Under £1m Dream Homes: Escape To The Country Buyer Success Stories

Table of Contents

Location, Location, Location: Finding the Perfect Countryside Spot Under £1m

Finding the right location is crucial when searching for affordable country living. While prime locations in popular counties often command high prices, savvy buyers can find incredible value in less-obvious areas. Your budget of under £1 million can stretch surprisingly far if you're willing to explore different regions.

-

Regions offering affordability: Areas further from major cities, such as parts of the North of England, Wales, and Scotland, often offer better value for money. Consider exploring charming villages and towns slightly off the beaten track. The availability of countryside property varies greatly across the UK.

-

Factors to consider: When choosing a location, don't just focus on price. Think about:

- Proximity to amenities: How far are you willing to travel for supermarkets, schools, and healthcare?

- Commuting distance: If you need to commute to a city for work, factor in travel time and cost.

- Local community: Research the local area to see if it aligns with your lifestyle and preferences.

-

Examples of affordable locations:

- The Cotswolds (outer edges): While the heart of the Cotswolds is expensive, the surrounding areas offer charming villages with more affordable rural locations.

- Parts of Yorkshire: Many beautiful villages and towns in Yorkshire offer excellent value for money and stunning countryside views.

- Rural areas of Wales: Wales boasts picturesque landscapes and charming villages where countryside property is often more affordable than in England.

-

Buyer Success Stories:

- Sarah and Mark found a beautiful three-bedroom cottage with a large garden in a quiet village in North Yorkshire for £750,000, exceeding their expectations for an affordable country escape.

- Emily and Tom secured a renovated farmhouse in Pembrokeshire, Wales, for under £800,000, enjoying stunning coastal views and a thriving local community.

Securing the Best Mortgage Deal for Your Country Escape

Finding the right mortgage is key to securing your country home. Even with a budget under £1 million, a competitive mortgage rate can significantly impact your monthly payments.

-

Competitive mortgage rates: Shop around and compare offers from different lenders specializing in country home mortgages or rural property financing.

-

Mortgage options: Explore various mortgage options, including fixed-rate, variable-rate, and potentially even first-time buyer schemes if applicable. Consider the length of your mortgage term and the implications for your monthly payments.

-

Professional advice: Seek professional advice from an independent mortgage broker. They can help navigate the complexities of the mortgage market and find the best deal for your circumstances.

-

Tips for securing a favourable mortgage:

- Improve your credit score.

- Have a substantial deposit.

- Shop around for the best deals.

- Provide thorough documentation to your lender.

-

Buyer Success Stories:

- John and Jane worked with a mortgage broker who secured them a fixed-rate mortgage at a highly competitive rate, allowing them to comfortably afford their dream home in the countryside.

Negotiating the Best Price: Tips and Tricks for Successful Buying

Negotiating the best possible price for your rural property is crucial, particularly when searching for under £1m dream homes.

-

Property valuations: Obtain independent valuations to ensure the asking price is justified.

-

Surveys: Conduct thorough surveys to identify any potential problems and use this information to your advantage in negotiations.

-

Experienced estate agent: Working with an experienced estate agent familiar with the local market can provide invaluable support and advice.

-

Successful negotiation tactics:

- Research comparable properties that have recently sold.

- Be prepared to walk away if the price is not right.

- Present a strong offer, clearly outlining your terms.

Renovation vs. Ready-to-Move-In: Making the Right Choice for Your Dream Home

When searching for under £1m dream homes, deciding between a renovation project and a move-in ready property is a significant choice.

-

Renovation: Buying a fixer-upper can potentially save you money but requires additional budgeting for renovation costs, time, and potential unforeseen complications. Consider the costs of materials, labour, and potential planning permission.

-

Move-in ready: A move-in ready country house offers immediate occupancy but may cost more upfront.

-

Choosing contractors: If you opt for renovation, choose reputable and experienced contractors.

-

Buyer Success Stories:

- David and Carol successfully renovated a dilapidated farmhouse, transforming it into their dream home while staying within their budget.

- Liam and Chloe opted for a move-in ready cottage, prioritizing immediate enjoyment of their new life in the country.

Conclusion

Finding your under £1m dream home in the countryside is entirely achievable with careful planning and smart decision-making. By understanding the market, securing the right financing, and negotiating effectively, you too can realise your rural retreat. The success stories highlighted above demonstrate that with the right approach, your dream of affordable country living is within reach. Start your search for under £1m dream homes today! Share your experiences or questions in the comments below. For further assistance, explore resources such as [link to mortgage broker], [link to estate agent], and [link to property valuation service].

