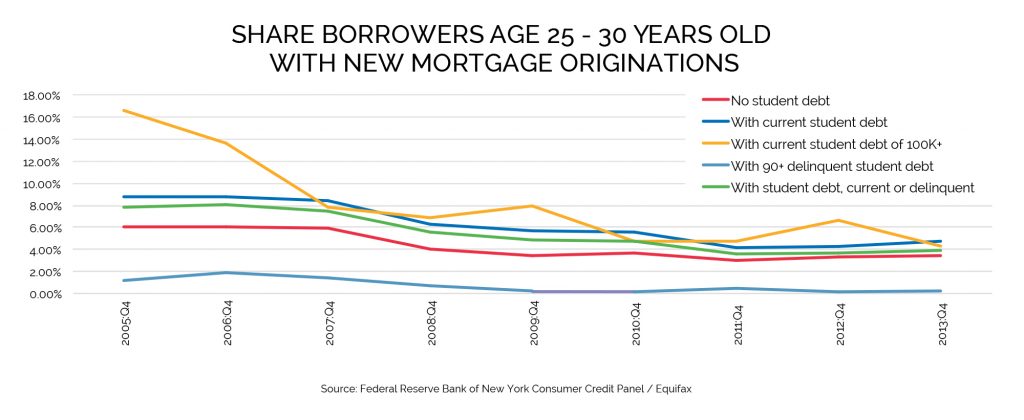

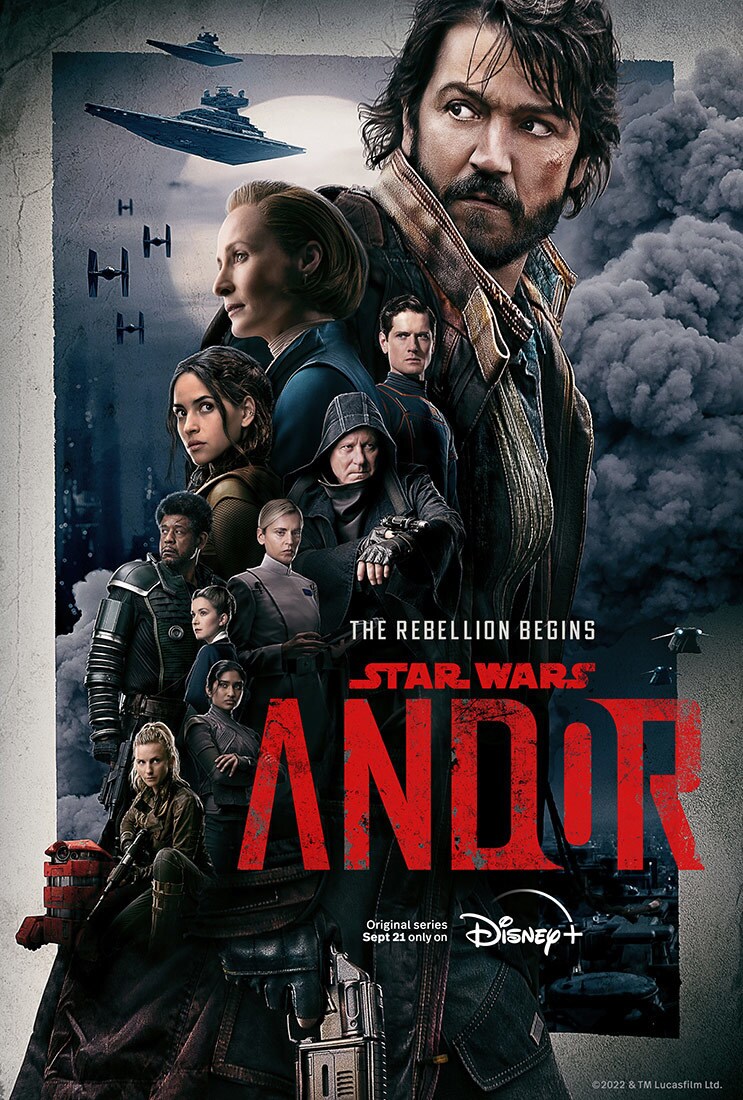

Managing Student Loan Debt To Achieve Homeownership

Table of Contents

Understanding Your Student Loan Debt

Before charting a course towards homeownership, it's crucial to fully understand your student loan landscape. This involves assessing your loan types, repayment plans, and overall debt burden.

Assessing Your Loan Types and Repayment Plans

Understanding your student loans – federal versus private – is paramount. Federal student loans often offer more flexible repayment options and protections, while private loans typically have stricter terms. Interest rates vary significantly, impacting your overall repayment costs. Familiarize yourself with the different repayment plans available:

- Standard Repayment Plan: Fixed monthly payments over 10 years. Pros: Predictable payments, faster payoff. Cons: Higher monthly payments, potentially less flexible.

- Income-Driven Repayment (IDR) Plans: Monthly payments are based on your income and family size. Pros: Lower monthly payments, potential for loan forgiveness after 20-25 years. Cons: Longer repayment periods, potential for more interest accumulation over time.

