Loblaw Adds More Canadian Products, But CEO Questions Long-Term Demand

Table of Contents

Loblaw's Increased Focus on Canadian-Made Goods

Loblaw's commitment to showcasing more Canadian products is evident in several recent initiatives. The company has actively sought out partnerships with smaller, homegrown suppliers and dedicated significant shelf space to highlight these domestic products. This strategy aims to tap into the growing consumer preference for locally sourced goods and bolster the Canadian economy.

- Specific examples: Loblaw has recently introduced several new lines of Canadian-made cheeses, organic produce from local farms, and artisanal baking products to its stores across the country. Specific brands and product lines could be named here if available (e.g., "Partnering with Maple Leaf Foods to expand their presence in our stores").

- Supplier support initiatives: Beyond increased shelf space, Loblaw has implemented marketing campaigns specifically promoting Canadian-made products within their stores and online platforms. This includes dedicated sections on their website and in-store signage highlighting the origin of the products. There may be information about financial assistance or other support programs offered to Canadian suppliers.

- Official statements: Any official press releases or statements from Loblaw confirming their commitment to increasing the availability of Canadian products should be cited here, providing verifiable support for the claims made.

CEO's Concerns about Long-Term Demand for Canadian Products

Despite the strategic push, Loblaw's CEO has expressed reservations about the long-term sustainability of consumer demand for Canadian products. This apprehension stems from several key factors.

- Direct quotes: Include direct quotes from the CEO, if available, expressing concerns about the potential for fluctuations in consumer demand for domestically produced goods. This provides authentic insight into the company's internal perspective.

- Economic factors: The current economic climate plays a crucial role. Inflation and economic uncertainty are leading many consumers to prioritize price over origin, potentially impacting the demand for sometimes more expensive Canadian products. This section should analyze the interplay between economic factors and consumer purchasing decisions.

- Consumer trends: While there is a growing interest in supporting local businesses and buying Canadian, consumer preferences are fluid and influenced by various factors. Analyzing the overall trend regarding consumer preference for local versus imported goods will add depth to this section. This could include discussing the impact of social media and marketing campaigns on consumer choices.

Analyzing the Market: Opportunities and Challenges for Canadian Suppliers

The increased focus on Canadian products presents both significant opportunities and considerable challenges for the suppliers partnering with Loblaw.

- Market access and brand visibility: For smaller Canadian suppliers, gaining access to Loblaw's extensive network of stores offers unparalleled market reach and brand visibility, potentially leading to significant business growth.

- Pricing and supply chain challenges: Meeting Loblaw's stringent pricing requirements while maintaining consistent supply can be difficult for smaller businesses, particularly given the complexities of local supply chains. Fluctuations in crop yields or production issues could pose significant risks.

- Government support: The Canadian government often offers various initiatives to support domestic businesses. This section could discuss how government programs might facilitate the success of these partnerships, such as subsidies, grants, or tax incentives for local producers.

The Future of Canadian Products at Loblaw – A Call to Action

In summary, Loblaw's expansion of Canadian products represents a bold move with the potential to benefit both the Canadian economy and consumers. However, the CEO's concerns regarding long-term consumer demand highlight the inherent risks associated with this strategy. The success of this initiative hinges on several factors, including maintaining competitive pricing, navigating a potentially volatile economic landscape, and fostering strong, mutually beneficial relationships with Canadian suppliers. The future of Canadian-made goods in major grocery chains remains uncertain, dependent on both consumer behaviour and Loblaw’s ability to successfully manage this complex endeavor.

What do you think about Loblaw’s focus on Canadian products? Will this strategy succeed in the long term? Share your views in the comments below! Let's continue the conversation about the future of Canadian products and Loblaw's role in shaping that future.

