Market Reaction: Dow Futures And Dollar After Moody's Action

Table of Contents

Immediate Impact on Dow Futures

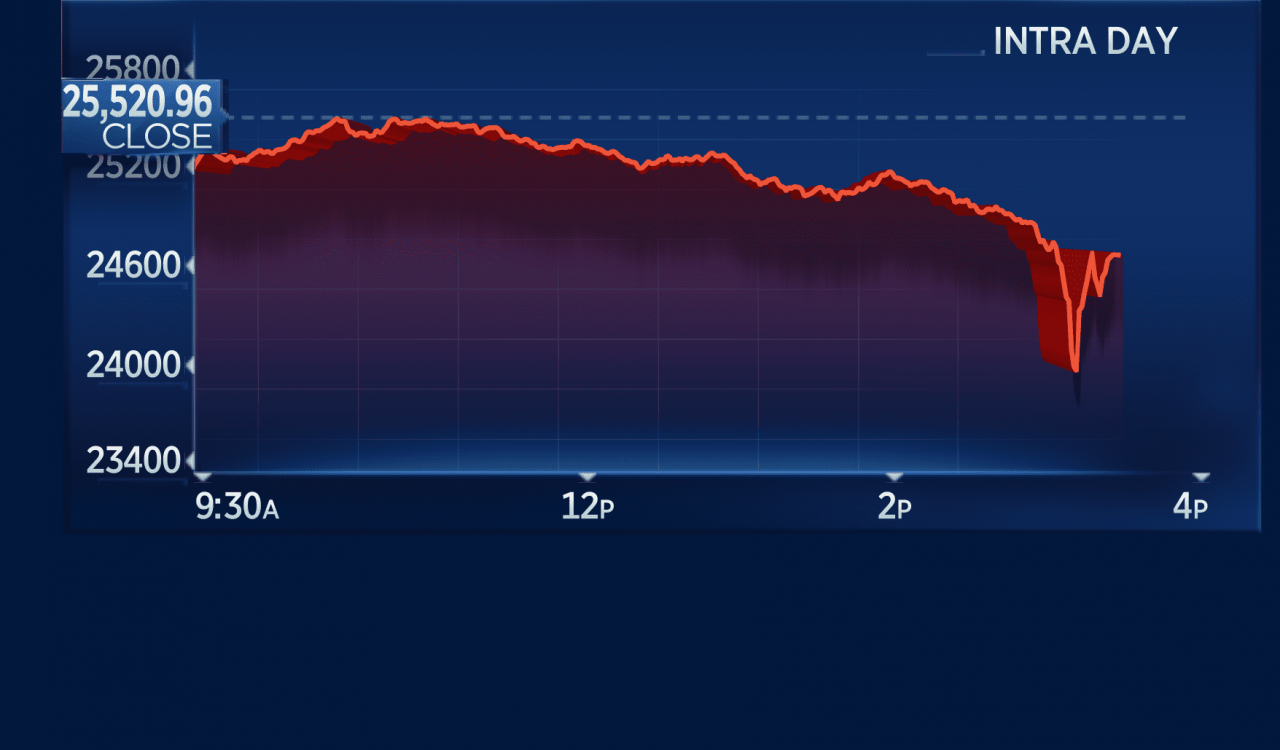

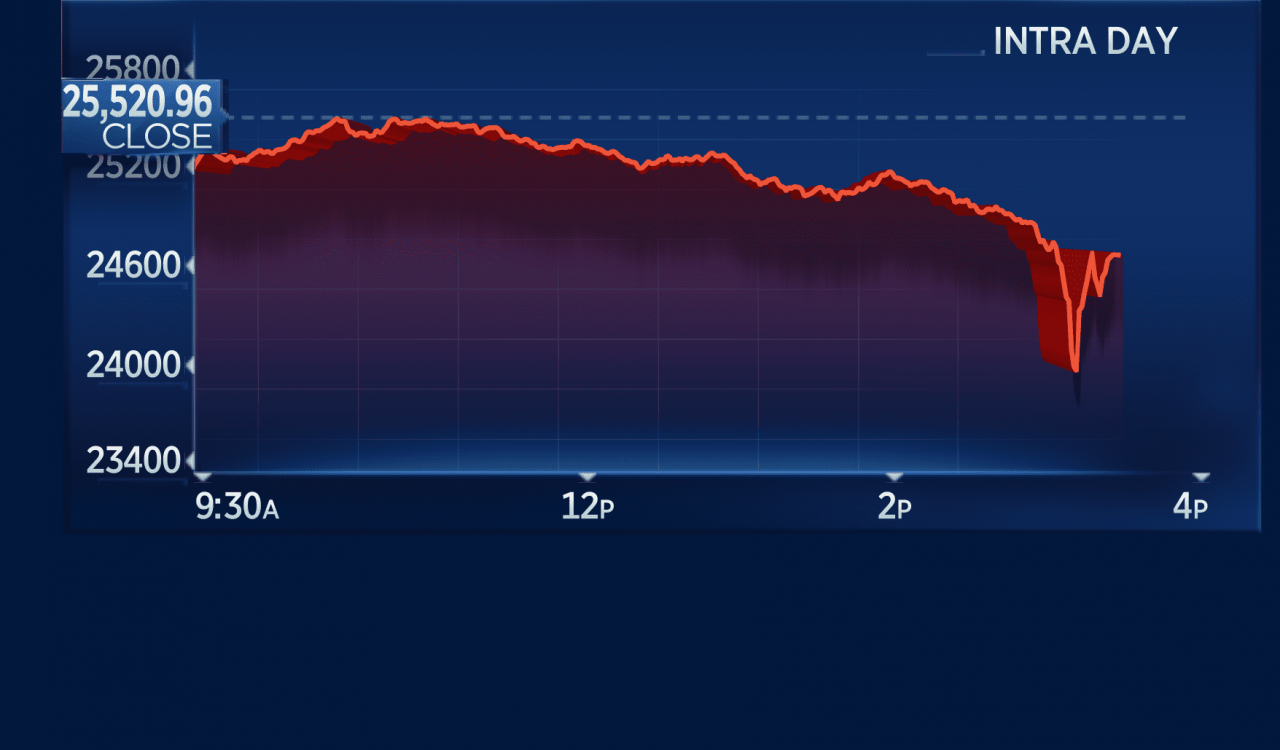

The announcement of Moody's downgrade resulted in an immediate and sharp decline in Dow Jones Industrial Average futures contracts. Market volatility surged as investors grappled with the implications of this unprecedented action. The Dow Futures experienced a significant point drop, reflecting a widespread sell-off driven by uncertainty and risk aversion.

- Specific Point Drops: The exact point drop will vary depending on the timing of the market observation, but reports indicated a substantial decrease in the immediate aftermath of the announcement. This was a significant percentage change compared to the previous day's closing values.

- Trading Volume: Trading volume in Dow Futures contracts increased dramatically, indicating heightened investor activity and a scramble to adjust positions in response to the news.

- Comparison to Previous Similar Events: This reaction can be compared to other instances of credit rating downgrades or significant economic news. The speed and magnitude of the drop may be assessed relative to past market responses to similar events.

- Contributing Factors: The surprise nature of the downgrade played a significant role in the immediate market reaction. Investor sentiment shifted rapidly from cautious optimism to significant concern, accelerating the sell-off.

Dollar's Response to Moody's Downgrade

The U.S. dollar's response to the Moody's downgrade was complex. While the dollar is often considered a safe-haven asset during times of global uncertainty, the downgrade's impact on investor confidence led to a mixed reaction.

- Changes in Exchange Rates: The dollar's value fluctuated against major currencies like the Euro, Japanese Yen, and British Pound. While some initial flight-to-safety might have led to a temporary increase in demand, the overall trend reflected concerns about the long-term economic implications.

- Trading Volume: Similar to Dow Futures, trading volume in the foreign exchange market increased significantly as investors adjusted their currency holdings based on their outlook for the U.S. economy.

