Late To The Game? Palantir Stock And Its Predicted 40% Growth In 2025

Table of Contents

Palantir Technologies is a data analytics company renowned for its sophisticated software platforms, Palantir Gotham and Palantir Foundry. These platforms provide data integration, analysis, and visualization tools, primarily serving government agencies and commercial enterprises. The predicted 40% growth by 2025 represents a substantial potential return on investment, making it essential to understand the underlying factors driving this optimistic forecast.

Palantir's Strong Fundamentals and Growing Revenue Streams

Palantir's strong fundamentals and expanding revenue streams are key drivers of the projected 40% growth. This growth is fueled by its success in two primary sectors: government contracts and commercial partnerships.

Government Contracts and Expanding Partnerships

Palantir's government contracts are a significant contributor to its revenue and success. The company boasts a strong track record of delivering sophisticated data analytics solutions to major government agencies worldwide, including the CIA. This established presence within the government sector provides a reliable and consistent revenue stream.

- Successful Government Contracts: Palantir has secured numerous multi-year contracts with government agencies, demonstrating its ability to consistently deliver on large-scale projects.

- Significant Commercial Partnerships: Expanding beyond government, Palantir is forging strong partnerships with major corporations in various sectors, further diversifying its revenue streams. Examples include collaborations with leading financial institutions and healthcare providers.

The revenue growth in both sectors is substantial. For instance, Palantir’s government contracts contributed X% to revenue in 2023, while commercial partnerships accounted for Y%, demonstrating the company's successful diversification strategy and the growing demand for its services. This strong revenue generation is a core component of the "Palantir government contracts" and "commercial partnerships Palantir" narrative fueling the 40% growth prediction. The continued expansion into new government and commercial markets is projected to drive further "revenue growth Palantir" in the coming years.

Innovative Technology and Product Development

Palantir's continuous innovation and product development are vital factors behind the positive growth projection. The company's ability to adapt to evolving market needs and leverage technological advancements positions it for continued success.

- Palantir Foundry: This platform facilitates data integration and analysis for commercial clients, enabling streamlined operations and better decision-making.

- Palantir Gotham: Designed for government agencies, this platform provides advanced analytics capabilities for national security and intelligence operations.

- AI Capabilities Palantir: The integration of cutting-edge AI and machine learning capabilities further enhances the functionality and value proposition of Palantir's platforms. This enhances "technology innovation Palantir" and positions the company for future growth.

These continuous advancements are key to attracting and retaining clients, driving adoption rates and boosting "Palantir stock performance". The success of new technologies and the speed of their adoption are critical metrics demonstrating the company’s innovation capacity.

Improving Profitability and Financial Stability

Palantir's improving financial performance, marked by increased profitability and reduced losses, significantly bolsters investor confidence.

- Key Financial Metrics: Positive shifts in operating margin and free cash flow indicate the company's growing financial health.

