Jim Cramer On Foot Locker (FL): Winning Investment Or Risky Bet?

Table of Contents

Cramer's Past Statements on Foot Locker (FL) and their Impact

Jim Cramer's history with Foot Locker (FL) reveals a fluctuating opinion, reflecting the dynamic nature of the retail sector. While finding specific dates and direct quotes requires extensive archival research across multiple platforms, a pattern emerges. His commentary has often hinged on the brand's dependence on key athletic footwear suppliers, the ever-present threat of e-commerce giants, and the cyclical nature of consumer spending on athletic apparel.

-

Reputable Sources: [Link to a credible financial news source discussing Cramer's past FL commentary]. [Link to another source]. (Note: Replace bracketed information with actual links.)

-

Positive Aspects of Past Analyses (According to Cramer):

- Strong brand recognition and established market presence.

- Potential for growth within specific niche markets (e.g., collaborations with popular brands).

- History of adapting to changing retail landscapes (though sometimes with mixed success).

-

Negative Aspects of Past Analyses (According to Cramer):

- Vulnerability to competition from direct-to-consumer brands and online retailers.

- Dependence on a limited number of key suppliers, creating supply chain risks.

- Sensitivity to macroeconomic factors affecting consumer discretionary spending.

Foot Locker's (FL) Current Financial Performance and Market Position

To assess the validity of Cramer's view on Foot Locker (FL), we must examine the company's recent financial performance. Analyzing the latest quarterly and annual reports reveals key metrics:

-

Key Financial Metrics: (Replace with actual data from Foot Locker's financial reports)

- Revenue Growth/Decline: [Insert Percentage]

- Profit Margins: [Insert Percentage]

- Debt Levels: [Insert Amount]

- E-commerce Performance: [Insert Percentage of Sales]

- Same-Store Sales Growth: [Insert Percentage]

-

Market Position: Foot Locker (FL) faces stiff competition from major players like Nike, Adidas, and other athletic retailers, both online and in physical stores. Its market share is [Insert Market Share Percentage], and its success is contingent upon managing inventory effectively and staying relevant to evolving consumer preferences. The company's growth strategies focus on [mention specific strategies, e.g., enhanced omnichannel experience, expansion into new markets].

Analyzing the Risks and Rewards of Investing in Foot Locker (FL)

Investing in Foot Locker (FL) presents a complex risk-reward scenario. A balanced approach requires careful consideration of both potential gains and losses:

-

Potential Risks:

- Economic downturn impacting consumer spending on discretionary items.

- Shifting consumer preferences towards different brands or shopping experiences.

- Increased competition from both established and emerging players in the athletic retail market.

- Supply chain disruptions impacting product availability.

- Negative publicity or brand image issues.

-

Potential Rewards:

- Potential for stock price appreciation based on successful execution of growth strategies.

- Dividend payments (if the company continues to issue them).

- Opportunities for capital appreciation if Foot Locker (FL) successfully navigates market challenges.

- Brand loyalty and established customer base.

Alternative Investment Strategies Considering Cramer's View on Foot Locker (FL)

Rather than focusing solely on Foot Locker (FL), investors might diversify their portfolios by considering alternative investments within the retail and footwear industries.

- Alternative Investment Options:

- Investments in other athletic footwear companies with stronger e-commerce presences.

- Investments in e-commerce platforms specializing in athletic apparel.

- Investments in companies involved in the manufacturing or distribution of athletic footwear.

- ETFs focused on the consumer discretionary sector.

Diversification reduces the overall risk associated with any single investment, providing a more balanced approach to portfolio management.

Conclusion: Is Foot Locker (FL) a Winning Investment Based on Jim Cramer's Insights?

Analyzing Jim Cramer's past comments and Foot Locker (FL)'s current financial position reveals a mixed outlook. While Foot Locker possesses strong brand recognition and a history of adaptation, it faces significant headwinds from competition and economic uncertainty. Cramer's insights, while informative, should be considered alongside independent analysis and a thorough understanding of the company's financial health and industry trends.

