Is This AI Quantum Computing Stock A Buy On The Dip? One Key Factor To Consider

Table of Contents

Understanding the Current Market Dip in AI Quantum Computing Stocks

The recent dip in AI quantum computing stocks is a multifaceted issue. Several factors contribute to this market correction. Firstly, broader market trends play a significant role. The overall economic climate, interest rate hikes, and inflation concerns often impact high-growth sectors like AI and quantum computing, which are often viewed as riskier investments during periods of economic uncertainty. Secondly, investor sentiment significantly influences stock prices. Periods of uncertainty can lead to investors shifting towards safer, more established investments, causing a sell-off in speculative sectors. Finally, regulatory concerns regarding data privacy, antitrust issues, and the ethical implications of AI are also contributing to the market's cautious approach.

- Specific examples of recent market fluctuations: The Nasdaq Composite, which houses many tech stocks, including AI and quantum computing companies, experienced a notable dip in [Insert Date and Percentage].

- Relevant economic factors: Rising interest rates and inflation are key factors affecting investor confidence and willingness to invest in higher-risk, longer-term investments like quantum computing stocks.

- Credible sources: [Link to a reputable financial news source discussing market trends]

Evaluating the Specific AI Quantum Computing Stock: IonQ Inc. (IONQ)

IonQ Inc. (IONQ) is a prominent player in the burgeoning field of quantum computing, specializing in trapped-ion technology. The company is focused on building commercially viable quantum computers and providing cloud access to its systems. While IonQ, like many other quantum computing companies, has experienced a decline in its stock price recently, its long-term potential remains a point of discussion among investors.

- Key financial metrics: While IonQ is still in its early stages of commercialization, analyzing its revenue growth, research and development spending, and overall operating expenses is crucial for understanding its financial health. [Insert relevant financial data with source links].

- Recent announcements and partnerships: IonQ has actively pursued strategic partnerships and collaborations to expand its market reach and accelerate its technology development. Tracking these announcements offers valuable insight into the company's progress. [Mention specific partnerships and collaborations].

- Market capitalization and stock valuation: IonQ's market capitalization and stock valuation should be evaluated in relation to its potential future growth and compared with other players in the quantum computing market. [Include current market cap and P/E ratio if available].

