Market Reaction To UK Inflation: Pound Rises, BOE Cuts Less Likely

Table of Contents

Pound Strengthens on Inflation Data

The correlation between inflation figures and the value of the pound is inverse; lower inflation generally strengthens the currency. The latest release of UK inflation data showed a significant impact on the pound's performance. The Office for National Statistics (ONS) reported that the Consumer Price Index (CPI) inflation rate fell to [Insert actual percentage here] in [Month, Year], down from [Previous percentage] in [Previous month, Year]. The Retail Price Index (RPI) also showed a similar trend, decreasing to [Insert actual percentage here]. This better-than-expected data, particularly the lower-than-anticipated core inflation (excluding volatile food and energy prices), significantly boosted investor confidence.

- CPI Inflation: Decreased from [Previous percentage] to [Current percentage].

- RPI Inflation: Decreased from [Previous percentage] to [Current percentage].

- Core Inflation: Remained lower than previously predicted.

- Market Analyst Reaction: "The unexpected drop in inflation has fueled a significant rally in the pound," stated [Name of Market Analyst], [Title] at [Financial Institution]. This sentiment was echoed across the financial press.

- Mechanisms Driving Appreciation: The pound's appreciation stems from increased investor confidence in the UK economy, coupled with its perceived safe-haven status amidst global economic uncertainty.

Diminished Expectations for BOE Interest Rate Cuts

The BOE's primary mandate is to maintain price stability, primarily targeting a 2% inflation rate. Previous expectations pointed towards further interest rate cuts to stimulate economic growth. However, the latest inflation figures significantly alter this outlook. The better-than-expected data reduces the immediate pressure on the BOE to cut rates further.

- Previous BOE Statements: The BOE's previous monetary policy committee (MPC) meetings indicated a cautious approach, with members hinting at potential rate cuts if inflation remained stubbornly high.

- Inflation Data's Impact: The lower-than-expected inflation figures effectively remove the urgency for immediate rate cuts, allowing the BOE to assess the economic landscape more carefully.

- BOE Officials' Statements: [Insert any statements made by BOE officials or MPC members regarding the recent inflation data and its impact on monetary policy].

- Alternative Monetary Policy Tools: While rate cuts are less likely in the near term, the BOE might consider other tools like quantitative easing (QE) or forward guidance to manage inflation and stimulate growth, depending on future economic developments.

Analysis of Market Sentiment and Investor Behavior

Following the inflation data release, market sentiment shifted noticeably towards optimism. Investors reacted positively, leading to a surge in demand for the pound and a rally in UK equities.

- FTSE 100 Performance: The FTSE 100, a key indicator of the UK stock market, experienced a [Percentage] increase following the inflation announcement.

- Impact on Asset Classes: Government bonds saw [Describe the impact], reflecting investor confidence in the UK's economic outlook. Equities experienced a [Describe the impact] due to the improved inflation picture.

- Long-Term Implications: The positive market reaction suggests a more favorable outlook for the UK economy, potentially leading to increased investment and stronger economic growth in the long term. However, further analysis is needed to ascertain the true and lasting extent of these effects.

Potential Risks and Uncertainties

Despite the positive market reaction, several risks and uncertainties remain. Future inflation projections are crucial, and a potential global economic slowdown could still impact the UK's economic performance.

- Future Inflation Projections: The BOE will be closely monitoring future inflation figures to assess the durability of the recent decline.

- Global Economic Slowdown: A global recession could negatively impact UK exports and investor confidence, potentially offsetting the positive impact of lower inflation.

- Geopolitical Factors: External factors, such as the ongoing war in Ukraine and global energy prices, still pose considerable uncertainty to the UK economy.

Market Reaction to UK Inflation: Implications and Outlook

In summary, the better-than-expected UK inflation data triggered a positive market reaction to UK inflation, strengthening the pound and reducing the likelihood of further BOE interest rate cuts. This positive market sentiment reflects increased investor confidence in the UK's economic trajectory. However, continued vigilance is necessary, as future inflation figures, global economic conditions, and geopolitical factors will continue to shape the UK's economic landscape. It will be crucial to observe future data releases, such as the next CPI and RPI reports, as well as the BOE's upcoming monetary policy decisions.

Stay tuned for further analysis of the UK's economic landscape and the ongoing market reaction to inflation. Subscribe to our newsletter for timely updates and in-depth insights.

