Is Palantir Stock A Buy Before May 5th? Analyst Ratings And Future Outlook

Table of Contents

The question on many investors' minds is: should you buy Palantir stock before May 5th? This article delves into the current analyst ratings, recent performance, and future outlook for PLTR, providing insights to help you make an informed investment decision. We'll examine key factors influencing Palantir's stock price and explore the potential for growth leading up to May 5th and beyond. Understanding the current sentiment surrounding Palantir stock is crucial for navigating this potentially volatile investment.

Current Analyst Ratings and Price Targets for Palantir Stock

Determining whether Palantir stock is a buy requires examining the consensus view from financial analysts. While individual analyst opinions vary, understanding the overall sentiment provides valuable context. Several factors influence these ratings, including recent financial performance, future growth projections, and competitive landscape analysis.

-

Analyst Consensus: As of [Insert Date - ensure this is current], the consensus rating for Palantir stock (PLTR) among major analysts appears to be [Insert Consensus - e.g., a "Hold" or "Moderate Buy"]. This is a summary of various opinions and should not be taken as definitive investment advice.

-

Specific Analyst Ratings and Price Targets:

-

Morgan Stanley: [Insert Morgan Stanley's rating and price target, e.g., "Rates PLTR a Buy with a $10 price target."] [Include a brief summary of their reasoning.]

-

Goldman Sachs: [Insert Goldman Sachs' rating and price target, e.g., "Rates PLTR a Neutral with a $7 price target."] [Include a brief summary of their reasoning.]

-

JPMorgan Chase: [Insert JPMorgan Chase's rating and price target, e.g., "Rates PLTR an Overweight with a $9 price target."] [Include a brief summary of their reasoning.]

-

Other Key Analysts: [List other prominent analysts and their ratings, summarizing their reasoning briefly.] The range of price targets reflects the differing perspectives on Palantir's future growth trajectory.

-

-

Recent Rating Changes: [Discuss any significant recent upgrades or downgrades, highlighting the underlying reasons provided by the analysts. This might include new contract wins, concerns about profitability, or shifts in the competitive landscape.]

Recent Palantir Stock Performance and Key Financial Indicators

Analyzing Palantir's recent financial performance provides crucial insights into its current health and future potential. Key metrics illuminate the company's progress and overall trajectory.

-

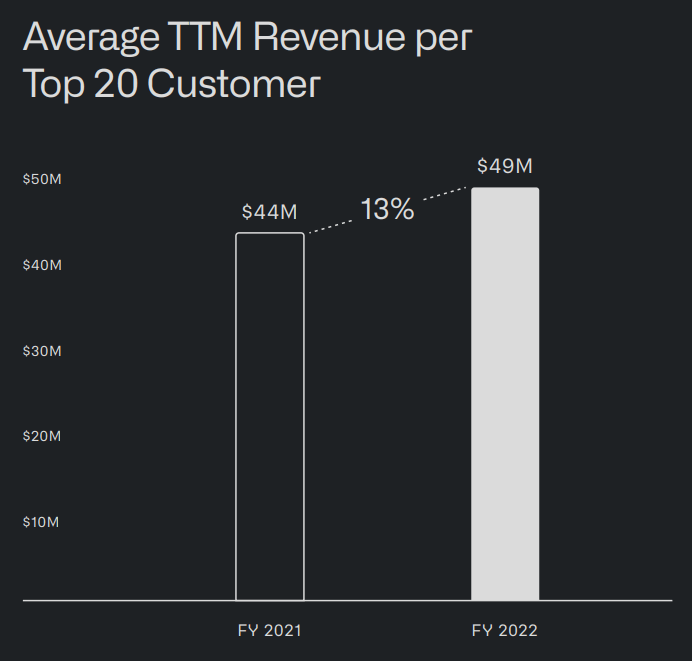

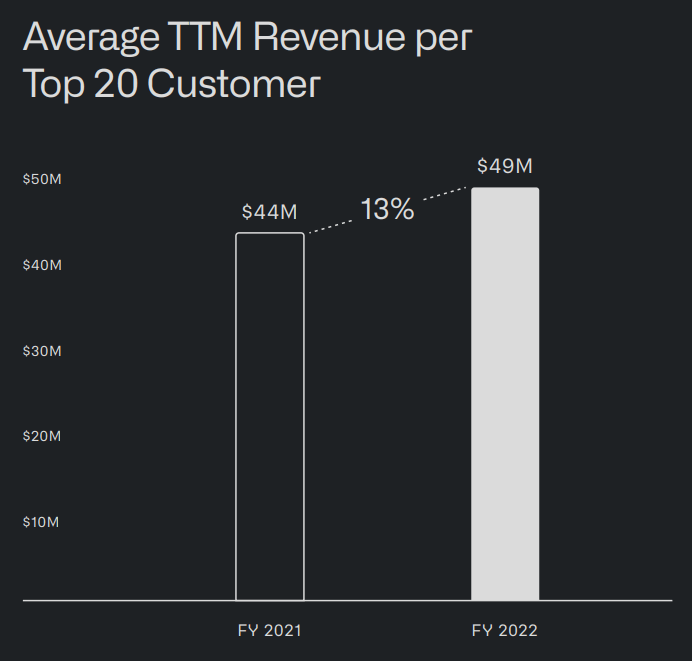

Revenue Growth: Palantir's revenue growth has shown [Insert description of recent revenue growth - e.g., "steady growth," "slowdown," or "acceleration"]. [Include specific figures for comparison. For example: "Q4 2023 revenue increased by X% compared to Q4 2022."]

