Lower Tesla Q1 Profits: Examining The Political And Economic Context

Table of Contents

The Impact of Global Economic Slowdown on Tesla's Q1 Performance

The global economic slowdown significantly impacted Tesla's Q1 performance, affecting both consumer demand and production costs.

Reduced Consumer Spending and Demand

- Decreased consumer confidence: Global uncertainty fueled by inflation and geopolitical tensions led to reduced consumer confidence, impacting discretionary spending on high-value items like electric vehicles.

- Inflation impacting purchasing power: Soaring inflation eroded consumer purchasing power, making Tesla vehicles less affordable for many potential buyers. The rising cost of living forced consumers to prioritize essential spending over luxury purchases.

- Rising interest rates affecting affordability: Increased interest rates made financing new vehicles more expensive, further impacting affordability and reducing demand.

Data points: While specific Q1 2024 data may not be fully available yet, consider referencing previous quarter's data and comparing it to current economic indicators. For instance, cite statistics on consumer confidence indices (like the Consumer Confidence Index), inflation rates (CPI), and prevailing interest rates from reliable sources. Mention the percentage change in vehicle sales compared to the previous quarter or year.

Analysis: The combined effect of these economic factors directly translated into lower sales volumes for Tesla during Q1, impacting revenue and consequently, profits. The reduced demand forced Tesla to adjust its strategies, leading to further challenges.

Supply Chain Disruptions and Increased Production Costs

- Raw material price fluctuations: Fluctuations in the prices of crucial raw materials like lithium, nickel, and cobalt, essential for battery production, increased production costs.

- Logistical challenges: Global supply chain disruptions continued to pose challenges, leading to delays in receiving vital components and impacting production schedules.

- Labor costs: Rising labor costs in various regions further contributed to increased production expenses.

Data points: Include data on price changes for key raw materials from reputable sources, referencing percentage increases or decreases over specific periods. Mention any reported production delays or capacity constraints experienced by Tesla.

Analysis: These supply chain disruptions and escalating production costs squeezed Tesla's profit margins, further contributing to the lower-than-expected Q1 profits. Efficient management of the supply chain will remain crucial for future profitability.

Geopolitical Instability and its Influence on Tesla's Global Operations

Geopolitical instability played a considerable role in influencing Tesla's Q1 results, impacting both supply chains and market access.

The Impact of the War in Ukraine

- Disruptions to the supply of crucial materials: The ongoing war in Ukraine disrupted the supply of several crucial materials, including those used in battery production, impacting Tesla's manufacturing process.

- Impact on energy prices: The war exacerbated global energy price volatility, increasing production costs and impacting overall operational expenses.

- General market uncertainty: The geopolitical uncertainty created a volatile market environment, making it challenging to forecast demand and manage risk effectively.

Data points: Include statistics on energy price fluctuations (e.g., oil and natural gas prices) and any reported disruptions to Tesla's supply chains due to the war in Ukraine. Reference any official statements from Tesla regarding these issues.

Analysis: The war in Ukraine created a ripple effect throughout Tesla's global operations, impacting supply chains, increasing costs, and reducing predictability, all of which contributed to lower Q1 profits.

Navigating Trade Wars and Regulatory Hurdles

- Specific trade disputes: Tesla faces ongoing trade disputes and tariffs in various global markets, increasing the cost of exporting vehicles and potentially limiting market access.

- Tariffs: Import tariffs and other trade barriers in key markets increased the price of Tesla vehicles for consumers in those regions, affecting demand and profitability.

- Changing regulations: Evolving regulations and standards in different countries pose challenges for Tesla in terms of compliance and market entry.

Data points: Include information on specific tariffs or trade disputes impacting Tesla's operations in particular regions. Reference any regulatory changes that might have affected Tesla's sales or production in specific markets.

Analysis: Navigating these complex trade and regulatory environments presents continuous challenges for Tesla, demanding significant resources and impacting the company’s bottom line.

The Role of Price Wars and Competitive Pressure on Tesla's Profitability

Increased competition and price wars played a significant role in Tesla's Q1 profit reduction.

Aggressive Pricing Strategies by Competitors

- Actions of competitors like BYD: Aggressive pricing strategies by competitors like BYD, offering comparable electric vehicles at lower prices, put pressure on Tesla's market share and pricing strategies.

- Impact on Tesla's market share: The intensified competition eroded Tesla's dominance in certain market segments, impacting sales volume and revenue.

- Impact on Tesla’s pricing strategies: Tesla responded with its own price cuts, which although increased sales volume, also affected profit margins.

Data points: Include pricing comparisons between Tesla vehicles and those of its main competitors, particularly BYD. Show comparative sales data to illustrate changes in market share.

