Latest Oil Prices: Market News And Analysis For April 23

Table of Contents

The global energy market is constantly shifting, and understanding the latest oil prices is crucial for businesses and investors alike. The price of oil, a fundamental commodity impacting global economies, is influenced by a complex interplay of geopolitical events, supply chain dynamics, and evolving energy consumption patterns. This report provides a comprehensive analysis of oil prices as of April 23rd, examining the key factors influencing the market's direction. We'll explore crude oil prices, Brent crude prices, and discuss potential future trends, helping you navigate this dynamic market.

Crude Oil Price Movements on April 23

Opening Prices and Daily Volatility

The oil market experienced [insert level of volatility, e.g., moderate volatility] on April 23rd. Understanding the daily fluctuations is critical for informed decision-making.

- Opening Prices: WTI crude oil opened at $[Insert WTI Opening Price] per barrel, while Brent crude opened at $[Insert Brent Opening Price] per barrel.

- Daily Highs and Lows: WTI reached a high of $[Insert WTI High] and a low of $[Insert WTI Low] during the day's trading. Similarly, Brent crude saw a high of $[Insert Brent High] and a low of $[Insert Brent Low].

- Percentage Changes: WTI experienced a [Insert Percentage Change]% change from its opening price, while Brent saw a [Insert Percentage Change]% fluctuation. This volatility reflects the sensitivity of oil prices to various market forces.

Impact of Geopolitical Factors

Geopolitical events significantly influence oil prices, often causing sudden and substantial price swings. These events create uncertainty, impacting both supply and demand.

- Ongoing Conflicts: The ongoing conflict in [mention specific region/conflict] continues to disrupt oil supplies, contributing to price increases. [Explain how the conflict impacts supply chains and production].

- Sanctions and Trade Agreements: The impact of sanctions imposed on [mention specific country/countries] and any new trade agreements significantly affects global oil availability and pricing. [Explain how these actions influence the market].

- OPEC+ Decisions: Recent OPEC+ decisions regarding production quotas have [explain the impact - increased/decreased production, and the resulting effect on prices]. Market participants closely watch these announcements for their impact on oil supply and price stability.

Analysis of Brent Crude Oil Prices

Brent Crude Price Trends

Brent crude, a global benchmark for oil pricing, often moves in tandem with WTI but can exhibit independent trends. Analyzing these trends provides valuable insights into market dynamics.

- Brent Crude Daily Performance: Brent crude opened at $[Insert Brent Opening Price], reached a high of $[Insert Brent High], a low of $[Insert Brent Low], and closed at $[Insert Brent Closing Price].

- Comparison with WTI: The correlation between Brent and WTI prices was [strong/weak] on April 23rd. [Explain any divergence or convergence between the two benchmarks and the reasons behind it].

- Reasons for Divergence (if any): [Explain any specific factors contributing to divergence, such as regional demand differences, supply disruptions in specific regions affecting one benchmark more than the other, or speculation in the futures markets].

Influence of Demand and Supply

The fundamental principles of supply and demand remain the primary drivers of oil price fluctuations.

- Global Economic Growth: Strong global economic growth typically increases demand for oil, leading to higher prices. Conversely, economic slowdowns can reduce demand and lower prices. [Explain current economic conditions and their projected impact].

- Production Disruptions: Any disruptions in oil production, whether due to natural disasters, political instability, or maintenance issues, can significantly impact supply and drive up prices. [Cite any significant production disruptions].

- Strategic Petroleum Reserves: Government decisions regarding the release or withholding of strategic petroleum reserves can significantly influence market supply and, consequently, price levels. [Discuss any recent announcements regarding strategic reserves].

Future Oil Price Predictions and Outlook

Short-Term Price Forecasts

Predicting short-term oil prices is inherently challenging due to the market's volatile nature. However, based on current market conditions, several scenarios are possible.

- Price Range: Over the next week or month, WTI crude is expected to trade within a range of $[Insert Lower Bound] to $[Insert Upper Bound] per barrel, while Brent crude may fluctuate between $[Insert Lower Bound] and $[Insert Upper Bound].

- Factors Affecting Forecast Accuracy: The accuracy of this forecast is subject to several factors including unexpected geopolitical events, changes in OPEC+ production policies, and unforeseen supply chain disruptions.

- Potential Catalysts for Change: Significant price movements could be triggered by escalating geopolitical tensions, major supply disruptions, or unexpected shifts in global economic growth.

Long-Term Market Trends

The long-term outlook for oil prices is intertwined with the global energy transition towards renewable energy sources.

- Renewable Energy Growth: The increasing adoption of renewable energy sources, such as solar and wind power, is gradually reducing global oil demand. [Provide statistics and projections of renewable energy growth].

- Government Policies and Regulations: Government policies aimed at promoting renewable energy and reducing carbon emissions are shaping the long-term demand for oil. [Discuss relevant policies and their potential impact].

- Long-Term Price Outlook: The long-term outlook for oil prices depends on the pace of the energy transition and the effectiveness of policies aimed at reducing carbon emissions. It is expected that oil will remain relevant for some time, but its dominance will gradually decline.

Conclusion

This report provided an in-depth analysis of the latest oil prices as of April 23rd, examining the driving factors behind the fluctuations in both WTI and Brent crude oil. Geopolitical events, supply and demand dynamics, and long-term energy trends all play significant roles in shaping the oil market. Understanding these complex interactions is crucial for making informed investment and business decisions in this dynamic sector.

