Kering Shares Plunge 6% Following Disappointing Q1 Earnings

Table of Contents

Key Factors Behind the Kering Stock Plunge

The sharp decline in Kering shares can be attributed to a confluence of factors, primarily impacting the performance of its core brands and exacerbated by global macroeconomic headwinds.

Slower than Expected Growth in Key Brands

Gucci, the flagship brand of Kering, significantly underperformed expectations in Q1 2024. Sales growth lagged considerably behind analyst predictions, raising concerns about its future performance. Yves Saint Laurent, another major contributor to Kering's revenue, also showed signs of slowing momentum. This deceleration in growth across key brands is a major reason for the stock's decline.

- Gucci: Sales growth significantly below projected figures, potentially due to shifts in consumer preferences and increased competition.

- Yves Saint Laurent: Demonstrated slower growth compared to previous quarters, indicating a potential saturation of the market or a need for renewed brand strategy.

- Weakening Chinese Market: The impact of a slowing Chinese economy on luxury goods sales significantly affected Kering’s overall performance. Reduced consumer spending in this key market impacted revenue significantly.

The specific sales figures released by Kering need to be carefully examined to understand the full extent of the underperformance. Further investigation into consumer behavior, marketing strategies, and competitive landscape is crucial to ascertain the root causes of the slowing growth in these key brands. A deeper dive into the geographic breakdown of sales will illuminate the impact of the weakening Chinese market.

Impact of Geopolitical Uncertainty and Inflation

The current global economic climate, characterized by geopolitical instability and persistent inflation, significantly impacted Kering's Q1 performance. The ongoing war in Ukraine, coupled with global inflation, has dampened consumer confidence and reduced discretionary spending, particularly in the luxury sector. Supply chain disruptions further exacerbated the challenges, impacting production and distribution.

- Global Economic Slowdown: The general reduction in global economic activity negatively impacted consumer spending power, decreasing demand for luxury goods.

- Inflationary Pressures: Increased prices have squeezed consumer budgets, limiting spending on non-essential items like luxury apparel and accessories.

- Geopolitical Uncertainty: The war in Ukraine and other global conflicts created uncertainty that impacted both consumer confidence and supply chains.

- Supply Chain Disruptions: Ongoing supply chain issues hampered production and delivery, leading to stock shortages and impacting sales.

These macroeconomic factors combined to create a perfect storm that negatively affected Kering's profitability and ultimately contributed to the significant drop in its share price. The company's ability to navigate these challenges effectively will be crucial to its future success.

Management's Response and Future Outlook

Kering's management has acknowledged the disappointing Q1 results, outlining plans to address the challenges ahead. Their statement, including the revised guidance for the year, will be scrutinized by investors. The strategies implemented to counter the slower growth and manage the impact of global headwinds will determine investor confidence in the coming quarters. The market's reaction to the management's response will heavily influence the trajectory of the Kering stock price.

- CEO's Statement: A comprehensive analysis of the CEO's public statement on the Q1 earnings is necessary to understand the company's perspective and planned actions.

- Revised Guidance: The adjusted forecasts for the remainder of the year will provide insights into the company's expectations and the anticipated recovery path.

- Strategic Initiatives: Any new strategies announced to revitalize brand performance, improve efficiency, and mitigate risks will heavily influence investor sentiment.

- Investor Reaction: Monitoring investor reactions, as evidenced by trading volumes and analyst comments, will gauge the effectiveness of the management's response.

Analysis of Investor Sentiment and Market Reaction

The immediate market response to Kering's disappointing Q1 earnings was swift and severe, highlighting the gravity of the situation for investors. The long-term implications for Kering are substantial and warrant close attention.

Immediate Market Response

The 6% share price plunge was accompanied by a significant increase in trading volume, indicating a high level of investor activity and concern. This drop had a direct and noticeable impact on Kering's market capitalization, reflecting a loss of investor confidence. Credit rating agencies may also reassess Kering's creditworthiness based on this performance.

- Share Price Movements: Detailed charts illustrating intraday share price fluctuations provide a clear picture of the immediate market reaction.

- Trading Volume: High trading volume signifies increased investor activity, reflecting significant market concern.

- Market Capitalization: The immediate impact on the company's market capitalization quantifies the financial loss incurred due to the share price decline.

- Credit Rating Changes: Potential downgrades from credit rating agencies would further negatively affect Kering's financial standing and borrowing costs.

Long-Term Implications for Kering

The disappointing Q1 results pose significant challenges for Kering's future, impacting potential investments, brand strategies, and market share. The company's ability to adapt and respond will determine its capacity to recover and maintain its leading position in the luxury goods sector. Competition from other luxury brands will be fierce, demanding innovative strategies to regain lost ground.

- Future Investments: The stock price drop may impact Kering’s ability to secure future funding for growth initiatives and acquisitions.

- Brand Strategies: A significant re-evaluation of brand strategies, particularly for Gucci and Yves Saint Laurent, is likely necessary to reinvigorate sales.

- Market Share: The risk of losing market share to competitors is significant if the company doesn't implement effective strategies to turn around its performance.