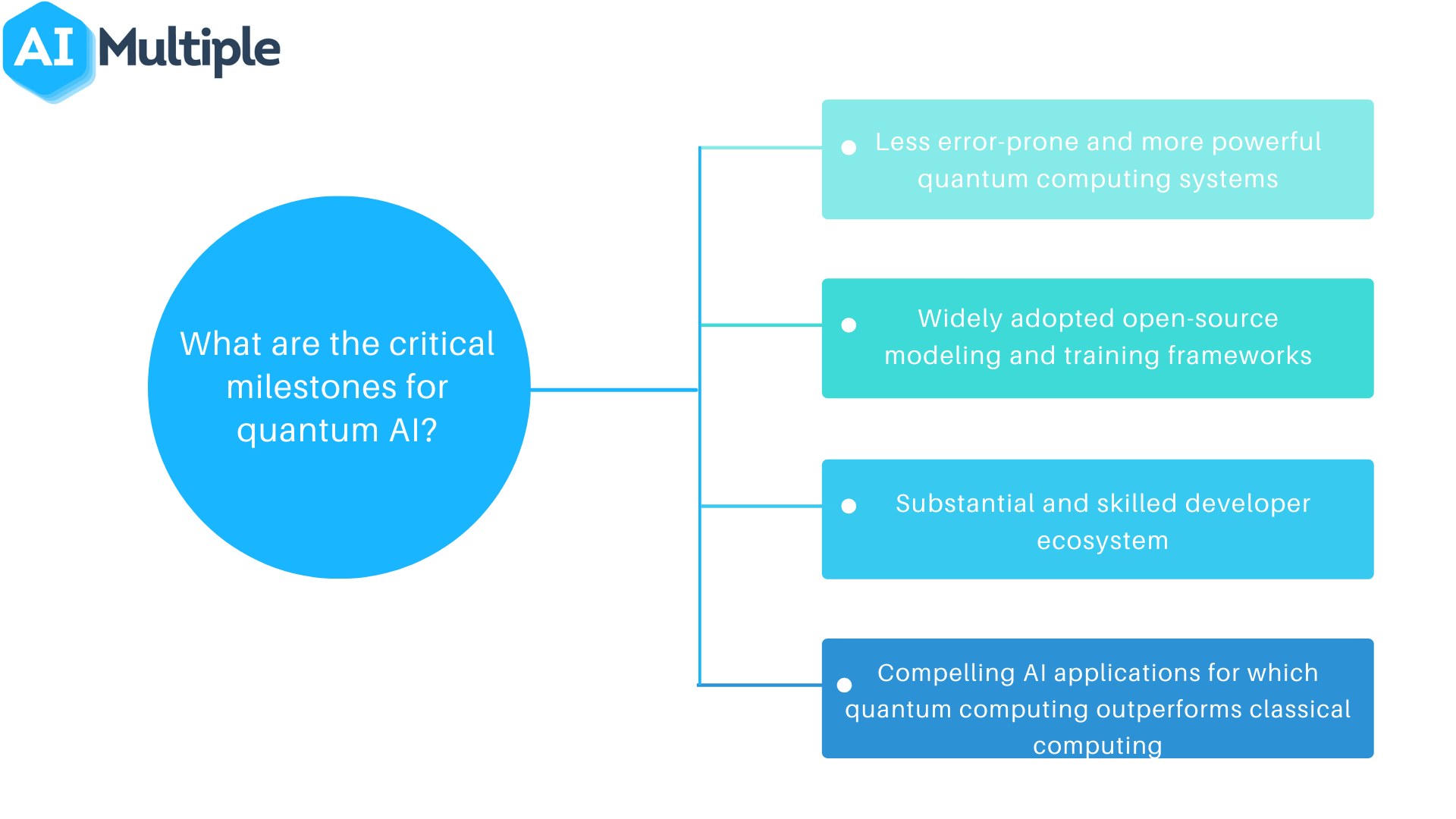

The Key Factor: Technological Advancement and Market Disruption Potential

IonQ's core strength lies in its trapped-ion quantum computing technology. This technology offers several potential advantages over other approaches, such as superconducting qubits, including higher qubit coherence times and potentially lower error rates. The company's continuous advancements in qubit control and scalability are key to its future success. IonQ’s potential to disrupt various industries—from drug discovery and materials science to financial modeling and artificial intelligence—is significant.

- Patents held and research progress: IonQ holds several key patents related to its trapped-ion technology and consistently publishes research findings in leading scientific journals. [Cite relevant patents and publications].

- Competitive advantages and unique selling propositions: IonQ's focus on trapped-ion technology differentiates it from competitors employing other qubit technologies. This creates a unique selling proposition. [Elaborate on specific advantages and unique aspects of their technology].

- Potential applications and market size: The potential applications of quantum computing are vast, and IonQ is actively pursuing opportunities in multiple sectors. The potential market size for these applications is substantial, offering significant growth prospects. [Discuss specific applications and market size estimations from reputable sources].

- Expert opinions and industry analysis: Several industry experts and analysts have commented positively on IonQ's technology and potential. [Include quotes or summaries of expert opinions and industry reports].

Risk Assessment and Due Diligence

Investing in IonQ, or any AI quantum computing stock, carries inherent risks. Technological hurdles, intense competition, and regulatory uncertainty are significant factors to consider. The field is still nascent, and the path to widespread commercialization is not without challenges.

- Specific examples of potential risks: Technological setbacks, slower-than-expected adoption rates, and the emergence of superior competing technologies all pose risks. [Elaborate on specific potential challenges and risks].

- Strategies for mitigating these risks: Diversification of investment portfolio and thorough due diligence can mitigate risk. [Suggest diversification and detailed research strategies].

- Recommendations for due diligence research: Investors should review IonQ's financial reports, press releases, analyst reports, and industry news to make an informed decision. [Provide links or examples of resources for research].

Conclusion: Is This AI Quantum Computing Stock a Buy on the Dip? A Final Verdict

Our analysis of IonQ (IONQ) suggests that its strong technological foundation and potential for market disruption make it an intriguing investment opportunity. While the current market dip presents a potential buying opportunity, the risks associated with investing in a relatively young company in a nascent technology sector should not be underestimated. While the market downturn presents a potential entry point, thorough due diligence is paramount.

While this analysis suggests a cautious "hold" or "buy on the dip" strategy depending on your risk tolerance, remember to always conduct thorough due diligence before investing in any AI quantum computing stock. Consider your own risk tolerance and investment goals before making a decision. Understanding the unique challenges and potential rewards associated with this sector is crucial for successful investment in AI quantum computing stocks.

Featured Posts

-

Explaining The Recent Significant Increase In D Wave Quantum Qbts Stock Value

May 20, 2025

Explaining The Recent Significant Increase In D Wave Quantum Qbts Stock Value

May 20, 2025 -

Diplomatie Ivoiro Ghaneenne Le President Mahama En Visite Officielle A Abidjan

May 20, 2025

Diplomatie Ivoiro Ghaneenne Le President Mahama En Visite Officielle A Abidjan

May 20, 2025 -

Where To Invest Mapping The Countrys Best Business Opportunities

May 20, 2025

Where To Invest Mapping The Countrys Best Business Opportunities

May 20, 2025 -

Chinas Fury Examining The New Us Missile Launcher Deployment

May 20, 2025

Chinas Fury Examining The New Us Missile Launcher Deployment

May 20, 2025 -

Critics Weigh In A Frank Assessment Of Jennifer Lawrences Latest Movie

May 20, 2025

Critics Weigh In A Frank Assessment Of Jennifer Lawrences Latest Movie

May 20, 2025