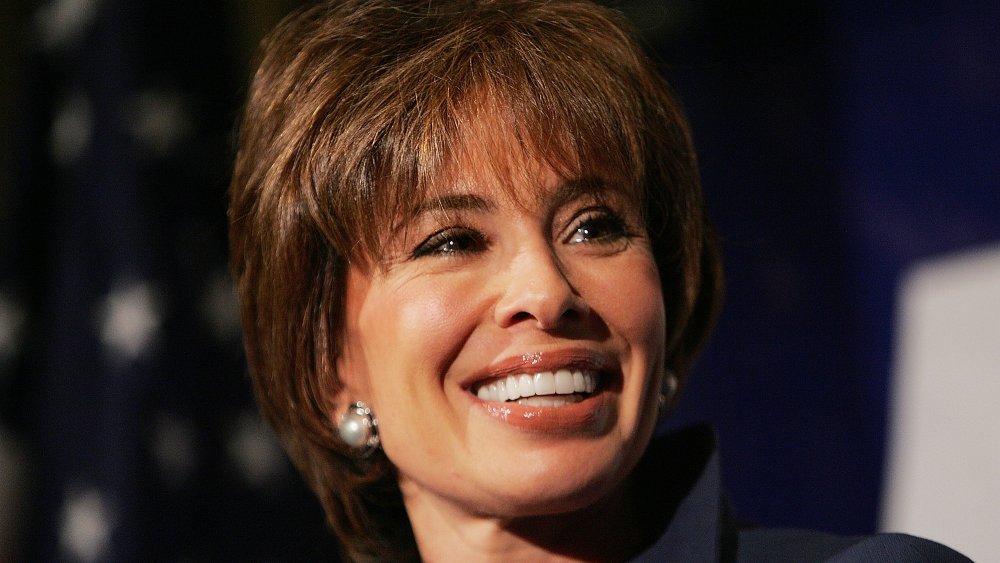

Is Jeanine Pirro Right? Should You Ignore The Stock Market Now?

Table of Contents

Jeanine Pirro's Stance on the Current Market

Jeanine Pirro, a prominent television personality, has recently voiced concerns about the current state of the stock market. While specific quotes and the exact context require verification through reputable news sources (and we encourage readers to seek those out), her general sentiment often reflects a cautious approach. Her reasoning often centers on concerns about inflation eroding purchasing power, the potential for a recession, and the impact of geopolitical events.

It's crucial to analyze Pirro's perspective critically. While she may offer valuable insights based on her observations, it's essential to remember that she is not a certified financial advisor. Her opinions should be considered alongside other expert analyses, and one must be mindful of potential biases or conflicts of interest.

- Specific quotes from Pirro (requires verification from reputable sources): [Insert verified quotes here, properly cited].

- Underlying concerns: High inflation, potential recession, geopolitical instability (e.g., the war in Ukraine), rising interest rates.

- Suggested alternatives (if any): [Insert any suggested alternatives mentioned by Pirro, again with proper sourcing].

Analyzing the Current Market Conditions

Understanding the current market conditions is paramount before making any investment decisions. Several key economic indicators paint a complex picture:

- Inflation: Current inflation rates are [Insert current inflation data and source]. High inflation erodes the value of savings and investments, making it a significant concern for investors.

- Interest Rates: The Federal Reserve's recent interest rate hikes [Insert data on interest rate changes and their impact on the market]. This affects borrowing costs for businesses and consumers, influencing overall economic activity.

- GDP Growth: Recent GDP growth figures are [Insert GDP growth data and source]. Slowing GDP growth can signal a potential recession.

- Unemployment: The unemployment rate currently stands at [Insert unemployment rate data and source]. Low unemployment usually signals a strong economy, but excessively low unemployment can contribute to inflationary pressures.

- Major Market Indices: The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite are all [Insert current performance data and source]. Analyzing the performance of these indices provides insight into the overall health of the market.

- Geopolitical Events: Geopolitical events, such as the war in Ukraine and rising tensions in other regions, inject uncertainty into the market and can lead to volatility.

Recent market trends indicate [summarize current market trends – bullish, bearish, sideways, etc., with supporting data]. This trend suggests [interpret the market trend and its potential implications].

The Case for Ignoring the Stock Market

Some argue that temporarily withdrawing from the stock market is a prudent strategy in times of high uncertainty. Preserving capital during periods of volatility is a key advantage of this approach.

- Risks associated with continued market participation: Potential for significant losses, increased market volatility.

- Advantages of a cautious approach: Preservation of capital, reduced risk of substantial losses.

- Alternative, lower-risk investments: High-yield savings accounts, government bonds, certificates of deposit (CDs).

The Case for Remaining in the Stock Market

Conversely, many seasoned investors advocate for remaining invested in the stock market, particularly for long-term goals. This strategy often relies on diversification and dollar-cost averaging to mitigate risk.

