Key Information From VusionGroup's AMF CP Document 2025E1029754

Table of Contents

VusionGroup's Financial Performance and Outlook

This section analyzes VusionGroup's financial performance as detailed in the AMF CP Document 2025E1029754, focusing on revenue growth, profitability, and key financial ratios.

Revenue Growth and Key Drivers

VusionGroup's revenue growth is a key indicator of its overall financial health. The AMF CP Document 2025E1029754 provides detailed revenue figures, allowing for a thorough analysis of its performance.

- Year-over-Year Comparison: The document reveals [Insert specific data, e.g., a 15% increase in revenue from 2023 to 2024].

- Significant Changes: [Explain significant changes and their causes. For example: A spike in Q3 revenue is attributed to the successful launch of Product X].

- Key Revenue Streams: [Specify major revenue sources, their individual growth rates and contribution to overall revenue. Example: Subscription services contributed 60% of total revenue]. This demonstrates the diversification of VusionGroup's income streams, crucial for assessing its financial stability. Analyzing this data within the context of the broader VusionGroup financials offers valuable insights.

This detailed analysis of VusionGroup’s revenue growth, as presented in the AMF CP Document 2025E1029754, provides valuable information regarding the company's performance and potential for future growth.

Profitability and Margin Analysis

The AMF CP Document 2025E1029754 also provides crucial data for profitability analysis. Examining profit margins is essential for understanding VusionGroup's efficiency and earnings.

- Gross Profit Margin: [Insert data and analysis, e.g., a consistent gross profit margin above 50% indicating efficient cost management].

- Operating Profit Margin: [Insert data and analysis, e.g., a slight decrease in the operating profit margin can be attributed to increased R&D investment].

- Net Profit Margin: [Insert data and analysis, showing overall profitability].

- Factors Impacting Profitability: [Discuss factors affecting profitability based on data from VusionGroup's AMF CP Document 2025E1029754, e.g., Increased competition or changes in pricing strategies].

Understanding these margins within the context of VusionGroup's profitability, as outlined in the AMF CP reporting, is critical for evaluating the company’s financial performance.

Key Financial Ratios and Metrics

The AMF CP Document 2025E1029754 allows for the calculation of several key financial ratios that offer insights into VusionGroup's financial health.

- Liquidity Ratios: [Mention specific ratios like current ratio and quick ratio, and their implications for the company's short-term financial health].

- Solvency Ratios: [Mention specific ratios like debt-to-equity ratio and times interest earned, and their implications for long-term financial stability].

- Efficiency Ratios: [Mention specific ratios like inventory turnover and asset turnover, and their implications for operational efficiency].

- Comparison to Industry Benchmarks: [Compare VusionGroup’s key performance indicators (KPIs) to industry averages for a competitive perspective].

Analyzing these financial ratios provides a comprehensive assessment of VusionGroup’s financial health as depicted in the AMF CP Document 2025E1029754.

VusionGroup's Strategic Initiatives and Future Plans

VusionGroup's AMF CP Document 2025E1029754 offers valuable insights into the company's strategic direction and future plans.

Growth Strategies and Market Opportunities

VusionGroup's strategic initiatives are vital for future growth. The AMF CP Document 2025E1029754 details plans for expansion and market penetration.

- Market Expansion: [Discuss specific geographic regions or market segments VusionGroup is targeting for expansion].

- New Product Launches: [Detail planned product launches and their expected contribution to revenue growth].

- Competitive Landscape Analysis: [Analyze VusionGroup's competitive position and strategies for maintaining a competitive advantage].

- Potential Risks: [Identify potential risks associated with VusionGroup’s growth strategy, as highlighted in the AMF CP Document 2025E1029754].

Research and Development Activities

Investment in research and development is crucial for long-term growth. VusionGroup’s AMF CP Document 2025E1029754 reveals details about R&D activities.

- R&D Spending: [Specify the amount invested in R&D and its percentage of total revenue].

- Key Projects: [Detail key R&D projects and their potential impact on future products and services].

- Expected Outcomes: [Discuss the anticipated outcomes of R&D investments, and their timeline for implementation].

