Land Your Dream Private Credit Job: 5 Key Do's & Don'ts To Follow

Table of Contents

<p><b>Meta Description:</b> Unlock your dream private credit career! Learn the 5 essential do's and don'ts to impress recruiters and land your ideal private credit job. Get expert advice on networking, resume writing, and interview skills.</p>

<p>Landing a dream job in the competitive world of private credit requires more than just a strong resume. This guide outlines five crucial do's and don'ts to help you stand out from the crowd and secure your ideal private credit career. We'll cover everything from networking strategies to acing the interview, ensuring you're well-prepared for your private lending job search.</p>

<h2>Do: Network Strategically in the Private Credit Industry</h2>

<h3>Attend industry events and conferences.</h3>

- Identify relevant conferences (e.g., industry-specific trade shows, networking events focused on alternative lending or private debt). Many private credit firms sponsor or attend these events.

- Prepare talking points highlighting your skills and experience in credit analysis, financial modeling, and portfolio management. Quantify your achievements whenever possible.

- Follow up with valuable contacts after the event. Send a personalized email referencing your conversation and expressing continued interest in their firm or area of expertise within private credit.

<h3>Leverage LinkedIn effectively.</h3>

- Optimize your LinkedIn profile with relevant keywords (private credit, alternative lending, private debt, credit analyst, financial modeling, etc.). Use keywords found in job descriptions for private credit jobs you're targeting.

- Connect with professionals in your target firms. Don't just connect; engage with their posts and share insightful comments to demonstrate your knowledge of the private credit industry.

- Engage in relevant industry discussions and groups. Participating in these discussions showcases your expertise and allows you to connect with like-minded individuals in the private credit space.

<h3>Informational Interviews are Key</h3>

- Reach out to professionals for informational interviews to learn about their experiences and gain insights into the specific area of private credit that interests you (e.g., distressed debt, mezzanine financing).

- Prepare thoughtful questions beforehand. Focus on questions that demonstrate your understanding of the industry and show you've done your research on the firm and the interviewer.

- Express genuine interest and follow up with a thank-you note. A handwritten note can make a lasting impression, distinguishing you from other applicants in your private credit job search.

<h2>Don't: Neglect Your Resume and Cover Letter</h2>

<h3>Tailor your resume to each specific role.</h3>

- Highlight relevant skills and experiences for each application. Don't just list your responsibilities; showcase the impact you made.

- Use keywords from the job description. Applicant Tracking Systems (ATS) scan resumes for keywords, so incorporating them naturally is essential.

- Quantify your accomplishments whenever possible (e.g., "increased efficiency by 15%," "managed a portfolio of $X million"). This demonstrates the value you bring.

<h3>Generic cover letters are a big no-no.</h3>

- Personalize your cover letter to address the specific requirements and company culture of each job. Show you understand their investment strategy and recent activities.

- Showcase your understanding of the firm's investment strategy. Research the firm thoroughly and demonstrate your knowledge of their portfolio and investment approach.

- Explain why you're interested in that specific role and company. Express genuine enthusiasm and explain what specifically draws you to this opportunity within the broader private credit field.

<h3>Avoid grammatical errors and typos.</h3>

- Proofread meticulously. Typos and grammatical errors are a significant turn-off for recruiters.

- Have a friend or professional review your resume and cover letter for any errors. A fresh pair of eyes can catch mistakes you might miss.

<h2>Do: Prepare Thoroughly for the Private Credit Interview</h2>

<h3>Research the firm and the interviewer.</h3>

- Understand the firm's investment strategy, recent deals, and company culture. This demonstrates your initiative and genuine interest.

- Look up the interviewer on LinkedIn to gain insight into their background and experience. Tailor your answers to resonate with their specific expertise.

<h3>Practice your behavioral interview questions.</h3>

- Prepare examples that demonstrate your skills and experiences, using the STAR method (Situation, Task, Action, Result). This provides concrete examples of your abilities.

<h3>Prepare insightful questions to ask the interviewer.</h3>

- Asking thoughtful questions shows your engagement and interest. Prepare questions about the firm's culture, investment strategy, or current projects in private debt. Avoid questions easily answered through online research.