- Benefits of long-term investing: Historical data shows that the stock market has delivered positive returns over the long term, despite short-term fluctuations.

- Strategies to mitigate market risk: Diversification across different asset classes, dollar-cost averaging, rebalancing your portfolio.

- Historical data supporting long-term market growth: [Cite relevant historical data and sources illustrating long-term market growth].

Conclusion: Should You Ignore the Stock Market – A Balanced Perspective

The decision of whether or not to ignore the stock market is highly personal and depends on your individual risk tolerance, financial goals, and time horizon. While Jeanine Pirro's perspective offers valuable food for thought, it's crucial to conduct thorough research and consider the current economic landscape before making any investment decisions. The arguments for and against temporarily withdrawing from the stock market both hold merit, depending on your unique circumstances.

Before making any decisions about your investment strategy, carefully consider the current market conditions, Jeanine Pirro's perspective (and remember to verify the source and context of her statements), and your own financial goals. Consult a financial advisor to determine the best course of action for you regarding the stock market. Remember, this article provides information and analysis, but not financial advice. Seek professional guidance before making any investment decisions.

Featured Posts

-

Elizabeth Hurley Showcasing Her Cleavage Through The Years

May 09, 2025

Elizabeth Hurley Showcasing Her Cleavage Through The Years

May 09, 2025 -

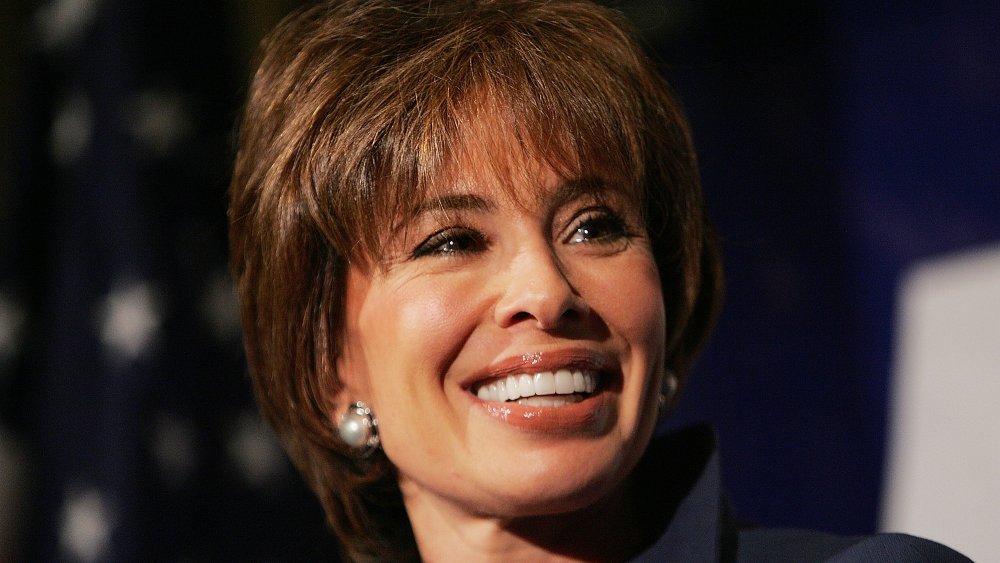

Harry Styles On Snl Impression A Disappointed Response

May 09, 2025

Harry Styles On Snl Impression A Disappointed Response

May 09, 2025 -

Asylum Seekers From Three Countries Face Increased Scrutiny In Uk

May 09, 2025

Asylum Seekers From Three Countries Face Increased Scrutiny In Uk

May 09, 2025 -

Return Of High Potential Season 2 Release Date And Episode Details

May 09, 2025

Return Of High Potential Season 2 Release Date And Episode Details

May 09, 2025 -

Ashhr Laeby Krt Alqdm Aldhyn Kanwa Mdkhnyn

May 09, 2025

Ashhr Laeby Krt Alqdm Aldhyn Kanwa Mdkhnyn

May 09, 2025

Latest Posts

-

The Power Of Middle Management Fostering Collaboration And Achieving Business Goals

May 10, 2025

The Power Of Middle Management Fostering Collaboration And Achieving Business Goals

May 10, 2025 -

Navigate The Private Credit Boom 5 Crucial Dos And Don Ts

May 10, 2025

Navigate The Private Credit Boom 5 Crucial Dos And Don Ts

May 10, 2025 -

Iron Ore Price Drop Chinas Steel Output Restrictions Explained

May 10, 2025

Iron Ore Price Drop Chinas Steel Output Restrictions Explained

May 10, 2025 -

Mapping The Countrys Emerging Business Hotspots

May 10, 2025

Mapping The Countrys Emerging Business Hotspots

May 10, 2025 -

La Fire Aftermath Price Gouging Concerns Raised By Selling Sunset Star

May 10, 2025

La Fire Aftermath Price Gouging Concerns Raised By Selling Sunset Star

May 10, 2025