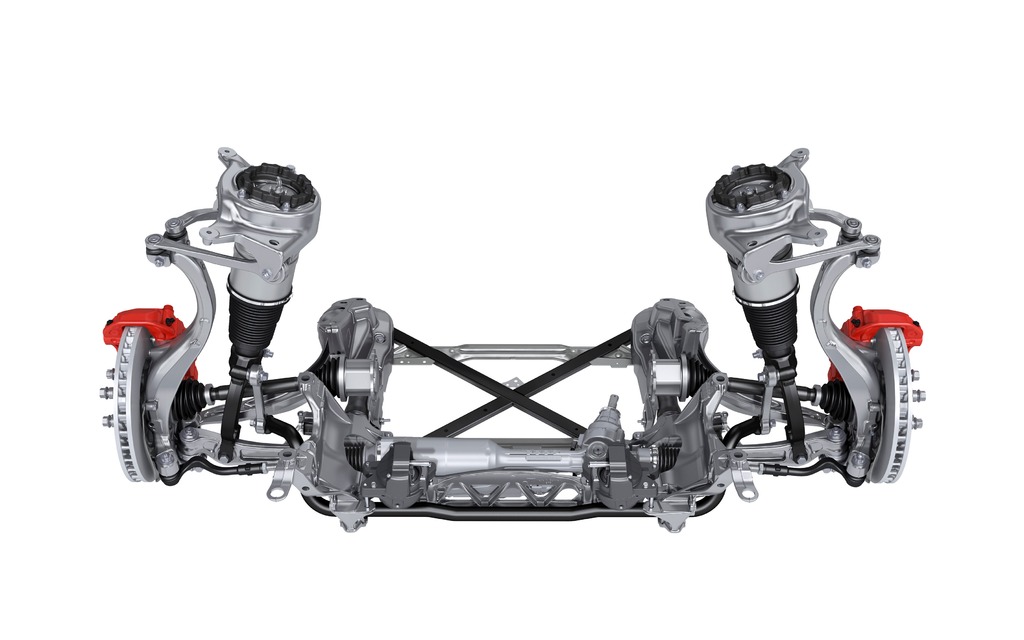

2024 Porsche Macan Buyers Guide Find The Perfect Suv

May 24, 2025

2024 Porsche Macan Buyers Guide Find The Perfect Suv

May 24, 2025 -

Hawaii Keikis Memorial Day Lei Making Poster Contest A Showcase Of Artistic Talent

May 24, 2025

Hawaii Keikis Memorial Day Lei Making Poster Contest A Showcase Of Artistic Talent

May 24, 2025 -

Nicki Chapman Reveals 700 000 Property Investment From Escape To The Country

May 24, 2025

Nicki Chapman Reveals 700 000 Property Investment From Escape To The Country

May 24, 2025

Latest Posts

-

Euronext Amsterdam Stock Market Reaction 8 Gain After Trumps Tariff Announcement

May 24, 2025

Euronext Amsterdam Stock Market Reaction 8 Gain After Trumps Tariff Announcement

May 24, 2025 -

8 Stock Market Increase On Euronext Amsterdam Impact Of Trumps Tariff Decision

May 24, 2025

8 Stock Market Increase On Euronext Amsterdam Impact Of Trumps Tariff Decision

May 24, 2025 -

Trumps Tariff Delay Sends Euronext Amsterdam Stocks Soaring 8

May 24, 2025

Trumps Tariff Delay Sends Euronext Amsterdam Stocks Soaring 8

May 24, 2025 -

11 Drop In Three Days Amsterdam Stock Exchange In Freefall

May 24, 2025

11 Drop In Three Days Amsterdam Stock Exchange In Freefall

May 24, 2025 -

Euronext Amsterdam Stocks Jump 8 Following Trump Tariff Decision

May 24, 2025

Euronext Amsterdam Stocks Jump 8 Following Trump Tariff Decision

May 24, 2025