Low Inflation Now: A Podcast On Smart Financial Choices

Table of Contents

Understanding Low Inflation and its Implications

What is Low Inflation and Why Does it Matter?

Low inflation refers to a slow and steady increase in the general price level of goods and services in an economy. Currently, many developed nations are experiencing inflation rates significantly below historical averages. Understanding the difference between low inflation, deflation (a decrease in prices), and high inflation is crucial. High inflation erodes purchasing power rapidly, while deflation can discourage spending and investment. Low inflation, however, provides a relatively stable economic environment, allowing for more predictable financial planning. The positive impacts include stable prices, encouraging consumer spending and business investment. However, persistently low inflation can also signal weak economic growth and potentially lead to deflationary pressures. Keywords: low inflation, deflation, inflation rate, economic impact, purchasing power

Low Inflation's Effect on Savings and Investments

Low inflation directly impacts the real return on your savings. When inflation is low, the interest earned on savings accounts and bonds retains more of its purchasing power. However, low interest rates often accompany low inflation, meaning your returns might still be modest. This necessitates a careful review of your investment strategies.

- Savings Accounts: While providing security, savings accounts often yield returns below the inflation rate, leading to a net loss in purchasing power in high-inflation environments. In low-inflation periods, this loss is minimized.

- Bonds: Bonds, typically considered low-risk investments, can also underperform during low-inflation periods if interest rates remain low.

- Opportunity Cost: Holding a significant amount of cash in a low-inflation environment presents an opportunity cost, as the money could be earning a potentially higher return through other investments. Keywords: savings accounts, bonds, investment strategies, real return, opportunity cost

Smart Financial Choices in a Low-Inflation Environment

Strategies to Maximize Your Financial Position

Low inflation presents a unique opportunity to strengthen your financial position. With potentially lower borrowing costs, it's an ideal time to focus on debt reduction. Aggressive repayment strategies can significantly reduce your long-term financial burden. Simultaneously, consider investing in assets that have historically outperformed inflation.

- Debt Reduction: Prioritize high-interest debt repayment, such as credit cards. Lower interest rates make it easier to pay down debt faster.

- Investment Options: Diversify your portfolio across different asset classes. Stocks, real estate, and other growth-oriented investments can potentially offer higher returns than savings accounts or bonds in a low-inflation environment.

- Increasing Investment Contributions: Take advantage of low inflation and potentially lower living costs to increase your regular investment contributions to maximize long-term growth. Keywords: debt reduction, investment options, stocks, real estate, investment contributions

Protecting Your Wealth During Low Inflation

While low inflation is generally favorable, it’s crucial to consider potential future shifts. Diversification remains key, shielding your portfolio from unexpected inflation spikes.

- Diversification: Spread your investments across various asset classes (stocks, bonds, real estate, commodities) to reduce risk.

- Inflation Hedge: Consider including inflation-hedging assets in your portfolio. These assets tend to retain or increase their value during inflationary periods. Examples include commodities (gold, oil) and real estate.

- Financial Plan Adjustment: Regularly review and adjust your financial plan based on updated inflation expectations. Economic forecasts and inflation predictions can inform your investment decisions and risk tolerance. Keywords: diversification, inflation hedge, financial planning, inflation expectations

Resources and Further Learning

Where to Find More Information

For a deeper dive into these strategies, listen to our podcast episode on smart financial choices during low inflation: [Insert Podcast Link Here]. You can also find helpful resources on personal finance at [Insert Links to Relevant Articles/Websites Here]. Several online financial tools and calculators can assist with budgeting and investment planning. Keywords: personal finance, financial resources, financial tools, budgeting

Making the Most of Low Inflation Now

In conclusion, understanding the implications of low inflation is crucial for making informed financial decisions. By actively managing your debt, diversifying your investments, and regularly reviewing your financial plan, you can effectively leverage this economic environment to strengthen your financial position. Take control of your finances during this period of low inflation. Listen to our podcast and start making smart financial choices today! Keywords: low inflation, smart financial choices, financial planning, podcast