- Graduated Repayment Plan: Payments start low and gradually increase over time. Pros: Lower initial payments. Cons: Payments significantly increase later, potentially causing financial strain.

- Extended Repayment Plan: Longer repayment period (up to 25 years), resulting in lower monthly payments. Pros: Lower monthly payments. Cons: Significantly more interest paid over the life of the loan.

Consider loan consolidation to simplify repayment by combining multiple loans into a single one. This can sometimes lead to a lower interest rate, but carefully compare offers before consolidating. Choosing the right repayment plan is crucial for managing your monthly budget and achieving your homeownership goals.

Creating a Realistic Budget

Budgeting is the cornerstone of successful debt management and homeownership savings. A detailed budget helps you visualize your income and expenses, allowing you to allocate funds effectively for both student loan repayments and homeownership savings.

- Utilize budgeting tools and apps: Mint, YNAB (You Need A Budget), and Personal Capital are popular options that can track your spending and help you create a budget.

- Categorize your expenses: Track spending in key categories such as housing, food, transportation, utilities, debt repayment, and savings.

- Employ the 50/30/20 rule: Allocate 50% of your after-tax income to needs, 30% to wants, and 20% to savings and debt repayment.

By meticulously tracking your spending and adjusting your budget as needed, you can free up funds for both your student loan payments and homeownership savings.

Strategies for Reducing Student Loan Debt

Several effective strategies can accelerate your student loan repayment and free up resources for your homeownership journey.

Exploring Debt Repayment Strategies

Different debt repayment methods exist, each with its own set of advantages and disadvantages:

- Debt Avalanche Method: Prioritize paying off the loan with the highest interest rate first. Pros: Minimizes total interest paid. Cons: Can be demotivating if the highest-interest loan has a large balance.

- Debt Snowball Method: Prioritize paying off the loan with the smallest balance first, regardless of the interest rate. Pros: Provides early wins and boosts motivation. Cons: May lead to paying more interest in the long run.

- Hybrid Method: Combine elements of both the avalanche and snowball methods, focusing on high-interest loans while also addressing smaller balances for motivation.

Choose the strategy that aligns best with your financial situation and motivation. Remember, consistency is key.

Improving Your Credit Score

A strong credit score is essential for securing a favorable mortgage. Lenders consider your creditworthiness when determining your eligibility for a loan and the interest rate they offer. Factors impacting your credit score include:

- Payment History: Consistent on-time payments are crucial (35% of your score).

- Amounts Owed: Keep your credit utilization low (30%).

- Length of Credit History: A longer credit history is generally better (15%).

- New Credit: Avoid opening many new accounts in a short period (10%).

- Credit Mix: Having a mix of credit accounts (credit cards, loans) can help (10%).

Regularly check your credit report for errors and take steps to improve your credit score before applying for a mortgage.

Saving for a Down Payment While Managing Debt

Saving for a down payment while managing student loan debt requires a dedicated savings plan and potentially exploring additional financial assistance.

Developing a Savings Plan

Create a realistic savings plan with specific goals and timelines.

- Utilize high-yield savings accounts: Earn a higher interest rate on your savings.

- Set up automatic transfers: Regularly transfer a portion of your income into your savings account.

- Reduce non-essential spending: Identify areas where you can cut back to maximize savings.

The impact of high-interest debt on your savings progress cannot be overstated. Prioritize paying down high-interest debt to maximize your savings potential.

Exploring First-Time Homebuyer Programs

Many government and non-profit organizations offer programs designed to assist first-time homebuyers.

- FHA Loans: Require a lower down payment than conventional loans.

- VA Loans: Offer loans to eligible veterans and military personnel with no down payment requirement.

- Down payment assistance programs: Provide grants or loans to help cover the down payment.

Research available programs in your area to see how they can benefit your homeownership journey.

Conclusion

Managing student loan debt while striving for homeownership is challenging but achievable. By understanding your student loans, creating a realistic budget, strategically reducing your debt, and diligently saving for a down payment, you can significantly increase your chances of owning a home. Start managing your student loan debt today! Take control of your finances and pursue your dream of homeownership! Begin your journey towards homeownership by creating a realistic plan to manage your student loans. Utilize the resources and strategies outlined in this guide to pave your path to financial freedom and the satisfaction of homeownership. Remember to explore first-time homebuyer programs to leverage additional assistance.

