Is This Investment Really A Safe Bet? A Practical Guide

Table of Contents

Understanding Your Risk Tolerance

Before evaluating any investment, you must understand your personal risk tolerance. This is crucial for determining whether a potential investment aligns with your investment goals and overall financial planning. Are you a conservative investor prioritizing capital preservation and seeking low-risk investment options, or are you more comfortable with higher-risk investments for potentially higher returns? Accurately assessing your risk tolerance is the first step toward making a safe bet with your money.

-

Define your investment timeline: Are you investing for the short-term (less than 5 years), medium-term (5-10 years), or long-term (10+ years)? Your timeline significantly impacts your risk tolerance. Short-term investments generally require lower-risk strategies.

-

Assess your emotional response to potential losses: How would you feel if your investment lost a significant portion of its value? Honest self-assessment is key. If the thought of losses causes significant anxiety, a conservative investment strategy is likely best.

-

Consider your overall financial situation and debt levels: Your current financial health plays a major role. If you have high levels of debt or limited emergency savings, a more conservative approach to investment is recommended. Focus on reducing debt and building an emergency fund before taking on significant investment risk.

-

Consult with a financial advisor: A qualified financial advisor can help you determine your risk profile by considering various factors and offering personalized guidance. They'll help you create a financial plan tailored to your individual needs and risk tolerance, significantly increasing your chances of making a safe bet.