Conclusion

Kering's disappointing Q1 2024 earnings report triggered a substantial 6% plunge in its share price, reflecting concerns about slowing growth in key brands and the impact of prevailing global economic uncertainties. The company’s strategic response and its revised outlook will be crucial in determining the long-term impact on its stock performance and overall market position. The luxury goods sector is highly competitive, demanding swift and effective action from Kering to regain lost ground and investor confidence.

Call to Action: Stay informed on the evolving situation surrounding Kering shares and the luxury goods market. Monitor Kering's performance closely and follow the implementation of its recovery strategies. Continue to track our updates for the latest news on Kering stock and the ongoing impact of its Q1 earnings.

Featured Posts

-

Trumps Tariffs Trigger 2 Drop In Amsterdam Stock Exchange

May 24, 2025

Trumps Tariffs Trigger 2 Drop In Amsterdam Stock Exchange

May 24, 2025 -

Muezelerde Porsche 956 Nin Sergilenme Yoentemi Tavan Asili

May 24, 2025

Muezelerde Porsche 956 Nin Sergilenme Yoentemi Tavan Asili

May 24, 2025 -

Under 1m Dream Homes Escape To The Country Buyer Success Stories

May 24, 2025

Under 1m Dream Homes Escape To The Country Buyer Success Stories

May 24, 2025 -

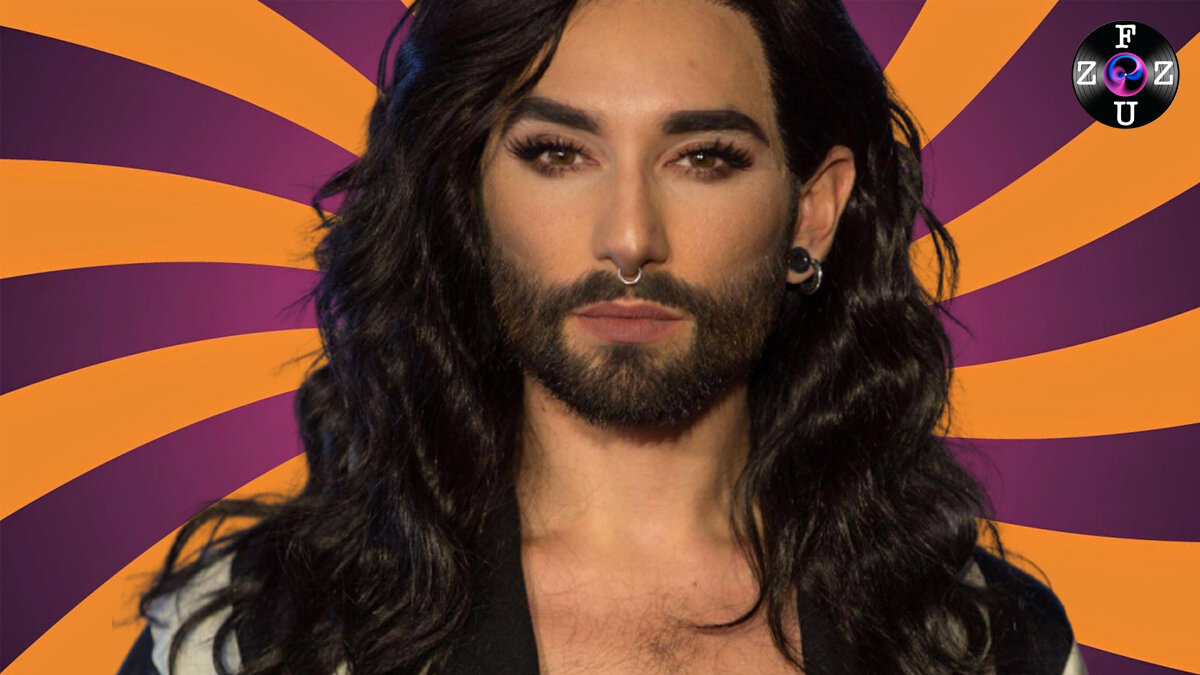

Konchita Vurst Zhivott Sled Bradatata Pobeda Na Evroviziya

May 24, 2025

Konchita Vurst Zhivott Sled Bradatata Pobeda Na Evroviziya

May 24, 2025 -

The Ultimate Escape To The Country Choosing The Right Location

May 24, 2025

The Ultimate Escape To The Country Choosing The Right Location

May 24, 2025

Latest Posts

-

Mia Farrow Trump Should Be Jailed Over Venezuelan Deportation Controversy

May 24, 2025

Mia Farrow Trump Should Be Jailed Over Venezuelan Deportation Controversy

May 24, 2025 -

Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025

Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025 -

Mia Farrows Outrage Trumps Actions On Venezuelan Deportations Demand Accountability

May 24, 2025

Mia Farrows Outrage Trumps Actions On Venezuelan Deportations Demand Accountability

May 24, 2025 -

Farrows Plea Prosecute Trump For Handling Of Venezuelan Deportations

May 24, 2025

Farrows Plea Prosecute Trump For Handling Of Venezuelan Deportations

May 24, 2025 -

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025