Analysis: The competitive landscape is becoming increasingly intense, requiring Tesla to adapt its strategies to maintain market share, but this could be at the cost of profitability in the short term.

Tesla's Own Pricing Decisions and Their Impact on Profitability

- Tesla's price cuts: Tesla implemented significant price cuts across its vehicle lineup in an attempt to stimulate demand and maintain market share.

- Effect on sales volume: The price cuts did lead to increased sales volume in some regions, although the overall impact was likely mixed.

- Profit per unit: The price reductions directly impacted profit margins per vehicle sold, which is a major factor contributing to lower overall profitability.

Data points: Include sales figures and profit margin data before and after Tesla's price changes. Illustrate the trade-off between volume and profitability.

Analysis: Tesla's pricing strategy reflects a delicate balancing act between maintaining market share and securing healthy profit margins. The Q1 results show that this balance is currently a challenge.

Conclusion: Understanding Lower Tesla Q1 Profits – A Path Forward

Tesla's reduced Q1 profits stem from a confluence of factors: a global economic slowdown impacting consumer demand and production costs, geopolitical instability disrupting supply chains and market access, and intensifying competition leading to price wars and margin compression. While challenges remain, Tesla's innovative capabilities and strong brand recognition offer potential opportunities for future growth. However, navigating these complex economic and political landscapes requires strategic adaptation and effective risk management.

Stay updated on future Tesla profit reports and analysis to understand how the company navigates these challenges and capitalizes on emerging opportunities. Understanding the dynamics of lower Tesla Q1 profits and their underlying causes is crucial for assessing the overall health of the electric vehicle industry and the broader global economy. Learn more about navigating the complexities of the automotive industry in times of economic and political uncertainty by subscribing to our newsletter or following us on social media.

Featured Posts

-

Post Roe America How Otc Birth Control Impacts Womens Health

Apr 24, 2025

Post Roe America How Otc Birth Control Impacts Womens Health

Apr 24, 2025 -

Teslas Q1 Profit Plunge A Deeper Look At The Causes

Apr 24, 2025

Teslas Q1 Profit Plunge A Deeper Look At The Causes

Apr 24, 2025 -

Is Google Fis 35 Unlimited Plan Worth It

Apr 24, 2025

Is Google Fis 35 Unlimited Plan Worth It

Apr 24, 2025 -

Tzon Travolta Mnimi Gia Ton Tzin Xakman

Apr 24, 2025

Tzon Travolta Mnimi Gia Ton Tzin Xakman

Apr 24, 2025 -

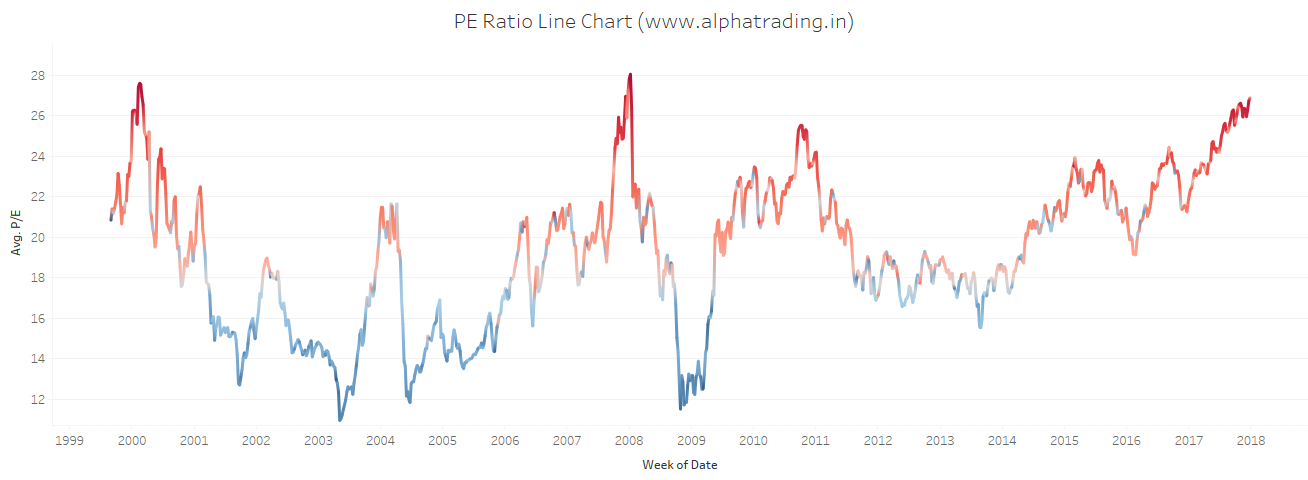

Analyzing The Current Trends In The Indian Stock Market Niftys Momentum

Apr 24, 2025

Analyzing The Current Trends In The Indian Stock Market Niftys Momentum

Apr 24, 2025