Analyzing the Investment's Fundamentals

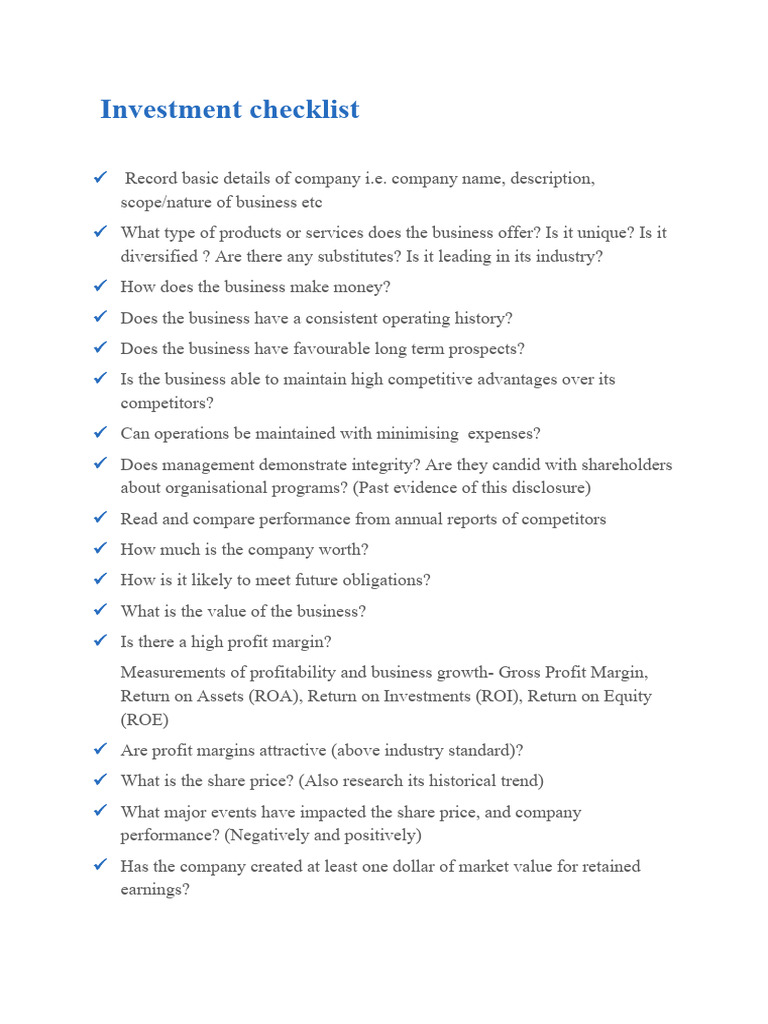

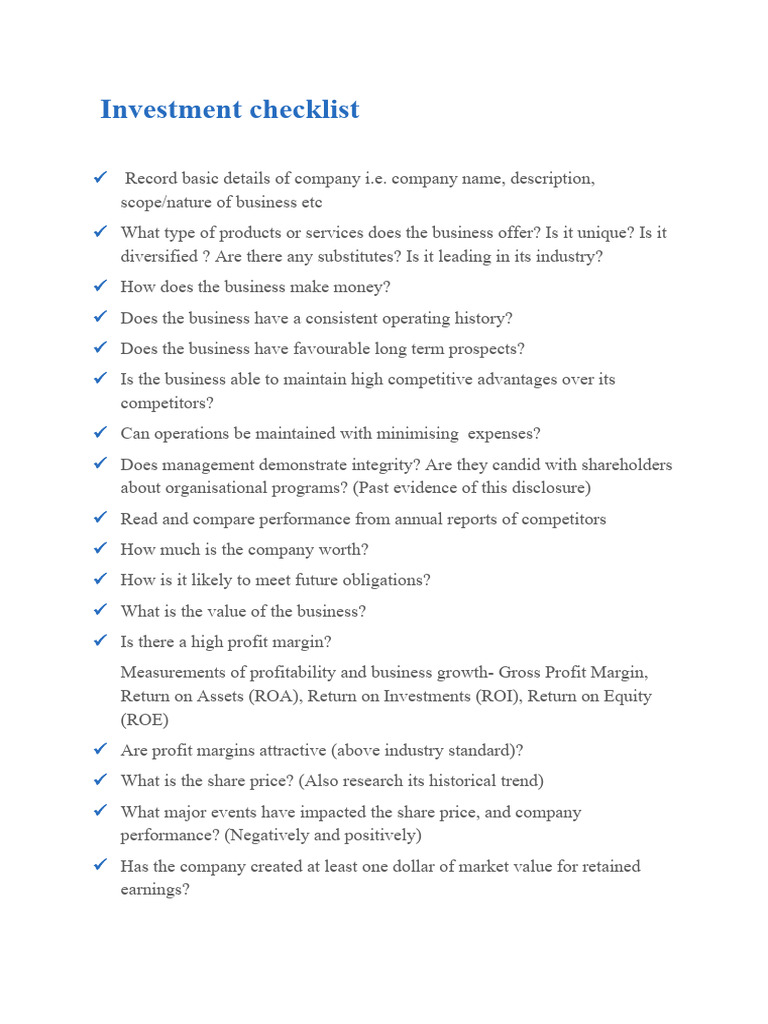

Thorough due diligence is paramount. Don't rely solely on marketing materials or flashy promises. Dig deep into the investment's fundamentals to ensure it's a secure investment. This involves a rigorous investment analysis that goes beyond surface-level information.

-

Research the company's financial history: Examine their financial statements (income statement, balance sheet, cash flow statement) to assess their revenue, profitability, debt levels, and overall financial health. Look for consistent growth and stability.

-

Analyze market trends and industry forecasts: Understanding the broader market context is crucial. Research industry trends, competitive landscape, and potential disruptions. This provides context for assessing the investment's potential for success and identifying potential risk factors.

-

Identify potential risks: Every investment carries some level of risk. Identify potential risk factors, such as competition, regulatory changes, economic downturns, and technological disruptions. Understanding these risks allows you to assess how they might impact your investment.

-

Evaluate the management team's experience and track record: A strong management team is often a key indicator of success. Research their experience, expertise, and past performance to gauge their ability to navigate challenges and generate returns.

Diversification: Spreading Your Risk

Diversification is a cornerstone of a sound investment strategy. The adage "Don't put all your eggs in one basket" holds true. By spreading your investments across different asset classes, you reduce your overall risk and enhance the likelihood of achieving your financial goals.

-

Spread your investments across different asset classes: Consider allocating your capital among stocks, bonds, real estate, and other asset classes. Each asset class has different risk and return characteristics, so diversification helps balance your portfolio.

