Is Palantir Stock A Buy Right Now? A Comprehensive Analysis

Table of Contents

Palantir's Business Model and Recent Performance

Palantir operates primarily through two platforms: Gotham, catering to government clients, and Foundry, serving commercial clients. These platforms leverage big data analytics to provide actionable intelligence and operational efficiency. Understanding Palantir's recent performance is crucial to assessing its current investment potential.

Recent financial performance has shown a mixed bag. While Palantir has demonstrated impressive revenue growth, consistently exceeding expectations in some quarters, profitability remains elusive. This is largely due to significant investments in research and development, sales, and marketing to fuel future growth.

Analyzing recent earnings reports and press releases reveals a complex picture. While revenue growth has been positive year-over-year, profit margins remain thin. This needs to be considered in any valuation analysis.

- Revenue growth in the last quarter/year: (Insert actual data from recent financial reports, e.g., "X% year-over-year growth in Q[quarter] 2024").

- Profitability (or lack thereof) and projected profitability: (Insert data on net income, operating margin, and any projections from management or analysts).

- Key customer wins and contract values: (Mention significant contract wins and their estimated values, highlighting the importance of government and commercial partnerships).

- Stock price performance in the recent past: (Discuss recent stock price fluctuations and their relation to market sentiment and financial announcements).

Market Position and Competition

Palantir operates in a fiercely competitive big data analytics market. Key competitors include established players like Microsoft, Amazon Web Services (AWS), and Google Cloud, as well as smaller, more specialized firms. Palantir’s competitive advantage lies in its specialized software designed for complex data analysis, particularly in the government and intelligence sectors. However, the high valuation of PLTR stock represents a significant hurdle for potential investors.

- Key competitive advantages: Palantir boasts a strong reputation for data security, particularly within government circles, and possesses a highly sophisticated platform that some consider superior in terms of data integration and analysis.

- Competitive disadvantages: Palantir faces intense competition from larger, more diversified tech giants with broader product portfolios. Its high valuation relative to earnings also poses a significant risk.

- Market growth projections and Palantir’s potential market share: The big data analytics market is projected to experience substantial growth in the coming years. Palantir's ability to capture a significant market share will depend on its continued innovation, successful expansion into new sectors, and effective competition against industry giants.

Financial Health and Valuation

A thorough assessment of Palantir's financial health is critical for determining its investment viability. Analyzing its balance sheet, income statement, and cash flow statement reveals a company with substantial cash reserves but also significant operating losses. Its debt levels are relatively low, suggesting a degree of financial stability. However, investors must carefully consider Palantir's valuation metrics.

- Debt-to-equity ratio: (Insert data and compare it to industry averages).

- Cash flow from operations: (Insert data and comment on its trend).

- Key valuation ratios and comparison to peers: (Analyze P/E ratio, price-to-sales ratio, etc., and compare them to competitors).

- Potential risks: Palantir's heavy reliance on government contracts and the inherent risks associated with that sector present significant financial risks.

Future Growth Potential and Risks

Palantir's future growth hinges on its ability to successfully expand into new markets and develop innovative products. The company has outlined plans to expand its commercial client base, particularly in the healthcare and financial services sectors. However, significant risks remain.

- New market expansion plans: Analyze Palantir’s stated plans for market expansion and assess their feasibility.

- New product development initiatives: Examine any new product development announcements and evaluate their potential impact on revenue and market share.

- Potential risks and mitigation strategies: Discuss geopolitical risks (e.g., changes in government spending), technological disruptions, and competitive pressures. Analyze Palantir's strategies to mitigate these risks.

- Analyst forecasts and price targets: Include forecasts from reputable financial analysts and their price targets for PLTR stock.

Conclusion

Palantir Technologies presents a compelling investment proposition due to its innovative technology and strong foothold in the government sector. However, significant risks associated with its high valuation, reliance on government contracts, and intense competition must be acknowledged. The company's path to profitability remains uncertain, and its high valuation may make it vulnerable to market corrections.

Based on this analysis, whether Palantir stock is a buy right now is a complex question without a simple yes or no answer. It depends heavily on individual risk tolerance and investment timeframe. While the long-term potential is intriguing, the near-term prospects are less certain.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Investing in the stock market involves significant risk, and you could lose money.

Call to action: Conduct your own due diligence before deciding whether Palantir stock is a buy right now. Thoroughly research the company's financials, competitive landscape, and future prospects before making any investment decisions. Remember to diversify your portfolio and consider your personal risk tolerance.

Featured Posts

-

Elon Musk Wealth Increase Billions Added After Tesla Rally And Dogecoin Step Back

May 10, 2025

Elon Musk Wealth Increase Billions Added After Tesla Rally And Dogecoin Step Back

May 10, 2025 -

Vegas Golden Nayts Pobeda Nad Minnesotoy V Overtayme Pley Off

May 10, 2025

Vegas Golden Nayts Pobeda Nad Minnesotoy V Overtayme Pley Off

May 10, 2025 -

Top 10 Must See Film Noir Movies

May 10, 2025

Top 10 Must See Film Noir Movies

May 10, 2025 -

500 Point Sensex Gain Detailed Market Analysis And Top Performers

May 10, 2025

500 Point Sensex Gain Detailed Market Analysis And Top Performers

May 10, 2025 -

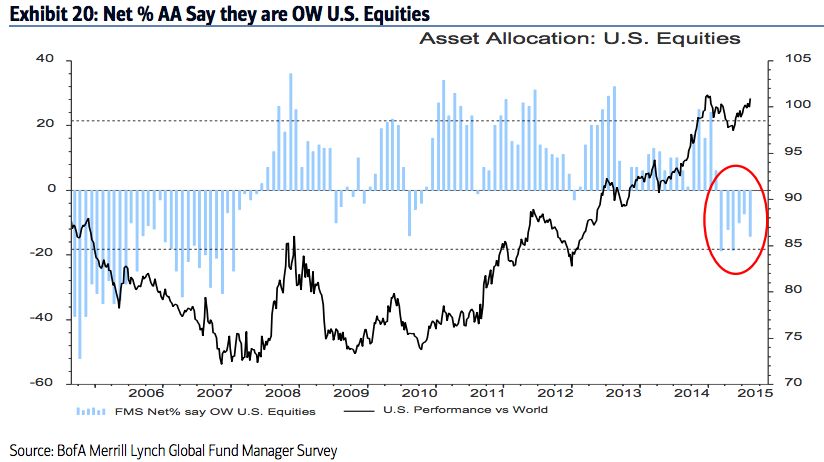

Wall Streets Comeback Implications For Bearish Investors

May 10, 2025

Wall Streets Comeback Implications For Bearish Investors

May 10, 2025