Featured Posts

-

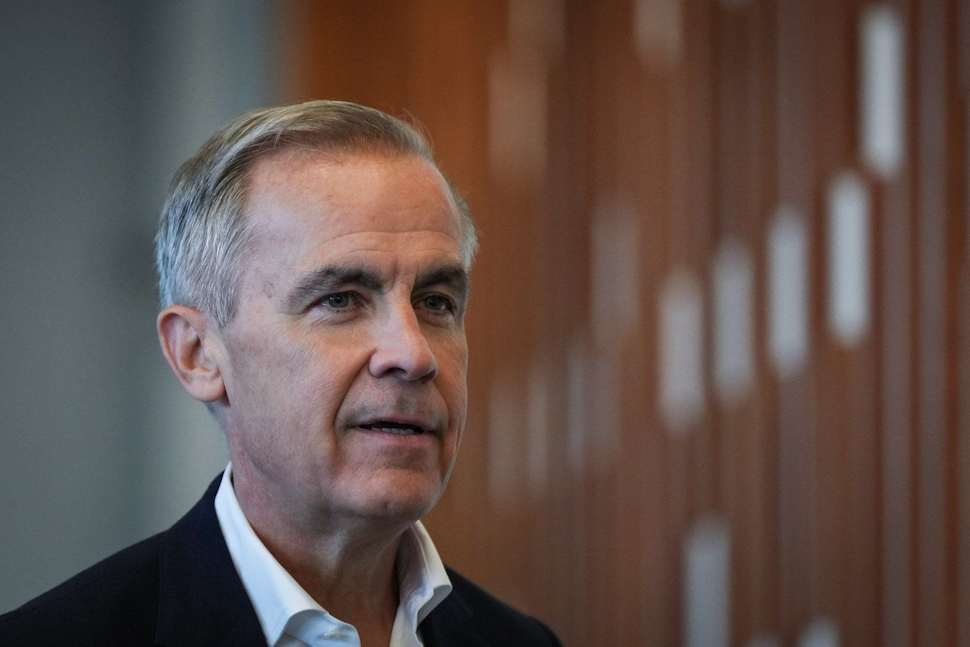

Mark Carneys Leadership Secure Canadas Liberals Halt Rule Changes

May 27, 2025

Mark Carneys Leadership Secure Canadas Liberals Halt Rule Changes

May 27, 2025 -

The Sex Lives Of College Girls Cancelled After Three Seasons On Max

May 27, 2025

The Sex Lives Of College Girls Cancelled After Three Seasons On Max

May 27, 2025 -

Alien Vs Predator Hulus Alien Earth Teaser Ignites Fan Theories

May 27, 2025

Alien Vs Predator Hulus Alien Earth Teaser Ignites Fan Theories

May 27, 2025 -

Robert F Kennedy Odtajnione Dokumenty I Nieznane Fakty Dotyczace Zamachu

May 27, 2025

Robert F Kennedy Odtajnione Dokumenty I Nieznane Fakty Dotyczace Zamachu

May 27, 2025 -

Experience Ringo And Friends Your Guide To The Cbs Country Music Event At The Ryman

May 27, 2025

Experience Ringo And Friends Your Guide To The Cbs Country Music Event At The Ryman

May 27, 2025

Latest Posts

-

Deutsche Bank And Ibm A Partnership Driving Digital Innovation

May 30, 2025

Deutsche Bank And Ibm A Partnership Driving Digital Innovation

May 30, 2025 -

Review Of Sparks Mad Album A Comprehensive Assessment

May 30, 2025

Review Of Sparks Mad Album A Comprehensive Assessment

May 30, 2025 -

Deutsche Banks Digital Transformation Accelerated By Ibm Software

May 30, 2025

Deutsche Banks Digital Transformation Accelerated By Ibm Software

May 30, 2025 -

Friday Forecast Continued Drop For Live Music Stocks

May 30, 2025

Friday Forecast Continued Drop For Live Music Stocks

May 30, 2025 -

Dara O Briain How His Voice Of Reason Challenges And Entertains

May 30, 2025

Dara O Briain How His Voice Of Reason Challenges And Entertains

May 30, 2025