Maximize Dividend Income: A Straightforward Approach

Table of Contents

Understanding Dividend Stocks

Dividend investing offers a compelling strategy for long-term wealth creation. However, successfully maximizing dividend income requires more than just picking the highest-yielding stocks. Thorough research and a solid understanding of key metrics are crucial.

Identifying High-Yield Dividend Stocks

Don't be fooled by flashy yield percentages alone. A high yield might signal underlying problems. Due diligence is essential. Look beyond the headline number and analyze the following:

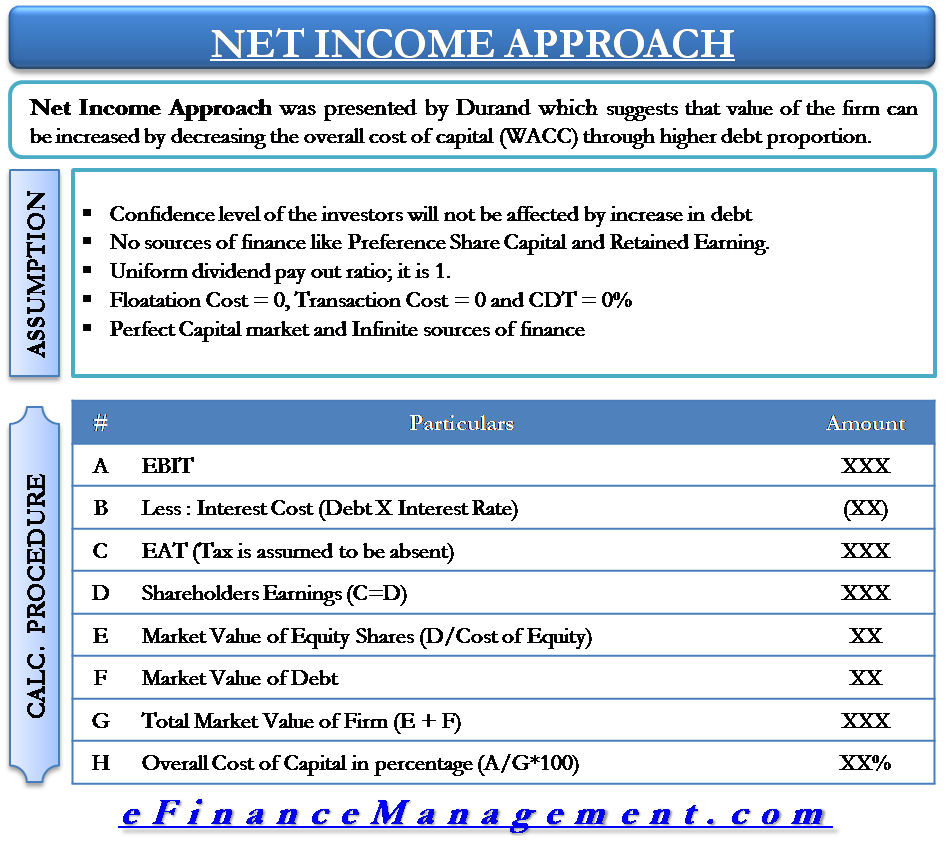

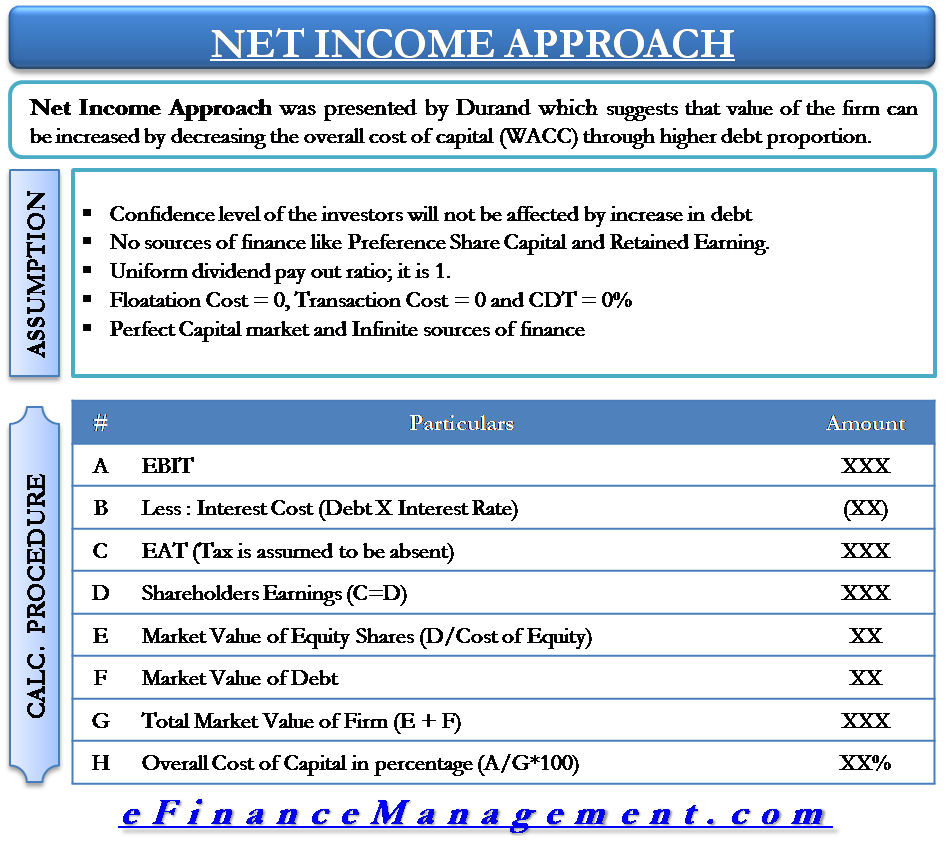

- Dividend Payout Ratio: This ratio indicates the percentage of earnings a company pays out as dividends. A sustainable payout ratio is generally below 70%. A ratio significantly above this suggests potential dividend cuts in the future.

- Dividend Growth History: Consistent dividend increases demonstrate a company's commitment to returning value to shareholders. Analyze a company's track record for dividend growth over several years.

- Financial Health: Examine key financial metrics like debt-to-equity ratio, earnings per share (EPS), and return on equity (ROE) to assess the company's overall financial strength and ability to sustain dividend payments.

Resources for Finding Dividend Stocks:

- Financial Websites: Many reputable financial websites (e.g., Yahoo Finance, Google Finance) offer stock screeners that allow you to filter stocks based on dividend yield, payout ratio, and other criteria.

- Brokerage Platforms: Most brokerage accounts provide robust screening tools to help you find dividend-paying stocks that meet your specific criteria. Explore these options to discover suitable dividend investment opportunities.

The Importance of Dividend Growth

The power of compounding is amplified with dividend growth. When companies consistently increase their dividends, your income grows exponentially over time. This is especially true if you utilize dividend reinvestment plans (DRIPs).

Companies with Strong Dividend Growth Histories: Many established companies have demonstrated impressive track records of increasing dividends year after year. Research companies known for their strong dividend growth history for long term investment opportunities.

Benefits of DRIPs:

- Automatic Reinvestment: DRIPs automatically reinvest your dividends to purchase additional shares, accelerating the growth of your portfolio.

- Compounding Returns: Reinvesting dividends allows you to earn dividends on your dividends, leading to exponential growth over time.

- Lower Transaction Costs: DRIPs often eliminate brokerage commissions, further boosting your returns.

Building a Diversified Dividend Portfolio

Diversification is a cornerstone of successful long-term investing. It significantly reduces risk by spreading your investments across various sectors and companies.

Diversification Strategies for Dividend Income

Don't put all your eggs in one basket! Diversification is key to mitigating risk and maximizing long-term returns in dividend investing.

