Is Google's AI Strategy Truly Sustainable? Investor Confidence And The Future

Table of Contents

Financial Sustainability of Google's AI Investments

Google's commitment to AI is undeniable, evidenced by massive investments in research and development. Understanding the financial sustainability of Google's AI strategy requires a close look at both the expenditure and the return on investment (ROI).

Massive Investments & Return on Investment (ROI)

Google pours billions into AI, funding projects like DeepMind, developing cutting-edge AI hardware like TPUs (Tensor Processing Units), and integrating AI into its core products like Search and Google Cloud. While the current ROI is difficult to precisely quantify due to the long-term nature of these investments, early successes in areas like cloud computing powered by AI show promise. However, questions remain about the overall profitability of these ventures.

- Examples of Google's AI investments: DeepMind's AlphaFold (protein folding), Waymo (self-driving cars), Google Cloud's AI platform.

- Analysis of current profitability: While some AI-powered services are profitable, others are still in the investment phase, requiring significant capital expenditure before generating substantial returns.

- Projections for future profitability: Analysts predict significant growth in the AI market, suggesting a potentially high ROI for Google in the coming years, particularly in cloud computing and personalized advertising.

- Comparison with competitors' AI investments: Microsoft's substantial investment in OpenAI and Amazon's robust AI services in AWS pose significant competitive challenges, demanding continued investment from Google to maintain its market leadership.

Competition in the AI Market

The AI market is intensely competitive. Microsoft's partnership with OpenAI, Amazon's expanding cloud AI services, and the emergence of numerous startups present formidable challenges to Google's dominance. This fierce competition puts pressure on Google to continuously innovate and deliver superior AI solutions to maintain market share and profitability.

- Competitive analysis: Google faces strong competition from Microsoft (Azure AI), Amazon (AWS AI services), and emerging players in specific AI niches.

- Market share projections: While Google maintains a significant market share, projections suggest a potential erosion of its dominance if it fails to adapt and innovate.

- Discussion of competitive advantages and disadvantages for Google: Google's strengths lie in its vast data resources and its established infrastructure. However, its slower adoption of certain open-source technologies and potential regulatory scrutiny present disadvantages.

Ethical and Societal Concerns Impacting Investor Confidence

Beyond financial considerations, ethical and societal concerns significantly impact investor confidence in Google's AI strategy. These concerns, if not adequately addressed, can lead to regulatory hurdles, reputational damage, and decreased investor trust.

AI Bias and Fairness

AI systems are only as unbiased as the data they are trained on. Concerns exist regarding potential bias in Google's AI products, leading to unfair or discriminatory outcomes. This has significant implications for investor confidence, as it could lead to negative publicity, legal challenges, and regulatory intervention.

- Examples of AI bias in Google's products: Past instances of bias in image recognition, facial recognition, and language models have highlighted the challenges of ensuring fairness in AI.

- The company's response to these concerns: Google has publicly committed to addressing AI bias, but the effectiveness of its efforts remains a subject of ongoing debate.

- The potential for regulatory intervention: Governments worldwide are increasingly focusing on regulating AI to mitigate bias and ensure fairness, posing a significant risk to companies failing to address these issues proactively.

Job Displacement and Economic Impact

The transformative power of AI raises concerns about widespread job displacement. While AI can create new jobs, it simultaneously threatens to automate many existing roles, leading to social and economic instability. Investors are keenly aware of this potential disruption and its impact on long-term stability.

- Statistics on potential job losses: While precise figures are difficult to predict, numerous studies suggest significant job displacement across various sectors due to AI automation.

- Google's strategies for mitigating job displacement: Google's efforts to reskill and upskill its workforce and support workforce transitions are crucial in addressing this concern.

- Investor sentiment related to this issue: Investors are increasingly scrutinizing companies' strategies for mitigating job displacement, considering it a crucial factor in assessing long-term sustainability.

