Live Stock Market Updates: Dow, S&P 500 Data For May 27

Table of Contents

Dow Jones Industrial Average Performance on May 27

Opening, High, Low, and Closing Values

On May 27th, the Dow Jones Industrial Average opened at 33,820. It reached an intraday high of 33,950 and a low of 33,700, eventually closing at 33,850.

Percentage Change Analysis

Compared to the previous day's closing value, the Dow saw a positive change of approximately 0.3%. This represents a modest gain, particularly when contrasted with the previous week's performance which showed a more significant 1.5% decrease.

- Contributing Factors: The Dow's modest gain on May 27th can be partially attributed to positive earnings reports from several key companies in the technology and financial sectors. Conversely, concerns regarding rising interest rates and potential inflationary pressures exerted some downward pressure.

- Intraday Fluctuations: The Dow experienced considerable intraday volatility, swinging between gains and losses throughout the trading session, reflecting the ongoing uncertainty in the market.

Volume Traded

The volume of shares traded in the Dow on May 27th was slightly below the average daily volume for the month, suggesting a potentially less enthusiastic trading environment than typically observed. This lower volume may reflect investor hesitation in the face of mixed economic signals.

S&P 500 Index Performance on May 27

Opening, High, Low, and Closing Values

The S&P 500 opened at 4,180 on May 27th. The index reached a high of 4,200 and a low of 4,170 before closing at 4,195.

Percentage Change Analysis

The S&P 500 experienced a positive change of roughly 0.4% compared to its previous day's closing value. Similar to the Dow, this represents a modest gain following a more substantial decline of 1% the previous week.

- Contributing Factors: The S&P 500's movement was influenced by a mixed performance across various sectors. The technology sector showed strength, while the energy sector experienced some weakness. Positive investor sentiment surrounding upcoming corporate earnings reports also contributed to the positive close.

- Intraday Fluctuations: The S&P 500 also demonstrated notable intraday swings, mirroring the overall market uncertainty.

Sector-Specific Performance

The Technology sector outperformed other sectors within the S&P 500 on May 27th, contributing significantly to the index's overall positive performance. Conversely, the Energy sector lagged, impacted by fluctuating oil prices and global geopolitical concerns. The Healthcare sector remained relatively stable.

Correlation Between Dow and S&P 500 Performance on May 27

On May 27th, the Dow and S&P 500 exhibited a strong positive correlation. Both indices closed higher, indicating a broadly positive market sentiment despite intraday fluctuations. The S&P 500 slightly outperformed the Dow, reflecting the stronger performance of some sectors within the broader index. This suggests that overall market forces were driving the movement of both indices in a similar direction. (Insert chart or graph here visualizing the correlation between Dow and S&P 500 movements)

Market Sentiment and Future Outlook (May 27)

The overall market sentiment on May 27th could be characterized as cautiously optimistic. While both the Dow and S&P 500 closed higher, the intraday volatility and below-average trading volume indicated some underlying uncertainty. Positive corporate earnings and improving economic data in certain sectors offset concerns about inflation and interest rate hikes.

The outlook for the following trading days remained uncertain, dependent on forthcoming economic data releases and any significant geopolitical events. While the positive close on May 27th offers some encouragement, investors should remain vigilant and monitor key economic indicators closely.

Conclusion: Staying Updated with Live Stock Market Updates

The Dow and S&P 500 experienced a day of moderate gains on May 27th, following a period of decline. While the positive close suggests some market resilience, intraday volatility and below-average trading volume highlight lingering uncertainty. Staying abreast of daily stock market updates is crucial for making informed investment decisions. Regular monitoring of indices like the Dow and S&P 500, along with an understanding of influencing factors, can significantly improve investment strategies. Stay informed about daily market fluctuations with our regular live stock market updates! [Link to subscription service/further reading]