Sectors Known for Consistent Dividend Payouts:

- Utilities: Utility companies generally offer stable dividend payouts due to the consistent demand for their services.

- Consumer Staples: Companies that produce essential goods (e.g., food, beverages) tend to have relatively stable earnings and dividend payments.

- Real Estate Investment Trusts (REITs): REITs are required to distribute a significant portion of their income as dividends, making them attractive for dividend investors.

Diversification Strategies:

- Geographical Diversification: Spread investments across different countries to reduce exposure to country-specific risks.

- Sector Diversification: Invest in companies across multiple sectors to avoid overexposure to any single industry.

- Company Size Diversification: Include a mix of large-cap, mid-cap, and small-cap companies in your portfolio.

Asset Allocation for Optimal Dividend Income

Your risk tolerance and financial goals should dictate your asset allocation. A balanced approach typically involves a mix of stocks and bonds.

Balancing Risk and Reward:

- Higher-Risk, Higher-Reward: Focusing on higher-yielding dividend stocks can lead to greater income but also carries more risk.

- Lower-Risk, Lower-Reward: A more conservative approach with lower-yielding, established companies prioritizes stability and consistency.

Including Bonds for Stability: Bonds can provide a buffer against market volatility, helping to ensure a consistent stream of income.

Tax-Efficient Dividend Investing

Understanding the tax implications of dividend income is crucial for maximizing your after-tax returns.

Tax Implications of Dividend Income

Dividend income is taxable, but the tax rate depends on whether they are qualified or non-qualified dividends. Qualified dividends generally receive a lower tax rate than ordinary income.

Strategies for Minimizing Tax Burden:

- Tax-Advantaged Accounts: Invest in tax-advantaged accounts like Individual Retirement Accounts (IRAs) and 401(k)s to reduce your tax liability.

- Tax-Loss Harvesting: If you have losses in your portfolio, you can use tax-loss harvesting to offset capital gains and reduce your tax bill.

Tax-Advantaged Accounts (IRAs, 401Ks)

Tax-advantaged accounts offer significant benefits for long-term dividend investing.

Advantages of Tax-Advantaged Accounts:

- Tax-Deferred Growth: Your investments grow tax-free until you withdraw them in retirement.

- Reduced Tax Liability: You'll pay less tax on your dividend income compared to taxable accounts.

Contribution Limits and Eligibility: Contribution limits vary depending on the type of account and your income. Be sure to check the current IRS guidelines for contribution limits and eligibility requirements.

Conclusion: Your Path to Maximizing Dividend Income

Maximizing dividend income requires a multi-faceted approach. By carefully identifying high-quality dividend stocks, building a diversified portfolio, and utilizing tax-efficient strategies, you can significantly increase your passive income and build long-term wealth. Remember, consistency and a long-term perspective are essential. Begin maximizing your dividend income today! Start your journey to maximizing dividend income now by using our [link to a dividend stock screener or financial planning tool].

