Is Palantir's 30% Drop A Good Time To Invest?

Table of Contents

Analyzing the 30% Drop: Understanding the Causes

The recent 30% drop in Palantir stock price is a complex issue with several contributing factors. Understanding these causes is crucial before considering a Palantir investment.

Market Sentiment and Macroeconomic Factors

The broader market environment significantly impacts Palantir's performance. Several macroeconomic factors have contributed to the recent downturn:

- Impact of rising interest rates on tech stocks: Rising interest rates generally lead to decreased valuations for growth stocks like Palantir, as investors seek higher returns in safer, fixed-income investments. This has created a headwind for many tech companies, including PLTR.

- General market volatility and investor risk aversion: Increased global uncertainty and volatility often lead investors to move towards less risky assets, impacting the price of even fundamentally strong companies like Palantir.

- Comparison to other tech company performance: The underperformance of Palantir stock needs to be considered relative to other tech companies. Is the drop unique to Palantir, or is it part of a broader sector-wide correction? Analyzing the performance of similar companies provides valuable context.

Palantir's Recent Financial Performance

Analyzing Palantir's recent earnings reports is essential to understanding the drop.

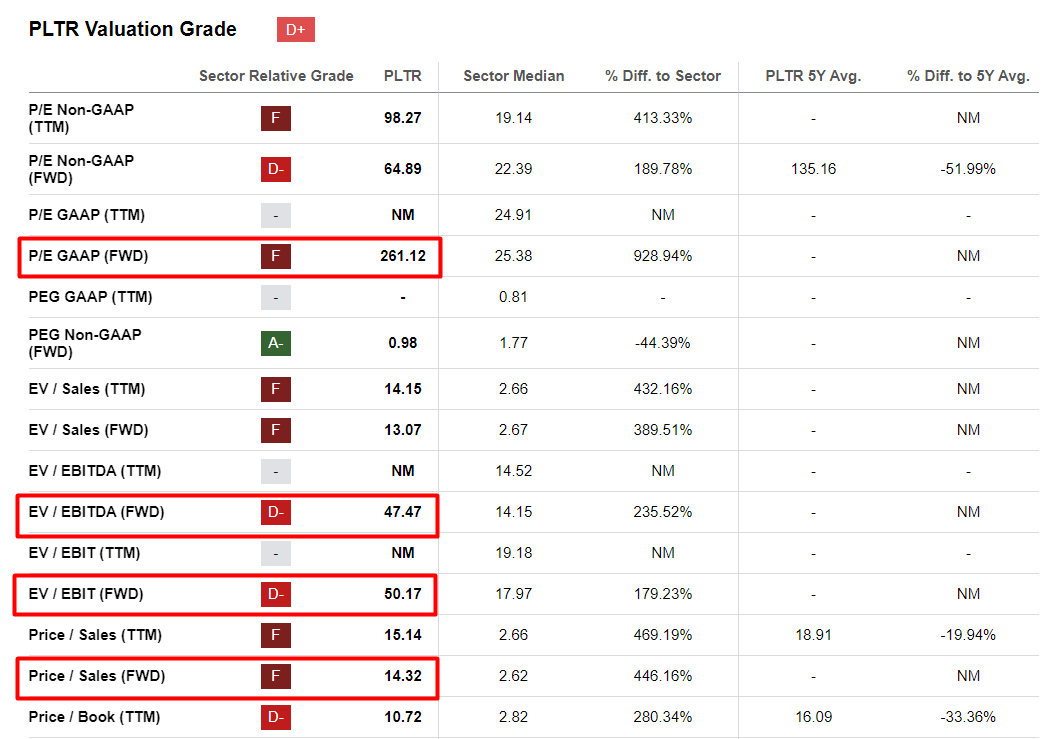

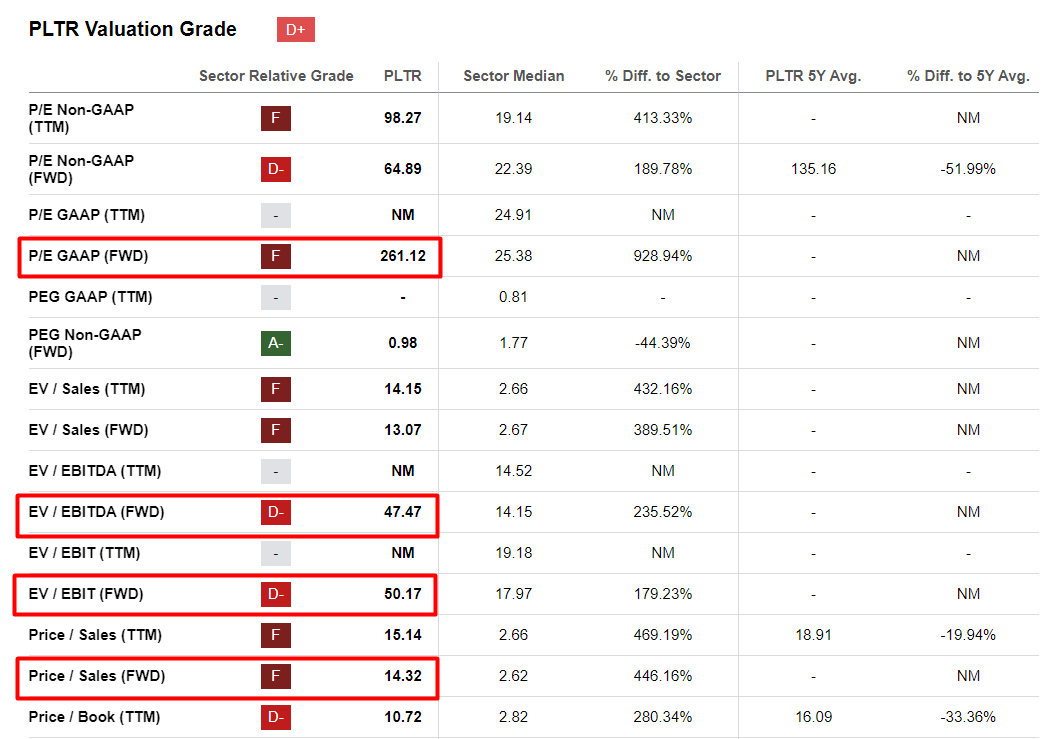

- Examination of key financial metrics (revenue, net income, etc.): Investors scrutinize revenue growth, net income margins, and cash flow to gauge the company's financial health. A closer look at these metrics can reveal whether the recent stock price drop is justified by the company's underlying performance.

- Analysis of the company's growth trajectory: Is Palantir's growth slowing down? Examining the historical growth rates and comparing them to future projections helps determine if the current valuation reflects the company's potential for future growth.

- Comparison to analyst expectations: Did Palantir's recent financial performance meet or exceed analyst expectations? A significant miss could contribute to the stock price decline.

Competition and Market Share

Palantir operates in a competitive data analytics market. Understanding its competitive positioning is crucial for any Palantir investment strategy.

- Discussion of key competitors and their strategies: Companies like AWS, Microsoft, and Google Cloud also offer data analytics solutions, posing significant competition to Palantir. Examining their strategies and market share is vital.

- Assessment of Palantir's competitive advantages: What makes Palantir unique and better positioned for success? Its focus on government contracts and specialized data solutions provides some differentiation.

- Analysis of the overall market growth potential: Is the market for data analytics expanding rapidly, providing opportunities for growth, or is it becoming saturated? This affects the potential for future revenue and profitability for Palantir.

