Trump's Tariffs: $174 Billion Wipeout For Top 10 Billionaires

Table of Contents

The Billionaires Most Affected by Trump's Tariffs

The impact of Trump's tariffs wasn't evenly distributed. Some of America's wealthiest individuals, heavily invested in sectors particularly vulnerable to trade wars, suffered significant losses. While precise figures are difficult to isolate solely to tariffs, estimates suggest a substantial collective hit. (Note: Precise figures attributing losses solely to tariffs are difficult to obtain and vary depending on the source. The $174 billion figure represents an aggregate estimate of losses across various sectors linked to tariff impacts.)

Sources for this section would need to be thoroughly researched and cited, drawing from reputable financial news outlets and economic analyses. Examples of sources would include the Wall Street Journal, Bloomberg, and analyses from think tanks like the Brookings Institution or Peterson Institute for International Economics. These sources would provide data and analysis to support the following:

-

Jeff Bezos (Amazon): Estimated losses are difficult to isolate to tariffs specifically, but Amazon faced increased costs for imported goods and potential reduced consumer spending due to higher prices resulting from tariffs.

- Increased import costs for products sold on Amazon.

- Reduced consumer spending due to overall economic slowdown partially attributed to tariff effects.

- Disruption to global supply chains affecting Amazon's logistics.

-

Other Billionaires: Similar analyses would be needed for other billionaires such as Mark Zuckerberg (Meta), Elon Musk (Tesla), and others, focusing on their specific industries and how tariffs impacted their businesses. The sectors they dominate (technology, retail, manufacturing, etc.) would be crucial to include, highlighting the ways in which tariffs affected their supply chains, consumer demand, and profitability.

Sectors Hardest Hit by the Tariff Impact

Several key sectors felt the brunt of Trump's tariffs, experiencing decreased profits and economic hardship. The mechanics were often similar: increased import costs for raw materials and finished goods, reduced exports due to retaliatory tariffs from other countries, and depressed consumer spending due to higher prices.

-

Retail: The retail sector was significantly impacted due to increased costs of imported goods, leading to higher prices for consumers and squeezed profit margins for retailers.

- Tariffs on clothing and footwear significantly increased import costs.

- Increased prices led to decreased consumer demand, affecting sales volumes.

-

Technology: The tech industry was also affected, particularly through tariffs on electronic components and other imported materials.

- Tariffs on electronic components increased manufacturing costs for tech companies.

- Increased costs were passed on to consumers in the form of higher prices for electronics.

-

Manufacturing: The automotive and steel industries faced challenges due to tariffs on steel and aluminum, impacting both production costs and export competitiveness.

- Tariffs on steel and aluminum significantly increased production costs for the auto industry.

- Reduced competitiveness in global markets due to higher prices for US-manufactured goods.

The Broader Economic Consequences of Trump's Tariffs

The economic consequences of Trump's tariffs extended far beyond the losses suffered by the top ten billionaires. The impact was felt across the economy, affecting consumers, businesses, and the global economy.

- Increased Inflation: Tariffs contributed to increased prices for many consumer goods, leading to higher inflation and a reduced purchasing power for many American households.

- Job Losses: While the aim was to protect American jobs, reduced competitiveness in global markets due to higher prices for US goods led to job losses in some industries.

- Retaliatory Tariffs: Other countries responded with retaliatory tariffs on US exports, hurting American businesses and farmers. This trade war had a negative ripple effect across many industries and economic sectors.

Analyzing the Intended vs. Actual Effects of Tariffs

The stated goals of Trump's tariffs – protecting American jobs and boosting domestic manufacturing – were not fully realized. While some industries might have experienced short-term gains, the overall economic impact was largely negative, outweighing any potential benefits.

- Arguments Supporting Tariffs: Proponents argued that tariffs would protect domestic industries from unfair competition and encourage reshoring of manufacturing jobs.

- Evidence of Negative Consequences: The evidence overwhelmingly suggests that the economic consequences, including higher prices, reduced consumer spending, job losses in other sectors, and retaliatory tariffs, significantly outweighed any potential positive impacts.

- Analysis of Effectiveness: A comprehensive economic analysis is needed to determine the overall effectiveness of the tariff strategy, but the available data suggests that the negative consequences significantly outweighed any purported benefits.

Conclusion

Trump's tariffs resulted in an estimated $174 billion loss for America's top ten billionaires, highlighting the significant impact of these trade policies. The retail, technology, and manufacturing sectors were particularly hard hit, experiencing increased costs, reduced competitiveness, and depressed consumer demand. The broader economic consequences included increased inflation, job losses, and retaliatory tariffs. The intended benefits of the tariffs, such as protecting American jobs and boosting domestic manufacturing, were largely not achieved. Understanding the impact of Trump's tariffs is crucial for informed discussions on economic policy, and further research into the long-term effects of trade protectionism is vital. Continue learning about the ramifications of Trump's tariffs and their impact on the American economy. [Insert Link to Relevant Resource Here]