<h2>Don't: Underestimate the Importance of Financial Modeling Skills</h2>

<h3>Showcase your modeling proficiency.</h3>

- Be ready to discuss your experience with financial modeling software (e.g., Excel, Argus). Demonstrate your expertise in building and interpreting financial models relevant to credit analysis.

- Practice building and interpreting financial models. Be prepared to walk through your assumptions and methodology. This will showcase your analytical skills for private credit.

<h3>Lack of understanding of credit analysis.</h3>

- Demonstrate a deep understanding of credit analysis principles, including credit scoring, financial statement analysis, and risk assessment. Be prepared to discuss different credit rating agencies and their methodologies.

<h3>Forget to highlight your analytical skills.</h3>

- In every stage of the application process, explicitly highlight your analytical and problem-solving abilities. These are crucial for success in a private credit analyst role or any other private credit position.

<h2>Do: Follow Up After the Interview</h2>

<h3>Send a thank-you note within 24 hours.</h3>

- Reiterate your interest and highlight key points from the conversation. Personalize the note for each interviewer.

<h3>Maintain contact and keep your network updated.</h3>

- Don't be afraid to politely follow up after a reasonable period (e.g., a week or two). This demonstrates your persistence and enthusiasm.

- Keep your network informed of your job search progress. This can lead to unexpected opportunities.

<h2>Conclusion</h2>

Landing your dream private credit job requires a strategic approach. By following these do's and don'ts—from strategic networking and resume optimization to acing the interview and following up effectively—you significantly increase your chances of success. Remember to highlight your analytical abilities, financial modeling skills, and understanding of credit analysis throughout the entire process. Don't delay, start implementing these tips today and begin your journey towards securing your ideal private credit career! Start your successful private credit job search now!

Featured Posts

-

Barrow Afc Supporters Take On Sky Bet Every Minute Matters Cycle Relay

May 02, 2025

Barrow Afc Supporters Take On Sky Bet Every Minute Matters Cycle Relay

May 02, 2025 -

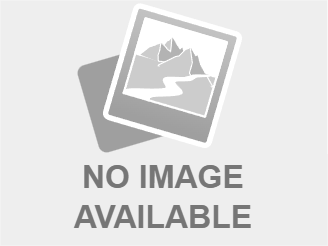

Addressing The Root Causes Of Misbehavior Instead Of School Suspensions

May 02, 2025

Addressing The Root Causes Of Misbehavior Instead Of School Suspensions

May 02, 2025 -

Ramos Architect Of Frances Six Nations Win Over Scotland

May 02, 2025

Ramos Architect Of Frances Six Nations Win Over Scotland

May 02, 2025 -

Saudi Arabias Abs Market Opens A Rule Change Bigger Than Spain

May 02, 2025

Saudi Arabias Abs Market Opens A Rule Change Bigger Than Spain

May 02, 2025 -

Lotto 6aus49 Gewinnzahlen Vom 12 April 2025

May 02, 2025

Lotto 6aus49 Gewinnzahlen Vom 12 April 2025

May 02, 2025

Latest Posts

-

Strands Nyt Crossword Solutions And Clues For February 15th Game 349

May 10, 2025

Strands Nyt Crossword Solutions And Clues For February 15th Game 349

May 10, 2025 -

Nyt Strands Game 349 Hints And Answers For February 15th

May 10, 2025

Nyt Strands Game 349 Hints And Answers For February 15th

May 10, 2025 -

Solve Nyt Strands Game 354 Thursday February 20 Hints And Answers

May 10, 2025

Solve Nyt Strands Game 354 Thursday February 20 Hints And Answers

May 10, 2025 -

Jeanine Pirro From Fox News To Potential Dc Prosecutor Under Trump

May 10, 2025

Jeanine Pirro From Fox News To Potential Dc Prosecutor Under Trump

May 10, 2025 -

Fox News Hosts Sharp Rebuttal To Colleagues Trump Tariff Comments

May 10, 2025

Fox News Hosts Sharp Rebuttal To Colleagues Trump Tariff Comments

May 10, 2025