Evaluating Palantir's Long-Term Potential

Despite the recent drop, Palantir possesses several factors suggesting long-term potential.

Government Contracts and Future Growth

Palantir has a significant presence in the government contracting sector.

- Analysis of the government contracting landscape: The stability and size of the government contracting market offers a steady revenue stream for Palantir. However, dependence on this sector also presents risk.

- Discussion of Palantir's pipeline of future contracts: A strong pipeline of future contracts indicates future revenue streams and reduces risk. Examining this pipeline is key.

- Assessment of the long-term growth potential in government services: The long-term growth potential of this sector influences Palantir's overall future.

Expansion into the Commercial Sector

Palantir is actively expanding into the commercial sector.

- Discussion of key commercial clients and partnerships: Successful partnerships and high-profile clients demonstrate the appeal of Palantir's solutions.

- Analysis of the growth potential in the commercial sector: The commercial sector typically offers faster growth than the government sector, potentially boosting Palantir's revenue.

- Assessment of competitive challenges in the commercial market: Competition is intense, so analyzing Palantir's ability to compete effectively is crucial.

Innovation and Technological Advancements

Palantir's ability to innovate is vital for its long-term success.

- Discussion of Palantir's R&D spending and new product development: Significant R&D investment shows a commitment to innovation and future growth.

- Analysis of Palantir's technological advantages: Palantir's unique technologies and data analysis capabilities provide a competitive advantage.

- Assessment of the potential for future technological breakthroughs: The potential for groundbreaking innovations will significantly impact Palantir's future.

Risk Assessment and Investment Considerations

Investing in Palantir involves inherent risks.

Potential Risks and Challenges

Several factors pose potential risks:

- Stock market volatility: The overall stock market's volatility can impact Palantir's price, regardless of its fundamental performance.

- Dependence on government contracts: Over-reliance on government contracts creates vulnerability to changes in government policy or budget cuts.

- Competition from other data analytics companies: The intense competition in the data analytics market poses a constant threat.

Diversification and Investment Strategy

Investing in Palantir requires a considered approach:

- Importance of diversification: Diversification across different asset classes is crucial to mitigate risk. Palantir should be part of a broader investment strategy, not the sole investment.

- Risk tolerance assessment: Investors must assess their own risk tolerance before investing in a volatile stock like Palantir.

- Long-term versus short-term investment strategies: Palantir is more suitable for long-term investors with a higher risk tolerance, as short-term price fluctuations can be significant.

