Is D-Wave Quantum (QBTS) Stock Right For Your Portfolio?

Table of Contents

Understanding D-Wave Quantum (QBTS) and its Business Model

D-Wave Quantum Inc. (QBTS) is a leading player in the burgeoning quantum computing industry. Unlike many competitors focusing on gate-based quantum computers, D-Wave specializes in a unique approach: quantum annealing.

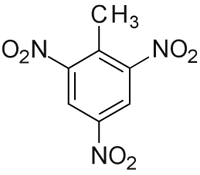

D-Wave's Quantum Annealing Technology

Quantum annealing is a type of quantum computation particularly well-suited for optimization problems. It leverages the principles of quantum mechanics to find the lowest energy state of a system, providing solutions to complex problems faster than classical computers for specific use cases. This contrasts with gate-based quantum computing, which employs qubits to perform universal computations. D-Wave's advantage lies in its established infrastructure and early adoption in specific industries.

- Advantages of Quantum Annealing: Faster solutions for specific optimization problems, readily available hardware, relatively lower error rates compared to some gate-based systems.

- Disadvantages of Quantum Annealing: Not a universal quantum computer; limited to optimization problems; scalability challenges compared to other approaches.

- Applications: Currently used in logistics optimization, materials science research, financial modeling, and artificial intelligence.

Revenue Streams and Financial Performance (QBTS Financials)

D-Wave's revenue primarily stems from the sale of its quantum computers and access to its cloud-based quantum computing platform. Analyzing QBTS financials requires scrutiny of its revenue growth, profitability, and market capitalization. While the company is currently not yet profitable, it's important to monitor key financial metrics:

- Key Financial Metrics: Revenue growth rates should be closely observed, along with operating expenses and debt levels. Investors should also track the company's cash burn rate and its runway.

- Comparison to Competitors: D-Wave's financial performance must be benchmarked against competitors like IBM, Google, and IonQ to assess its relative market position and growth potential.

Competitive Landscape and Future Outlook

The quantum computing market is fiercely competitive. D-Wave faces competition from giants like IBM, Google, and IonQ, each pursuing different quantum computing technologies. Understanding D-Wave's position in this landscape is crucial for assessing QBTS investment opportunities.

- Strengths: First-mover advantage in quantum annealing, established customer base, and a strong focus on practical applications.

- Weaknesses: Limited applicability of quantum annealing compared to universal quantum computers, potential for technological disruption by gate-based systems, and dependence on specific niche markets.

- Projected Growth Potential: The long-term growth potential of the quantum computing market is significant, offering considerable upside for D-Wave if it can successfully navigate the competitive landscape and expand its market share.

Assessing the Risks and Rewards of Investing in QBTS

Investing in QBTS, like any investment in a nascent technology, carries significant risks and rewards.

Market Volatility and Risk Factors

The quantum computing sector is inherently volatile. Investing in QBTS exposes you to several risks:

- Technological Hurdles: Further technological advancements could render D-Wave's technology obsolete.

- Competition: Intense competition from established tech giants poses a threat to D-Wave's market share.

- Market Adoption: The pace of market adoption for quantum computing solutions will significantly influence D-Wave's financial performance.

- QBTS Volatility: The stock price itself is subject to significant fluctuations based on market sentiment and company news.

Potential for High Returns and Long-Term Growth (QBTS Growth Potential)

Despite the risks, the potential for high returns from investing in QBTS is substantial. The long-term outlook for quantum computing is positive, and D-Wave could become a major player.

- New Product Launches: The introduction of new and improved quantum annealing systems can drive revenue growth.

- Partnerships: Strategic partnerships with major companies can open up new markets and accelerate adoption.

- Increased Market Adoption: Wider acceptance of quantum computing solutions across various industries can lead to substantial revenue growth.

How D-Wave Quantum (QBTS) Stock Fits into a Diversified Portfolio

Integrating QBTS into a diversified portfolio is a crucial aspect of managing investment risk.