Featured Posts

-

The Perils Of Dissent When Seeking Change Leads To Punishment

May 24, 2025

The Perils Of Dissent When Seeking Change Leads To Punishment

May 24, 2025 -

The Kyle And Teddi Dog Walker Incident A Heated Debate

May 24, 2025

The Kyle And Teddi Dog Walker Incident A Heated Debate

May 24, 2025 -

Crisi Dazi Mercati Azionari In Picchiata La Ue Risponde

May 24, 2025

Crisi Dazi Mercati Azionari In Picchiata La Ue Risponde

May 24, 2025 -

2024 Porsche Macan Buyers Guide Find The Perfect Suv

May 24, 2025

2024 Porsche Macan Buyers Guide Find The Perfect Suv

May 24, 2025 -

Riviera Blue Porsche 911 S T Exceptional Condition Rare Find

May 24, 2025

Riviera Blue Porsche 911 S T Exceptional Condition Rare Find

May 24, 2025

Latest Posts

-

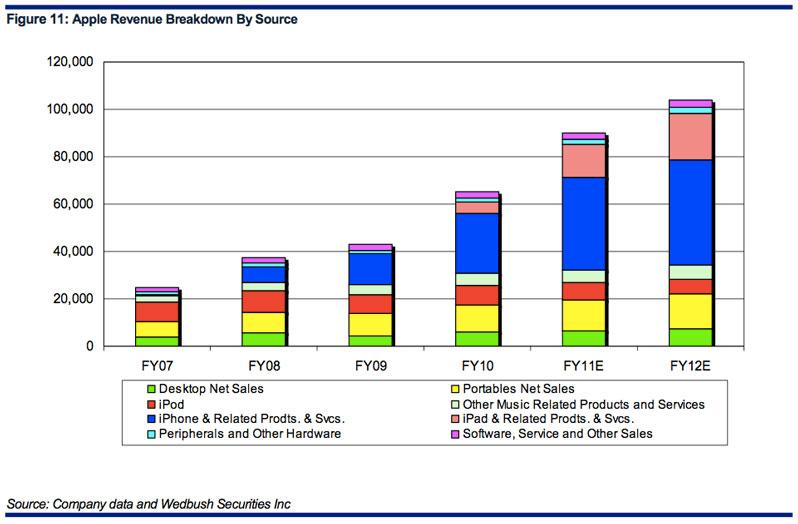

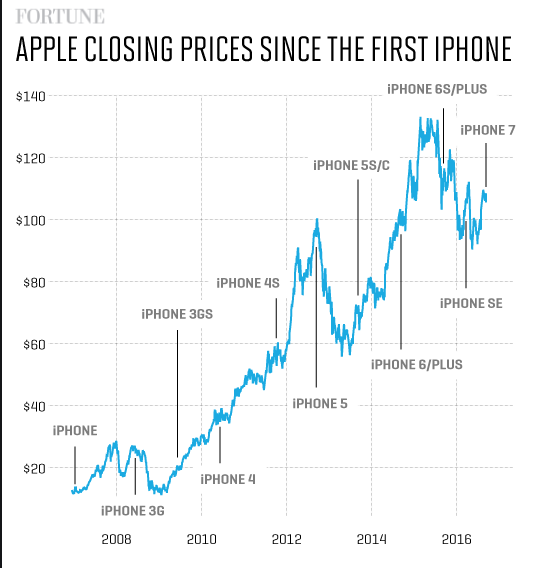

Investing In Apple Stock Is It A Good Buy After Q2

May 24, 2025

Investing In Apple Stock Is It A Good Buy After Q2

May 24, 2025 -

Should You Follow Wedbushs Lead On Apple Stock Despite Price Target Cut

May 24, 2025

Should You Follow Wedbushs Lead On Apple Stock Despite Price Target Cut

May 24, 2025 -

Apple Stock Dip Key Levels Breached Before Q2 Earnings

May 24, 2025

Apple Stock Dip Key Levels Breached Before Q2 Earnings

May 24, 2025 -

Apple Stock Analysis I Phone Drives Strong Q2 Results

May 24, 2025

Apple Stock Analysis I Phone Drives Strong Q2 Results

May 24, 2025 -

Apple Stock Wedbushs Long Term Bullish Prediction After Price Target Reduction

May 24, 2025

Apple Stock Wedbushs Long Term Bullish Prediction After Price Target Reduction

May 24, 2025