Conclusion

Palantir's 30% stock price drop presents a complex investment scenario. While the drop is partly attributable to broader market conditions and the company's performance relative to analyst expectations, Palantir's long-term potential in both the government and commercial sectors remains significant. However, investors must carefully consider the inherent risks, including market volatility and competition. Before investing in Palantir stock, conduct thorough due diligence, assess your risk tolerance, and consider your overall investment goals. A balanced, diversified portfolio is crucial. Remember to consult with a financial advisor before making any investment decisions related to Palantir stock analysis or investing in Palantir.

Featured Posts

-

Senator Warner On Trumps Unwavering Stance On Tariffs

May 10, 2025

Senator Warner On Trumps Unwavering Stance On Tariffs

May 10, 2025 -

Changes To Uk Visa Applications Impact Assessment By Nationality

May 10, 2025

Changes To Uk Visa Applications Impact Assessment By Nationality

May 10, 2025 -

Investigating Us Funding For Transgender Animal Research Studies

May 10, 2025

Investigating Us Funding For Transgender Animal Research Studies

May 10, 2025 -

Cheap Elizabeth Arden Skincare Smart Shopping Guide

May 10, 2025

Cheap Elizabeth Arden Skincare Smart Shopping Guide

May 10, 2025 -

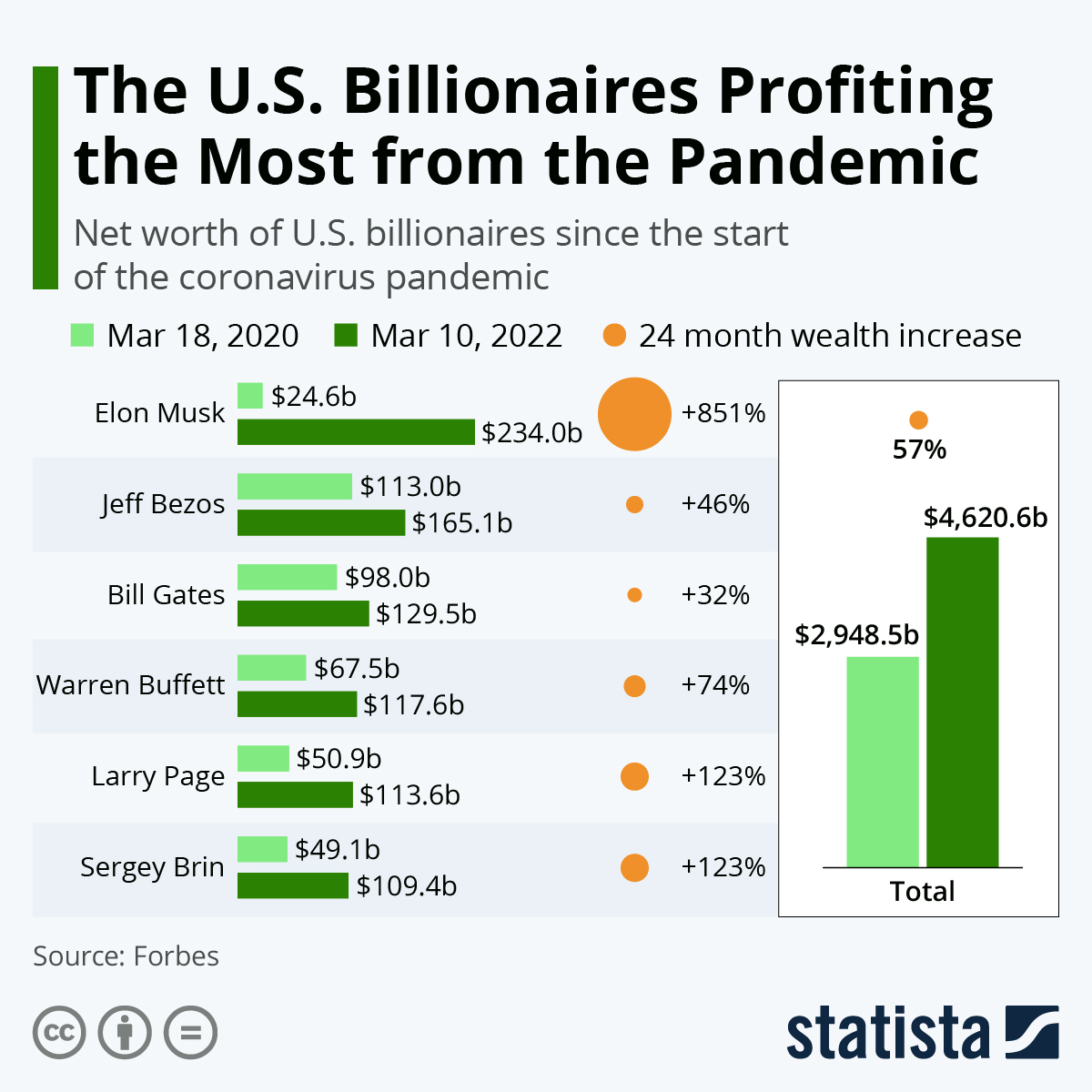

Post Trump Inauguration Analyzing The Net Worth Changes Of Tech Billionaires

May 10, 2025

Post Trump Inauguration Analyzing The Net Worth Changes Of Tech Billionaires

May 10, 2025