-

Consider geographic diversification: Investing in different countries or regions reduces your exposure to risks specific to a single geographic area. This is crucial in mitigating potential economic or political instability.

-

Regularly rebalance your portfolio: Over time, the proportions of different assets in your portfolio may change due to market fluctuations. Regular rebalancing ensures that you maintain your desired asset allocation and risk profile. This helps you stay aligned with your initial investment strategy, contributing to a more secure investment.

Seeking Professional Advice

While independent research is essential, seeking professional advice from a qualified financial advisor can provide invaluable insights and personalized guidance. A financial advisor can help you navigate the complexities of the financial world and make informed investment decisions.

-

Discuss your investment goals and risk tolerance: A financial advisor will work with you to understand your financial aspirations and risk appetite, helping you select investments that are suitable for your individual circumstances.

-

Get professional analysis of potential investment opportunities: They can provide expert analysis of potential investment opportunities, taking into account your financial situation and goals, helping you assess the risks and rewards effectively.

-

Gain clarity on complex financial instruments and strategies: The world of finance can be complex. A financial advisor can help you understand complex investment strategies and instruments, ensuring you make informed decisions about your financial future.

Conclusion

Determining if an investment is a truly safe bet requires careful consideration of your risk tolerance, a thorough analysis of the investment's fundamentals, a well-diversified portfolio, and potentially, professional guidance. Remember, there is no such thing as a completely risk-free investment. The goal is to manage risk effectively and make informed decisions aligned with your financial objectives. By understanding your risk profile and performing due diligence, you can significantly increase your chances of making sound investment decisions that contribute to your long-term financial security.

Call to Action: Before making your next investment, take the time to perform thorough due diligence and consider seeking professional advice to ensure your investment is a safe bet for your financial future. Learn more about building a secure investment portfolio by exploring our resources on [link to relevant resources].