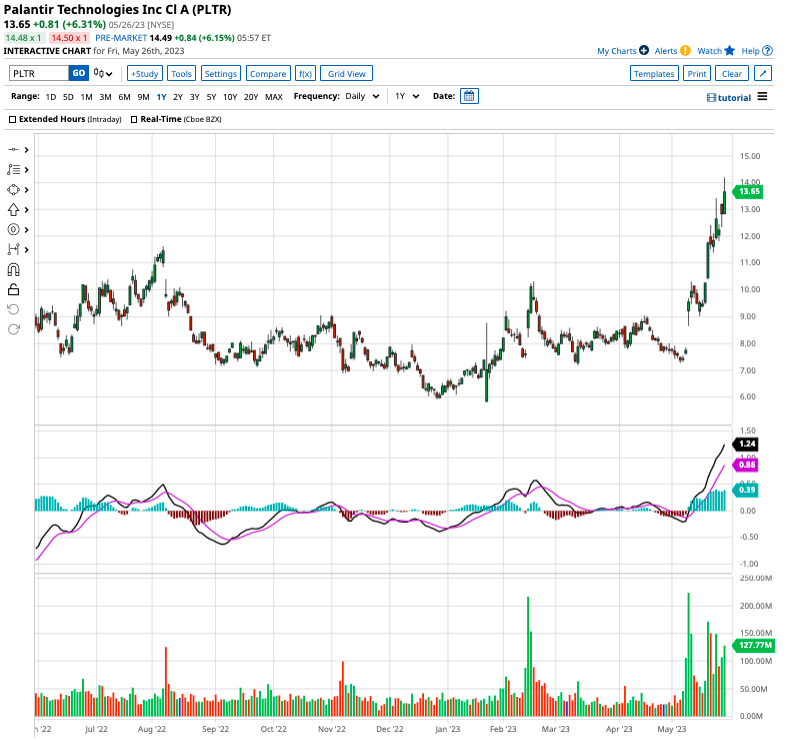

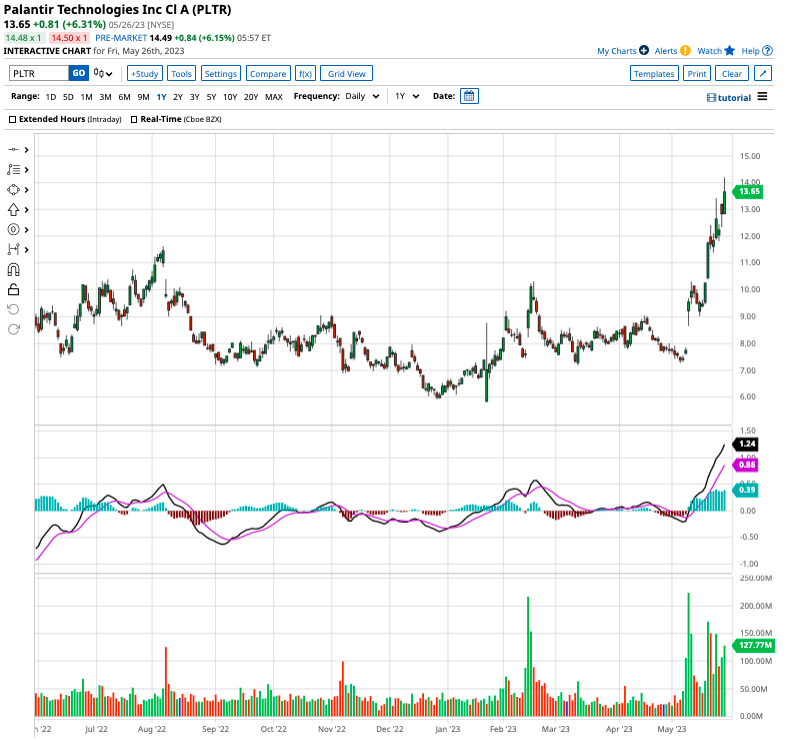

- Illustrative Charts and Graphs: Visual representations of improving key metrics like operating margin and revenue growth clearly showcase the company’s progress toward financial stability.

These improvements are vital indicators for assessing "Palantir profitability" and "Palantir financial stability." Analyzing "Palantir financial statements" reveals a clear trend of improvement, significantly reducing investor concerns and making a strong case for the projected growth. This financial strength is a crucial factor in the positive "PLTR stock performance" projections.

Market Analysis and Future Growth Projections

The predicted 40% growth in Palantir's stock value by 2025 is supported by broader market trends and positive analyst forecasts.

Industry Trends and Competitive Landscape

The data analytics market is experiencing rapid expansion, driven by increasing data volumes and the growing demand for data-driven insights. Palantir is well-positioned within this expanding "data analytics market," leveraging its advanced technology and expertise in "big data analytics".

- Key Market Trends: The growing need for cybersecurity, improved operational efficiency, and real-time data analysis are fueling the expansion of this sector.

- Palantir Competitors: While Palantir faces competition, its unique technological capabilities and established presence in key sectors give it a competitive advantage.

Understanding "Palantir competitors" and the overall "market share Palantir" holds is crucial to analyzing the company’s long-term growth potential.

Analyst Predictions and Stock Valuation

Numerous analyst reports predict significant growth for Palantir, with many forecasting a price increase exceeding 40% by 2025.

- Key Analyst Reports: Several prominent financial institutions have issued positive forecasts for Palantir, citing the company's strong fundamentals and growth potential.