Risk Factors and Challenges

The AMF CP Document 2025E1029754 identifies potential risks and challenges faced by VusionGroup. Understanding these is crucial for assessing the company's outlook.

- Specific Risk Factors: [List key risk factors identified in the document, such as market competition, regulatory changes, or economic downturns].

- Potential Impact: [Assess the potential impact of each risk factor on VusionGroup’s operations and financial performance].

- Mitigation Strategies: [Discuss the strategies VusionGroup has implemented to mitigate these risks].

A thorough understanding of VusionGroup's risk assessment, as presented in the AMF CP Document 2025E1029754, is crucial for informed decision-making.

Compliance and Regulatory Information

VusionGroup’s AMF CP Document 2025E1029754 includes essential information regarding regulatory compliance.

Key Compliance Requirements

This section summarizes key compliance matters discussed in the document.

- Specific Regulations: [List the relevant regulations VusionGroup must comply with].

- Compliance Status: [Assess VusionGroup’s current compliance status with respect to these regulations].

- Potential Issues: [Highlight any potential compliance issues or challenges].

Understanding VusionGroup’s regulatory compliance, as detailed in the AMF CP Document 2025E1029754, is vital for assessing its operational risk.

Conclusion: Understanding the Significance of VusionGroup's AMF CP Document 2025E1029754

VusionGroup's AMF CP Document 2025E1029754 provides crucial insights into the company's financial performance, strategic direction, and compliance status. By analyzing its revenue growth, profitability, key financial ratios, growth strategies, R&D activities, and risk factors, stakeholders can gain a comprehensive understanding of VusionGroup’s current position and future outlook. This document is essential reading for investors, analysts, and anyone seeking a detailed understanding of VusionGroup. Access the full VusionGroup's AMF CP Document 2025E1029754 [Insert link here if available] for a complete picture and conduct your own thorough analysis of VusionGroup's AMF CP Document 2025E1029754 and related financial information. A deeper dive into this document will undoubtedly enhance your understanding of VusionGroup's potential.