Portfolio Diversification Strategies

Diversification is key to mitigating risk. Adding QBTS can be part of a diversified technology portfolio.

- Asset Allocation: Allocate a small percentage of your overall portfolio to QBTS, limiting exposure to potential losses.

- Alternative Investments: Consider investing in other technology companies or ETFs to diversify further.

Considering Your Investment Goals and Risk Tolerance

Before investing in QBTS, carefully consider your individual circumstances:

- Investment Goals: Is QBTS aligned with your short-term and long-term financial goals?

- Risk Tolerance: Can you withstand significant short-term losses in pursuit of potential long-term gains?

- Investment Timeline: How long are you willing to hold QBTS before expecting a return?

Conclusion: Is D-Wave Quantum (QBTS) Stock Right for You?

Investing in D-Wave Quantum (QBTS) stock offers a unique opportunity to participate in the exciting world of quantum computing. However, it’s vital to acknowledge the inherent risks associated with this emerging technology and the company's position within a fiercely competitive landscape. While the potential for substantial long-term growth is undeniable, careful consideration of your investment goals, risk tolerance, and diversification strategy is paramount. Remember that this article is for informational purposes only and does not constitute financial advice. Before making any investment decisions concerning D-Wave Quantum (QBTS) stock, conduct thorough due diligence and, if necessary, consult with a qualified financial advisor. Learn more about investing in QBTS, exploring D-Wave Quantum stock analysis, and understanding QBTS investment opportunities by conducting independent research.