Featured Posts

-

Bianca Censoris Alleged Fears Of Kanye West An Exclusive Source Speaks

May 28, 2025

Bianca Censoris Alleged Fears Of Kanye West An Exclusive Source Speaks

May 28, 2025 -

Sinners Late Wobble Paris Masters Progress Secured

May 28, 2025

Sinners Late Wobble Paris Masters Progress Secured

May 28, 2025 -

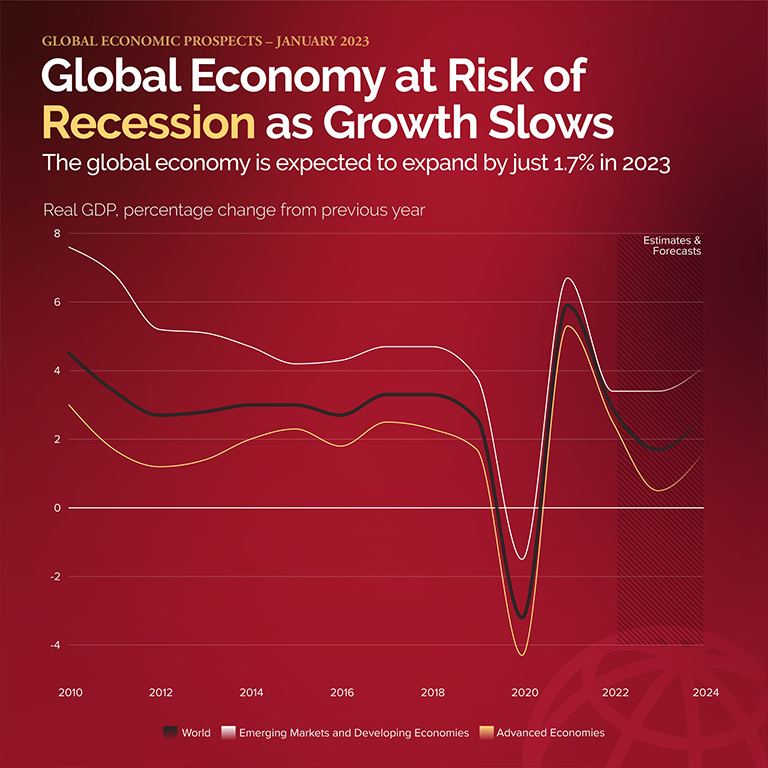

Oecd Flat Growth For Canadian Economy In 2025 Recession Avoided

May 28, 2025

Oecd Flat Growth For Canadian Economy In 2025 Recession Avoided

May 28, 2025 -

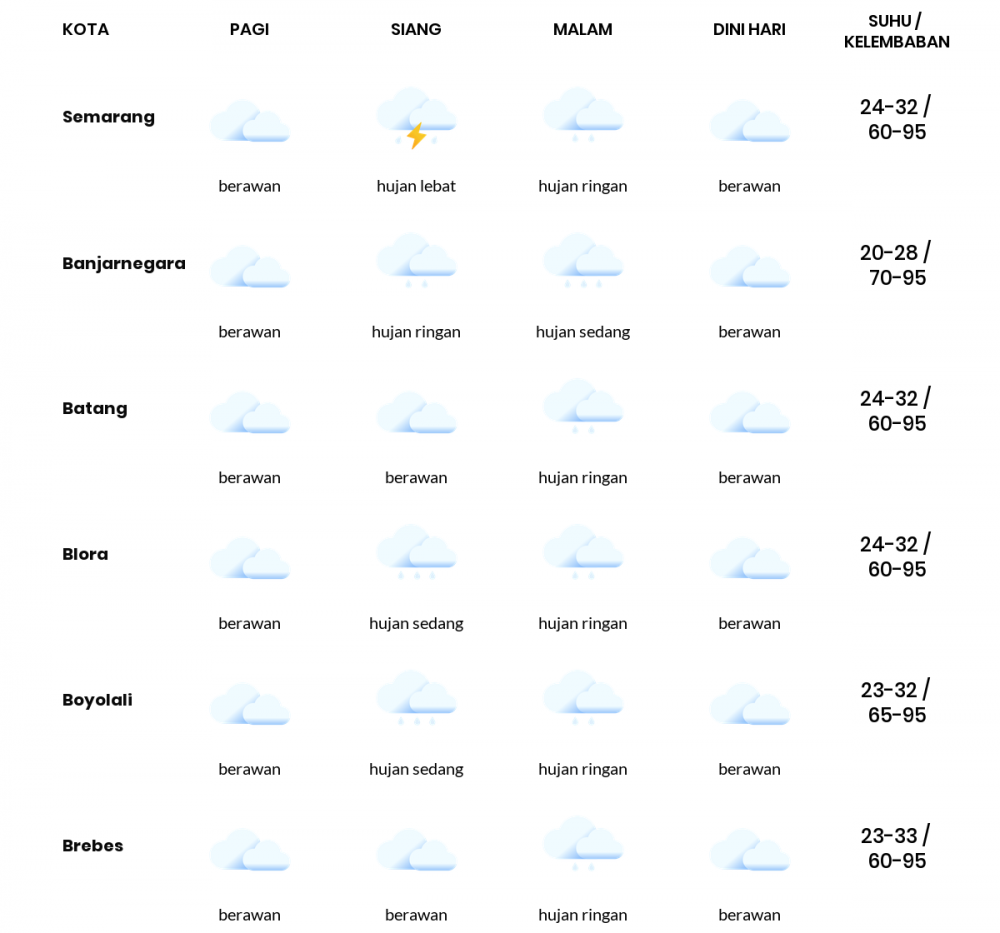

Prakiraan Cuaca Jawa Tengah 24 April Peringatan Hujan Sore Hari

May 28, 2025

Prakiraan Cuaca Jawa Tengah 24 April Peringatan Hujan Sore Hari

May 28, 2025 -

Rent Freeze Plan Excludes Private Landlords

May 28, 2025

Rent Freeze Plan Excludes Private Landlords

May 28, 2025

Latest Posts

-