-

Earnings Per Share (EPS): Palantir's EPS has [Insert description of recent EPS performance - e.g., "improved," "remained flat," or "declined"]. [Provide specific figures for comparison.]

-

Profit Margins: Palantir's profit margins have [Insert description of recent profit margin performance - e.g., "expanded," "contracted," or "remained stable"]. [Provide specific figures for comparison, explaining the underlying reasons.]

-

Stock Price Volatility: Palantir's stock price has demonstrated [Insert description of recent stock price volatility - e.g., "significant volatility," "relative stability," or "recent upward/downward trend"]. [Include specific data points, perhaps a chart, to illustrate this volatility.]

-

Comparison to Competitors: [Compare Palantir's performance to its key competitors in the data analytics and government services sectors, highlighting areas of strength and weakness.]

Factors Influencing Palantir's Future Outlook

Several factors significantly impact Palantir's future growth and stock performance. Understanding these factors is crucial for assessing the investment's potential.

Government Contracts and Growth

Government contracts are a significant revenue stream for Palantir. Future contract wins or losses will substantially influence the company's financial outlook. [Discuss recent contract wins or losses and their potential impact on revenue and future growth. Mention any potential upcoming contract bids.]

Commercial Market Expansion

Palantir's success in expanding its commercial customer base is critical for long-term growth. [Analyze their progress in this area, highlighting key wins and challenges. Discuss the potential for increased revenue from this sector.]

Competition and Market Dynamics

The data analytics market is highly competitive. Palantir faces competition from established players and emerging startups. [Analyze Palantir's competitive positioning, highlighting its strengths and weaknesses compared to its competitors. Discuss potential disruptive technologies and their impact.]

Technological Innovation and R&D

Palantir's investment in research and development is essential for maintaining its competitive edge. [Analyze their R&D spending and discuss potential new product offerings or technological advancements that could drive future growth.]

Risks and Potential Downsides of Investing in Palantir Stock

Investing in Palantir stock carries inherent risks. A thorough understanding of these potential downsides is crucial for informed decision-making.

-

Stock Price Volatility: Palantir's stock price is known for its volatility, meaning it can experience significant price swings in relatively short periods. This volatility makes it a higher-risk investment.

-

Regulatory and Legal Challenges: Palantir operates in a heavily regulated environment, and any significant regulatory changes or legal challenges could negatively impact its business.

-

Dependence on Government Contracts: A substantial portion of Palantir's revenue comes from government contracts. Any decrease in government spending or a loss of major contracts could significantly impact the company's financials.

-

Debt Levels and Financial Health: [Analyze Palantir's debt levels and overall financial health. High debt levels can increase financial risk.]

Conclusion

Determining whether Palantir stock is a buy before May 5th requires a careful assessment of analyst ratings, recent performance, and future growth potential. While some analysts hold a positive outlook, with price targets indicating potential upside, others maintain a more cautious stance due to factors such as stock volatility and dependence on government contracts. The consensus appears to be [reiterate the consensus rating]. However, the potential for growth in the commercial sector and Palantir's ongoing technological innovation offer counterbalancing factors.

While the outlook for Palantir stock is promising, remember to conduct your own due diligence before making any investment decisions related to Palantir stock. Consider your personal risk tolerance and investment goals before investing in this potentially volatile stock. Learn more about Palantir's investment potential and consult with a financial advisor to make an informed decision.

Featured Posts

-

Oilers Vs Kings Series Betting Odds And Predictions

May 10, 2025

Oilers Vs Kings Series Betting Odds And Predictions

May 10, 2025 -

Trumps 10 Tariff Threat Baseline Unless Exceptional Offer Received

May 10, 2025

Trumps 10 Tariff Threat Baseline Unless Exceptional Offer Received

May 10, 2025 -

Britannian Kruununperimysjaerjestys Taessae On Paeivitetty Lista

May 10, 2025

Britannian Kruununperimysjaerjestys Taessae On Paeivitetty Lista

May 10, 2025 -

Hl Altdkhyn Athr Ela Msyrt Hwlae Alnjwm Alkrwyyn

May 10, 2025

Hl Altdkhyn Athr Ela Msyrt Hwlae Alnjwm Alkrwyyn

May 10, 2025 -

Vegas Golden Nayts Pobeda Nad Minnesotoy V Overtayme Pley Off

May 10, 2025

Vegas Golden Nayts Pobeda Nad Minnesotoy V Overtayme Pley Off

May 10, 2025