Featured Posts

-

Yates And Dr Jessica Johnson A Powerful Black History Narrative

Apr 30, 2025

Yates And Dr Jessica Johnson A Powerful Black History Narrative

Apr 30, 2025 -

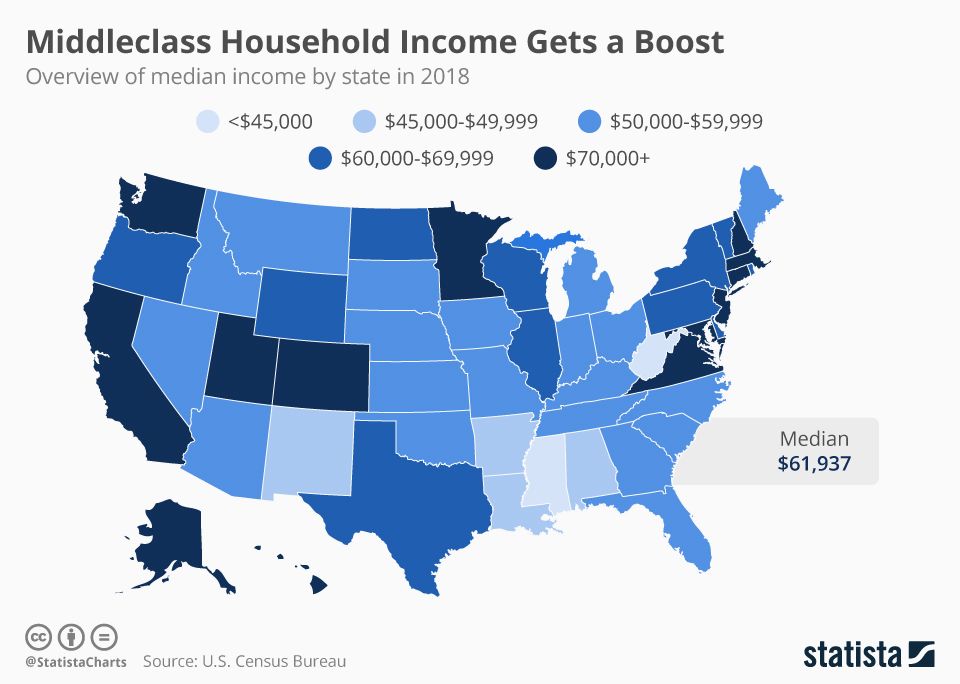

Income Needed For Middle Class Status By Us State

Apr 30, 2025

Income Needed For Middle Class Status By Us State

Apr 30, 2025 -

Legal And Free Ways To Watch Ru Pauls Drag Race Season 17 Episode 9

Apr 30, 2025

Legal And Free Ways To Watch Ru Pauls Drag Race Season 17 Episode 9

Apr 30, 2025 -

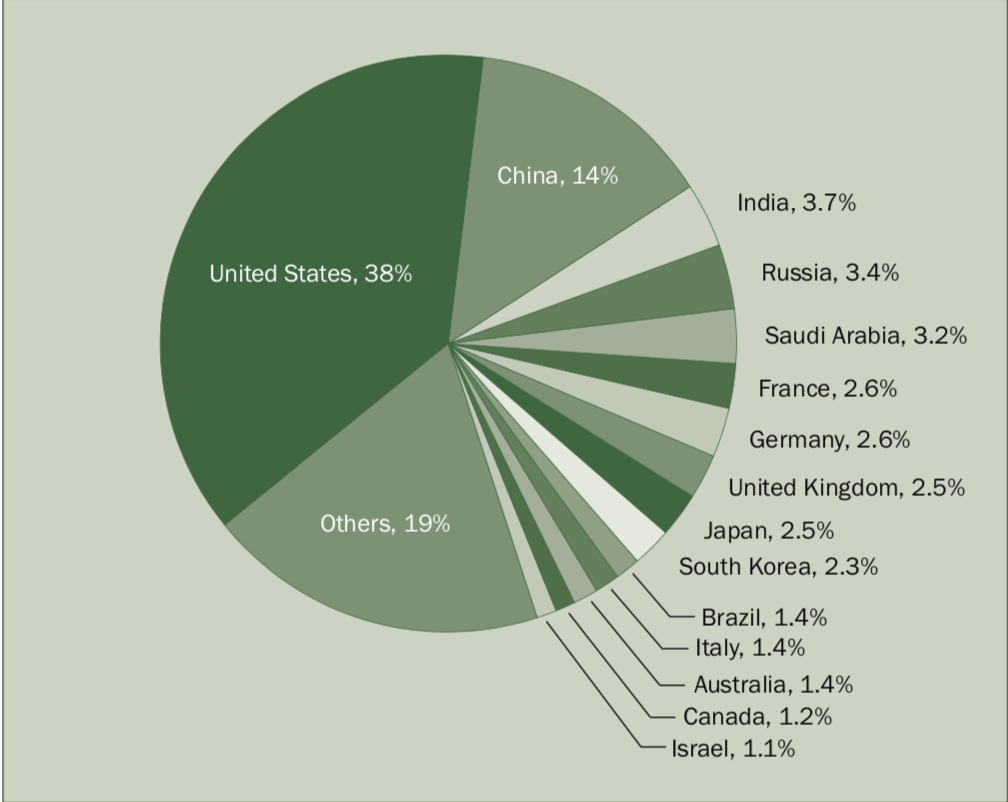

The Global Rise In Military Expenditure Focus On Europe And Russia

Apr 30, 2025

The Global Rise In Military Expenditure Focus On Europe And Russia

Apr 30, 2025 -

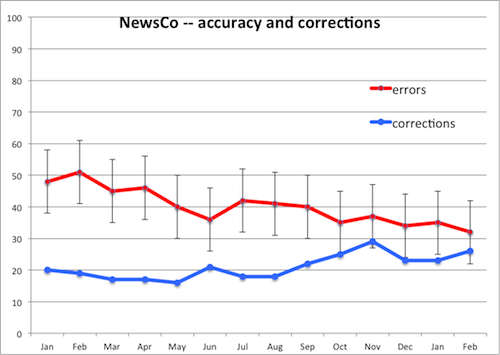

Improving Accuracy Essential Corrections And Clarifications

Apr 30, 2025

Improving Accuracy Essential Corrections And Clarifications

Apr 30, 2025