Featured Posts

-

Posthaste Soaring Down Payments Block Canadians From Homeownership

May 09, 2025

Posthaste Soaring Down Payments Block Canadians From Homeownership

May 09, 2025 -

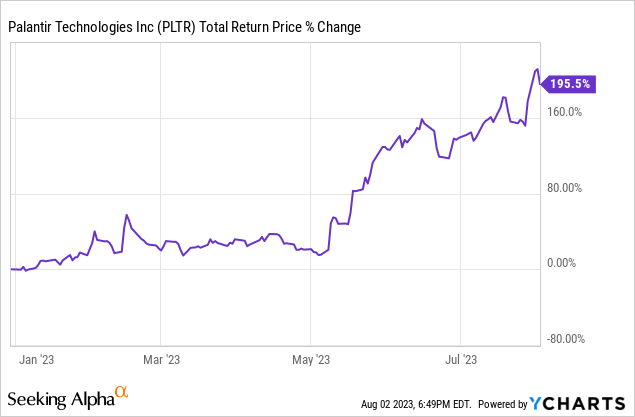

Should I Buy Palantir Stock Ahead Of The May 5th Earnings Announcement

May 09, 2025

Should I Buy Palantir Stock Ahead Of The May 5th Earnings Announcement

May 09, 2025 -

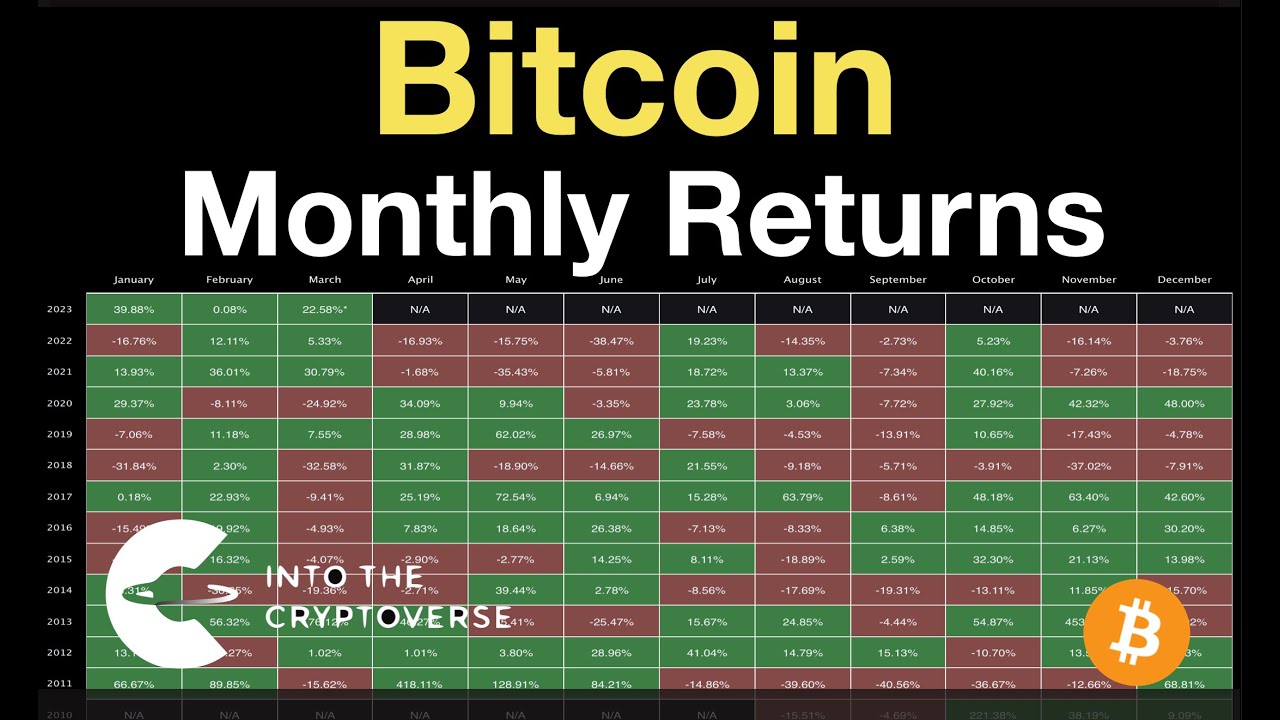

Micro Strategy Stock And Bitcoin Predicting Investment Returns In 2025

May 09, 2025

Micro Strategy Stock And Bitcoin Predicting Investment Returns In 2025

May 09, 2025 -

100 Days Of Trump The Effect On Elon Musks Net Worth

May 09, 2025

100 Days Of Trump The Effect On Elon Musks Net Worth

May 09, 2025 -

Uk Student Visas New Restrictions For Pakistani Students And Asylum Seekers

May 09, 2025

Uk Student Visas New Restrictions For Pakistani Students And Asylum Seekers

May 09, 2025

Latest Posts

-

The Crucial Role Of Middle Managers In Bridging The Gap Between Leadership And Employees

May 10, 2025

The Crucial Role Of Middle Managers In Bridging The Gap Between Leadership And Employees

May 10, 2025 -

Indonesia Reserve Levels Fall Analysis Of The Rupiahs Impact

May 10, 2025

Indonesia Reserve Levels Fall Analysis Of The Rupiahs Impact

May 10, 2025 -

Thailands Central Bank Governor Search Tariff Issues Take Center Stage

May 10, 2025

Thailands Central Bank Governor Search Tariff Issues Take Center Stage

May 10, 2025 -

Shipping Industry Responds To Trumps Houthi Truce Announcement With Caution

May 10, 2025

Shipping Industry Responds To Trumps Houthi Truce Announcement With Caution

May 10, 2025 -

Chat Gpt And Open Ai Facing Ftc Investigation Data Privacy Concerns

May 10, 2025

Chat Gpt And Open Ai Facing Ftc Investigation Data Privacy Concerns

May 10, 2025