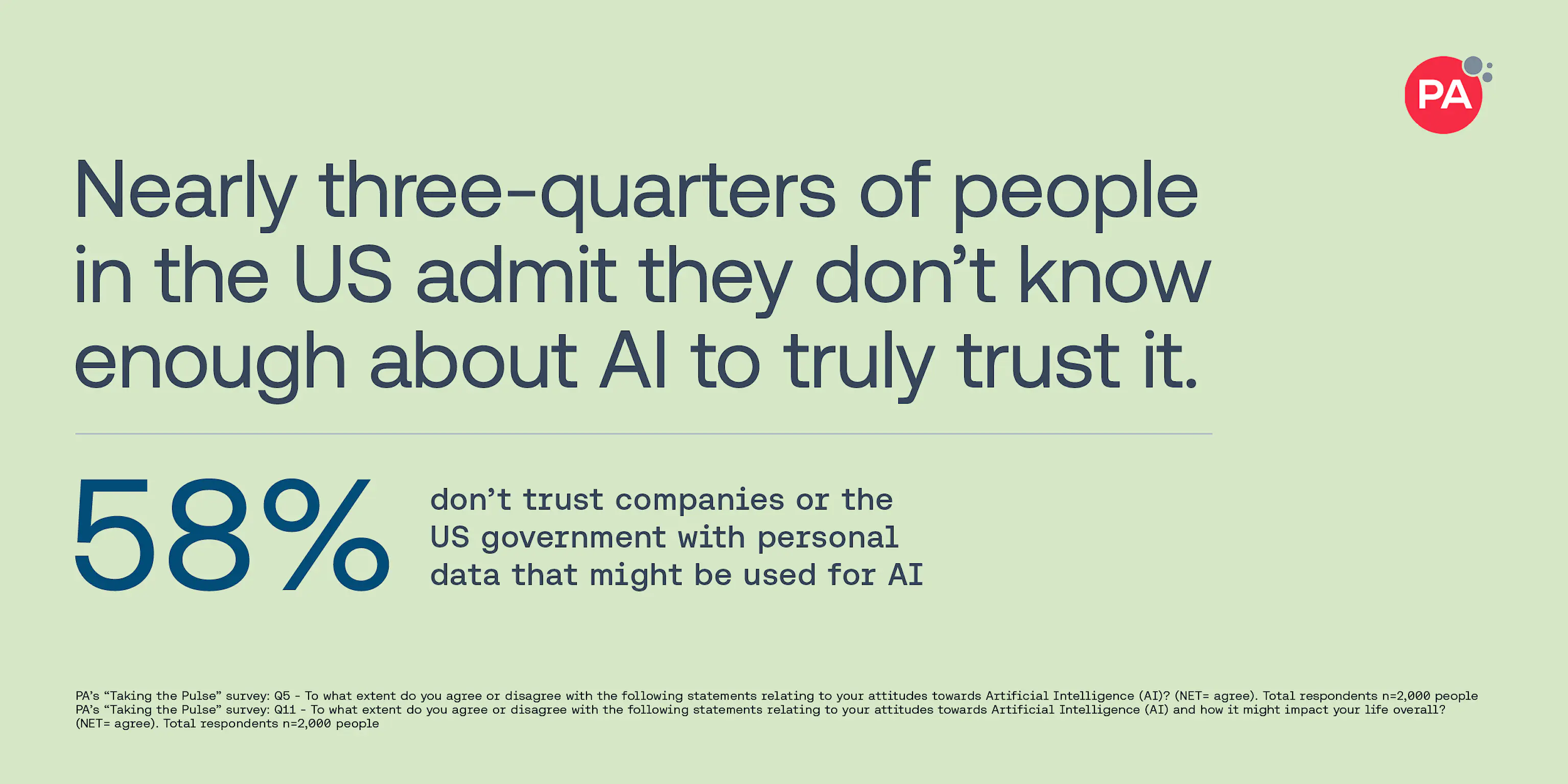

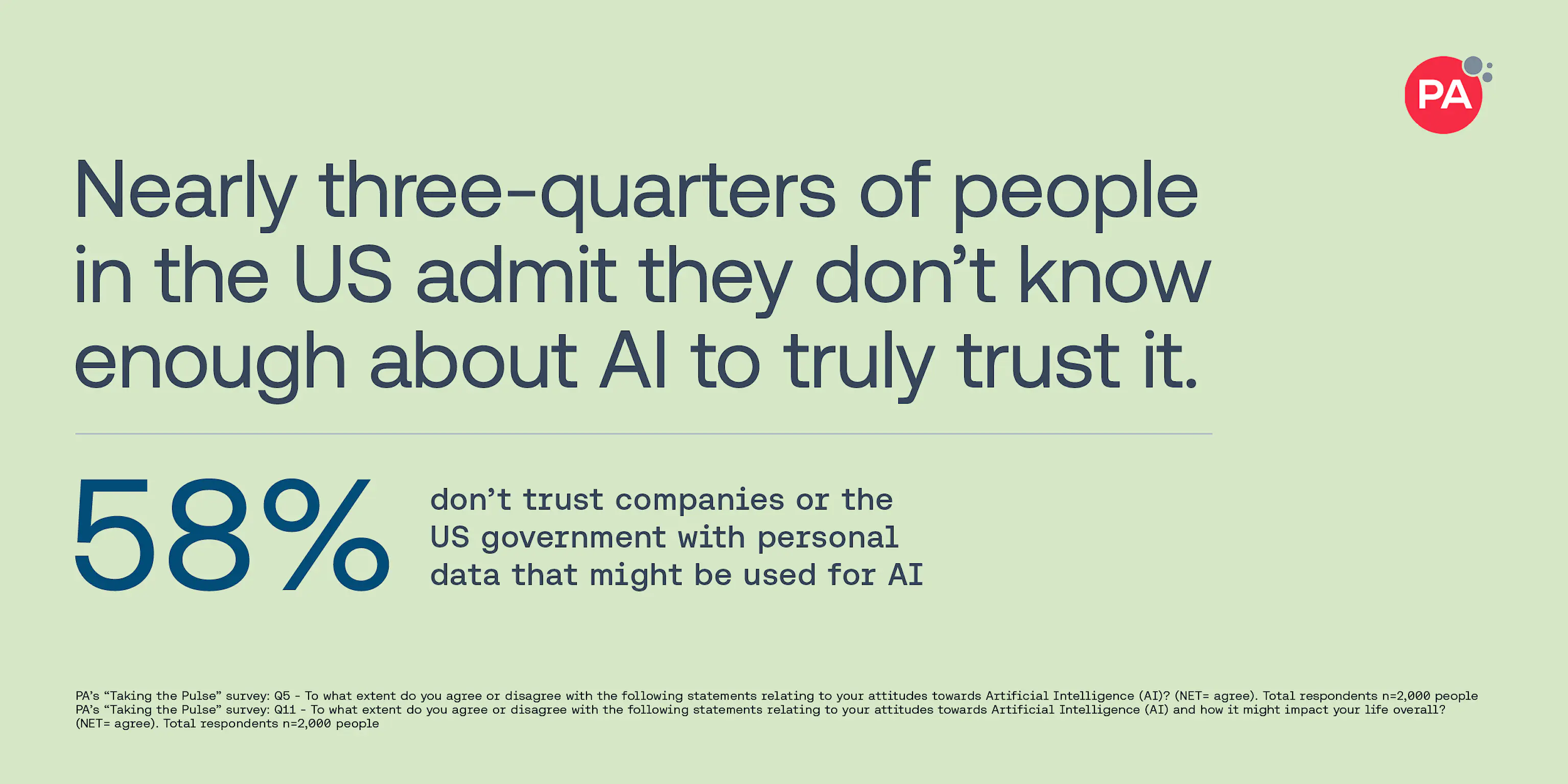

Data Privacy and Security Concerns

Google's AI initiatives rely heavily on vast amounts of user data. Concerns about data privacy and security are paramount, particularly given the increasing sophistication of cyberattacks. Data breaches or misuse of user data can severely damage Google's reputation and erode investor confidence.

- Discussion of Google's data usage policies: Transparency and clarity regarding data usage are crucial for maintaining user trust and investor confidence.

- Recent data breaches or controversies: Past instances of data breaches or controversies involving Google highlight the vulnerability of its data infrastructure and the potential impact on its reputation and investor sentiment.

- Impact on investor confidence: Concerns about data security can significantly affect investor perception of the long-term viability of Google's AI strategy.

Google's Long-Term AI Vision and Strategic Adaptability

The sustainability of Google's AI strategy depends heavily on its long-term vision, its ability to adapt to technological advancements, and its strategic choices regarding partnerships, acquisitions, and talent acquisition.