Featured Posts

-

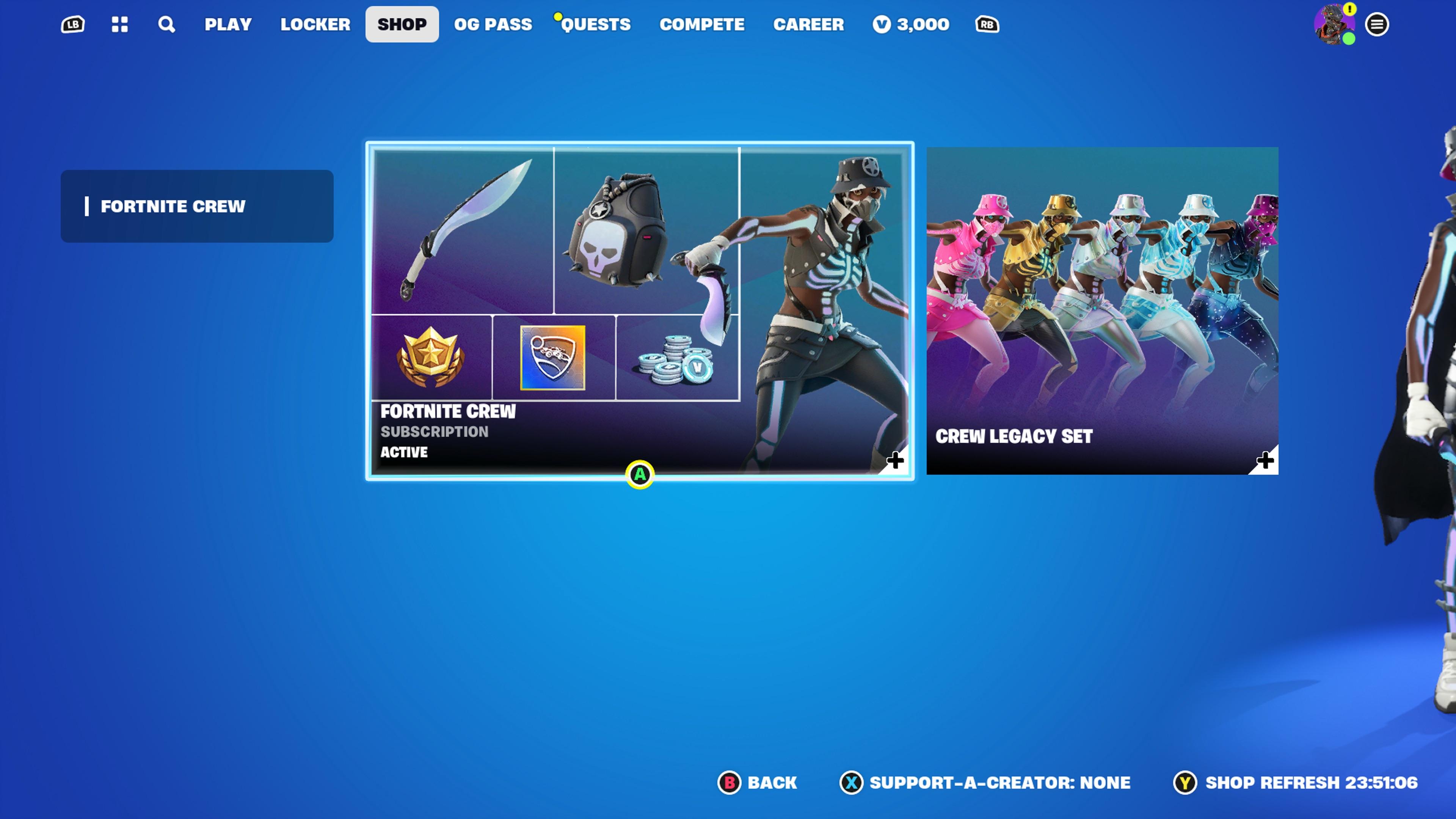

Fortnite Fans Furious Over Latest Item Shop Update

May 02, 2025

Fortnite Fans Furious Over Latest Item Shop Update

May 02, 2025 -

Loblaw Adds More Canadian Products But Ceo Questions Long Term Demand

May 02, 2025

Loblaw Adds More Canadian Products But Ceo Questions Long Term Demand

May 02, 2025 -

Medvedev Missili Nucleari E Russofobia La Terapia Dell Ue

May 02, 2025

Medvedev Missili Nucleari E Russofobia La Terapia Dell Ue

May 02, 2025 -

Remembering Priscilla Pointer Dalla Star Passes Away At 100

May 02, 2025

Remembering Priscilla Pointer Dalla Star Passes Away At 100

May 02, 2025 -

England Women Vs Spain Women World Cup Final Lineup Predictions And Analysis

May 02, 2025

England Women Vs Spain Women World Cup Final Lineup Predictions And Analysis

May 02, 2025

Latest Posts

-

Mshahyr Krt Alqdm Aldhyn Tathrwa Baltdkhyn

May 10, 2025

Mshahyr Krt Alqdm Aldhyn Tathrwa Baltdkhyn

May 10, 2025 -

Ma Qdmh Fyraty Me Alerby Alqtry Bed Andmamh Mn Alahly Almsry

May 10, 2025

Ma Qdmh Fyraty Me Alerby Alqtry Bed Andmamh Mn Alahly Almsry

May 10, 2025 -

Abrz Almdkhnyn Fy Tarykh Krt Alqdm

May 10, 2025

Abrz Almdkhnyn Fy Tarykh Krt Alqdm

May 10, 2025 -

Rhlt Fyraty Mn Alahly Almsry Ila Alerby Alqtry Ihsayyat Wadae

May 10, 2025

Rhlt Fyraty Mn Alahly Almsry Ila Alerby Alqtry Ihsayyat Wadae

May 10, 2025 -

Njwm Krt Alqdm Waltbgh Drast Fy Altnaqdat

May 10, 2025

Njwm Krt Alqdm Waltbgh Drast Fy Altnaqdat

May 10, 2025