Iron Ore Price Drop: China's Steel Output Restrictions Explained

Table of Contents

China's Steel Production Restrictions: The Core Cause

China's steel industry, the world's largest, is undergoing a dramatic transformation, directly impacting the iron ore price drop. This transformation is driven by several key factors:

Environmental Concerns and the "Dual Carbon" Goals

China's commitment to achieving its "dual carbon" goals – peaking carbon emissions before 2030 and achieving carbon neutrality before 2060 – is fundamentally reshaping its industrial landscape. This commitment translates into significant restrictions on energy-intensive industries, including steel production.

- Stricter emission standards: Implementation of stricter environmental regulations and penalties for exceeding emission limits.

- Energy consumption caps: Limitations on the amount of energy steel mills can consume, forcing them to operate at reduced capacity.

- Promotion of renewable energy: Government incentives for steel mills to transition to cleaner energy sources like wind and solar power.

- Carbon trading scheme: The establishment of a national carbon trading market puts a price on carbon emissions, further incentivizing emission reductions.

China aims to reduce its carbon intensity (CO2 emissions per unit of GDP) significantly. These ambitious targets necessitate a substantial reduction in steel production, a major source of carbon emissions.

Curbing Excess Capacity and Promoting Sustainable Development

Beyond environmental concerns, China is actively consolidating its steel industry. The government is aiming to eliminate outdated, inefficient, and polluting steel mills, leading to a reduction in overall steel production capacity.

- Mergers and acquisitions: Encouraging mergers and acquisitions among steel producers to create larger, more efficient entities.

- Plant closures: The shutdown of smaller, less efficient steel mills that fail to meet environmental and technological standards.

- Technological upgrades: Incentivizing the adoption of advanced technologies that improve energy efficiency and reduce emissions in remaining steel mills.

This consolidation, while beneficial for long-term sustainability, results in reduced steel output in the short term, impacting iron ore demand.

Real Estate Market Slowdown and Reduced Steel Demand

China's slowing real estate market plays a crucial role in the iron ore price drop. Construction, a major consumer of steel, has significantly slowed due to tighter government regulations on property development and a decrease in overall demand.

- Government regulations: Stricter rules on real estate financing and speculation have dampened construction activity.

- Reduced housing starts: Fewer new housing projects are being initiated, directly impacting steel demand.

- Debt concerns: Financial distress within some real estate developers has further reduced construction activity.

The interconnectedness between China's property sector and steel consumption is undeniable, and the slowdown contributes significantly to the decreased demand for iron ore.

Impact of Reduced Steel Production on Iron Ore Prices

The decreased steel production in China directly translates to lower demand for iron ore, the primary raw material used in steelmaking. This fundamental principle of supply and demand is at the heart of the current iron ore price drop.

Supply and Demand Dynamics

The reduced demand from China creates a surplus of iron ore in the global market. This surplus, coupled with relatively stable supply from major producers like Australia and Brazil, puts downward pressure on prices.