Featured Posts

-

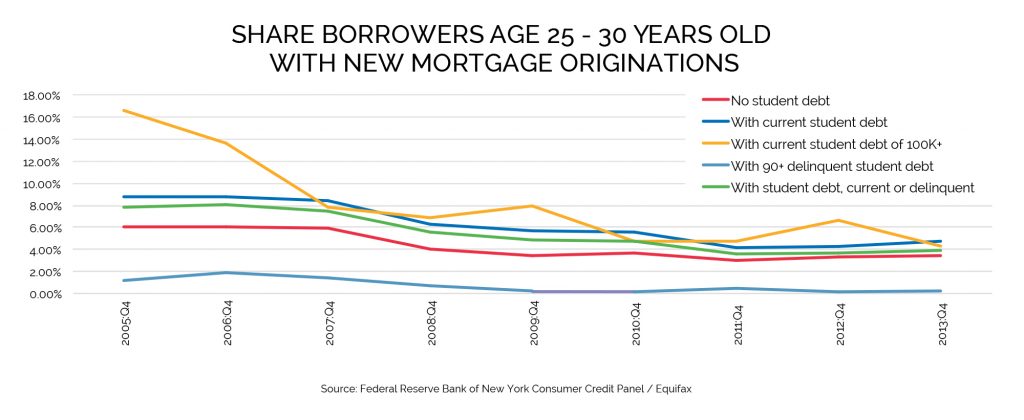

Trumps China Tariffs Projected To Stay At 30 Through 2025

May 17, 2025

Trumps China Tariffs Projected To Stay At 30 Through 2025

May 17, 2025 -

New York Daily News May 2025 Archives Historical News

May 17, 2025

New York Daily News May 2025 Archives Historical News

May 17, 2025 -

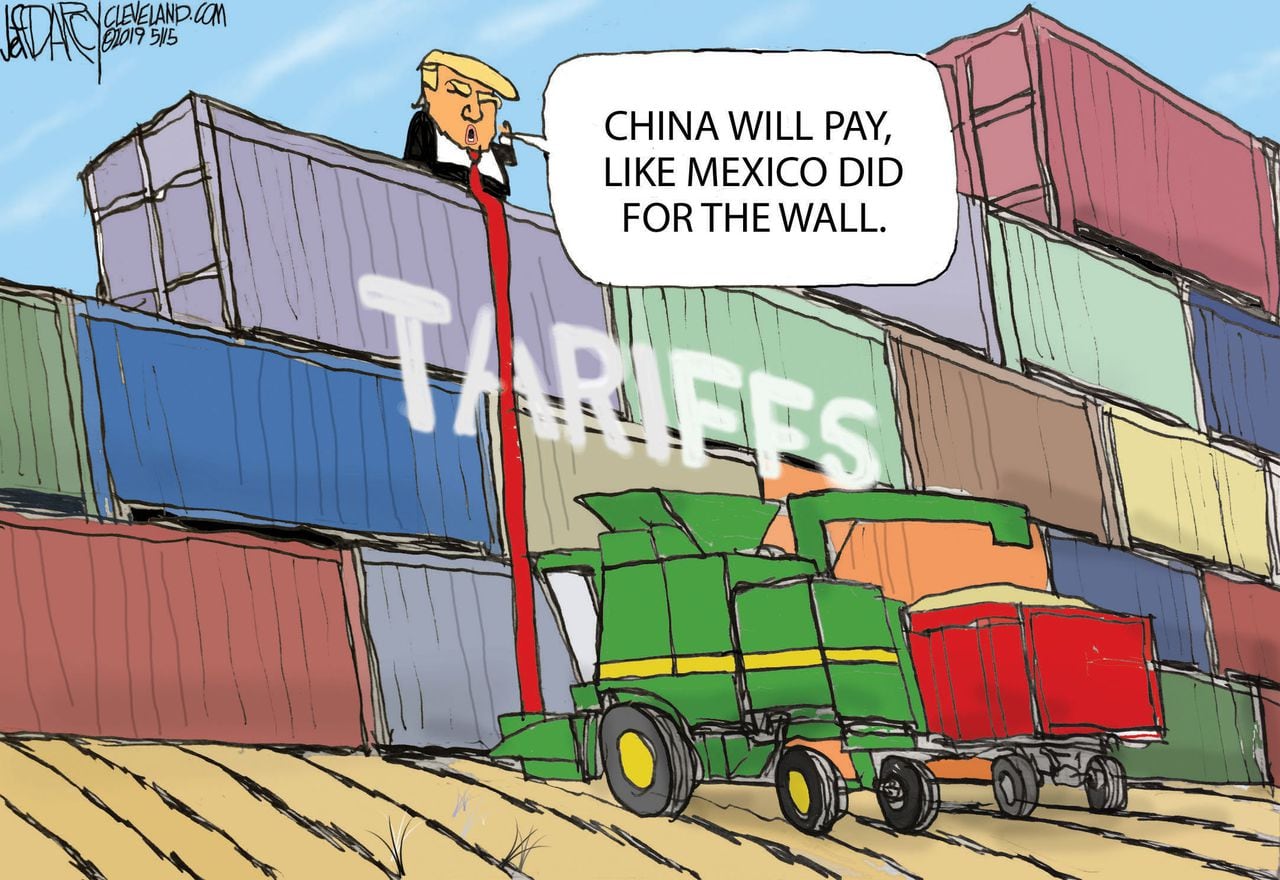

Andor Season 2 A Recap Of Season 1 And What To Expect

May 17, 2025

Andor Season 2 A Recap Of Season 1 And What To Expect

May 17, 2025 -

Is Reddit Down In The Us Users Report Page Not Found

May 17, 2025

Is Reddit Down In The Us Users Report Page Not Found

May 17, 2025 -

New York Knicks Revival Thibodeaus Strategic Changes And Positive Impact

May 17, 2025

New York Knicks Revival Thibodeaus Strategic Changes And Positive Impact

May 17, 2025