Featured Posts

-

Liverpools Luck Arne Slot And Luis Enrique Offer Insights

May 22, 2025

Liverpools Luck Arne Slot And Luis Enrique Offer Insights

May 22, 2025 -

Core Weave Crwv Stock Soars Analyzing Last Weeks Performance

May 22, 2025

Core Weave Crwv Stock Soars Analyzing Last Weeks Performance

May 22, 2025 -

Understanding Jim Cramers Investment In Core Weave Crwv And Its Open Ai Ties

May 22, 2025

Understanding Jim Cramers Investment In Core Weave Crwv And Its Open Ai Ties

May 22, 2025 -

Unexpected Win Tigers Defeat Rockies 8 6

May 22, 2025

Unexpected Win Tigers Defeat Rockies 8 6

May 22, 2025 -

Ing Groups Form 20 F 2024 Annual Report And Financial Statements

May 22, 2025

Ing Groups Form 20 F 2024 Annual Report And Financial Statements

May 22, 2025

Latest Posts

-

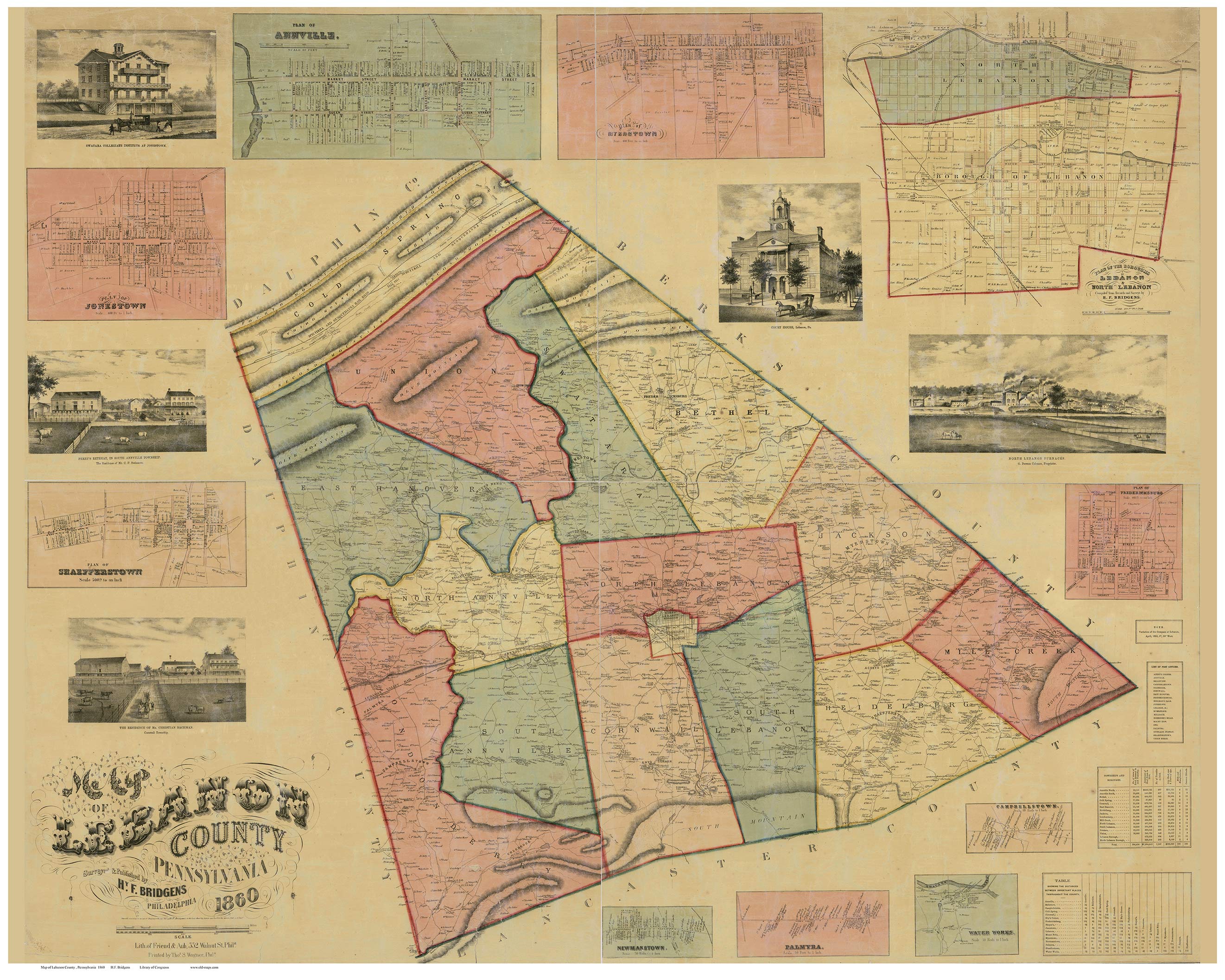

Lebanon County Pa Fbi Executes Search Warrant

May 22, 2025

Lebanon County Pa Fbi Executes Search Warrant

May 22, 2025 -

Overnight Apartment Building Fire In Dauphin County Pa Investigation Underway

May 22, 2025

Overnight Apartment Building Fire In Dauphin County Pa Investigation Underway

May 22, 2025 -

Fbi Raid In Lebanon County Pennsylvania What We Know

May 22, 2025

Fbi Raid In Lebanon County Pennsylvania What We Know

May 22, 2025 -

Recovery Complete Pilot And Son Released After Severe Lancaster County Crash

May 22, 2025

Recovery Complete Pilot And Son Released After Severe Lancaster County Crash

May 22, 2025 -

Lehigh Valley Burn Center Pilot And Son Discharged Following Lancaster County Crash

May 22, 2025

Lehigh Valley Burn Center Pilot And Son Discharged Following Lancaster County Crash

May 22, 2025