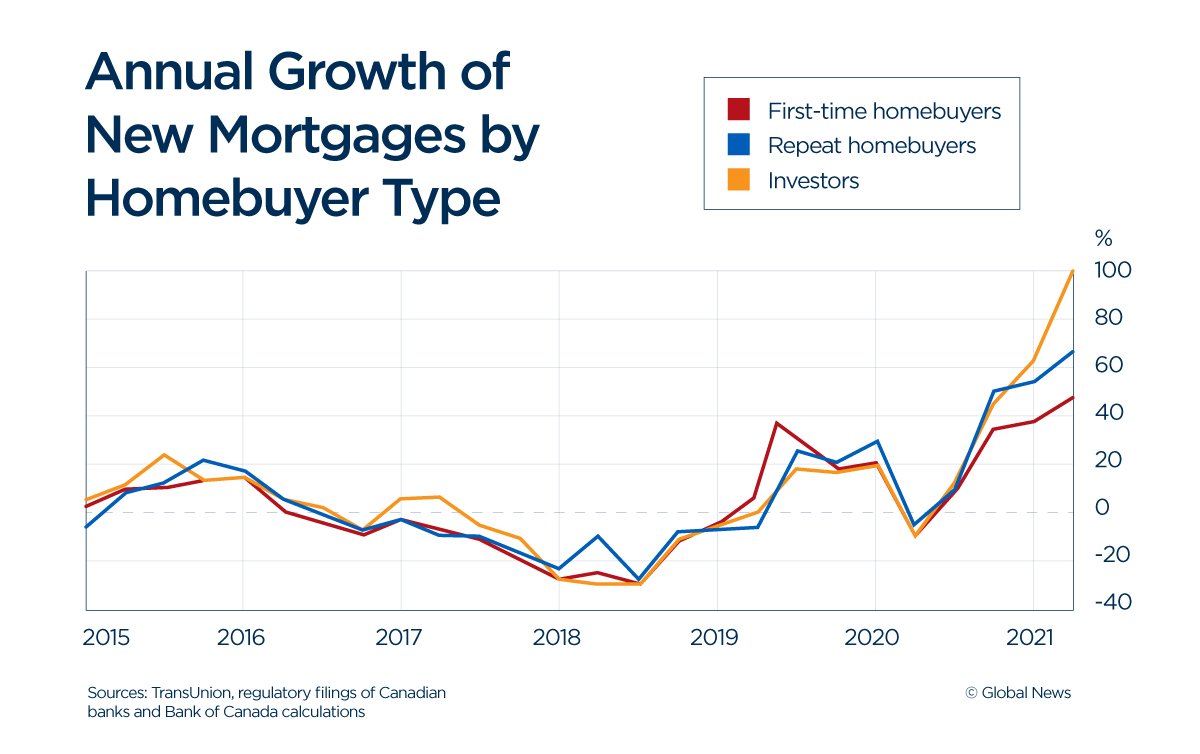

[Insert a chart or graph here visually representing the correlation between Chinese steel production and iron ore prices].

Global iron ore supply isn't solely dictated by Chinese demand, however. Geopolitical events, weather patterns, and mining production capacity all contribute to price fluctuations, but China's decreased demand is the most significant factor in the current price drop.

Impact on Iron Ore Producing Countries

The reduced demand for iron ore significantly impacts major producing countries like Australia and Brazil, which rely heavily on exports to China.

- Economic impact: Lower iron ore prices lead to reduced export revenue, affecting government budgets and related industries.

- Mining sector adjustments: Mining companies are forced to cut production, potentially leading to job losses and reduced investment.

- Government responses: Governments may implement support measures for affected industries or seek to diversify export markets.

Future Outlook for Iron Ore Prices

Predicting future iron ore prices is challenging. However, considering the ongoing factors, the near-term outlook suggests continued price volatility. While a significant price rebound isn't likely in the short term, a stabilization at lower levels might be possible. Unforeseen geopolitical events or a significant recovery in the Chinese real estate market could significantly alter this prediction.

Investing in the Changing Landscape of the Iron Ore Market

Navigating the current iron ore market requires careful consideration.

Strategies for Investors

Investors should adopt diversified investment strategies to mitigate risks associated with the fluctuating iron ore price. This could involve investing in a broader range of commodities or diversifying across different asset classes.

Disclaimer: This information is for general knowledge and should not be considered investment advice. Always consult a financial professional before making investment decisions.

Opportunities in Sustainable Steel Production

Despite the challenges, opportunities exist in the transition towards sustainable steel production. Investing in companies developing and implementing green steel technologies or those focused on reducing the carbon footprint of steelmaking could yield significant long-term returns.

Conclusion: Navigating the Iron Ore Price Drop

The iron ore price drop is primarily driven by China's stringent steel output restrictions, implemented in response to environmental concerns and a desire to restructure its steel industry. This has created a ripple effect throughout global markets, impacting iron ore producing nations and investors alike. Understanding the interplay between government policy, environmental sustainability, and market forces is crucial for navigating this complex situation. To stay ahead, keep abreast of iron ore market trends, iron ore price fluctuations, and adapt your iron ore investment strategies accordingly. Conduct thorough research and consult with financial professionals before making any investment decisions.

Featured Posts

-

Canadas Housing Market The Impact Of Steep Down Payments

May 10, 2025

Canadas Housing Market The Impact Of Steep Down Payments

May 10, 2025 -

Indian Insurers Seek Regulatory Easing For Bond Forward Trading

May 10, 2025

Indian Insurers Seek Regulatory Easing For Bond Forward Trading

May 10, 2025 -

Wave Of Car Break Ins Hits Elizabeth City Apartment Complexes

May 10, 2025

Wave Of Car Break Ins Hits Elizabeth City Apartment Complexes

May 10, 2025 -

Dogovor Frantsii I Polshi Makron I Tusk Dostigli Soglasheniya Unian

May 10, 2025

Dogovor Frantsii I Polshi Makron I Tusk Dostigli Soglasheniya Unian

May 10, 2025 -

Dakota Johnson Melanie Griffith And Siblings Attend Materialist Screening

May 10, 2025

Dakota Johnson Melanie Griffith And Siblings Attend Materialist Screening

May 10, 2025