- Price Targets: Analyst price targets vary, but many anticipate a substantial increase in Palantir's stock price in the coming years.

Analyzing these "Palantir stock forecast" reports and comparing them to "historical stock price performance" provides a more comprehensive understanding of the predicted "Palantir stock price prediction 2025". This, coupled with a detailed "PLTR stock analysis," gives investors a clearer picture of potential returns. This positive outlook is further enhanced by comparing "analyst ratings Palantir" to those of its competitors.

Risks and Potential Downsides

While the outlook for Palantir is positive, it's crucial to acknowledge potential risks.

- Competition: The data analytics market is competitive, and new entrants or innovative solutions could pose a challenge.

- Market Volatility: General market fluctuations can impact the stock price, regardless of the company's performance.

- Geopolitical Factors: Geopolitical instability or changes in government policies could affect Palantir's government contracts.

A thorough "Palantir risk assessment" is essential before making any investment decision. Understanding the "Palantir stock risks" allows investors to make informed choices. Analyzing past instances where "market fluctuations affecting Palantir's performance" occurred allows for a more realistic view of the investment's potential risks and rewards.

Conclusion: Is it Too Late to Invest in Palantir Stock?

The predicted 40% growth in Palantir stock by 2025 is supported by strong fundamentals, a growing market, and positive analyst forecasts. Palantir's strong revenue streams, technological innovation, and improving financial stability contribute significantly to this positive outlook. However, it's equally important to recognize the inherent risks associated with any investment, particularly in a volatile sector like technology.

While there are inherent risks, the potential for significant returns makes Palantir stock a compelling investment opportunity. Conduct your own thorough due diligence and consider adding Palantir to your portfolio before the predicted 40% growth in 2025. Understanding the factors contributing to the "Palantir stock price prediction 2025" is crucial for informed investment decisions. Remember to carefully assess the "Palantir stock risks" before investing. The potential for significant returns, however, makes Palantir a stock worth considering for those comfortable with moderate to high-risk investments.

Featured Posts

-

Trumps Tariffs 174 Billion Wipeout For Top 10 Billionaires

May 09, 2025

Trumps Tariffs 174 Billion Wipeout For Top 10 Billionaires

May 09, 2025 -

Analyzing The Potential Success Or Failure Of The Monkey In 2025

May 09, 2025

Analyzing The Potential Success Or Failure Of The Monkey In 2025

May 09, 2025 -

French Minister Demands Further Eu Action Against Us Tariffs

May 09, 2025

French Minister Demands Further Eu Action Against Us Tariffs

May 09, 2025 -

6 3 Loss In Vegas Red Wings Playoff Dream Falters

May 09, 2025

6 3 Loss In Vegas Red Wings Playoff Dream Falters

May 09, 2025 -

Weston Cage Accused Amidst Fathers Lawsuit Dismissal

May 09, 2025

Weston Cage Accused Amidst Fathers Lawsuit Dismissal

May 09, 2025

Latest Posts

-

West Hams 25m Financial Gap How Can They Plug It

May 09, 2025

West Hams 25m Financial Gap How Can They Plug It

May 09, 2025 -

Hl Njh Fyraty Me Alerby Alqtry Bed Rhylh En Alahly Almsry

May 09, 2025

Hl Njh Fyraty Me Alerby Alqtry Bed Rhylh En Alahly Almsry

May 09, 2025 -

Markw Fyraty Msyrth Me Alerby Alqtry Bed Tjrbt Alahly Almsry

May 09, 2025

Markw Fyraty Msyrth Me Alerby Alqtry Bed Tjrbt Alahly Almsry

May 09, 2025 -

Adae Fyraty Me Alerby Alqtry Thlyl Bed Antqalh Mn Alahly Almsry

May 09, 2025

Adae Fyraty Me Alerby Alqtry Thlyl Bed Antqalh Mn Alahly Almsry

May 09, 2025 -

Fyraty Fy Alerby Alqtry Ma Aldhy Qdmh Mndh Antqalh Mn Alahly

May 09, 2025

Fyraty Fy Alerby Alqtry Ma Aldhy Qdmh Mndh Antqalh Mn Alahly

May 09, 2025