- Influencing Factors: Investor confidence, the perceived stability of other major economies, and expectations regarding future interest rate adjustments all played a crucial role in shaping the dollar's reaction. The downgrade highlighted concerns about the sustainability of the U.S. debt burden, negatively impacting investor confidence.

Longer-Term Implications for the US Economy

The Moody's downgrade carries significant long-term implications for the U.S. economy. Increased borrowing costs, reduced investor confidence, and potential inflationary pressures are all potential consequences.

- Potential Impact on Borrowing Costs: The downgrade could make it more expensive for the U.S. government to borrow money, potentially leading to increased interest rates across the board.

- Government Spending: Higher borrowing costs could constrain government spending, potentially impacting crucial infrastructure projects and social programs.

- Economic Growth Forecasts: Economic growth forecasts are likely to be revised downward, reflecting the increased uncertainty and potential headwinds caused by the downgrade.

- Expert Opinions: Economists and financial analysts are offering diverse opinions on the long-term implications, highlighting the complexity of the situation and the range of potential outcomes.

Investment Strategies in Light of Moody's Action

The Moody's downgrade necessitates a reassessment of investment strategies. Investors should prioritize risk management and portfolio diversification.

- Adjusting Asset Allocation: Investors may consider adjusting their asset allocation to reduce exposure to riskier assets and increase holdings in more stable investments.

- Considering Alternative Investments: Exploring alternative investment options like precious metals or high-quality bonds could help mitigate risk associated with the current market conditions.

- Strategies for Risk Mitigation: Implementing strategies like hedging and diversification can help reduce portfolio vulnerability.

- Disclaimer: It is crucial to remember that this information is for general knowledge and should not be considered financial advice. Consult with a qualified financial advisor before making any investment decisions.

Conclusion

Moody's downgrade had an immediate and significant impact on Dow Futures and the U.S. dollar, reflecting growing concerns about the U.S. economy's fiscal health. The market reaction underscores the gravity of the situation and highlights the potential for long-term consequences. Investors need to carefully assess their portfolios, consider risk mitigation strategies, and remain informed about ongoing developments. Monitor Dow Futures and track the dollar's movement after Moody's action to stay abreast of the evolving situation. Understand the market reaction to Moody's – your financial future depends on it. Return to this site for updates and further analysis as the situation unfolds.