Call to Action: Stay informed about the latest oil price movements and market analysis by regularly checking back for updates on our website. We provide timely reporting on latest oil prices, crude oil prices, Brent crude prices, and in-depth market analysis to keep you ahead of the curve.

Featured Posts

-

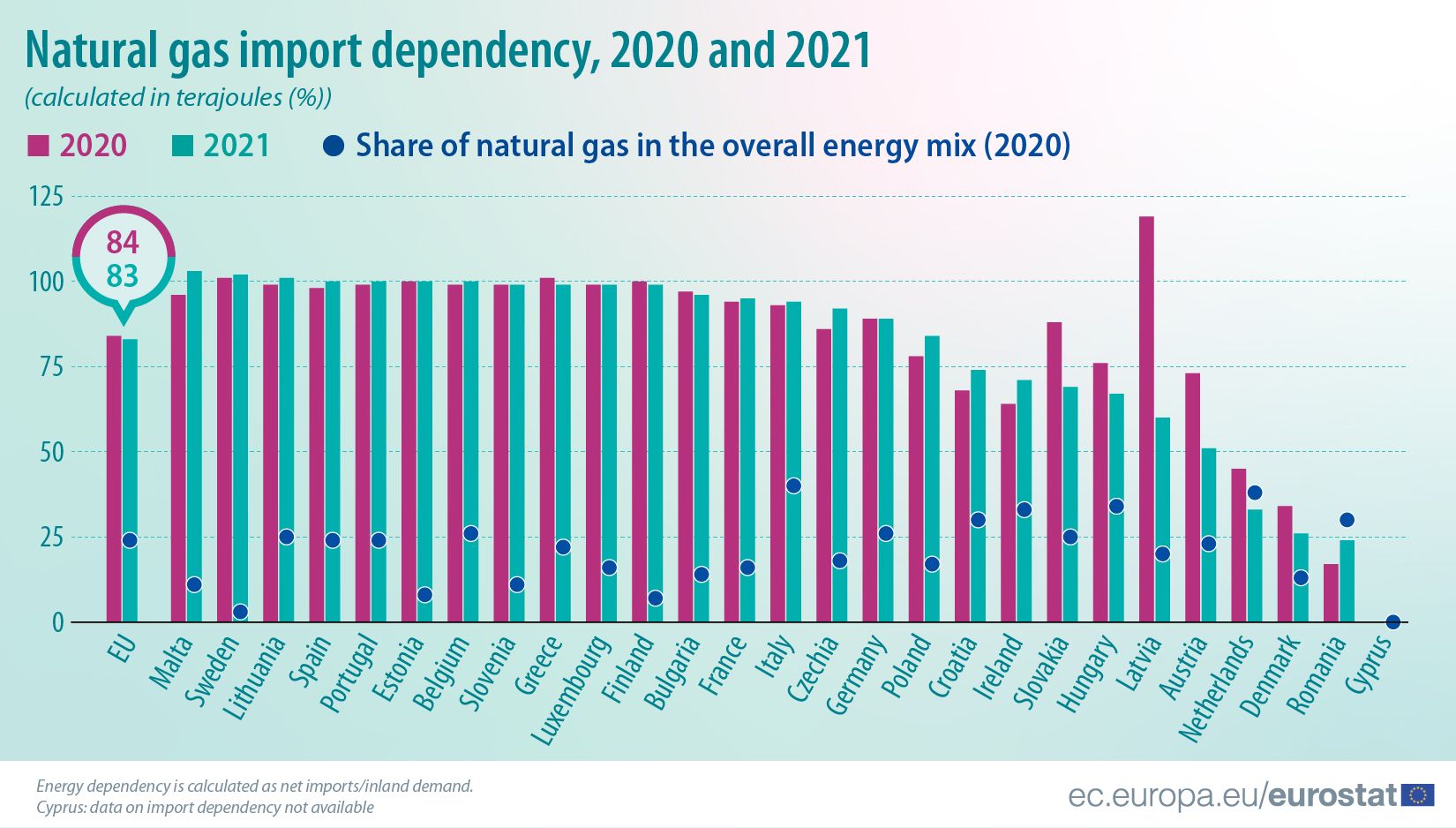

Eus Strategy To End Russian Gas Imports Spot Market Action Plan

Apr 24, 2025

Eus Strategy To End Russian Gas Imports Spot Market Action Plan

Apr 24, 2025 -

Legal Battles Hamper Trumps Immigration Policies

Apr 24, 2025

Legal Battles Hamper Trumps Immigration Policies

Apr 24, 2025 -

Deportation Flights A New Revenue Stream For A Startup Airline

Apr 24, 2025

Deportation Flights A New Revenue Stream For A Startup Airline

Apr 24, 2025 -

Niftys Upward Surge Analyzing The Positive Factors Driving Indias Market

Apr 24, 2025

Niftys Upward Surge Analyzing The Positive Factors Driving Indias Market

Apr 24, 2025 -

The Bold And The Beautiful April 23 Finn Vows To Liam Kellys Stepfathers Pledge

Apr 24, 2025

The Bold And The Beautiful April 23 Finn Vows To Liam Kellys Stepfathers Pledge

Apr 24, 2025