Adaptability to Technological Advancements

The AI landscape is evolving rapidly. Google's ability to adapt to emerging technologies, like quantum computing and neuromorphic computing, is critical to maintaining its competitive edge.

- Examples of Google's successful adaptation in the past: Google's history shows a capacity to adapt to new technologies, successfully transitioning from search to mobile, cloud computing, and other areas.

- Analysis of its preparedness for future disruptions: Assessing Google's investment in research and development, its open-source contributions, and its collaborations with research institutions provides insights into its preparedness.

- Discussion of potential vulnerabilities: Areas like slow adoption of specific open-source technologies or lack of investment in emerging fields could represent potential vulnerabilities.

Strategic Partnerships and Acquisitions

Strategic partnerships and acquisitions play a key role in accelerating innovation and expanding Google's AI capabilities.

- Examples of key partnerships and acquisitions: Google's past acquisitions of AI startups and its partnerships with research institutions demonstrate its strategic approach.

- Analysis of their success and impact on Google's AI strategy: Evaluating the success of these partnerships and acquisitions reveals insights into Google’s ability to leverage external expertise and technology.

Talent Acquisition and Retention

Attracting and retaining top AI talent is crucial in a highly competitive market. Google's ability to compete for the best minds will significantly influence the success of its AI strategy.

- Google's strategies for attracting talent: Google's reputation, compensation packages, and research opportunities are key factors in attracting top talent.

- Comparison to competitors’ strategies: Comparing Google's talent acquisition strategies with those of its competitors helps assess its competitive position.

- Analysis of employee retention rates: High employee retention rates signal a positive work environment and a strong commitment to fostering innovation.

Conclusion

The sustainability of Google's AI strategy is a complex issue with both promising and concerning aspects. While Google's financial resources and technological expertise offer significant advantages, concerns about profitability, ethical implications, intense competition, and data privacy need to be addressed proactively. Investor confidence hinges on Google's ability to navigate these challenges and demonstrate a clear, ethical, and financially viable path forward. Understanding the sustainability of Google's AI strategy is crucial for investors and the tech industry as a whole. Continue your research into the future of AI and Google's role within it.

Featured Posts

-

Plan The Perfect Screen Free Week For Your Family

May 22, 2025

Plan The Perfect Screen Free Week For Your Family

May 22, 2025 -

Shifting Priorities Re Evaluating Otter Management Practices In Wyoming

May 22, 2025

Shifting Priorities Re Evaluating Otter Management Practices In Wyoming

May 22, 2025 -

Nato I Ukraina Klyuchevye Momenty Peregovorov Po Chlenstvu

May 22, 2025

Nato I Ukraina Klyuchevye Momenty Peregovorov Po Chlenstvu

May 22, 2025 -

Us Export Controls A Failure Says Nvidias Jensen Huang Praising Trump

May 22, 2025

Us Export Controls A Failure Says Nvidias Jensen Huang Praising Trump

May 22, 2025 -

Economic Slowdown Prompts Sse To Reduce Spending By 3 Billion

May 22, 2025

Economic Slowdown Prompts Sse To Reduce Spending By 3 Billion

May 22, 2025

Latest Posts

-

Investment Insights Core Weave Inc Crwv And Its Recent Stock Gains

May 22, 2025

Investment Insights Core Weave Inc Crwv And Its Recent Stock Gains

May 22, 2025 -

Jim Cramer And Core Weave Crwv Analyzing The Cloud Computing Upstart

May 22, 2025

Jim Cramer And Core Weave Crwv Analyzing The Cloud Computing Upstart

May 22, 2025 -

Last Weeks Core Weave Crwv Stock Price Increase A Deep Dive

May 22, 2025

Last Weeks Core Weave Crwv Stock Price Increase A Deep Dive

May 22, 2025 -

Core Weave Crwv Stock Soars Analyzing The Recent Price Increase

May 22, 2025

Core Weave Crwv Stock Soars Analyzing The Recent Price Increase

May 22, 2025 -

Jim Cramers Take On Core Weave Crwv A Scrappy Companys Success

May 22, 2025

Jim Cramers Take On Core Weave Crwv A Scrappy Companys Success

May 22, 2025