Featured Posts

-

Harsh Words Pub Landlords Angry Response To Employees Departure

May 21, 2025

Harsh Words Pub Landlords Angry Response To Employees Departure

May 21, 2025 -

Cobolli Claims First Atp Tour Victory In Bucharest

May 21, 2025

Cobolli Claims First Atp Tour Victory In Bucharest

May 21, 2025 -

The Impact Of Self Esteem On Vybz Kartels Skin Bleaching Decision

May 21, 2025

The Impact Of Self Esteem On Vybz Kartels Skin Bleaching Decision

May 21, 2025 -

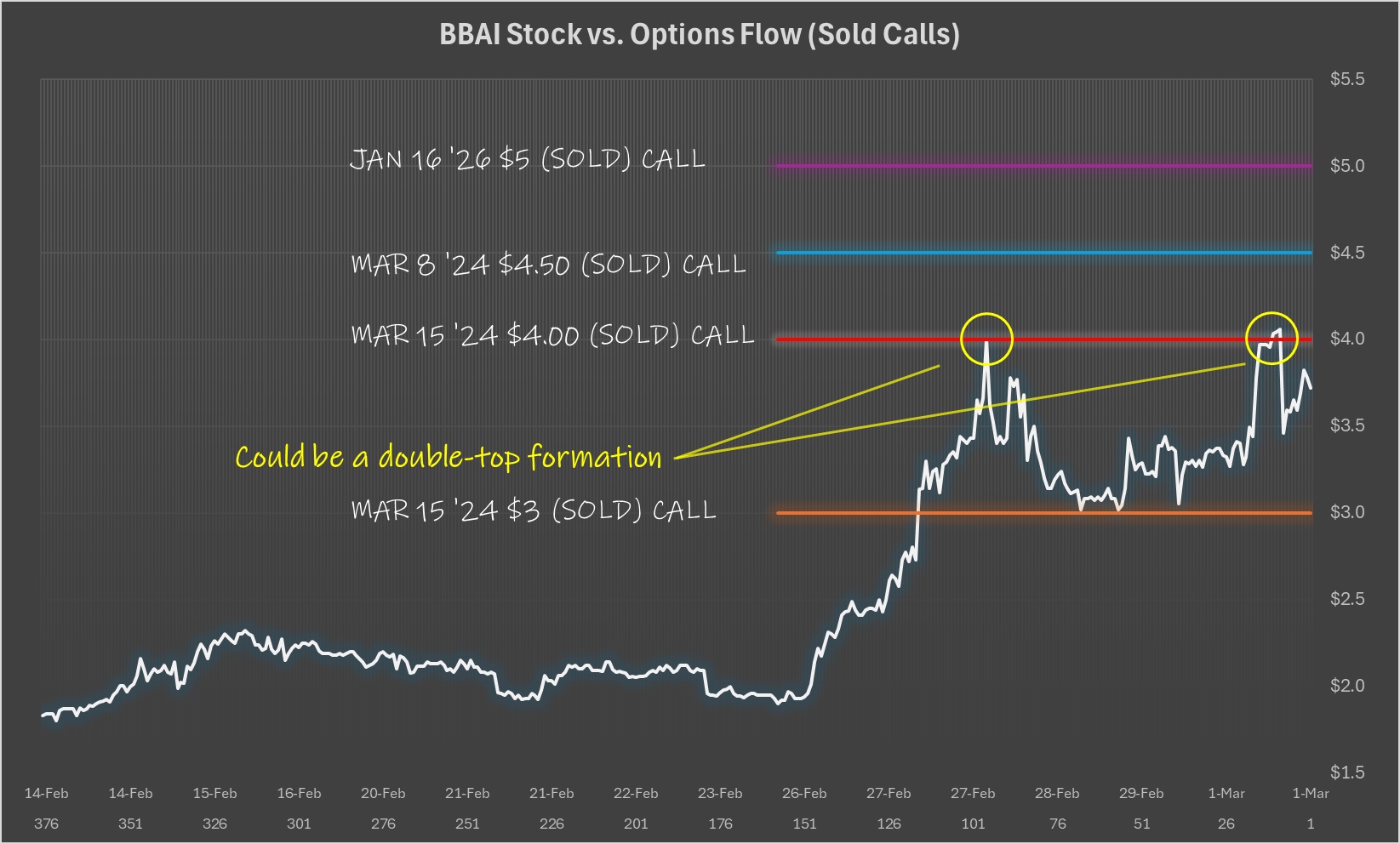

Big Bear Ai Bbai Growth Uncertainty Prompts Analyst Downgrade

May 21, 2025

Big Bear Ai Bbai Growth Uncertainty Prompts Analyst Downgrade

May 21, 2025 -

Fratii Tate Cum Au Fost Intampinati La Revenirea In Romania

May 21, 2025

Fratii Tate Cum Au Fost Intampinati La Revenirea In Romania

May 21, 2025

Latest Posts

-

Goretzka Returns To Germany Squad Nagelsmanns Nations League Call Up

May 21, 2025

Goretzka Returns To Germany Squad Nagelsmanns Nations League Call Up

May 21, 2025 -

Quarterfinal Preview Germanys Path To Victory Against Italy

May 21, 2025

Quarterfinal Preview Germanys Path To Victory Against Italy

May 21, 2025 -

Germany Italy Quarterfinal A Clash Of Titans

May 21, 2025

Germany Italy Quarterfinal A Clash Of Titans

May 21, 2025 -

Bangladeshinfo Com Reliable Information And Data On Bangladesh

May 21, 2025

Bangladeshinfo Com Reliable Information And Data On Bangladesh

May 21, 2025 -

Live Bundesliga Schedules Teams And Top Performers

May 21, 2025

Live Bundesliga Schedules Teams And Top Performers

May 21, 2025