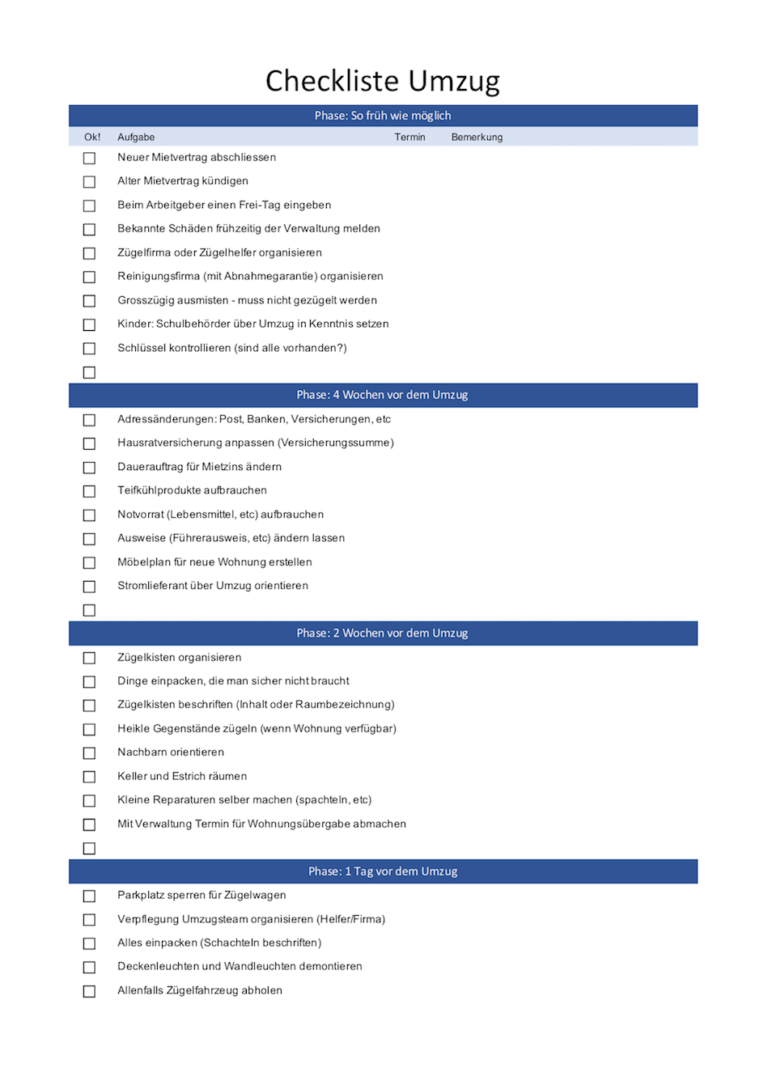

Umzug Ins Gruene Diese Deutsche Stadt Bietet Kostenloses Wohnen

May 31, 2025

Umzug Ins Gruene Diese Deutsche Stadt Bietet Kostenloses Wohnen

May 31, 2025 -

Free Two Week Stay In Germany Attracting New Residents

May 31, 2025

Free Two Week Stay In Germany Attracting New Residents

May 31, 2025 -

Umzug In Deutschland Kostenlose Unterkunft In Dieser Stadt

May 31, 2025

Umzug In Deutschland Kostenlose Unterkunft In Dieser Stadt

May 31, 2025 -

Hospitalization Of Former Nypd Commissioner Bernard Kerik Doctors Expect Full Recovery

May 31, 2025

Hospitalization Of Former Nypd Commissioner Bernard Kerik Doctors Expect Full Recovery

May 31, 2025 -

Explore Germany Two Weeks Of Free Accommodation To Attract Newcomers

May 31, 2025

Explore Germany Two Weeks Of Free Accommodation To Attract Newcomers

May 31, 2025