Featured Posts

-

Barys San Jyrman Hl Yktb Altarykh Fy Dwry Abtal Awrwba

May 09, 2025

Barys San Jyrman Hl Yktb Altarykh Fy Dwry Abtal Awrwba

May 09, 2025 -

Vatikanskaya Vstrecha Zelenskogo I Trampa Analiz Rezultatov Ot Makrona

May 09, 2025

Vatikanskaya Vstrecha Zelenskogo I Trampa Analiz Rezultatov Ot Makrona

May 09, 2025 -

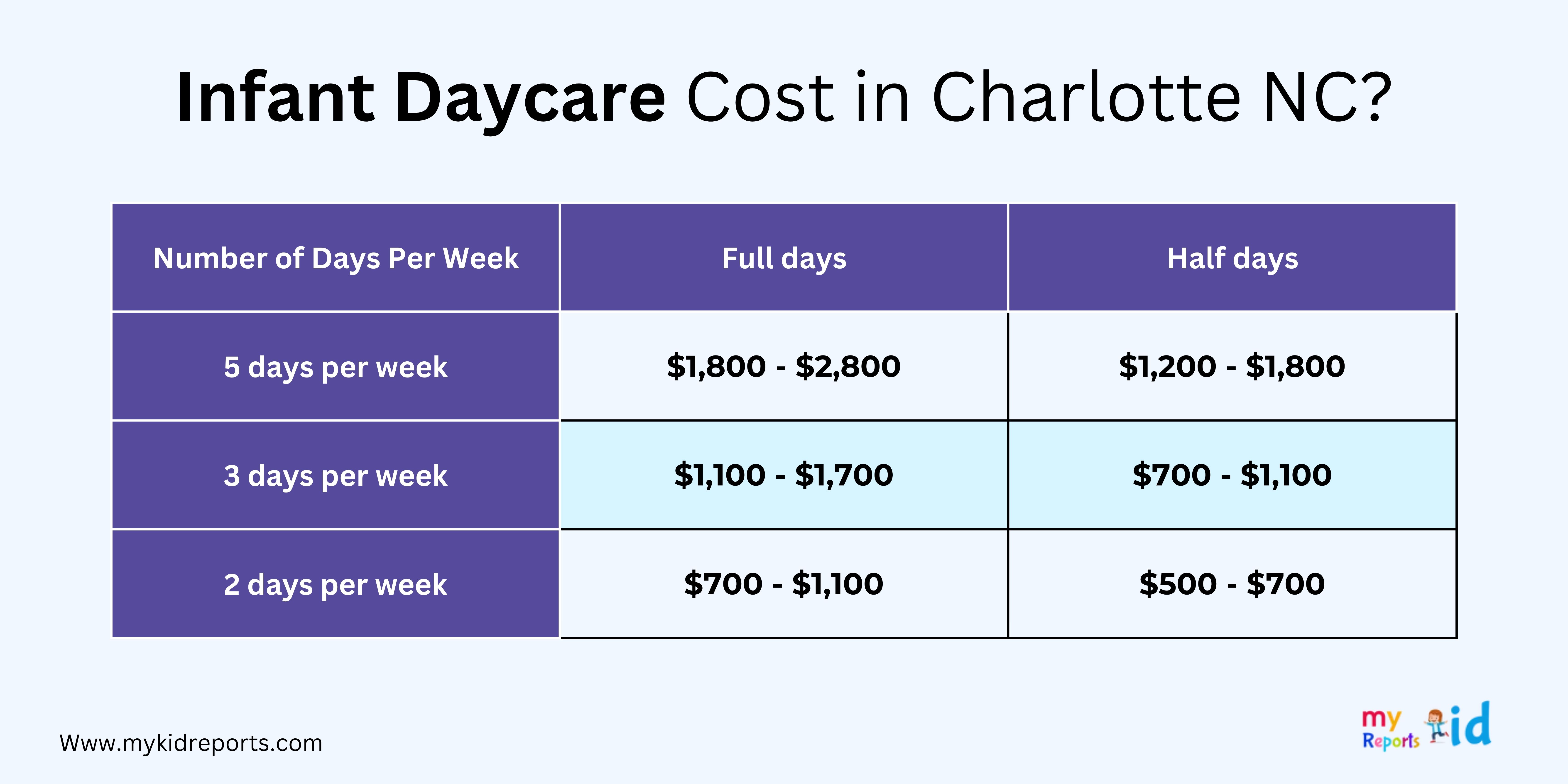

Expensive Babysitting Costs Father 3 000 Then 3 600 In Daycare Fees

May 09, 2025

Expensive Babysitting Costs Father 3 000 Then 3 600 In Daycare Fees

May 09, 2025 -

Chief Justice Roberts Mistaken For Gop Leader His Response Revealed

May 09, 2025

Chief Justice Roberts Mistaken For Gop Leader His Response Revealed

May 09, 2025 -

Pakistan Stock Exchange Portal Down Volatility And Tensions Impact Trading

May 09, 2025

Pakistan Stock Exchange Portal Down Volatility And Tensions Impact Trading

May 09, 2025

Latest Posts

-

Analysis Of Broadcoms Extreme Price Increase On V Mware Costs

May 10, 2025

Analysis Of Broadcoms Extreme Price Increase On V Mware Costs

May 10, 2025 -

The Impact Of Broadcoms Extreme V Mware Price Hike At And Ts Perspective

May 10, 2025

The Impact Of Broadcoms Extreme V Mware Price Hike At And Ts Perspective

May 10, 2025 -

Broadcoms Extreme Price Hike On V Mware A 1 050 Jump Says At And T

May 10, 2025

Broadcoms Extreme Price Hike On V Mware A 1 050 Jump Says At And T

May 10, 2025 -

Extreme V Mware Price Hike At And T Highlights Broadcoms 1 050 Increase

May 10, 2025

Extreme V Mware Price Hike At And T Highlights Broadcoms 1 050 Increase

May 10, 2025 -

1 050 V Mware Price Increase At And T Challenges Broadcoms Proposal

May 10, 2025

1 050 V Mware Price Increase At And T Challenges Broadcoms Proposal

May 10, 2025