Featured Posts

-

Despite 100 Billion Loss Elon Musk Tops Hurun Global Rich List 2025

May 10, 2025

Despite 100 Billion Loss Elon Musk Tops Hurun Global Rich List 2025

May 10, 2025 -

Les Miserables Actors Consider Protest Against Trump At Kennedy Center

May 10, 2025

Les Miserables Actors Consider Protest Against Trump At Kennedy Center

May 10, 2025 -

Justice Sought After Brutal Racist Murder Of Family Member

May 10, 2025

Justice Sought After Brutal Racist Murder Of Family Member

May 10, 2025 -

Dijon Violente Agression Au Lac Kir Trois Blesses

May 10, 2025

Dijon Violente Agression Au Lac Kir Trois Blesses

May 10, 2025 -

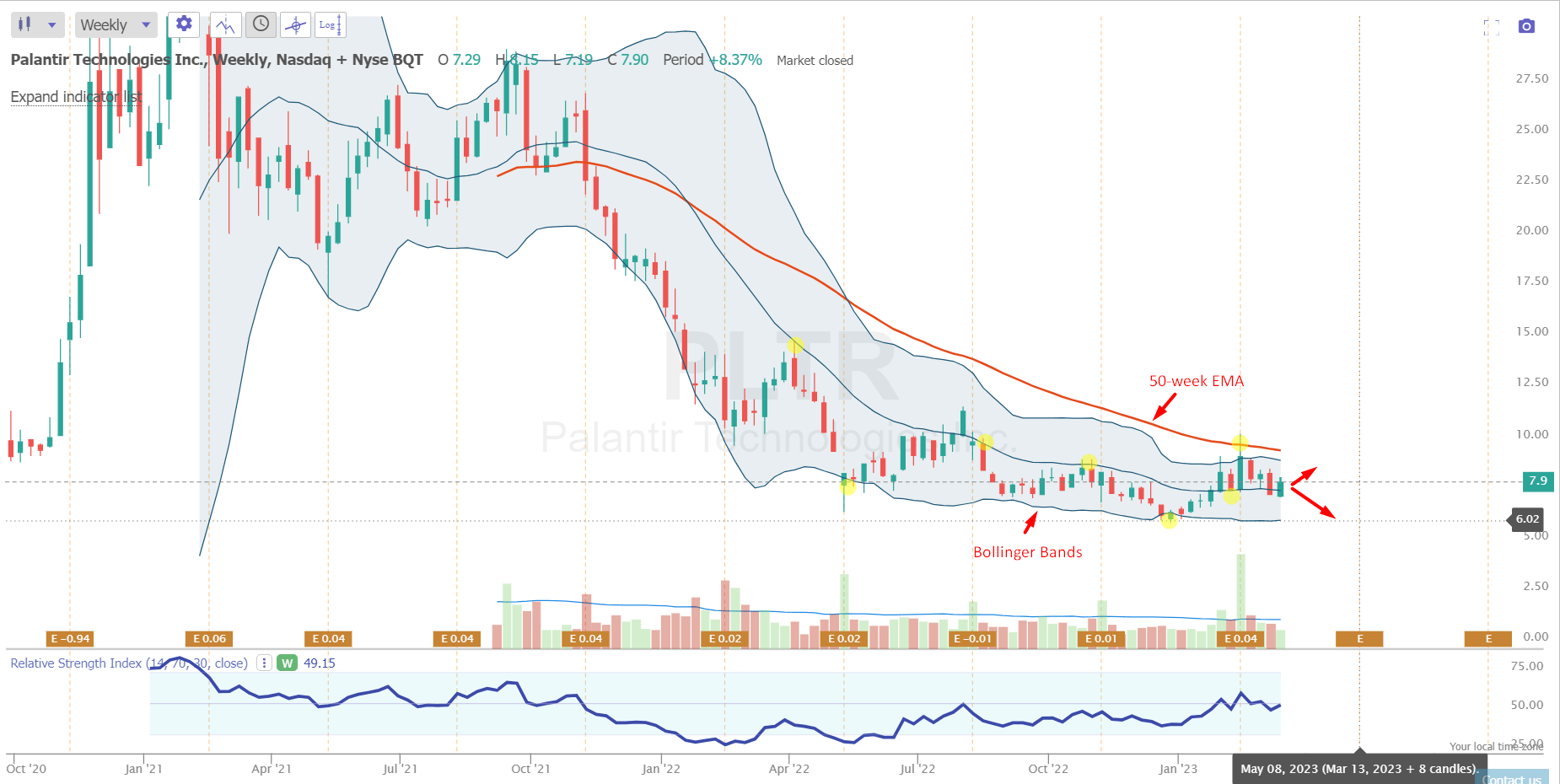

Palantir Technologies Stock A Detailed Investment Analysis For 2024

May 10, 2025

Palantir Technologies Stock A Detailed Investment Analysis For 2024

May 10, 2025