Featured Posts

-

Analysis Of Sasol Sol S New Strategic Direction Investor Implications

May 21, 2025

Analysis Of Sasol Sol S New Strategic Direction Investor Implications

May 21, 2025 -

Mas Alla Del Arandano El Mejor Alimento Para Prevenir Enfermedades Cronicas

May 21, 2025

Mas Alla Del Arandano El Mejor Alimento Para Prevenir Enfermedades Cronicas

May 21, 2025 -

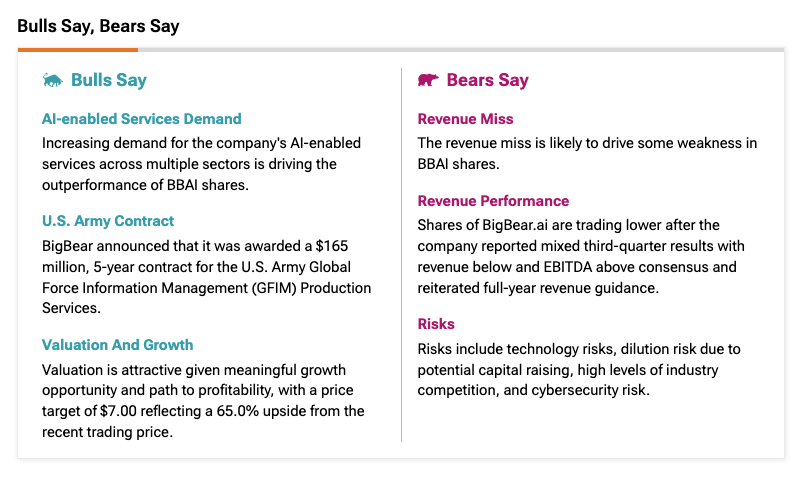

Big Bear Ai Bbai Stock Buy Rating Maintained Amidst Rising Defense Spending

May 21, 2025

Big Bear Ai Bbai Stock Buy Rating Maintained Amidst Rising Defense Spending

May 21, 2025 -

Cedar Rapids Facing Collins Aerospace Layoffs What We Know

May 21, 2025

Cedar Rapids Facing Collins Aerospace Layoffs What We Know

May 21, 2025 -

The Love Monster Within Self Reflection And Personal Growth In Love

May 21, 2025

The Love Monster Within Self Reflection And Personal Growth In Love

May 21, 2025

Latest Posts

-

Southport Migrant Rant Tory Politicians Wife To Stay In Jail

May 22, 2025

Southport Migrant Rant Tory Politicians Wife To Stay In Jail

May 22, 2025 -

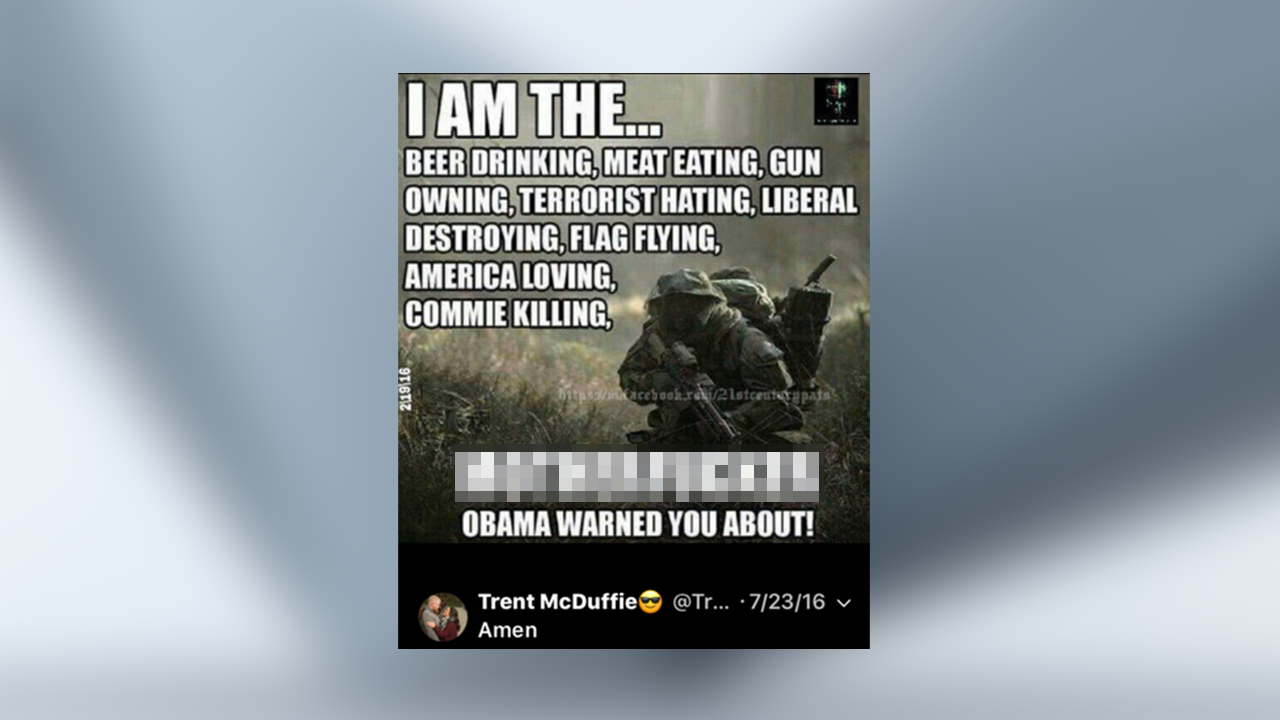

Connollys Racial Hatred Conviction Upheld Appeal Rejected

May 22, 2025

Connollys Racial Hatred Conviction Upheld Appeal Rejected

May 22, 2025 -

Tory Wifes Jail Sentence Confirmed After Anti Migrant Outburst In Southport

May 22, 2025

Tory Wifes Jail Sentence Confirmed After Anti Migrant Outburst In Southport

May 22, 2025 -

Mother Imprisoned For Social Media Post After Southport Stabbing Incident

May 22, 2025

Mother Imprisoned For Social Media Post After Southport Stabbing Incident

May 22, 2025 -

Lucy Connolly Loses Appeal Over Racist Social Media Post

May 22, 2025

Lucy Connolly Loses Appeal Over Racist Social Media Post

May 22, 2025