Before making any investment decisions regarding Foot Locker stock (FL), consider conducting your own comprehensive due diligence. Analyze Foot Locker's financial statements, compare its performance to competitors, and consider alternative investments in the athletic footwear market before making your final decision on Foot Locker (FL). Remember, investing in individual stocks carries inherent risk, and no single expert's opinion should dictate your investment strategy.

Featured Posts

-

Dodgers Max Muncy Breaks Silence On Arenado Trade Speculation

May 16, 2025

Dodgers Max Muncy Breaks Silence On Arenado Trade Speculation

May 16, 2025 -

Analyzing The San Diego Padres Winning Strategies

May 16, 2025

Analyzing The San Diego Padres Winning Strategies

May 16, 2025 -

Will Paddy Pimbletts Ufc 314 Win Secure A Championship Fight

May 16, 2025

Will Paddy Pimbletts Ufc 314 Win Secure A Championship Fight

May 16, 2025 -

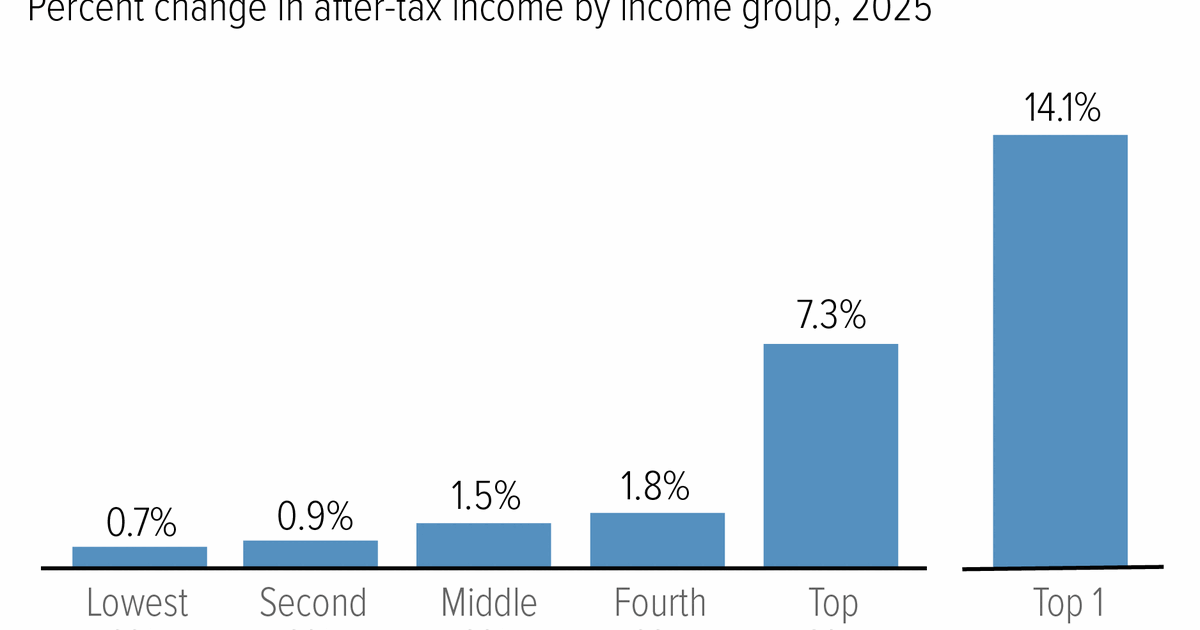

Revised Trump Tax Plan Details Released By House Republicans

May 16, 2025

Revised Trump Tax Plan Details Released By House Republicans

May 16, 2025 -

Tampa Bay Rays Complete Sweep Of San Diego Padres

May 16, 2025

Tampa Bay Rays Complete Sweep Of San Diego Padres

May 16, 2025